Others here are following $3DP more closely than I am, so I will hold back on the broader commentary.

However, I have just updated my trend charts on CF.

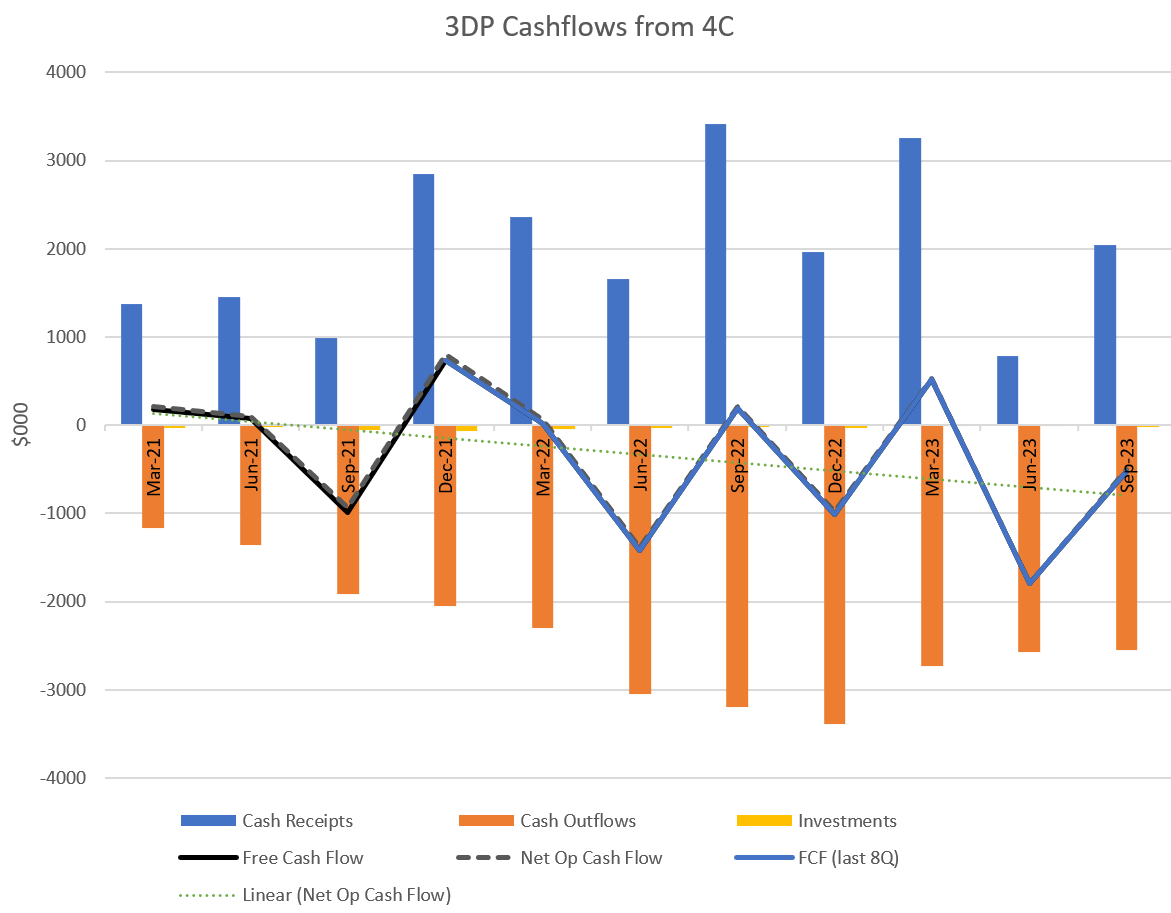

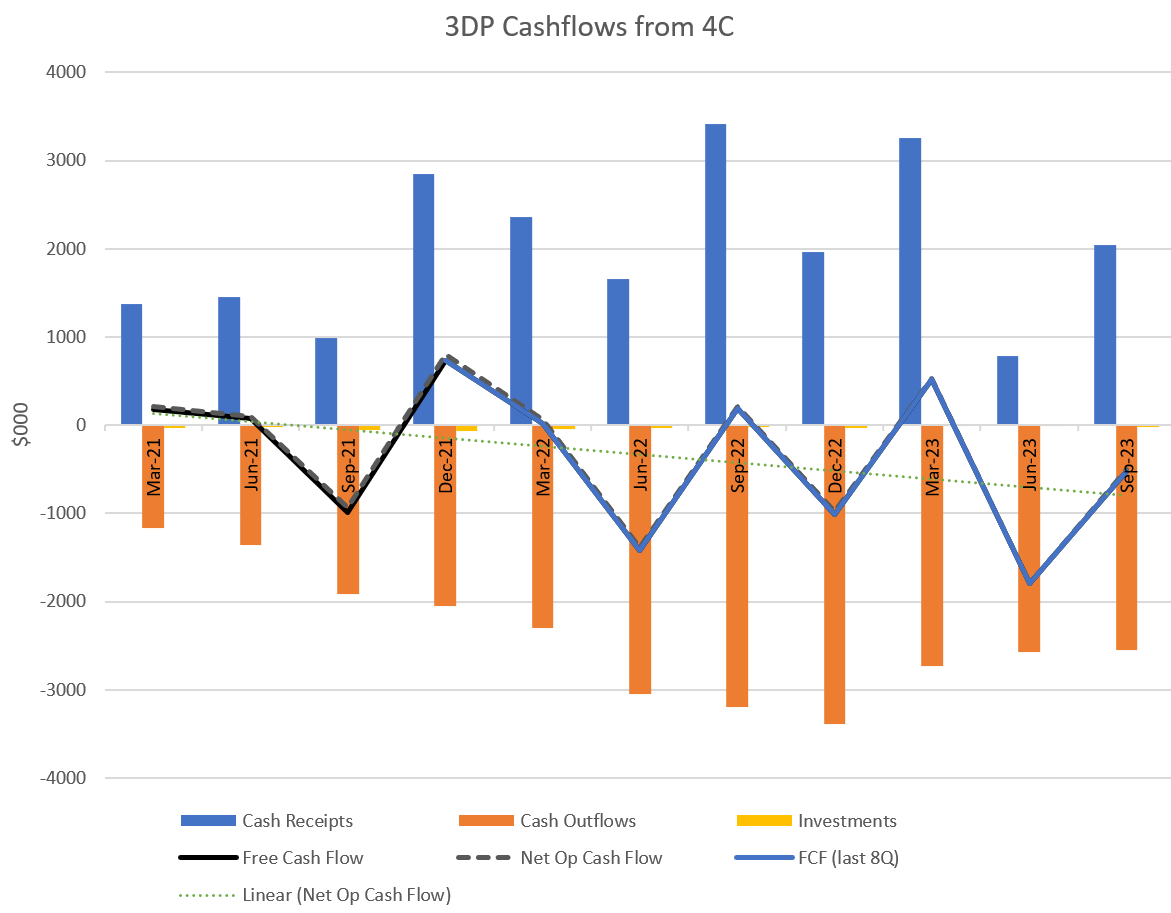

Figure 1 - Quarterly Cash Flows

The faint dotted green line is the trend on FCF over 8Q.

