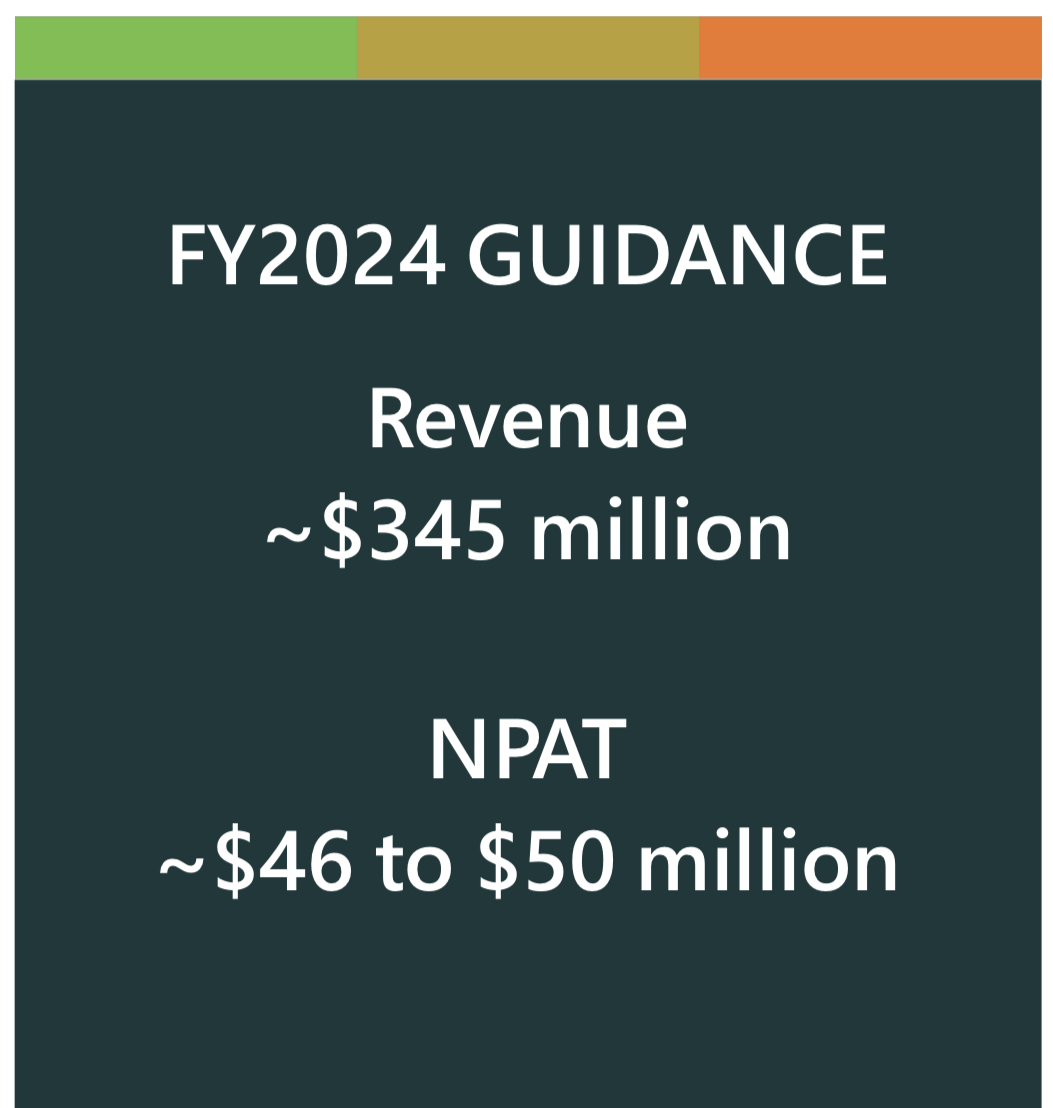

Lycopodium released its FY23 AGM Presentation this morning. Sandwiched in the middle of the presentation was a slide titled “Current Snapshot” which contained FY24 Guidance:

How does this compare to FY23?

Management expect FY24 Revenue to be $345 million which would be up 6.5% on FY23 revenue of $324 million.

Management expect FY24 NPAT to be flat to 7% higher than FY23 NPAT of $46.8 million

