11-Dec-2023: Regis Resources (RRL) had a diabolical hedgebook that would have seen them continuing to sell a good portion of their gold at around half the current spot price through until the middle of 2024. However they've just closed that hedgebook out - see here: Closure-of-Hedge-Book.PDF

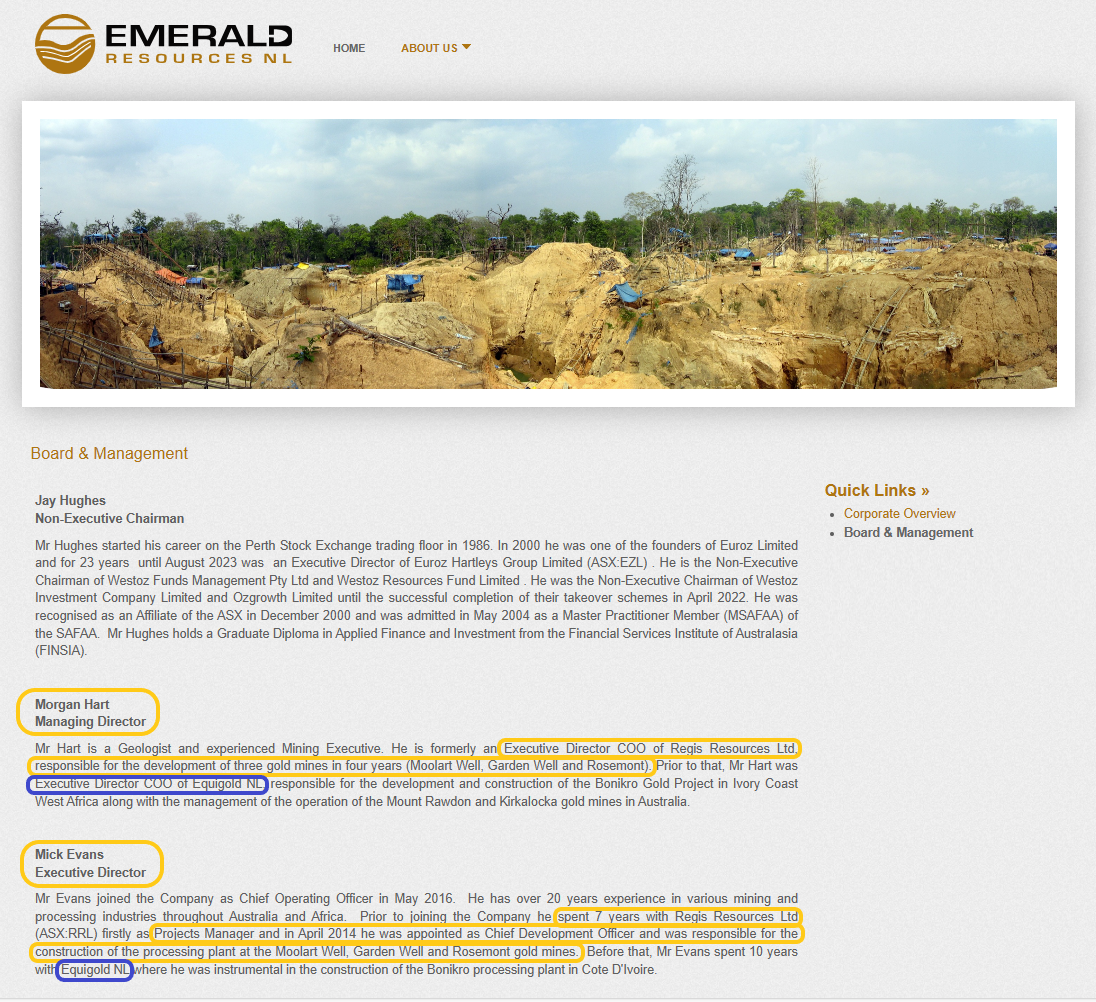

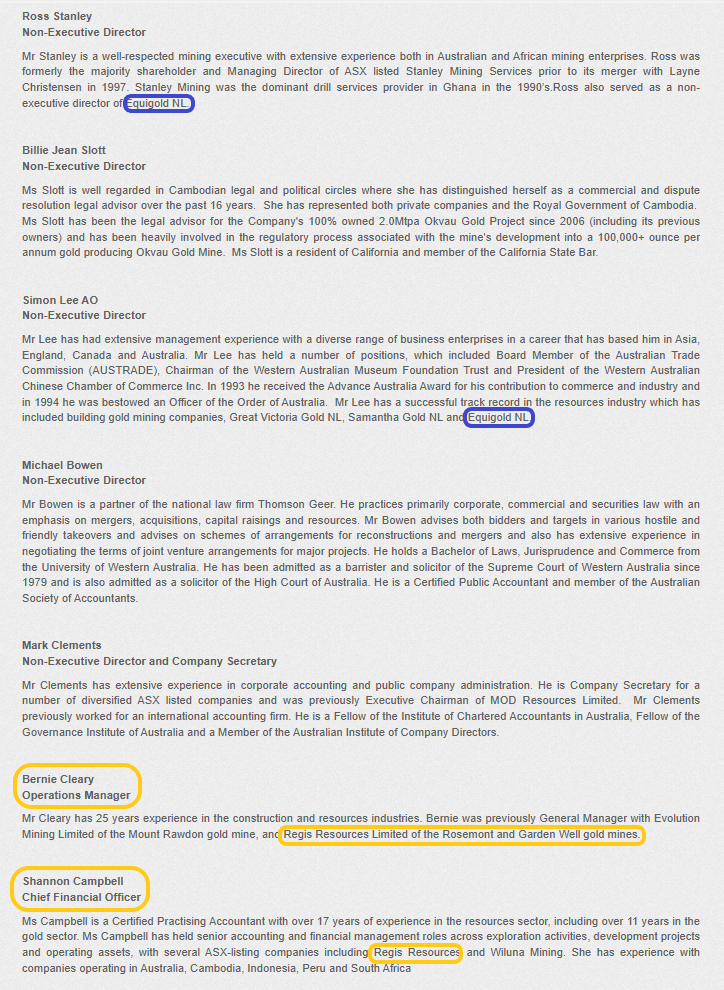

