ASX: ABV – Advanced Braking Technology

Advanced Braking Technology has been around for 20 years. Pre 2019 they were predominantly an R&D company, investing millions into brake technology. Since 2019 they have pivoted to a commercial format with the appropriate management team to guide them. Their principal activities include research, development, design, commercialisation and manufacture of braking solutions for light, heavy, defence and electric vehicles as well as emergency braking and brake controllers under the ABT Failsafe, ABT Failsafe Emergency and Terra Dura brand names.

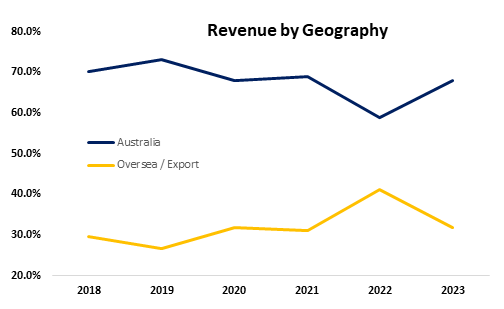

ABT export to over 40 countries, up from 16 a year ago and claim they are the market leader in failsafe braking. Management state innovation and safety are at their core and that they tick all 3 ESG boxes.

Heavy vehicles and their wet brake solutions are key to their growth. They offer recreational users a dry sealed product, Terra Dura. This is still too costly and not a priority for the company but they hope to one day get the cost down on this while maintaining margins.

The mining services industry makes up roughly 70% of their sales following by mining at 15%, fleet management at 7%, defence at 5% and waste management at 1%.

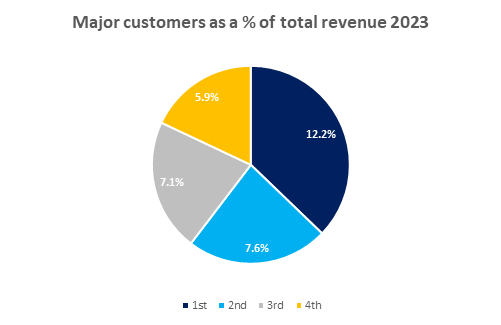

They are the original equipment manufacturer of their sealed brake technology and they own the IP. They’ve invested millions into their braking products which offer improved safety and performance and zero emissions, ticking the ESG box. As a result they have a strong blue chip customer base.

The Problem

Maintenance

Traditional open brake systems being used in mining are prone to contamination and corrosion and need to be stripped and cleaned every few weeks. This results in significant downtime on an asset that is being used 24/7. ABTs sealed integrated braking system (SIBS) offer operational improvement and considerable cost savings providing months of maintenance free operation, critical for mining companies with fleets of 100’s of vehicles in constant use.

Safety

ABTs Failsafe offerings can be incorporated into the park and emergency brake system to automatically apply when the E-Stop button is pressed, the engine is turned off or a vehicle door is opened. This provides a high level of safety for vehicle operators and site personnel ensuring the vehicle cannot roll away unexpectedly.

Emissions

50% of a diesel vehicles emissions are exhaust and 25% brakes. The company’s Sealed Integrated Brake Solutions (SIBS) protect the environment by eliminating all brake dust emissions, improving air quality.