Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

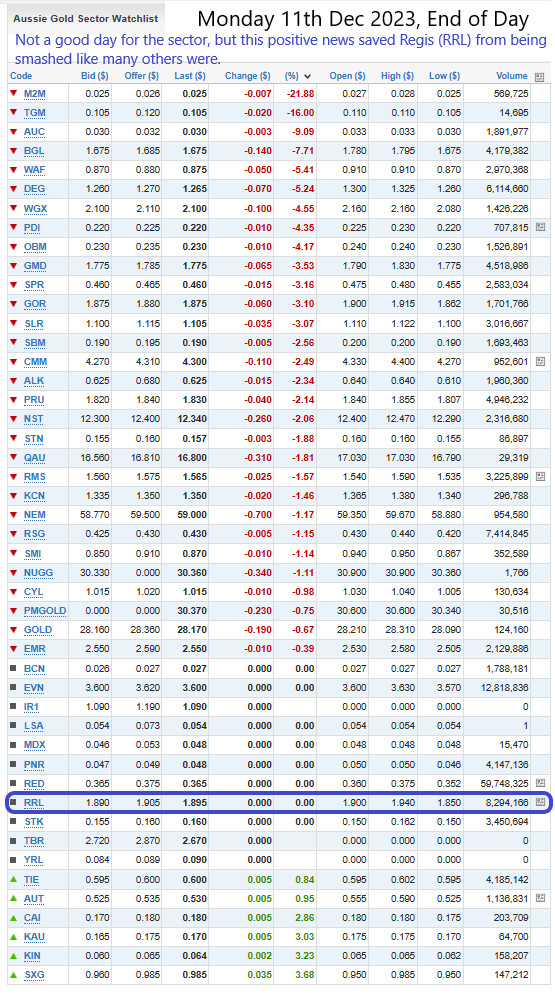

11-Dec-2023: Regis Resources (RRL) had a diabolical hedgebook that would have seen them continuing to sell a good portion of their gold at around half the current spot price through until the middle of 2024. However they've just closed that hedgebook out - see here: Closure-of-Hedge-Book.PDF