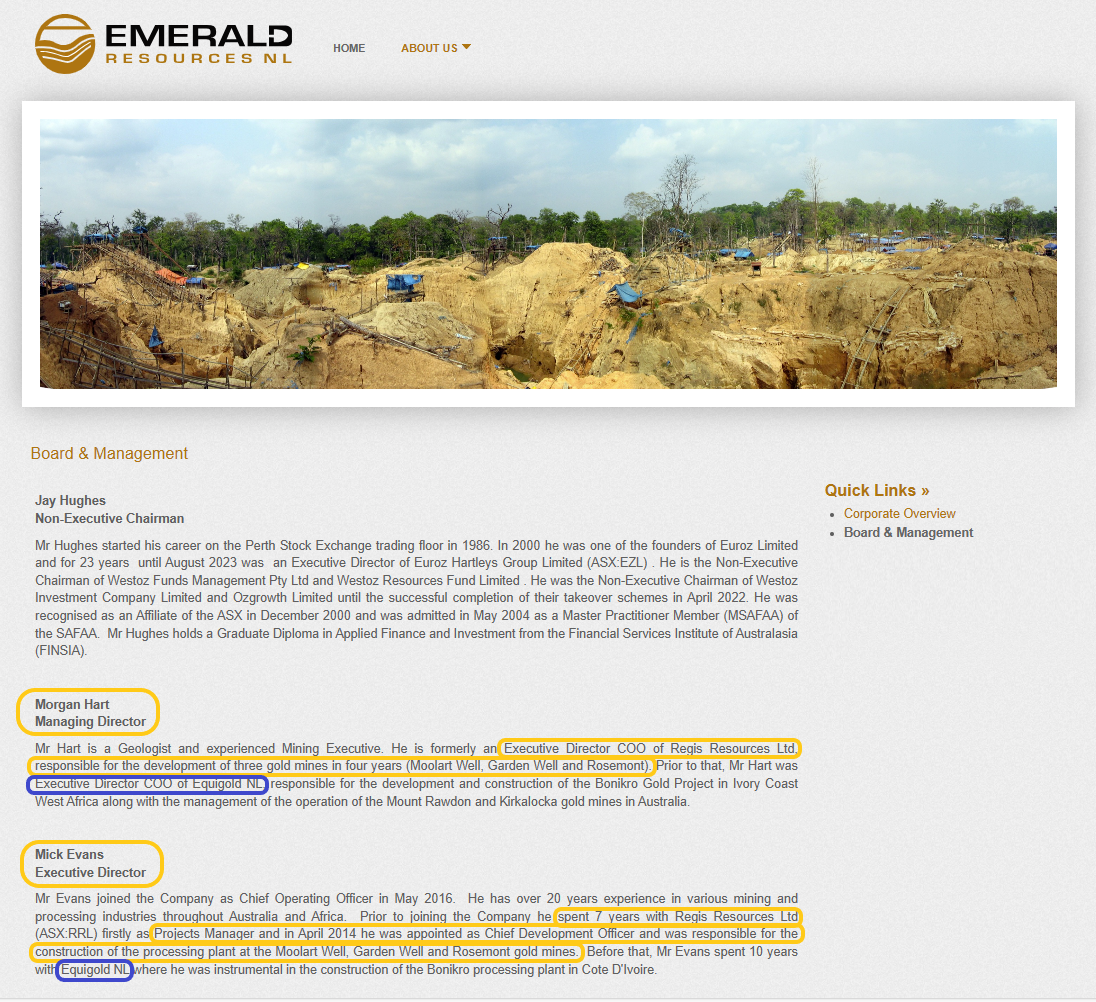

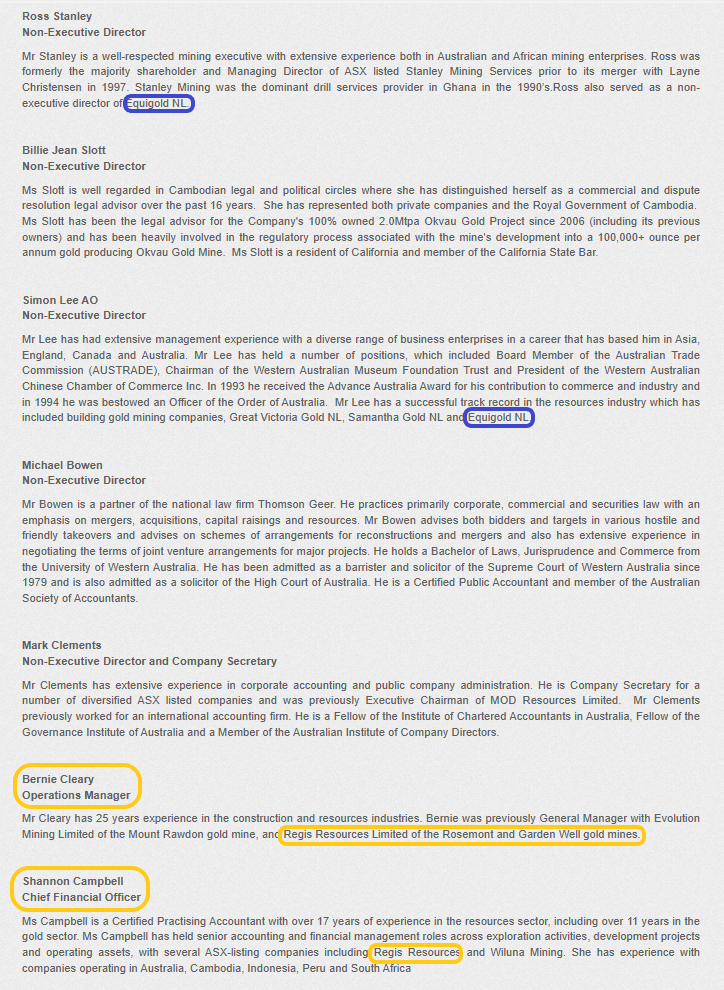

That's a very positive move by a management team that has made their fair share of mistakes. It's not the same management team who were there during the Duketon build-out when Regis were fast growing and also one of the best dividend paying gold companies in Australia - no, those people all ended up at either Capricorn (CMM) or Emerald (EMR) - see screenshots from their websites below - and that former management team would NOT have signed up for such low priced gold hedges that didn't even gurantee profitability in the recent inflationary cost environment. But this lot - that are in charge now - have finally bitten the bullet and closed out all of their hedges - and are now fully exposed to the high spot price.