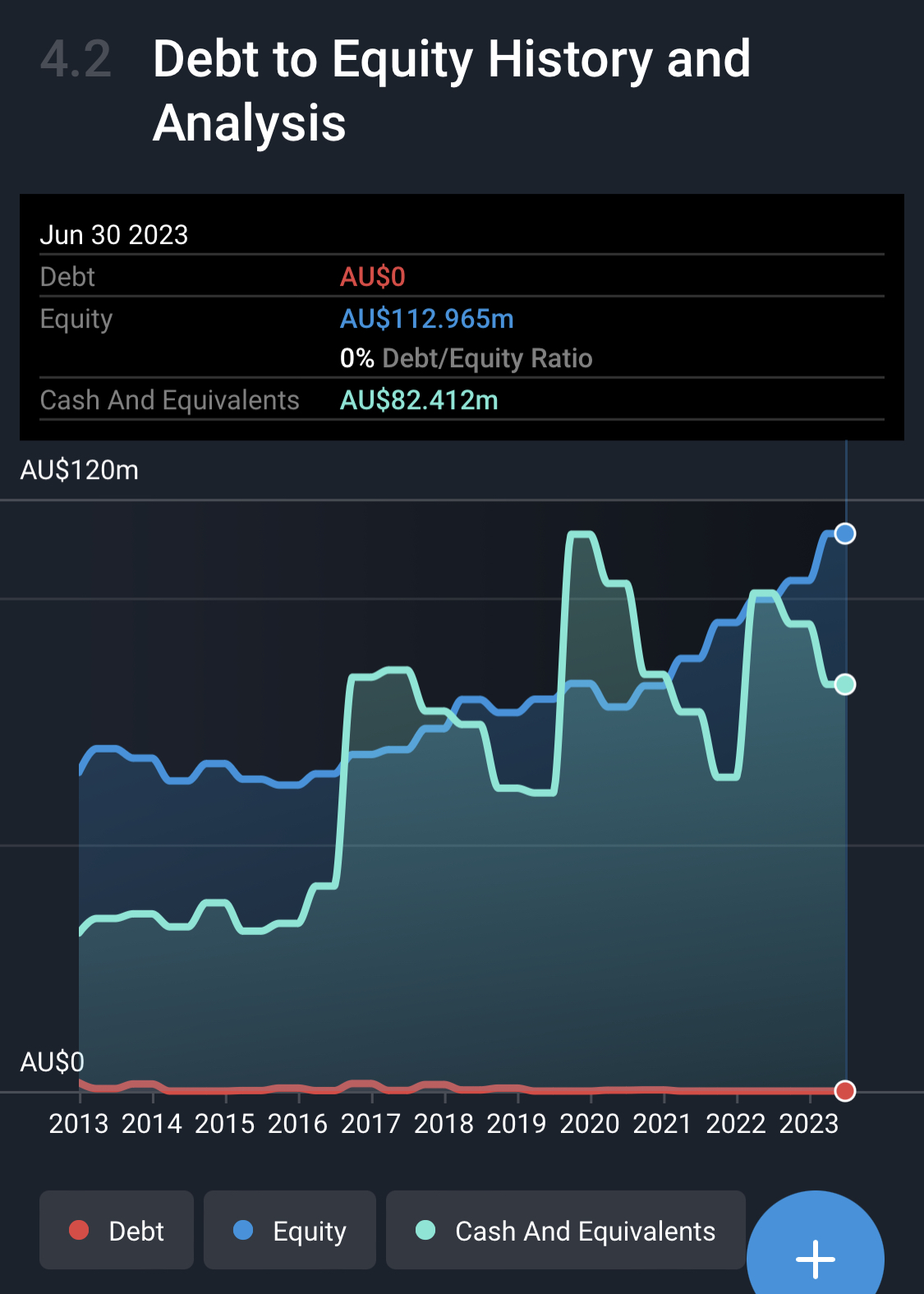

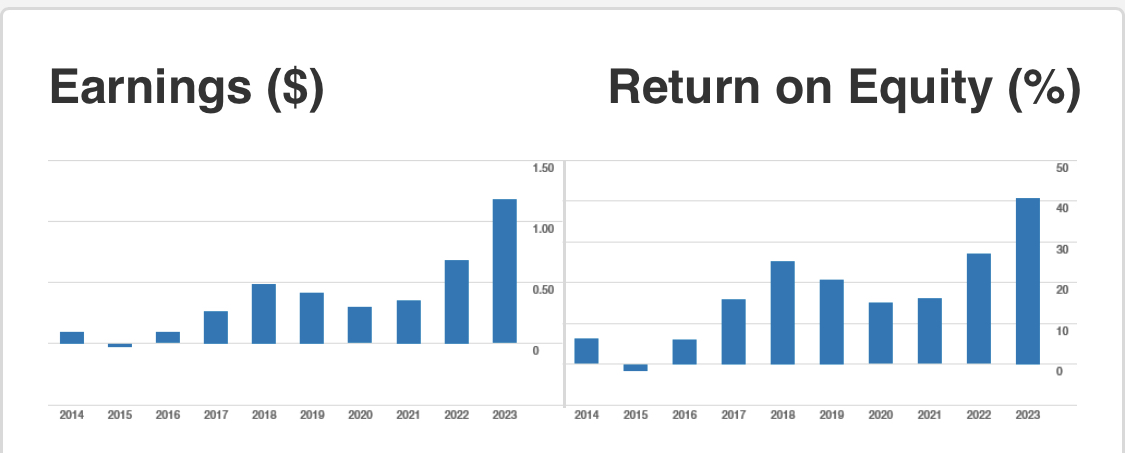

Importantly, FY24 ROE should remain between 40% and 44% which is exceptional, particularly when you consider LYL has a lazy $82.4 million of the $113 million in total shareholder equity sitting in cash.

