I’m trying to understand more about the SAXUM acquisition to get a better handle on the current valuation of Lycopodium. However, the financial details of the acquisition seem to be missing. I have no idea what LYL are paying for a 60% shareholding in the business. All I can assume is that it is likely to be less than A$68 million, the total cash reserves at 30 June 2024 (since it’s to be funded from cash reserves).

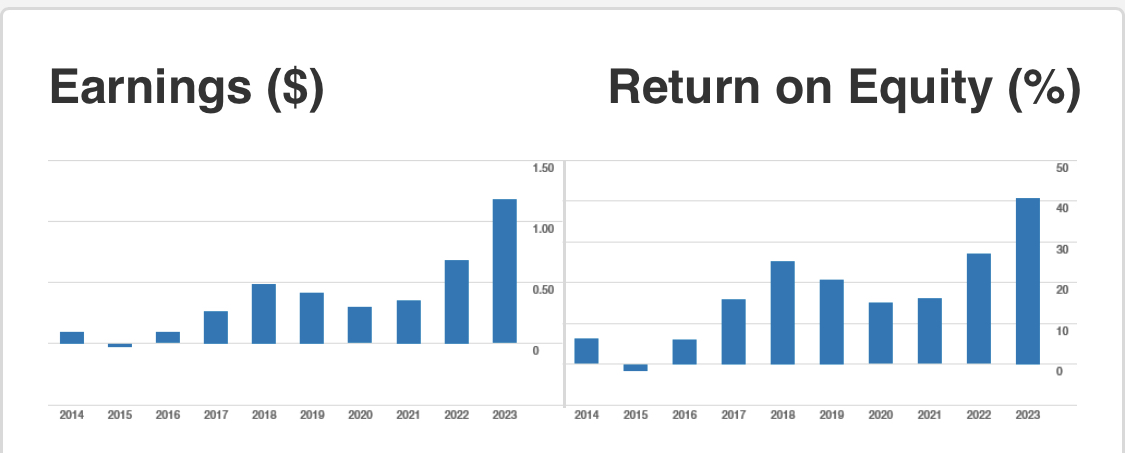

I have no idea how SAXUM is performing financially other than “Holding no debt and with consistent revenue growth and strong profit margins, SAXUM will contribute immediately to Lycopodium’s revenue and profitability and the acquisition supports Lycopodium’s key strategic initiative to further geographically expand its global presence in the Americas.” I wonder how it’s ROE or ROIC compare? Will it dilute LYL’s recent 30% to 40% ROE metric?