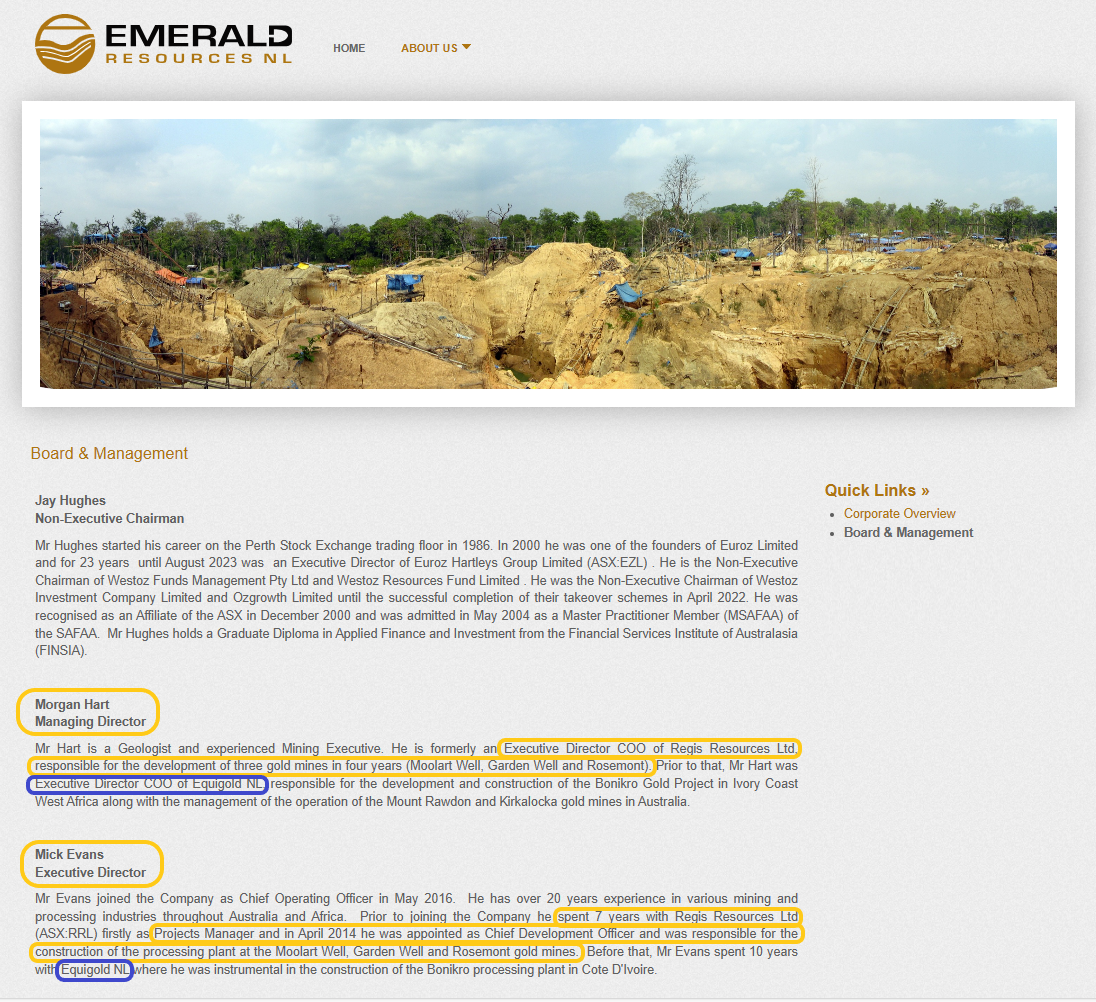

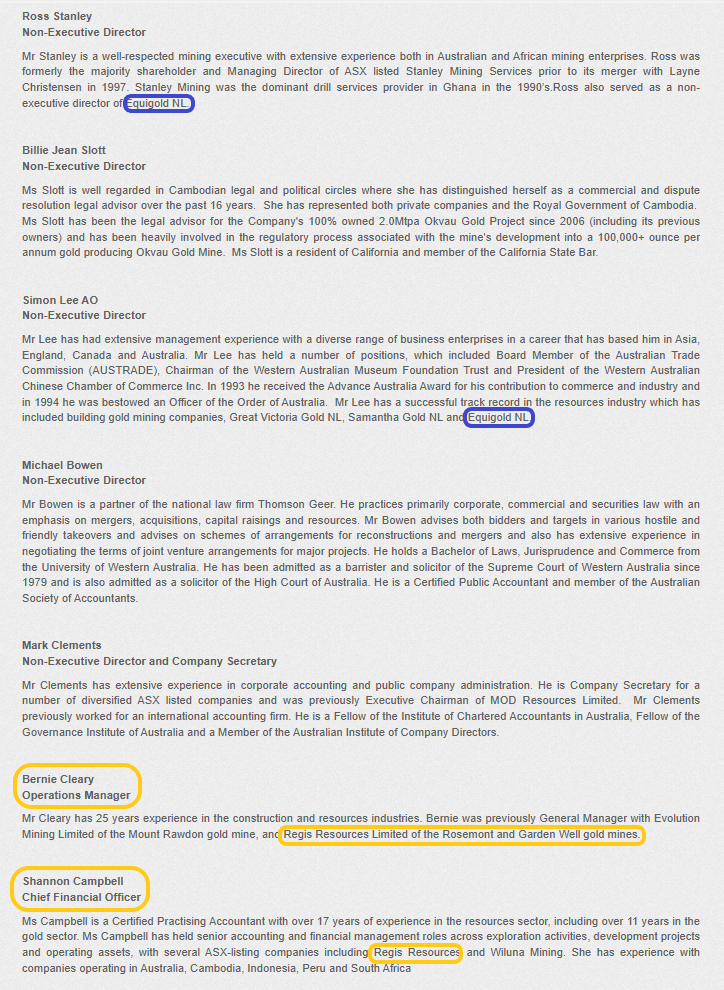

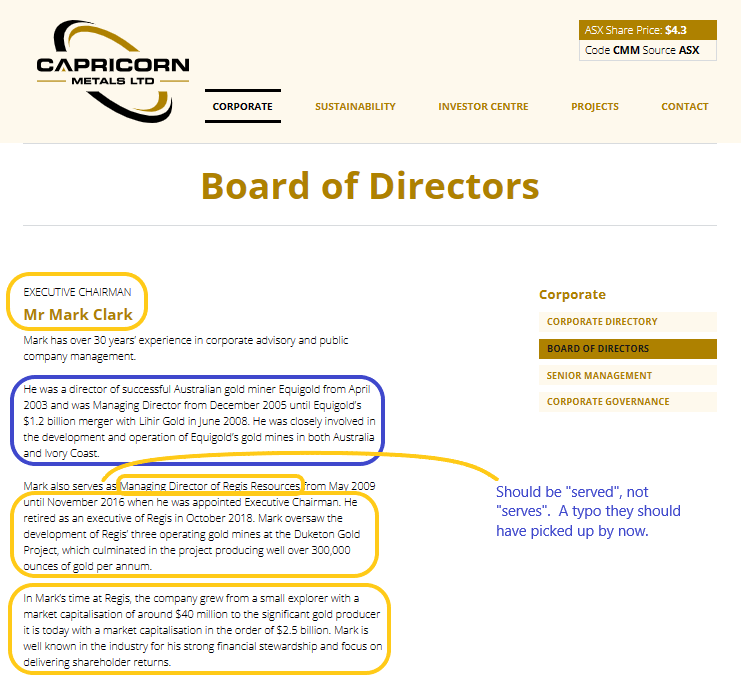

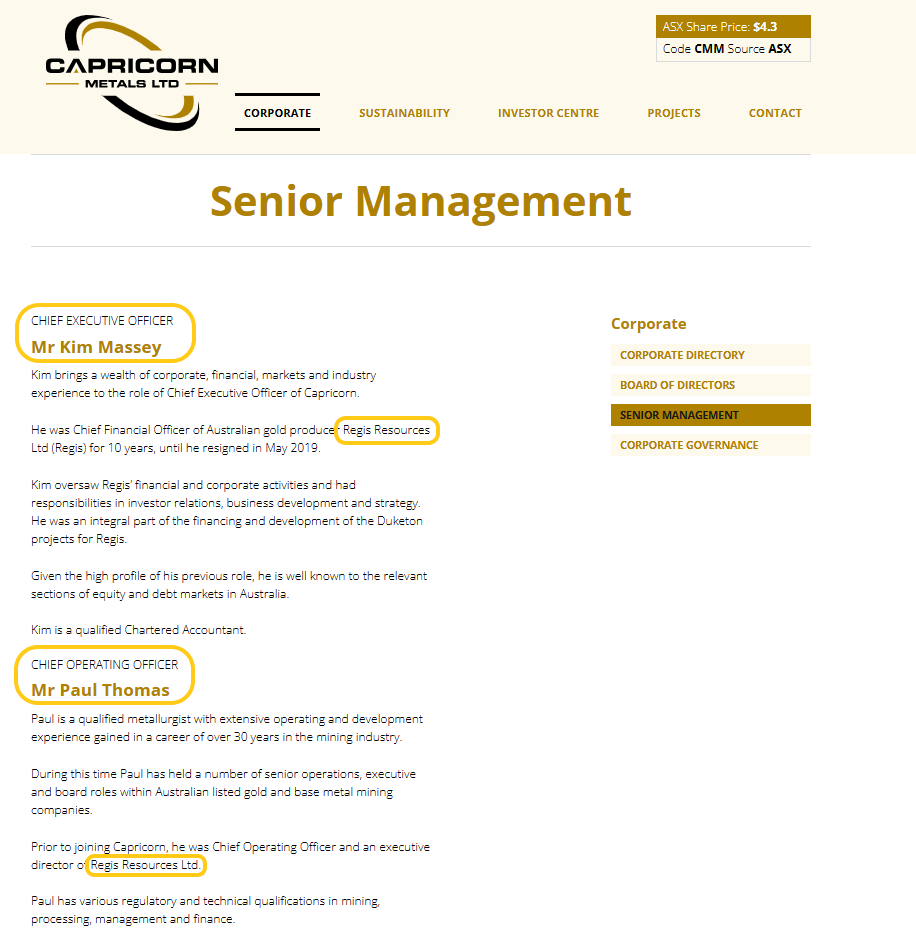

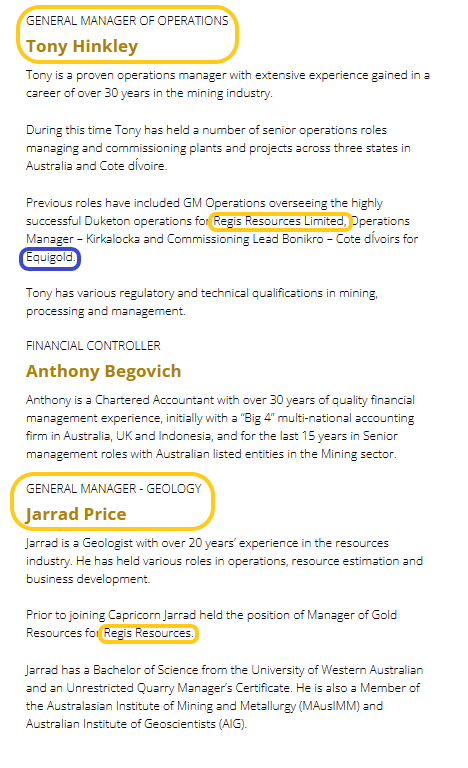

That's a very positive move by a management team that has made their fair share of mistakes. It's not the same management team who were there during the Duketon build-out when Regis were fast growing and also one of the best dividend paying gold companies in Australia - no, those people all ended up at either Capricorn (CMM) or Emerald (EMR) - see screenshots from their websites below - and that former management team would NOT have signed up for such low priced gold hedges that didn't even gurantee profitability in the recent inflationary cost environment. But this lot - that are in charge now - have finally bitten the bullet and closed out all of their hedges - and are now fully exposed to the high spot price.

Not before time!

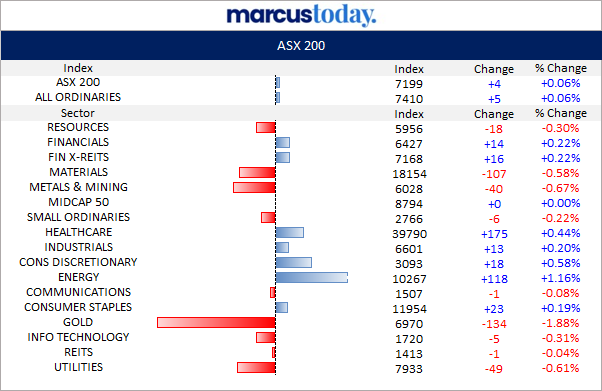

Their (RRL's) share price didn't rise, but it also didn't fall today, which was actually a good result, because there was a sea of red across the Aussie Gold Sector.

Here's where the early Regis management (prior to 2020) ended up. Some of them were together at Equigold before Regis:

I've highlighted some of the Regis experience in orange and Equigold in blue.

And here is a link to the list of current Regis Board and Management: Our Leadership - Regis Resources