Not before time!

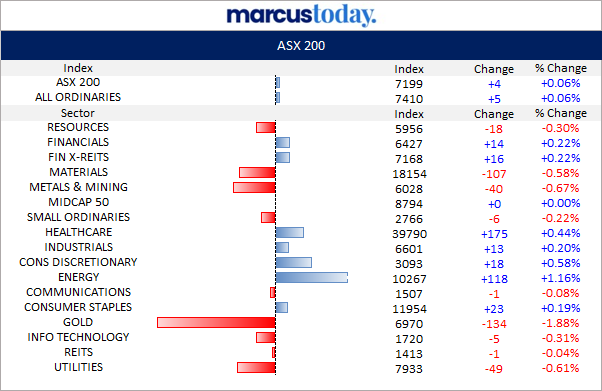

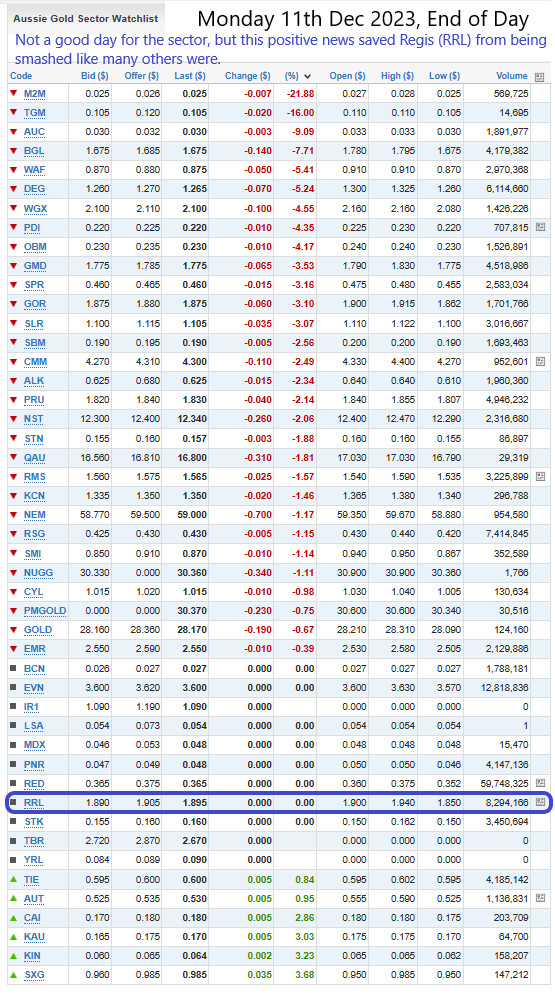

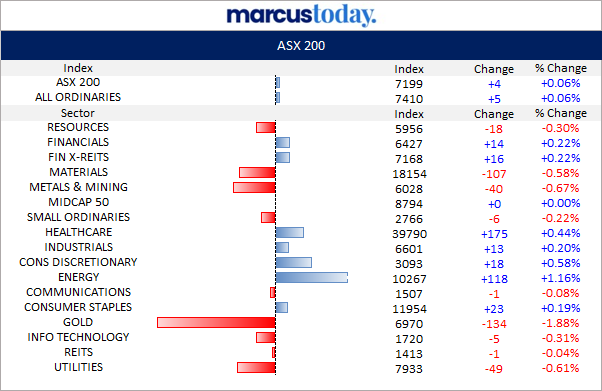

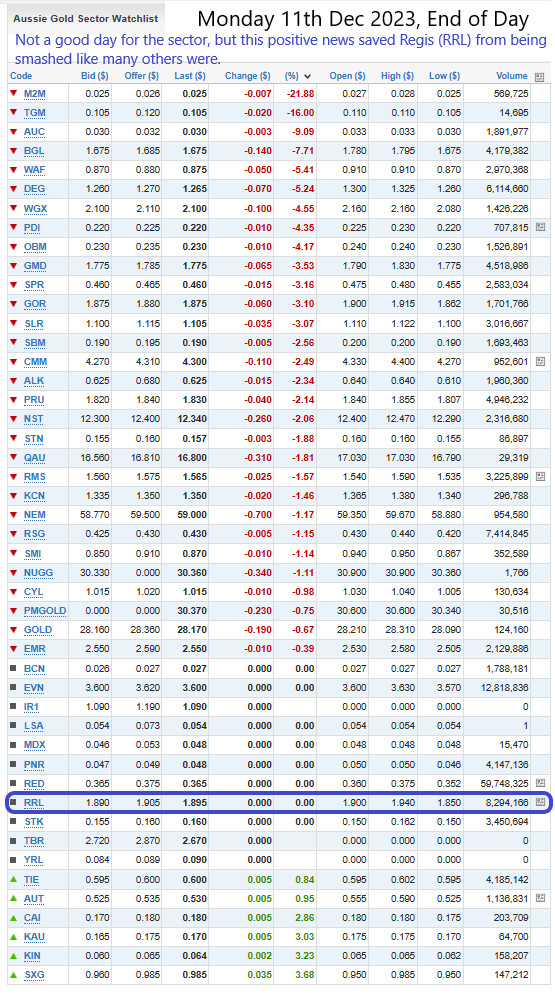

Their (RRL's) share price didn't rise, but it also didn't fall today, which was actually a good result, because there was a sea of red across the Aussie Gold Sector.