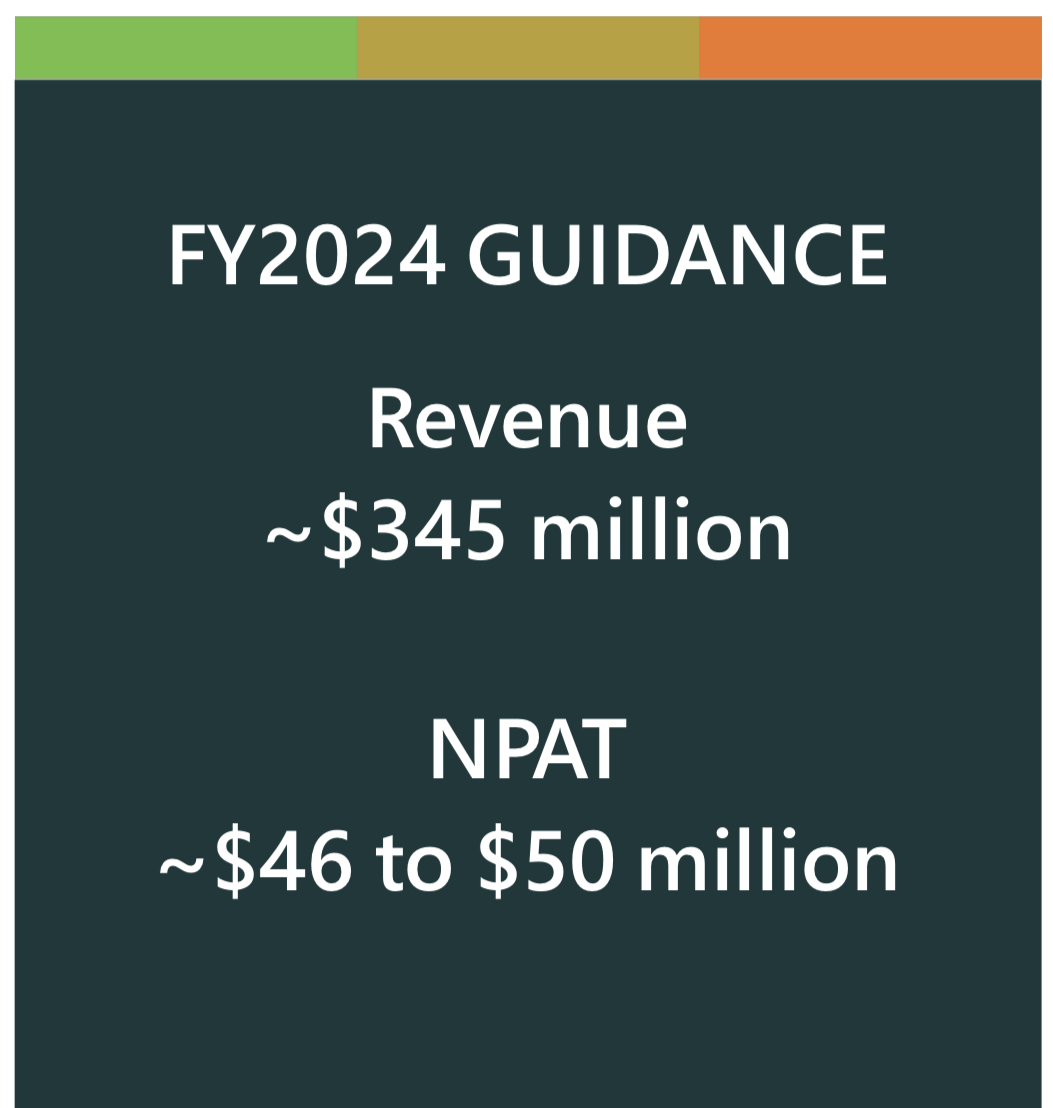

I agree with @Slideup’s comment “The part I am struggling to follow with this update is why is NPAT lower than the preceding two years on stable to growing revenue.” When you also consider that “SAXUM will contribute immediately to Lycopodium’s revenue and profitability”, why will NPAT be lower in FY25? Does this mean other parts of the existing business are not expected to do well?

I don’t know what others think, but the lack of financial detail re the SAXUM acquisition seems a bit strange, unless management are still negotiating the price? Then it’s like “Trust us, we know what we are doing”! I guess that’s worked so far!

Tell me if I’m missing some important information here. It makes it difficult to refine the LYL valuation without more financial detail on SAXUM.

