Attended the C79 call on their 1QFY24 Appendix 4C. It was the usual short call as C79 has a standard set of clear slides with changed numbers each quarter ... a good thing!

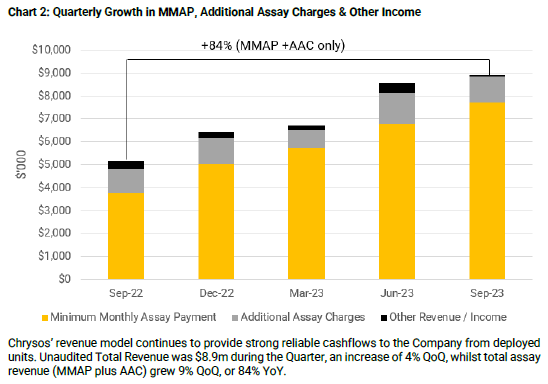

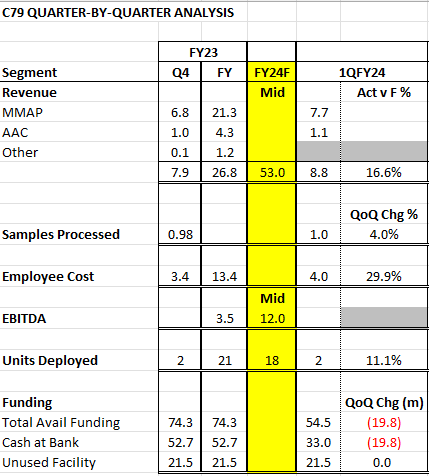

Built a simple xls to summarise the key metrics from the 4C that I need to watch, based on the various discussions here. Rather than take a YoY comparison, which for C79, is really no longer impressive or relvant, really, as it is marching forward in a clearly defined trajectory, have taken (1) a forward looking view against the mid-point of FY24 guidance, where the guidance was provided (2) QoQ trend for those metrics which provide a "rule-thy-world with PhotonAssay" perspective eg. Samples processed and (3) QoQ trend of key watch areas - funding and employment cost.

It does give a more balanced perspective of the risks as @RhinoInvestor rightfully pointed out, vs merely focusing on the wonderful by-definition revenue % increases, which masks future issues. The call with Dirk also provided valuable background context which makes these figures that much more meaningful.

Discl: High conviction holding IRL

GOOD

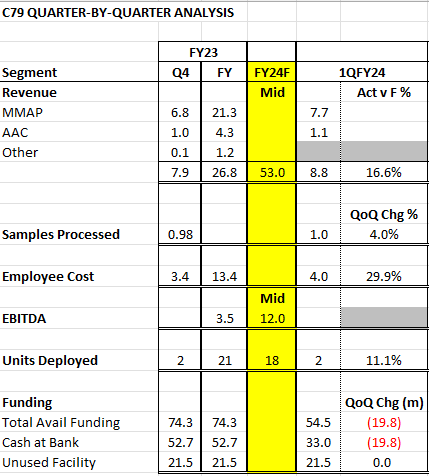

- Solid result, key operational and financial metrics on track

- 2 units deployed, 4 units are currently being installed (3 in Canada, 1 in Ghana) - on track

- Successfully re-deployed one unit - a technical first, proving that the units can be moved, learnings etc

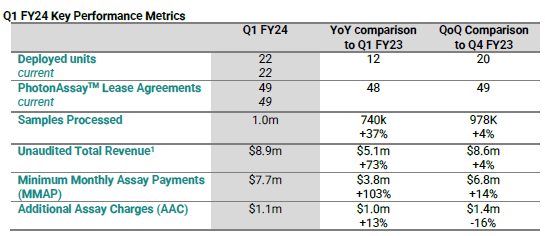

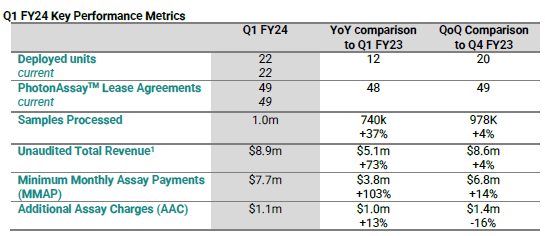

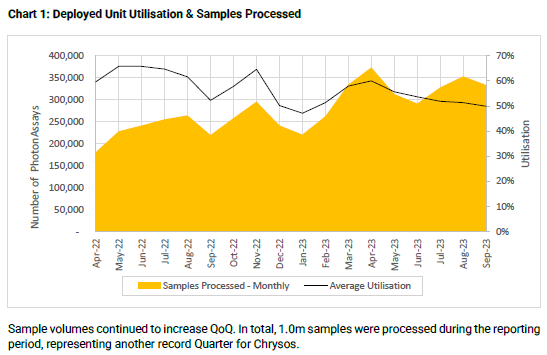

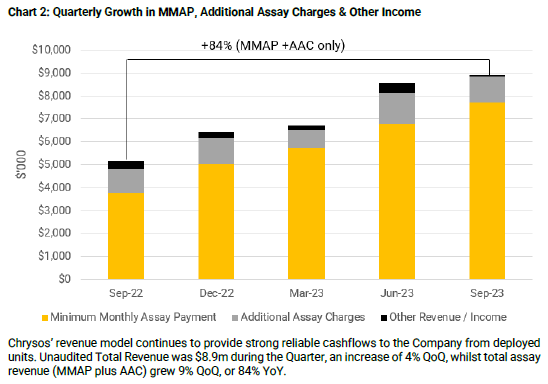

- Sample volumes continued to increase QoQ from 978k Q4FY23 to 1.0m this quarter - revenue upside but also an indicator of the uptake of Photon Assay technology

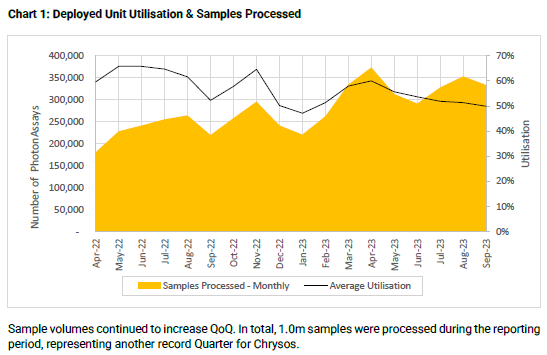

- 15% increase in gold exploration in 4QFY23 over 3QFY23 - augurs well for growth of samples, and hence AAC upside revenue in the coming quarters as this is what drives the range variability in the FY revenue guidance

- Revenue increase is as expected - $8.8m revenue is ~16.6% of the mid-point of the FY24 Revenue Guidance of $48.0m to $58.0m

- Well funded - $54.5m available funding, $33.0 of which is cash at bank - noted comment that “broader debt discussions progressing” which was also mentioned in the Investor call

- In response to a question around the sales approach between Labs and Mines, Dirk reiterated that C79’s focus at the moment is to convert the mining industry to Photon Assay technology, so the Lab vs Minesite equation is less important as the TAM of Labs and Mines is already very concentrated

NOT SO GOOD

Nothing to not like

TO WATCH

- Employee cost has gone up $0.6m QoQ to $4.0m, which is 29.9% of total FY23 employee cost - watch the QoQ increase in this cost

- Available funding has dropped $19.8m from Q4 - the drawdown feels a bit higher given (1) back-end nature of capex payments (2) 3 units deployed this Qtr (3) 4 are in deployment - need to watch this vs funding-related announcements