DYOR if you are interested enough. Disc: I hold Regis (RRL) in my SMSF as part of a group of gold miners, but nowhere else currently. I hold CMM shares here on SM, and have held both CMM and EMR in real money portfolios previously, but do not currently hold any shares in either of them.

I am bullish on Regis IF they can get McPhillamys (in central NSW) up and running, but they're a few years away from that at this point. This news today about them now being unhedged is a definite positive. Imagine how much better off they'd be now if they'd done this last year!

The four logos at the top of that 14th June "Media Release" letter are the main 4 protest groups that RRL have to deal with in relation to developing their McPhillamys Gold Project.

- The Belubula Headwaters Protection Group (BHPG): The Belubula Headwaters Protection Group | Kings Plains NSW | Facebook - this group is the one most focused on McPhillamys. They were trying to stop it, but now that McPhillamys has been given development approval by the NSW Government, the BHPG is probably going to switch their efforts to trying to ensure that all environmental conditions stipulated in the approval documents are adhered to in full by RRL. They are also reportedly considering whether to spend the money required to appeal the approval decision. No appeal has been lodged to date.

- The Mudgee Region Action Group (MRAG): Mudgee Region Action Group (lueactiongroup.org) and Mudgee Region Action Group | Facebook MRAG is more concerned with stopping the Bowdens zinc/lead/silver project near the small village of Lue, 28 km east of Mudgee, but all of these groups are against mining and metals processing plants (including gold mills) in the NSW Central West region.