PERTH, 18 October 2024

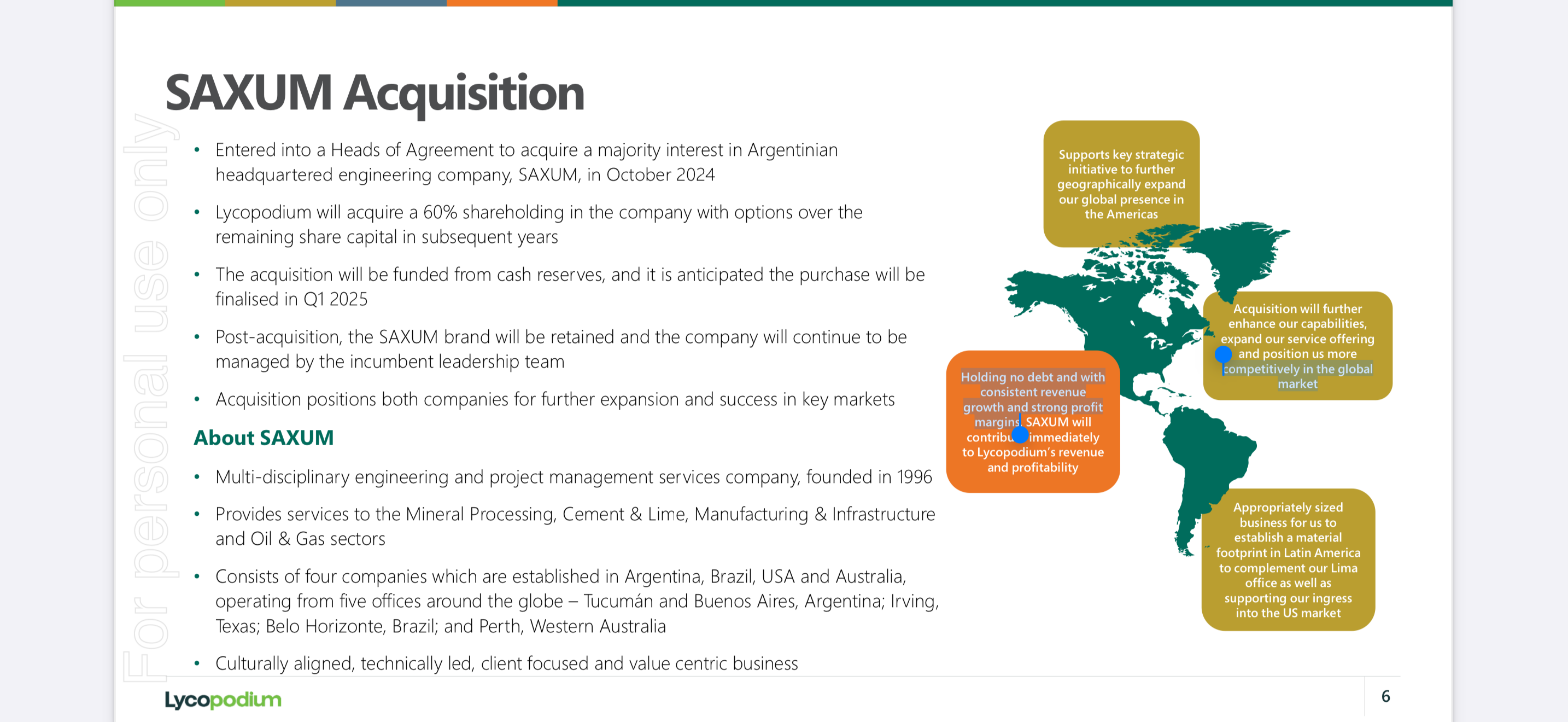

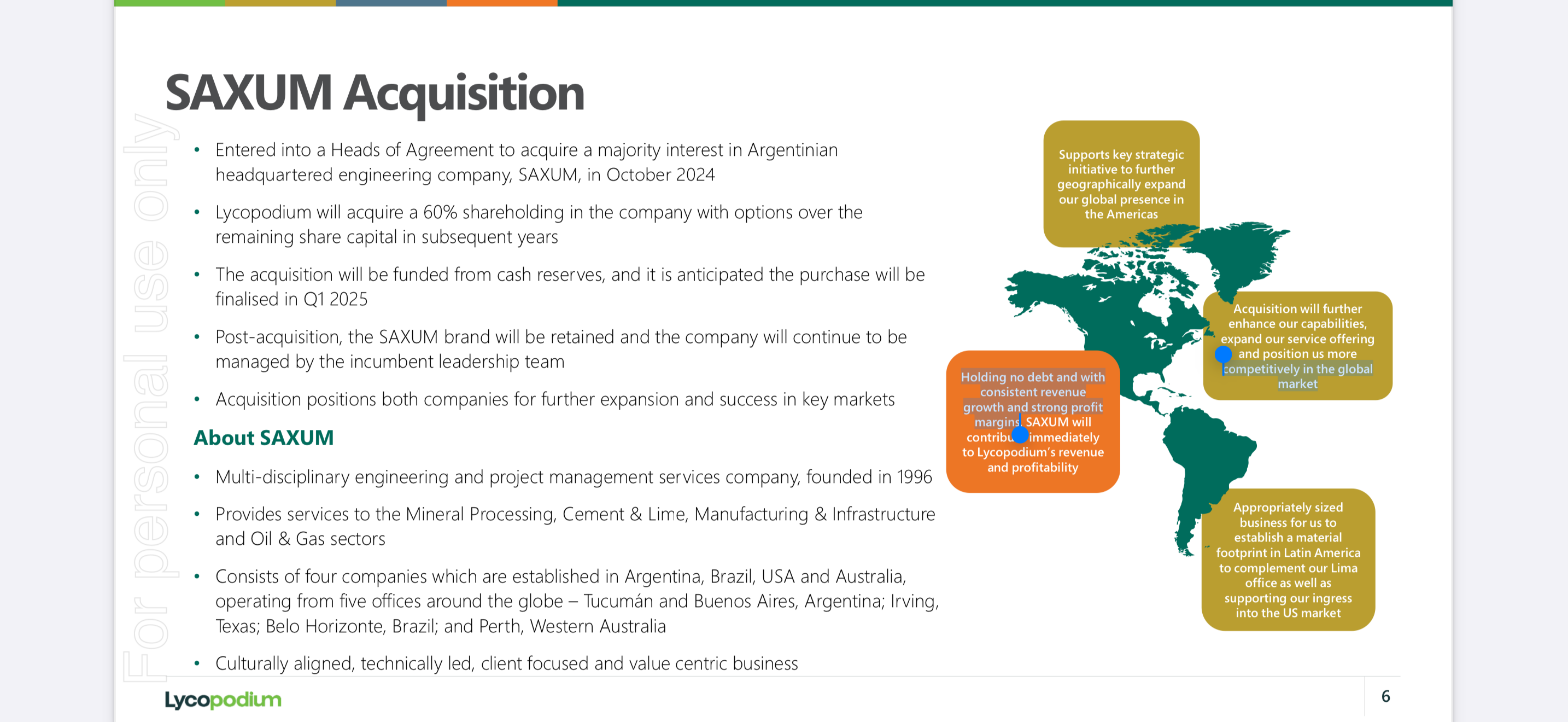

Lycopodium Limited (“Lycopodium” or the “Company”) is pleased to advise that, following a due diligence process, it has entered into a Heads of Agreement to acquire a majority interest in SAXUM, an Argentinian headquartered engineering company. Under the terms of the agreement, Lycopodium will acquire a 60% shareholding in SAXUM with options over the remaining share capital in subsequent years.

SAXUM is a multi-disciplinary engineering and project management services company, founded in 1996, which provides services to the Mineral Processing, Cement & Lime, Manufacturing & Infrastructure and Oil & Gas sectors. It consists of four companies which are established in Argentina,

Brazil, USA and Australia and operates from five offices around the globe – Tucumán and Buenos Aires, Argentina; Irving, Texas; Belo Horizonte, Brazil; and Perth, Western Australia.

Holding no debt and with consistent revenue growth and strong profit margins, SAXUM will contribute immediately to Lycopodium’s revenue and profitability and the acquisition supports Lycopodium’s key strategic initiative to further geographically expand its global presence in the Americas.

Lycopodium’s Managing Director, Peter De Leo, said: “We are extremely pleased to announce this acquisition, which will further enhance our capabilities, expand our service offering and position us more competitively in the global market. SAXUM is a mature business, is culturally aligned with Lycopodium and is an appropriately sized business for us to establish a material footprint in Latin America to complement our Lima office as well as supporting our ingress into the US market.”

Post-acquisition, the SAXUM brand will be retained and the company will continue to be managed by the incumbent leadership team, which will not only secure trust with existing clients but also positions SAXUM for further expansion and success in its markets.

SAXUM founder and CEO, Dr Guillermo Etse, said: “We are thrilled with the opportunity to join the global Lycopodium family. I believe this is an excellent fit for our business, as we too are a technically led, client focused and value centric business.”

The acquisition will be funded from cash reserves, and it is anticipated the purchase will be finalised in Q1 2025, at which point further details will be provided.

As

As