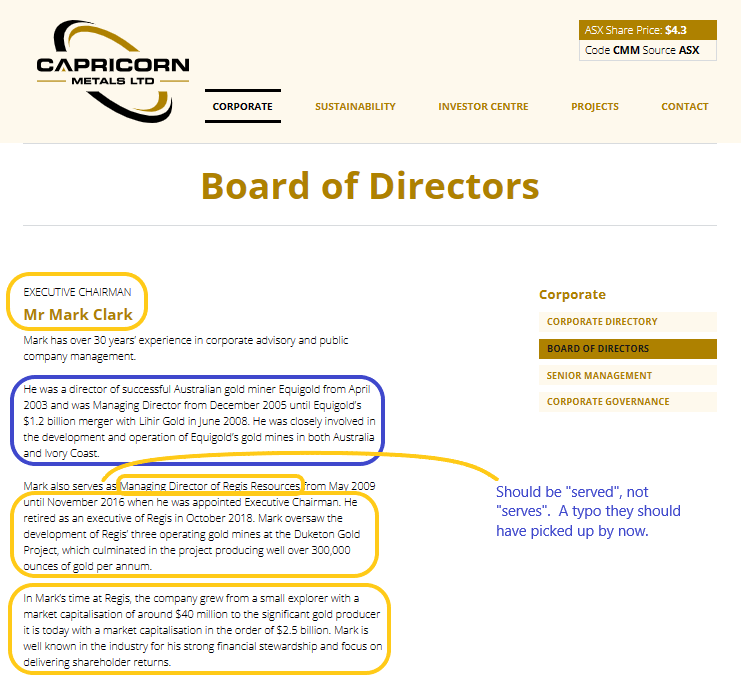

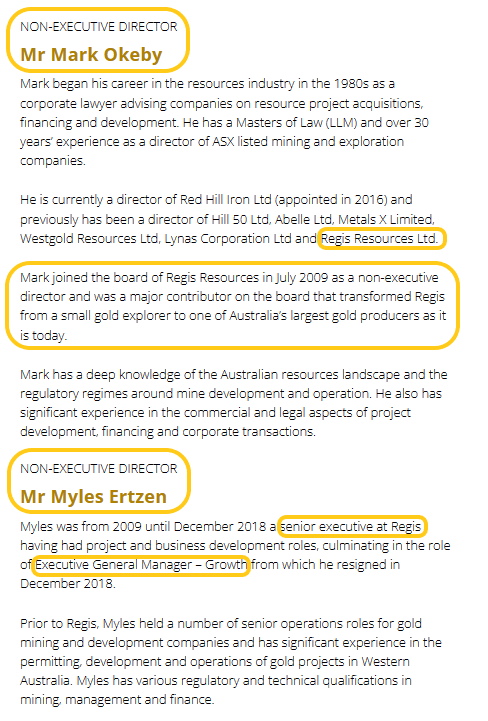

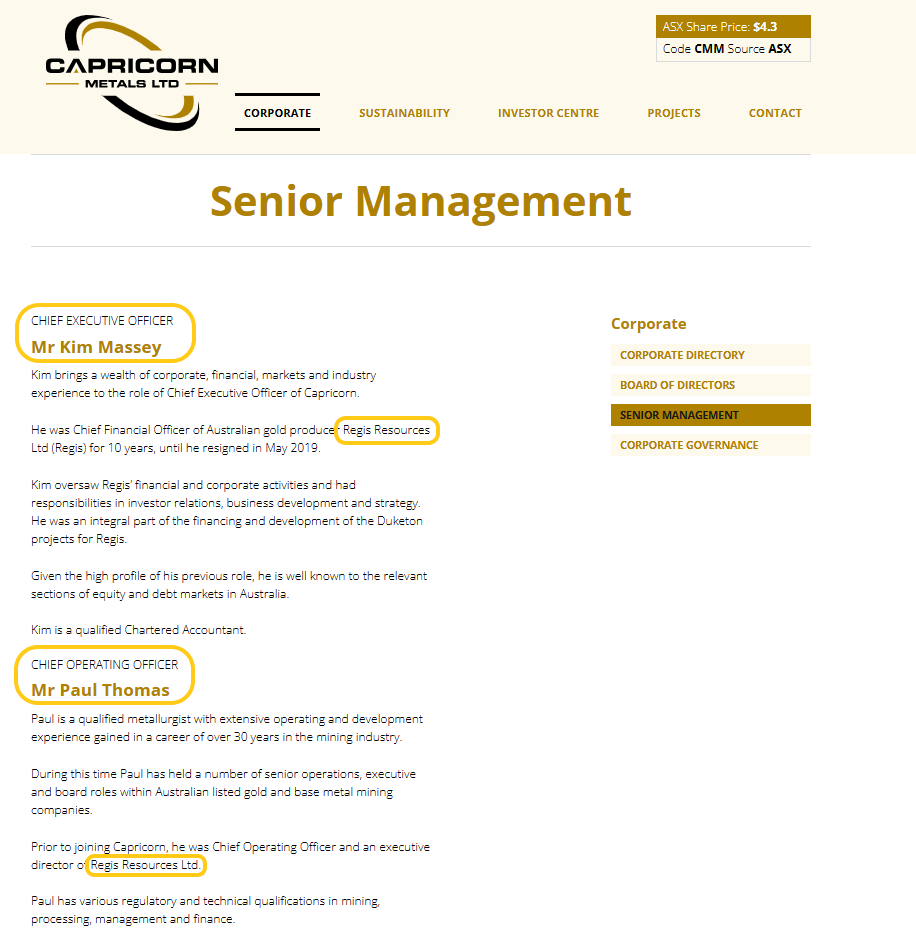

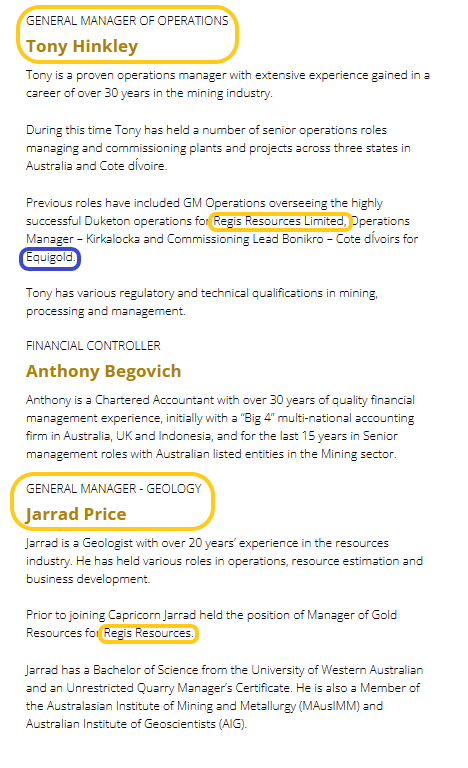

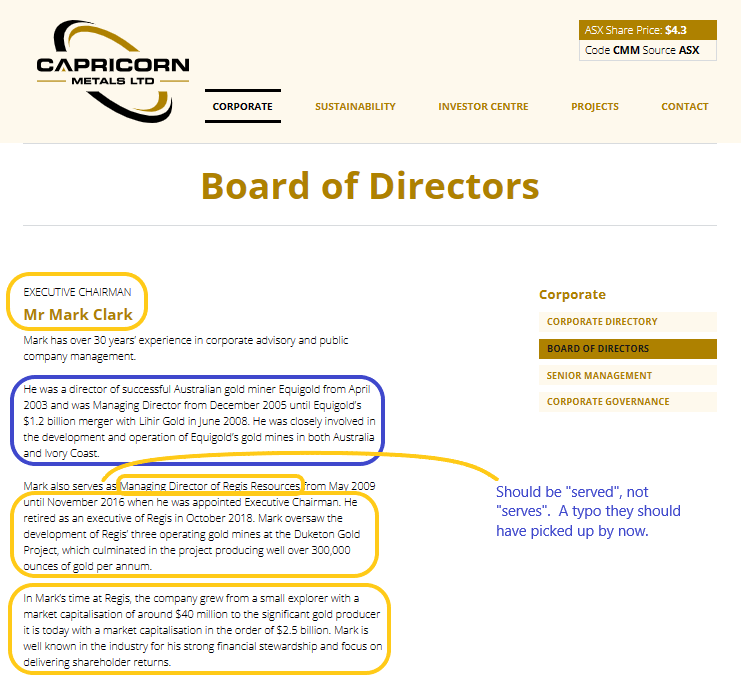

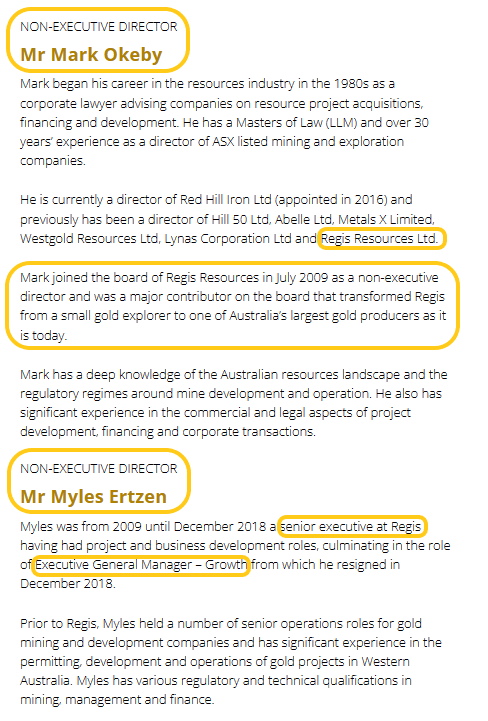

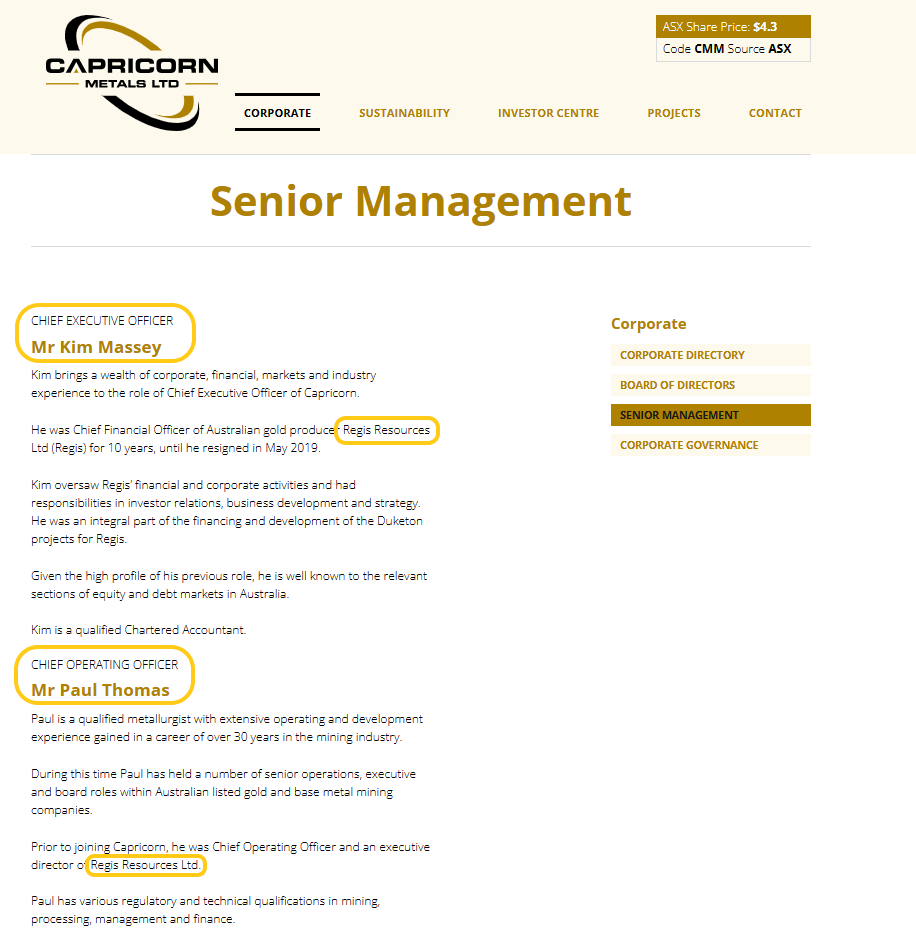