- The Cadia Community Sustainability Network (CCSN): Cadia Community Sustainability Network | Orange NSW | Facebook The CCSN is mostly concerned with the nearby Cadia mine, owned and operated by Newcrest Mining (NCM), and its environmental impacts, and holding NCM to account for environmental damage they might cause, but they also don't want a second open-pit gold mine in the area, which is what McPhillamys will be.

- The Central West Environmental Council (CWEC): About CWEC | Cwecouncil The CWEC is an umbrella network of district environment groups in the Central West of NSW. Member groups are based in Orange, Bathurst, Dubbo, Lithgow, Mudgee, Rylstone and other parts of the region. The CWEC provides resources to their member groups, helps to coordinate protests and meetings, submissions, etc, and organises Media Releases like the one at the top of this post on behalf of various member groups.

These groups held a public meeting yesterday (Saturday) in Orange:

If I see any newspaper coverage online (usually in the local rags like the Blayney Chronical or the Central Western Daily in Orange) of this or any other relevant meeting - I'll add a comment to this straw.

The last meeting they held was attended by around 100 people.

It is par for the course to encounter opposition to new mines being developed, however it is up to the mining company and the relevant government departments to ensure that the community and the environment are protected to the fullest possible extent and that all opposition concerns are heard and addressed. It is the mining industry's woeful prior track record that results in such opposition to new mine development, which is entirely understandable.

The industry needs to do a LOT better, and the relevant Government departments responsible for new mines being developed around the world are, for the most part, acting to enforce much greater environmental protections during the development and production phases throughout the mine-life of new mines that are approved for development. This means that companies wanting to develop new mines have to be prepared to spend a LOT more money these days than they would have had to spend 50, 40 or 30 years ago to develop a similar mine in a similar location.

The consultation and approvals processes are longer and more costly, they need to spend more on the design and construction to protect the environment (and their neighbours, including from excessive noise), they need to spend more during production to monitor environmental impacts (did somebody say Envirosuite? No? Just me then...) and there are much stronger compliance and reporting programs in place which also result in greater costs during the production years.

There are also usually higher costs included in a gold miner's ongoing AISC (all-in sustaining costs) during production, which relate to complying with environmental regulations and conditions. For instance, while mines can often still use Arsenic in the extraction process, that very toxic Arsenic has to removed from the tailings (a.k.a. waste slurry, which is all of the ore and processing chemicals and water used in the gold extraction process that remains after the gold has been extracted). And not just Arsenic. There are a lot of potentially harmful substances which can't be pumped out into TSFs (tailing dams) these days, especially in the better regulated countries like Australia and Canada.

Companies don't always get these responsibilities 100% right all of the time, but it can be very costly for them when they stuff up and do cause environmental damage, especially in countries like Australia and Canada.

To be clear, I am pro-mining, but only when the mining is done in an environmentally responsible manner, so I fully support these changes that have resulted in increased costs that miners have to endure. It means that the hurdles that new mines need to overcome are higher - the bar has been raised - so you need a project to be VERY good before you get serious about developing it into a mine, and that's a GOOD thing. And proper environmental protection during construction, commissioning and production, plus proper site rehabilitation after the mine has reached the end of its life, are essential.

It's just a pity that these much stronger approval processes and compliance monitoring/enforcement - plus environmental bonds that cover the rehab cost up front - were not introduced decades ago.

Disclosure: I am a RRL (Regis Resources) shareholder. I do not own NCM shares (NCM own the Cadia gold mine and mill). My IT (investment thesis) with RRL is fairly dependent on them getting McPhillamys into production in the next few years, as they aren't nearly so good without McPhillamys gold.

I expect most punters won't have the patience, or won't want to hold RRL shares during the next couple of years while McPhillamys gets built and commissioned. Meanwhile RRL have another year of low-priced gold hedges to close out, which limits their exposure to the higher gold price (much higher than their hedges which are all priced at AU$1,571/ounce and are due to last through to June 2024). So, RRL have gone from a low-cost, high-dividend-paying mid-tier Aussie gold miner to a middle-of-the-road-AISC, low-dividend-paying mid-tier Aussie goldie who are selling some of their gold at a loss over the next 12 months due to diabolical hedging mistakes by their overly conservative and short-sighted management team. Not much going for them, except for McPhillamys, which could be as good for RRL as nearby Cadia was for Newcrest. Cadia is not only Newcrest's best mine, it's their ONLY good gold mine - the other two (Telfer and Lihir) are rubbish IMO.

Further Reading:

McPhillamys gold mine, near Bathurst, approved to operate open-cut pit for 11 years - ABC News

McPhillamys Gold Project determination - NSW Mining

McPhillamys Gold Project | Mining, Exploration and Geoscience (nsw.gov.au) [McPhillamys Approval details from the Gov. Dept.]

Independent Planning Commission gives the go-ahead for McPhillamys Gold Project - McPhillamys

Green light for McPhillamys Gold Project - Mining Magazine

5_MGP_Community-Consultative-Committee-CCC-updated-310523.pdf (mcphillamysgold.com)

Community Consultative Committee (CCC) - McPhillamys (mcphillamysgold.com)

30-April-2023: I have recently written about this over in the "Gold as an Investment" forum, however I think it also deserves a straw under "Regis Resources", as McPhillamy's is their largest growth project, and this permission to go ahead from the IPC of NSW (in late March) has been a long time coming.