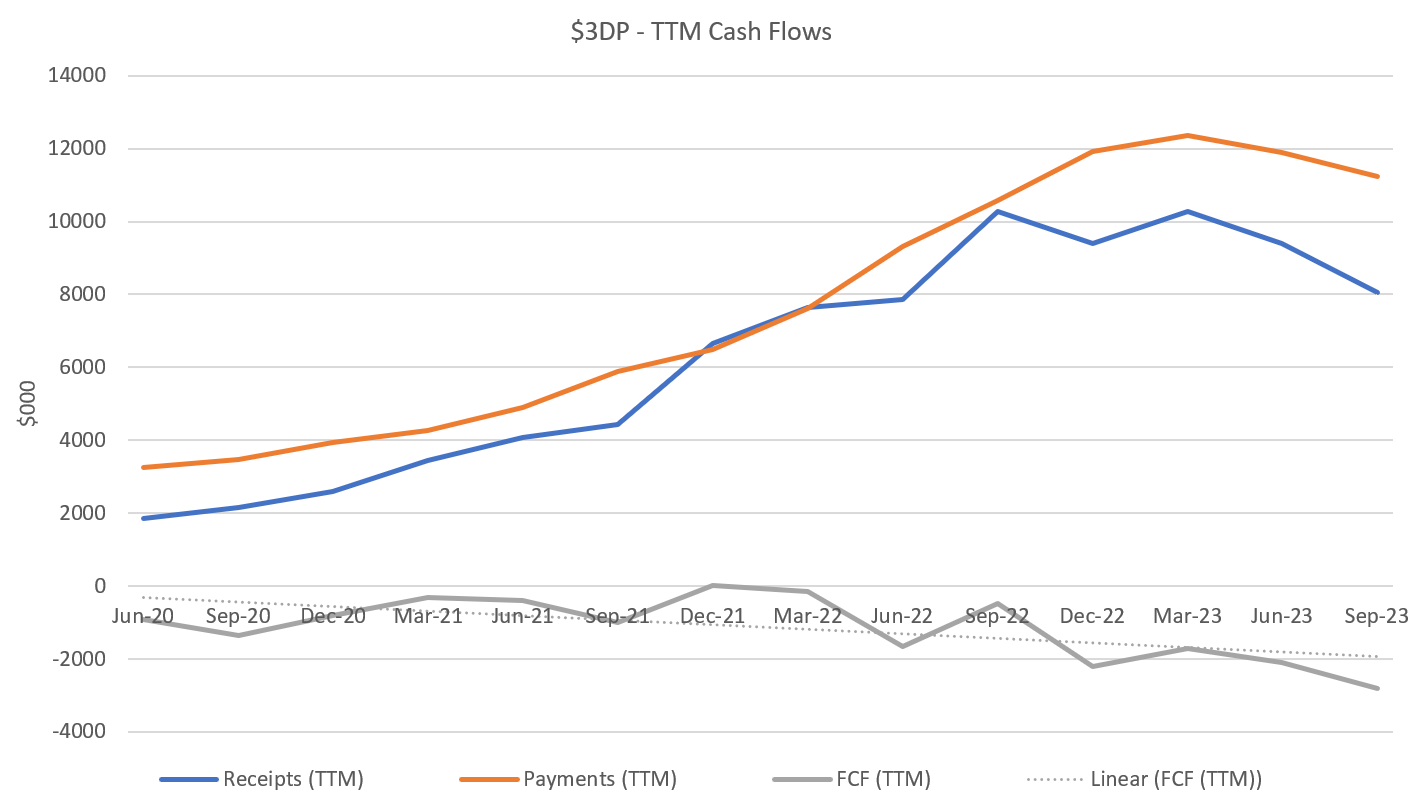

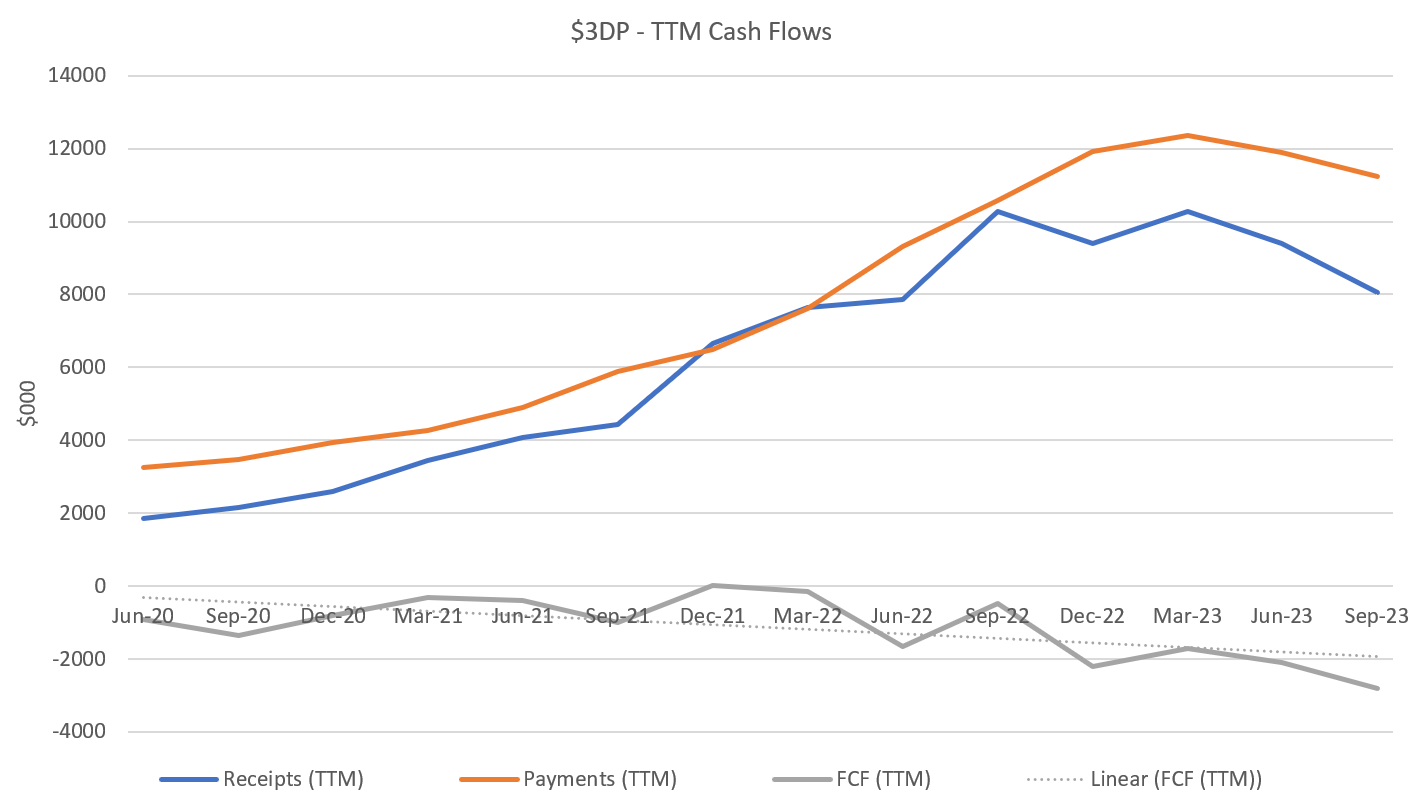

Just to highlight that the trends are fundamental, I have plotted the data in a rolling Trailing 12-Month format (TTM):

Figure 2; Cash Flow Trends TTM

This visualisation shows the same trends but takes out some of the noise.

My Key Takeaways

The business has declining receipts. But it can't control costs well enough. The gap between the receipts and costs trajectory is widening.

Absent a breakthrough, this is in danger of entering a death spiral. Not only does it lack scale, but its not even showing a trajectory to ever reach scale.

Not investible from my perspective.

Hopefully this provides some fodder for questions to Ian later today around sustainability of the business. (I'll have to catch up with the recording later, as I have other commitments today and can't attend.)

Disc: No longer held in RL and SM