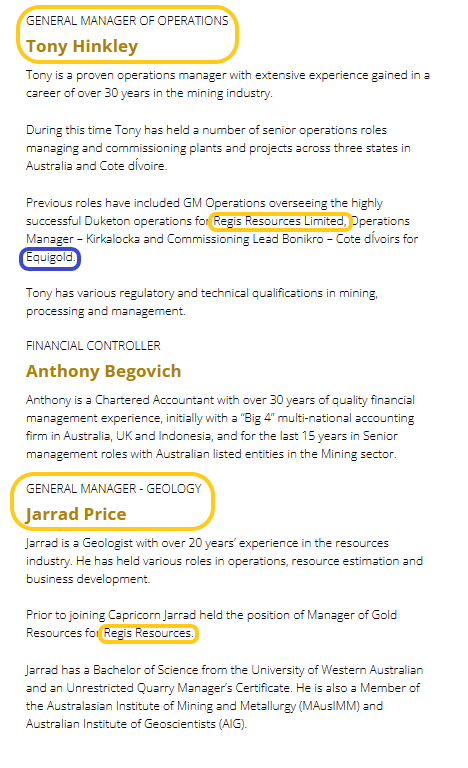

Here's where the early Regis management (prior to 2020) ended up. Some of them were together at Equigold before Regis:

I've highlighted some of the Regis experience in orange and Equigold in blue.

And here is a link to the list of current Regis Board and Management: Our Leadership - Regis Resources

DYOR if you are interested enough. Disc: I hold Regis (RRL) in my SMSF as part of a group of gold miners, but nowhere else currently. I hold CMM shares here on SM, and have held both CMM and EMR in real money portfolios previously, but do not currently hold any shares in either of them.

I am bullish on Regis IF they can get McPhillamys (in central NSW) up and running, but they're a few years away from that at this point. This news today about them now being unhedged is a definite positive. Imagine how much better off they'd be now if they'd done this last year!