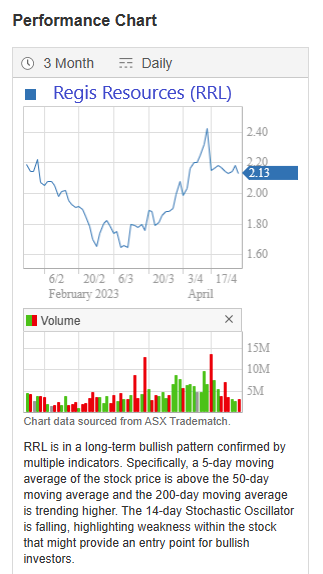

RRL have been in a nasty downtrend that is evident on their 3-year chart below, however they had a decent March and the first couple of weeks of April weren't bad either - the last two weeks have been fairly ordinary however...

Regis Resources (RRL) had a share price that rose +19.5% in March and another +2.4% in April, and while a lot of the recent rise can be attributed to the gold price which is making regular new all-time highs of late, they've also had a big win in late March with their McPhillamys gold project in rural NSW (not far from Newcrest’s flagship Cadia/Ridgeway mining complex) receiving approval from the NSW Independent Planning Commission (IPC) for an initial 11 year mine life – see here:

McPhillamys gold mine, near Bathurst, approved to operate open-cut pit for 11 years - ABC News [30-March-2023]

ABC Central West / By Xanthe Gregory and Hugh Hogan - Posted Thu 30 Mar 2023 at 1:35pm

The company has received conditional approval to extract gold for up to 11 years. (ABC Central West: Micaela Hambrett)

Regis Resources has received approval, with conditions, for its McPhillamy's Gold Mine at Blayney, near Bathurst, which includes an open-cut pit and tailings storage at the head of the Belubula River, as well as a pipeline to transfer water from Lithgow's Mount Piper Power Station.

The company intends to extract up to 60 million tonnes of ore, and, produce up to 2 million ounces of gold, during the mine's estimated 11-year life span.

The plans also include the construction of a 90-kilometre pipeline to supply excess water to the site from a coal mine near Lithgow.

The Department of Planning and Environment recommended the mine for approval, but, it was up to the NSW Independent Planning Commission (IPC) to make the final determination due to the number of submissions opposing the plan.

Key points:

- The mine has created significant debate in the community

- About 80 locals spoke about it at a meeting in February

- Strict conditions will be put on the mine's operator, Regis Resources

There was significant community debate about the mine.(ABC Central West: Xanthe Gregory)

The three-member panel found "on balance" the project was in the public interest.

The benefits, the IPC said, included "producing a significant mineral resource to meet the growing demand for raw materials".

It also said the mine would create employment, training and investment opportunities for the community, which would "outweigh the negative impacts".

Regis Resources wants to build the open-cut mine in the rural area.(ABC Central West: Tim Fookes )

In February, community members fronted IPC commissioners at a meeting.

About 80 people spoke, with most opposing the mine due to environmental concerns, particularly about water contamination, and, dust.

At least 85 people live within 2 kilometres of the proposed mine.

The IPC today acknowledged the various concerns about the mine, including its impact on Aboriginal cultural heritage, but said they could be "effectively avoided, minimised or offset through strict conditions".

In a statement to the Australian Stock Exchange, Regis Resources said it was "pleased" with the result.

"McPhillamys is one of Australia's largest undeveloped open-pittable gold resources and underpins significant value potential for Regis," said managing director Jim Beyer.

"We look forward to working with local communities, stakeholders and companies to mitigate the risks and concerns surrounding the project," he said.

Local environmental organisation The Belubula Headwaters Protection Group said it was disappointed with the decision but not surprised.

"We're working in a system that's skewed to approve projects like this, so unfortunately it's not surprising," said President Daniel Sutton.

Many locals are concerned about potential impacts on the Belubula River.(ABC Central West: Xanthe Gregory)

The group said it was good to see conditions placed on the mine to minimise impacts such as noise, dust and water but the focus should now be on enforcement.

"It's one thing for something to get approved and have conditions on it, but it's entirely different to actually enforce them," Mr Sutton said.

The group is now considering whether to appeal the decision to the Land and Environment Court.

--- ends ---

Related Stories

'It makes the village unliveable': Dust from gold mine will leave residents unable to open windows, panel hears

Critics claim proposed gold mine would risk food security, planning panel told

Mental health decline, fears for river dominate hearing into community's struggle with gold mine plan

So there is an option for the Belubula Headwaters Protection Group to appeal the decision, but I can't imagine an appeal would be succesful unless they are able to introduce new evidence or data that they have not already provided to the NSW DPE (Department of Planning and Environment) and/or the IPC (NSW Independent Planning Commission). Both sides have now had a number of years to present their case and I would expect that all sides of the argument have been carefully considered and, in the words of the IPC, "on balance" the project was deemed to be in the public interest.

In handing down their decision the IPC said that the benefits of the proposed mine (McPhillamys) included "producing a significant mineral resource to meet the growing demand for raw materials".

It also said the mine would create employment, training and investment opportunities for the community, which would "outweigh the negative impacts".

So, as I said, I'm not counting my chickens yet, but it's looking positive, and I just need to give Regis time to progress this through. They have allowed for a substantial amount of spending in relation to progressing the McPhillamys gold project in the current and the next financial year, so I'll continue to watch and wait. In the meantime, they continue to benefit from their 30% stake in Tropicana and their 100%-owned Duketon assets (producing gold mines in WA).

They are saying that McPhillamys has at least 2.5 million ounces of gold there and that they expect to extract at least 2 million of that during the initial 11 year open-pit period (that they have been approved for at this stage). Anybody who knows anything about Newcrest's (NCM's) nearby Cadia mine, without which NCM would be a total basket case in my view, as Cadia is the only really good gold mine they have (Telfer is rubbish, and Lihir has been a huge disappointment), may have an inkling about just how good McPhillamys may well end up being. Cadia is the mine that just keeps on giving for Newcrest.

