$ABB provided some key updates in the AGM address being presented later today:

- NBN Market share has now passed 8%

- Update on connections at Q1 FY24

- Update on SAU (Special Access Undertaking) - overall favourable to $ABB

- Rationale for $SYM takeover bid

- FY24 Guidance Reaffirmed

I'll comment further on the last 4 items, the first item being self explanatory

2. NBN Connection Updates

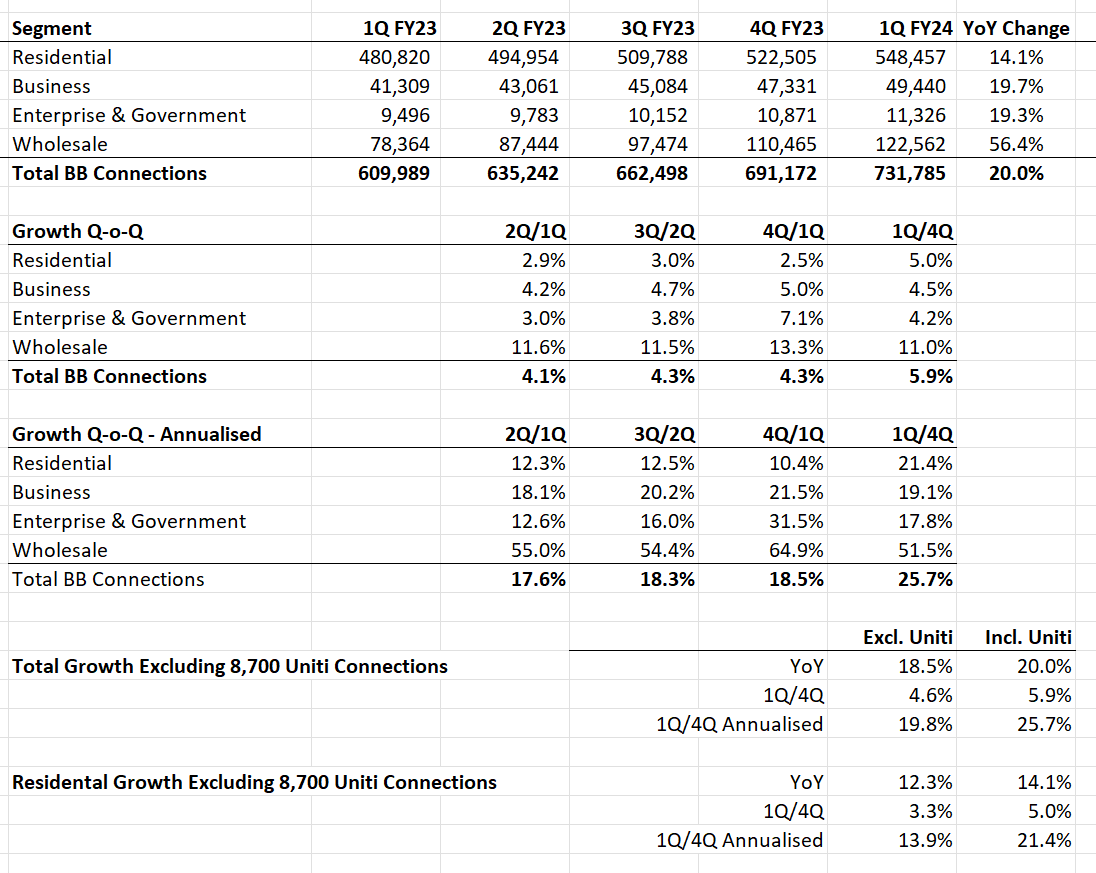

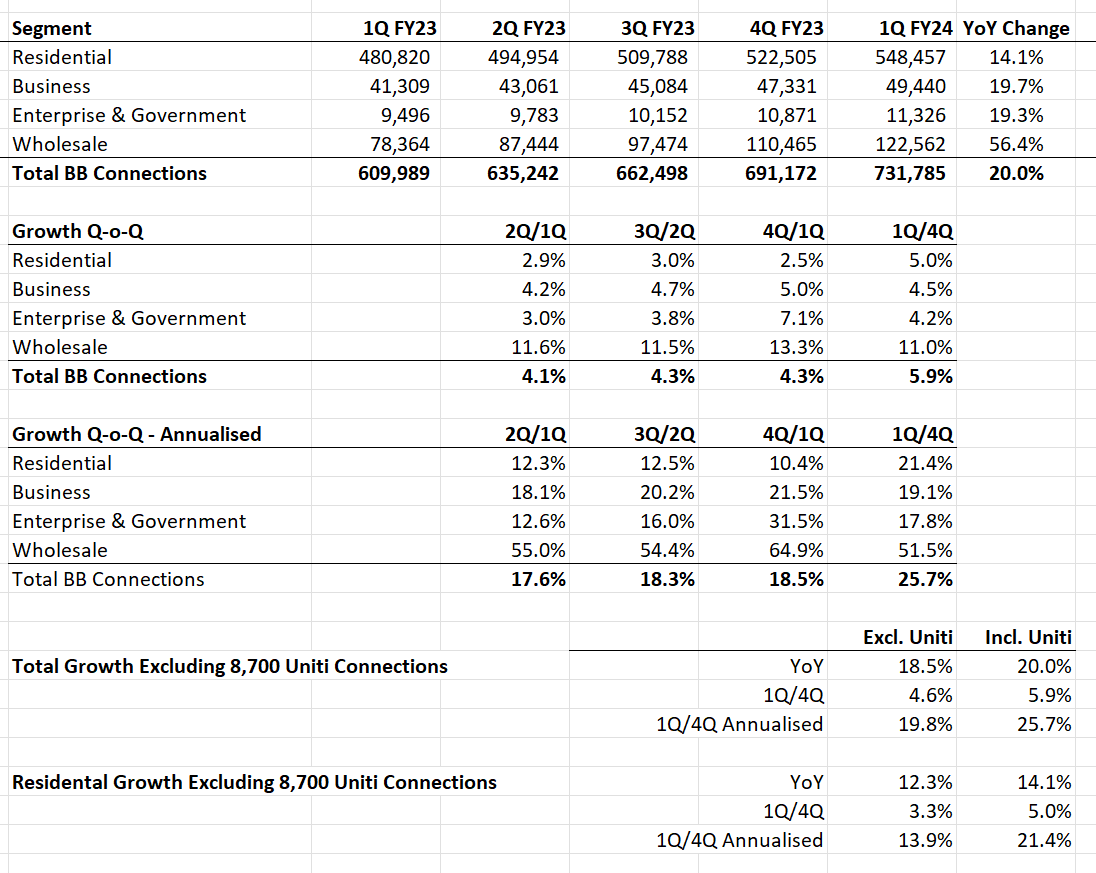

In the table below I compare the YoY connection growth rates with the quarterly growth rates, and quarterly growth rates (Gq) annualised (Ga). (Note: Ga = ((1+Gq)^4 -1) and not 4xGq!)

Figure 1: Connection Growth (Connections)

Although this kind of analysis is too fine-grained to pay much attention too (e.g., because it doesn't show seasonal variations), it shows that residential growth in 1Q FY24 has accelerated significantly over the prior 3Qs. The other 3 segments are still also growing strongly in 1Q, alebit at a slightly moderated pace compared with the FY23 overall growth rate.

However, the 1Q numbers include 8,700 customers acquired from Uniti. (Hey, I thought it was 15,000, but they are reporting the number as 8,700 having migrated across in 1Q FY24, so let's take that at face value.)

So, the two tables at the bottom of Figure 1 look at the growth rates taking 8,700 out of the Total Connections and Residential Connections, to get a better handle on the organic growth (Excl. Uniti), which for ease of reading I place alongside the reported numbers (Incl. Uniti).

So, even if the Uniti Connections are excluded, the growth rate in Total Connections picked up pace to 19.8% Q-o-Q Annualised, compared with 17.6%, 18..3%, and 18.5% rates in the prior 3 quarters. And the same metric in Residential picked up to 13.9% compared with 12.3%, 12.5% and 10.4% QoQ annualised in the prior three quarters.

So, no matter how you slice and dice the numbers, Aussie is continuing to maintain strong momentum in growing market share.