LYL is obviously building some sort of ‘moat’ around their expertise to be increasing ROE every year to this level without the need for leverage and with so much lazy cash sitting almost idle on the balance sheet. Since 2020 LYL has definitely landed in a sweet spot, and this looks set to continue into the near future.

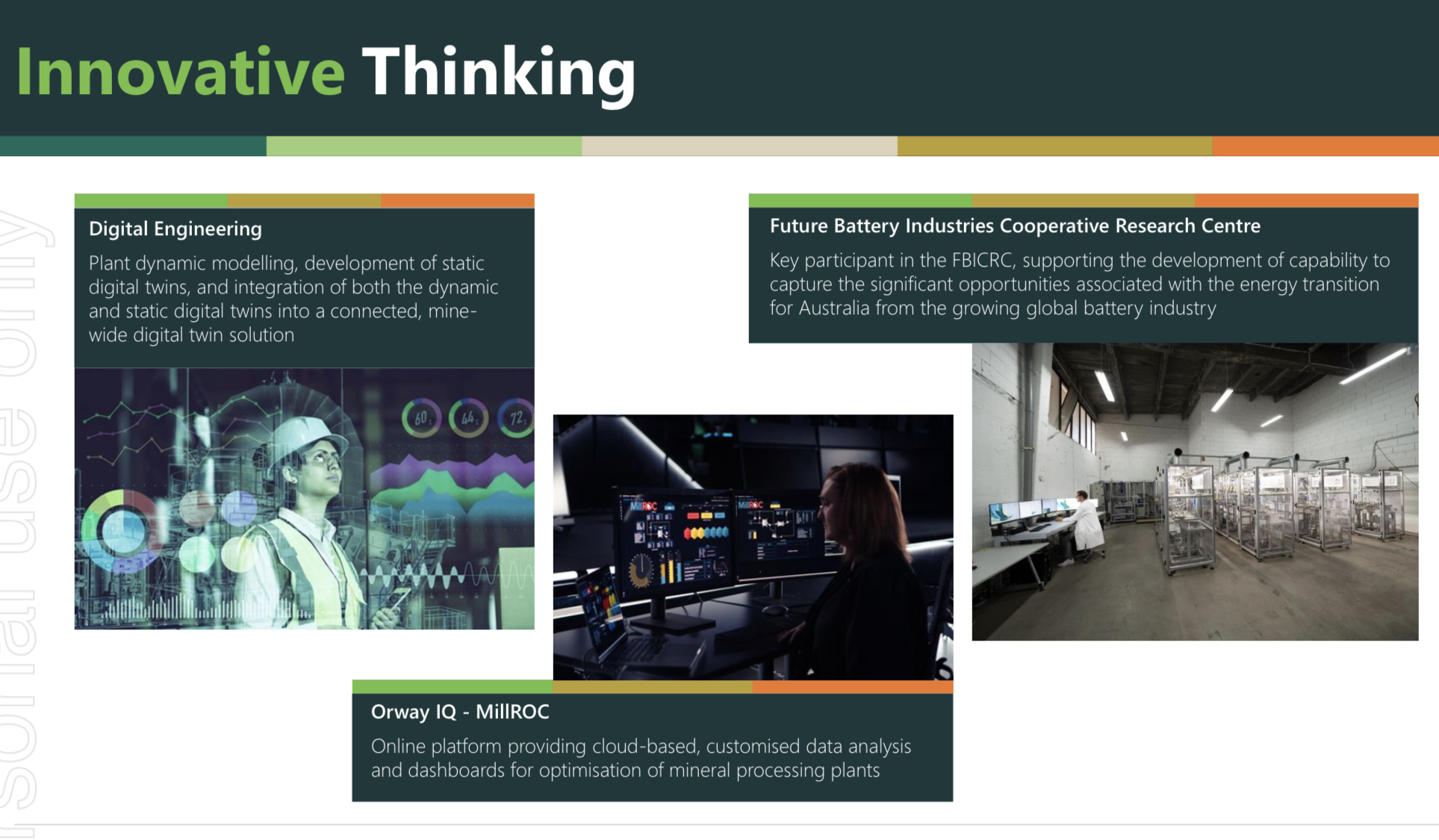

I also like that LYL management are very forward thinking and try to seperate themselves by focusing on a unique suite of specialised engineering and professional services rather than trying to compete in the mainstream. The slide below is an example of how management is always thinking forward to stay ahead of the pack.

As @Bear77 has already mentioned LYL is also diversifying away from their heavy reliance on expertise to the Western African gold mimers, which @Bear77 pointed out is an area where they are also specialists in the field of electrical engineering.

As @Bear77 has already mentioned LYL is also diversifying away from their heavy reliance on expertise to the Western African gold mimers, which @Bear77 pointed out is an area where they are also specialists in the field of electrical engineering.

This slide demonstrates LYL have several irons in the fire, and are are carving out a unique niche in each. I’m liking this business more each year, and have continued to add more shares to our portfolio.

Better leave something for @Bear77 to talk about!

Disc: Held IRL (2.6%)