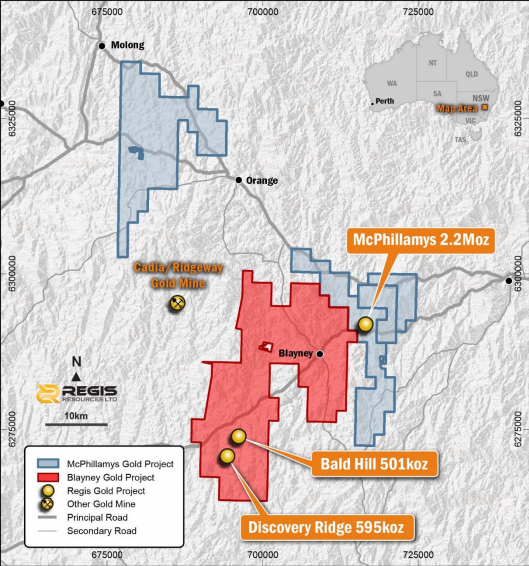

Newcrest's flagship Cadia/Ridgeway gold mine and processing plant is shown there (in the map above) to the left (west) of McPhillamys, which itself is west of Bathurst and NE of Cowra (and very close to Blayney). Cadia is the open pit and the processing plant, while Ridgeway is the underground extension of Cadia. Together they are known as Cadia/Ridgeway and they are by far the best asset that Newcrest Mining (Australia's largest gold mining company, currently under a takeover offer from the World's largest gold company Newmont Corporation) have. Their other producing mines, Telfer and Lihir are very inferior to Cadia/Ridgeway.

Anyway, McPhillamys is NOT in production yet, and they're probably still a couple of years off being in production, but I definitely want to still be holding my RRL shares when they start producing gold at McPhillamys (in addition to Duketon and Tropicana).

While the approval can be challenged (appealed), I would doubt that any appeal would be successful given the lengthy consultation process that has already occurred in the lead up to this decision by the NSW IPC. So this is an important milestone for Regis.

I should also note that I expect the initial 11 year mine life to be extended at some point, just as the mine life at Cadia has been. It is, after all, a heck of a lot easier to get permission to extend the life of an existing operating mine than it is to get permission to build a new one from scratch. The more gold they find (at good mineable grades) the greater the chances of a mine life extension down the track.

Disclosure: I hold RRL shares (both here and IRL).

27-Sep-2021: https://www.ausbiz.com.au/media/the-call-monday-27-september?videoId=15169

That link will take you to "The Call" on Ausbiz at midday on Monday 27th September 2021 where Gaurav Sodhi from Intelligent Investor and Mathan Somasundaram from Deep Data Analytics both have a positive view on Regis Resources (RRL). The commentary on Regis starts from the 35 minute mark.

Gaurav says at one stage that Regis could be the cheapest gold stock on the market (at this point in time obviously, they have all fallen but Regis has clearly fallen more than most, this bit in brackets is my own commentary, not from Gaurav) and that the valuation looks extremely attractive. He also says that while Regis clearly overpaid for the 40% of Tropicana that they bought from IGO, that should not hurt them longer term because Tropicana is a wonderful asset, and one of the best three gold mines found in Australia over the past 20 years; it will be producing gold for decades to come, and with low costs as well.

While they both said that RRL is a Buy, the boys did not mention the ace up Regis' sleeve, being the McPhillamys gold project (in NSW), but I can tell you that if Regis get the approvals through for McPhillamys, it's going to cause a significant positive re-rating of Regis by the market, regardless of what the gold price is doing at that time, because McPhillamys is going to be a major gold mine with very attractive economics, and the fact that it is so close to (28 km from) Newcrest Mining's (NCM's) flagship Cadia/Ridgeway gold mining operations which processes approximately 27 to 30 million tonnes of ore per annum; Cadia produced 76,000 ounces of gold and 106,000 tonnes of copper in FY21.

Disclosure: I hold RRL shares.

06-May-2021: RRL: Acqn 30% Tropicana-All Conditions Precedent Satisfied

ACQUISITION OF 30% TROPICANA INTEREST - FINAL CONDITION PRECEDENT SATISFIED WITH MINISTERIAL CONSENT RECEIVED

Regis Resources Limited (ASX Code: RRL) (Regis) is pleased to announce that the Minister for Mines and Petroleum has consented to the transfer of certain tenements from IGO Limited (IGO, ASX:IGO) to Regis. This means the proposed acquisition of a 30% interest in Tropicana by Regis from IGO (Acquisition) is now free from all conditions precedent.

As announced by Regis on 13 April 2021, Regis has entered into an agreement with IGO to acquire a 30% interest in Tropicana with an effective date of 31 March 2021 for a cash consideration of A$903 million (subject to completion adjustments).

With all conditions precedent now satisfied, the Acquisition is no longer conditional. Completion of the Acquisition is expected to occur on or around 31 May 2021.

Jim Beyer, Regis’ Managing Director and CEO said “We are very pleased that the Minister’s approval for the tenement transfer has been received and, now that the transaction is unconditional, we look forward to completing the deal. As I’ve said previously, this acquisition provides significant strategic benefits to Regis and when combined with our existing assets, provides a larger-scale, longer-term financial and operating platform to pursue internal and external growth opportunities.”

--- ends ---

[I hold RRL shares.]

25-Oct-2018: Regis Resources' 2018 Annual Report was released today - see here.

24-Oct-2019: One year on, Regis' 2019 Annual Report can be viewed here, and their 2019 Sustainability Report can be read here.