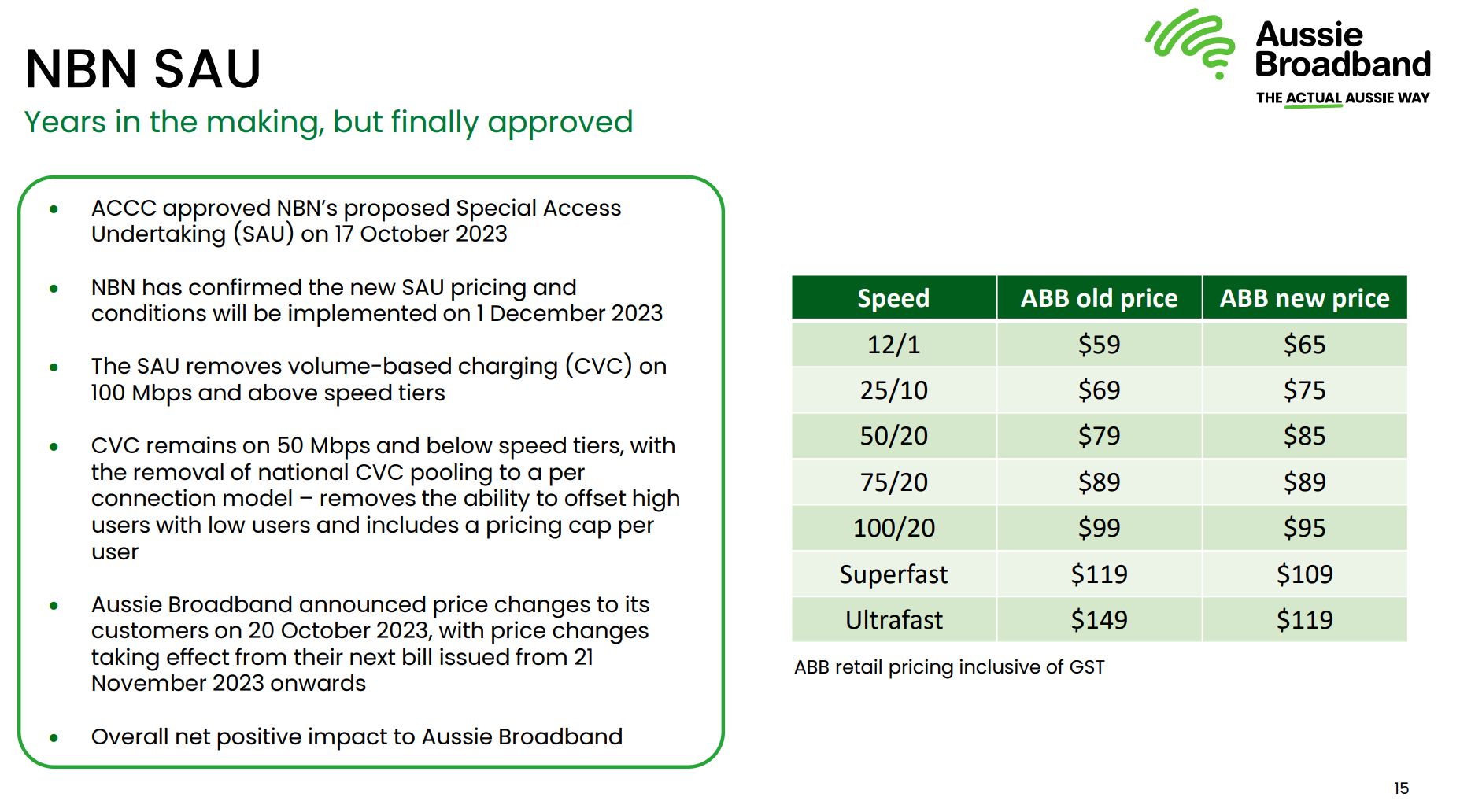

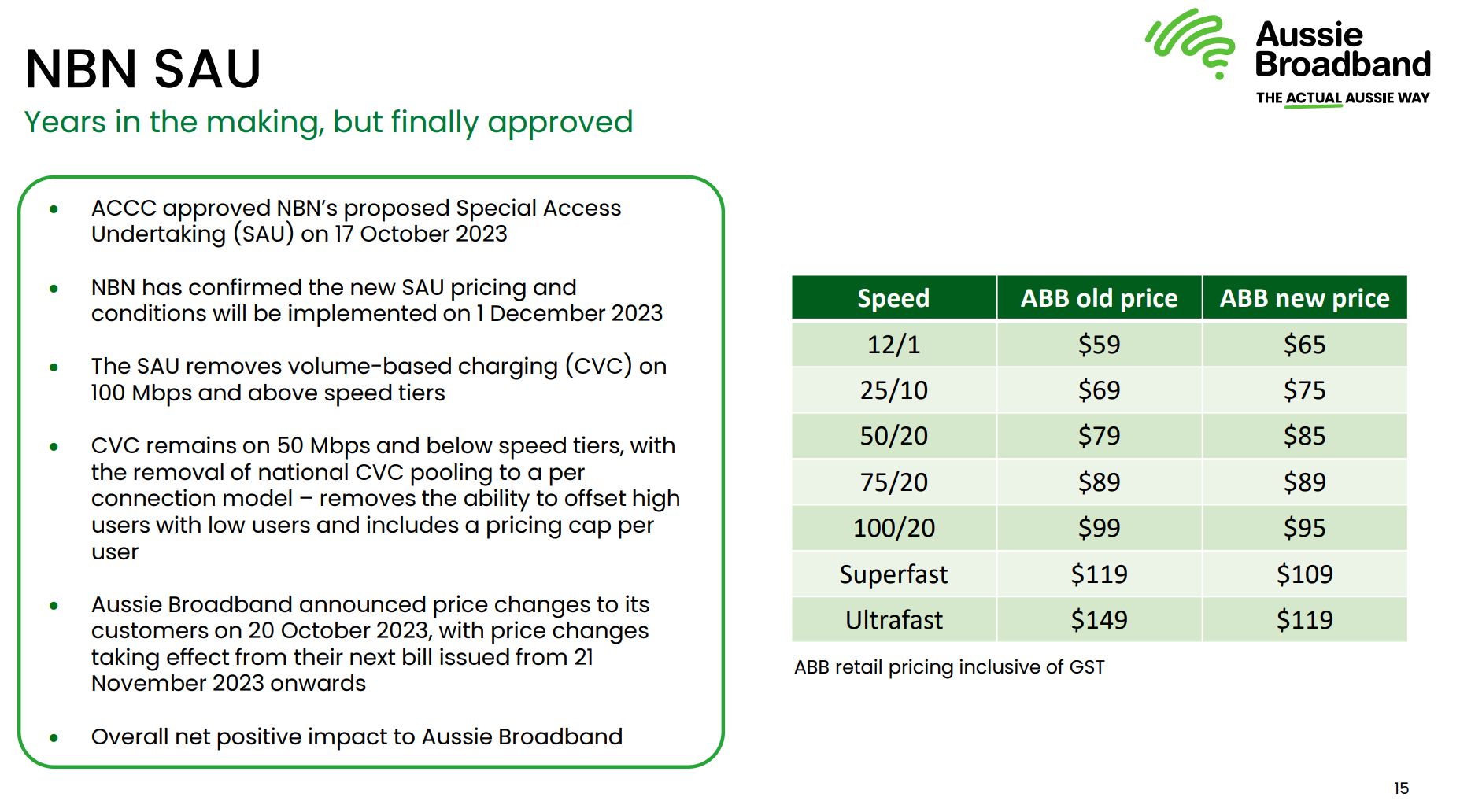

3. Update on SAU (Special Access Undertaking)

The market has been waiting some time to hear how the determination for the SAU has played out. At the FY23 Results $ABB said they expected it to be net favourable for ABB. Today they published how the determination impacts their different plans. See Slide 15 below.

While the CVC volume-based charging remains on the lower speed plans, Aussie makes its money in the higher speed plans.

The net effect is that the premum plans will be cheaper and therefore more attractive to customers, which should drive incremental adoption and margin growth for $ABB.

In a word - good news. (Looking forward to signing up for Power House Plan!)

Slide 15 from Presentation

4. Rationale for the $SYM Acquisition

While the due diligence period has been extended by a week, Phil set out the following rationale for the takeover in his MD's address as follows:

"We believe that Symbio’s range of services and platform would complement Aussie’s NetSIP operations. Symbio offers three product sets: Communications Platform as a Service, Telecommunications as a Service, and Unified Communications as a Service. The business hosts 7.3 million phone numbers, carries 9 billion voice minutes, and manages over 180,000 mobile, nbn and voice services for other MSPs. In FY23, Symbio reported revenue of $211m and underlying EBITDA before one-off items of $27.7m. We are continuing our due diligence, and we will provide a market update at the appropriate time."

While the rationale is just as we have discussed here in other straws, it is silent on the international aspect of the business. For now, we just have to see what happens i.e., whether the deal progresses.

5. FY24 Guidance Reaffirmed

Good on 'ya Phil. Enough said. (Of course given the run up in SP some might be disappointed not to see an upgrade, however, it is early in the FY.)

My Key Takeaways

$ABB tracking nicely in line with the thesis.

It will be good to see how the $SYM deal plays out.

Disc: Held in RL and SM