I’m relatively new to ABV. It’s one of my 2026 picks and I have a relatively small holding IRL. Perhaps I should have allocated more to ABV looking at the Q2FY26 report! Very impressive! Sales up 34%, NPBT up 191%, Gross margins 48.% and cash in the bank. I’m guessing these figures might be lumpy and the market might already has factored in high expectations for the business. Nevertheless, I’m pleased to see the business is building momentum and performing exceptionally well.

December 2025 Quarterly Activities Report and Appendix 4C

Summary of Reporting Highlights:

• Product Sales Revenue of $5.6m for Q2 FY26, up 34% on prior corresponding period (pcp)1

• Reported NPBT for Q2 expected to be $0.35m, up 191% on pcp demonstrating strong operating leverage in the business

• Achieved Gross Margins of 48.3% for Q2

• Continuing to grow ABT install base of Failsafe safety systems,internationally

Perth, Australia: Advanced Braking Technology Ltd (ASX: ABV) (‘ABT’ or ‘the Company’ or ‘the ABT Group’) is pleased to report its quarterly activities report for the period ended 31 December 2025 (Q2).

Q2 saw a continued strategic emphasis on international market penetration, leveraging ABT’s reputation as a key provider of safety-critical braking solutions for the global mining industry.

Domestically, ABT achieved +70% growth in sales revenue in Q2 supported by continuing strong pipeline including a mandate for FailSafe brakes from MMG Dugald River, one of the world's top 10 zinc operations, located in Queensland.

Reported NPBT in Q2 is expected to be $0.35m, representing 191% growth on pcp. The Q2 NPBT result was achieved via increased revenue while also optimising operating cost management throughout the period.

Financial Commentary (versus previous corresponding period)

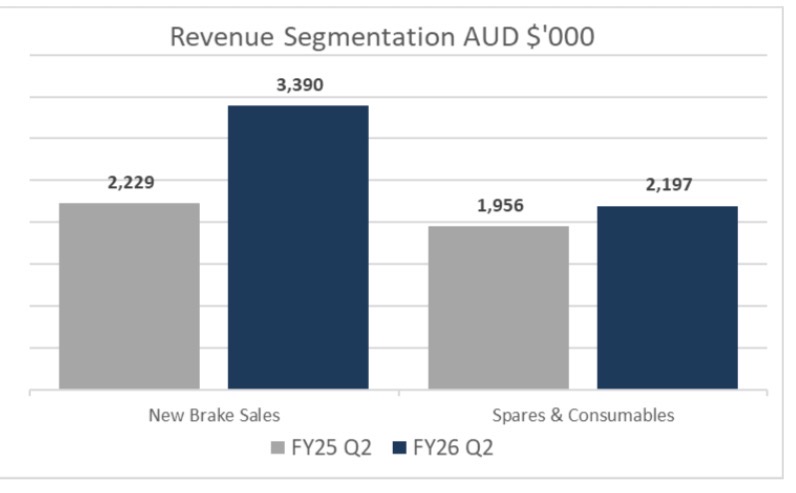

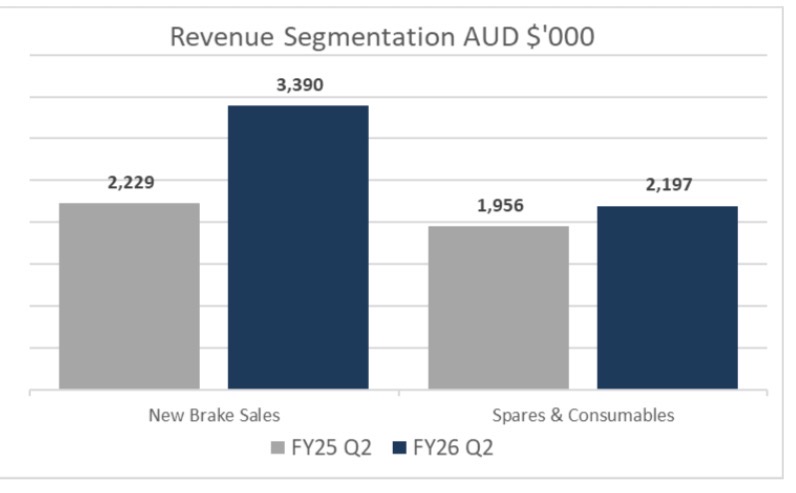

Reported revenue increased by 34% versus pcp and product sales included light and heavy vehicle brake systems as well as spares and consumables.

New Brake revenue increased 52%, driven by strong customer uptake and continued expansion of the install base.

Spares & Consumables grew 12%, supported by ongoing maintenance demand and utilisation across the installed fleet.

Cash & Cash Equivalents at the end of the period were $4.14m, representing a 44% increase vs FY25 end balance of $2.88m, and an increase of 76% on the previous corresponding period in FY25. The cash balance included the receipt of the $0.57m Research and Development tax incentive (RDTI) for the FY24 period during the quarter.

The Company’s strong liquidity position, effective working capital management and strong financial performance supported the decision to not renew the existing trade finance facility which expired on 31 October 2025.

The Company’s Managing Director and Chief Executive Officer, Andrew Booth, commented on the Q2 performance saying:

"ABT has commenced FY26 with strong momentum, demonstrating our ability to convert our strategic roadmap into robust financial performance, and the growth in products sales revenue is a testament to the growing global demand for our safety-critical braking solutions.”

“Whilst our strategic focus on international market penetration is yielding significant results, our domestic performance remained strong during the quarter. The securing of a mandate for our FailSafe brakes from MMG further validates our reputation within the Tier-1 mining sector.”

“Financially, the business is leaner and more efficient. We achieved a 191% increase in NPBT by pairing record sales with disciplined operating cost management. ABT’s balance sheet has never been stronger, with cash reserves growing to $4.14m, and we are well-positioned to fund our ongoing growth and innovation through our strong operational cash flows.”

This release is authorised by the Board of Directors.

- ENDS -