23-Oct-2020: Another year on, Regis' 2020 Annual Report can be viewed here, and their corresponding letter to shareholders (sent out with that AR) can be viewed here. Their 2020 Sustainability Report can be viewed here.

2021: RRL's 2021 AR and SR are due to be released in late October once again. When they do get released, you will be able to access them from here: https://regisresources.com.au/investor-centre/reports/

[I hold RRL shares. I've just updated the old links to now link to the same reports on the RRL website rather than use the ASX website which always includes "For Personal Use Only" stamped up the left edge of every page, making it difficult to read some pages. As these links are now to the original versions of those documents at Regis, that will no longer be an issue.]

22-Apr-2021: Regis has released three announcements this morning:

AGG: AngloGold waives pre-emptive right over Tropicana stake

IGO: Tropicana Investment Update

RRL: Key Condition Precedent Satisfied 30% Tropicana Acq

From the AGG (AngloGold) announcement:

AngloGold Ashanti Welcomes Regis Resources as 30% Partner at Tropicana Gold Mine

(PRESS RELEASE) – AngloGold Ashanti (AGA) (ASX:AGG) has, after careful consideration, decided to waive its pre-emptive right over the 30% stake in the Tropicana Gold Mine, paving the way for Regis Resources Limited (ASX: RRL) to acquire the stake from current joint venture partner IGO Limited (ASX:IGO).

AngloGold Ashanti owns 70% of Tropicana and is the mine’s operator. On 13 April 2021, IGO announced it had entered into a binding agreement with Regis for the sale of IGO’s 30% interest in the Tropicana Joint Venture for A$903 million. Completion of the transaction is subject to AngloGold Ashanti waiving its right to pre-empt the Regis Offer on the same price and terms.

“Tropicana is a key asset in AGA’s portfolio. Having decided, in this context and after considerable deliberation to waive our pre-emptive rights, with the sale process behind us we are looking forward to working with Regis to deliver Tropicana’s considerable potential over the coming years,” said Christine Ramon, AngloGold Ashanti’s Interim Chief Executive Officer.

AngloGold Ashanti discovered Tropicana which, with a Mineral Resource of 7.64Moz of gold and Ore Reserve of 2.7Moz, is a key asset in its portfolio and one of Australia’s best gold mining assets.

In February of this year AngloGold Ashanti outlined a multi-year organic growth plan, to increase production over the coming four years from brownfield investment in its existing suite of mines and then investment in greenfield projects in Colombia.

The company’s strategy is premised on disciplined capital allocation at conservative gold price assumptions, with an initial focus on increasing reserves from exploration on its mine sites. Last year, the company added 6.1 million ounces of gold on a gross basis, further extending the life of its portfolio.

“IGO has been an excellent partner for well over a decade, through exploration to development and then operation,” Mike Erickson, AngloGold Ashanti’s Senior Vice President: Australia, said. “We wish them well in their new strategy and focus on battery metals.”

ENDS

From Regis' Announcement:

ACQUISITION OF 30% TROPICANA INTEREST - KEY CONDITION PRECEDENT SATISFIED WITH ANGLOGOLD WAIVER OF PRE-EMPTIVE RIGHTS

Regis Resources Limited (ASX Code: RRL) (Regis) is pleased to announce that AngloGold Ashanti Australia Limited (AngloGold, ASX:AGG) has waived its pre-emptive rights under the joint venture agreement (JVA) between IGO Limited (IGO, ASX:IGO) and AngloGold in relation to the Tropicana Gold Project (Tropicana). This means the proposed acquisition of a 30% interest in Tropicana by Regis from IGO (Acquisition) is now free from the condition precedent relating to those pre-emptive rights (Pre-Emptive Rights Condition).

As announced by Regis on 13 April 2021, Regis has entered into a conditional binding agreement with IGO to acquire a 30% interest in Tropicana with an effective date of 31 March 2021 for a cash consideration of A$903 million (subject to completion adjustments).

With the Pre-Emptive Rights Condition now satisfied, the Acquisition only remains conditional on the approval from the Minister for Mines and Petroleum to the transfer of certain tenements. Regis expects the Ministerial consent application will be submitted in the near future.

A further announcement will be made once the agreement is no longer conditional.

Jim Beyer, Regis’ Managing Director and CEO said “We are very pleased this critical condition has been satisfied and look forward to working closely with our new JV partner, AngloGold. While recognising the pending nature of the Minister’s approval for the tenement transfer, we look forward to completing this key strategic transaction. With this transaction, Regis will acquire a 30% interest in a well-operated, favourably located, tier-one mine with a production outlook of 380-430Koz in FY21E (100% basis), an expected mine life beyond 10 years* and multiple near mine and regional growth opportunities for longer term upside.

Furthermore, this acquisition provides significant strategic benefits to Regis and when combined with our existing assets, provides a larger-scale, longer-term financial and operating platform to pursue internal and external growth opportunities.”

For further information in relation to the Acquisition please refer to Regis’ announcement on 13 April 2021.

Note: * Source: IGO Limited’s 2Q21 and 1H21 Results Presentation. This guidance has not been prepared by Regis and after completion of the Transaction, Regis will include its own Tropicana guidance in due course.

[I hold RRL shares and will buy more through their EO (entitlement offer) as part of their CR (capital raising) for the 30%-of-Tropicana acquisition.]

16-April-2020. Quite a lot of conflicting views on this one. Many analysts think that at $903m for 30% of Tropicana, one of Australia's top five largest producing gold mines, Regis is paying a premium based on the current gold price and their (the analysts') valuations of Tropicana on a 100% basis.

However, the overall calls are still positive. At the bottom of this straw I'll include a slide that summarises the major broking firms' calls and price targets for RRL, with all but UBS and Macquarie having updated those calls since this acquisition announcement. There is not one "sell" or "underweight". Of the seven firms that FNArena.com cover, the calls on RRL are hold x1, Neutral x2, Overweight x1, Add x1, Outperform x1 and Buy x1. I read that as 3 neutrals and 4 buys.

For Strawman community views, see here.

Plus straws and valuations of course.

Here is an interesting article from MiningNews.Net from yesterday:

Regis shares slump on trading return

by Kristie Batten

REGIS Resources has received a lukewarm response from analysts and investors to its A$903 million acquisition of 30% of the Tropicana gold mine in Western Australia.

The stock plunged as much as 17% this morning to $2.61 on its return to trade. The company resumed trading after announcing a placement and the institutional component of its one-for-3.08 entitlement offer had closed, raising $494 million. The $294 million institutional entitlement offer had a take-up rate of about 86%.

The $156 million retail component of the entitlement offer will open on Tuesday.

The total $650 million raising is fully underwritten by Bank of America.

New shares will be issued at $2.70 per share, a 14.8% discount to Monday's closing price of $3.17. The funds raised, along with a new $300 million debt facility, will be used to acquire IGO's 30% interest in Tropicana.

Analyst valuations of the stake varied significantly, from $650 million (RBC Capital Markets) to $1.2 billion (BofA), though RBC's assessment was based on a US$1500 an ounce gold price, while BofA's used a $1750/oz price.

"Even after baking in our exploration upside (circa A$200 million) for ounces not included in our base case estimates, Regis appears to be paying a premium ($120 million) for IGO's stake," RBC analyst Paul Kaner said on Tuesday.

"Tropicana would improve Regis' production profile by circa 150,000ozpa from FY22, increase the portfolio's average mine life with additional resources and reserves, and reduce reliance on the maturing Duketon assets ahead of the potential forthcoming McPhillamy's project.

"However, the potential premium paid (and subsequent dilution) will be hard to argue considering the lack of operational synergies given the non-controlling stake, with the upside relative to our base case reliant on gold price improvements (potentially a counter-cyclical acquisition) or future reserve ounce additions.

"We appreciate the corporate motivation and will retain an open mind until we understand more; however, the market's reaction may be more cautious."

JP Morgan analyst Levi Spry cut his recommendation for Regis to neutral from overweight and lowered his price target from $4.05 to $3.40, describing the deal as "dilutive".

Morgans and Credit Suisse maintained buy ratings but lowered price targets to $4.01 and $4.40, respectively.

Argonaut Securities analyst John Macdonald noted the sale price valued 100% of Tropicana at $3 billion - more than what Northern Star Resources and Saracen Mineral Holdings paid for the Super Pit.

"Regis had $220 million cash and bullion at the end of December 2020, with McPhillamys capex of plus-$270 million looming, subject to DPIE approval that might be coming mid-year," he said.

"All manageable as long as Tropicana generates plus-$300 million per annum cash#ow for the next 10 years.

"Otherwise IGO [are] the winner here."

Analysis by MinesOnline.com showed Regis was paying US$852 per reserve ounce.

"This represents a 313%, 218% and 207% premium to Minesonline.com's one, three and five-year normalised average operation reserve multiples of $206/oz gold equivalent, $268/oz gold equivalent and $277/oz gold equivalent respectively," it said.

"The premium offered by Regis could be attributed to Tropicana's substantial exploration potential and Regis' confidence in converting a majority of the project's mineral resources into ore reserves."

Meanwhile, Tropicana's 70% owner and operator AngloGold still has 58 days to decide if it will match Regis' offer and acquire the stake.

UBS values AngloGold's 70% stake in Tropicana at US$948 million, which implies a value of $1.35 billion for the asset compared to an implied transaction value of $2.3 billion.

Bloomberg Intelligence analyst Grant Sporre said the sale valued Tropicana's production at more than $8000/oz.

"Applying the Tropicana sale value to AngloGold's entire annual production of about 2.8 million ounces suggests a value of over 330 billion rand, nearly 2.5x the company's current market cap," he said.

Regis shares last traded 13.9% lower at A$2.73.

--- ends ---

As you can see, varied views, with BoM being the most bullish, hardly surprising considering they are fully underwriting the capital raising.

I thought Bloomberg's "Intelligence Analyst" Grant Sporre's comments at the end were not particularly helpful. After all, who would value an acquisition of 30% of a producing gold mine with gold open at depth and thousands of square kilometres of exploration tenements on the basis of dollar per current production ounce? He would, obviously...

Here are some summaries of recent broker updates post-acquisition-announcement:

Morgans - 15/04/2021, Add, Target: $4.01, Gain to target $1.32

Morgans believes the agreement to purchase a 30% interest in the Tropicana gold mine for $903m is transformational for the long-term outlook and an immediate lift for production and cash flow. The Add rating is unchanged and the target price falls to $4.01 from $4.44.

The broker sees substantial long-term potential for the asset with a number of deposits open at depth and a large land package with minimal exploration to date.

Anglogold, the manager and majority owner, maintains its right to match any offer for the 30% stake. Regis Resources has guided that if the bid is successful operating cash flow will be sufficient to internally fund development of McPhillamys.

Target price : $4.01 Price : $2.69 (15/04/2021) Gain to target $1.32, 49.07%

Ord Minnett - 15/04/2021, Downgrade to Hold from Buy, Target: $3.40, Gain to target $0.71

Regis Resources will buy a 30% stake in the Tropicana gold mine from IGO Ltd, to be funded with debt and equity. Ord Minnett observes the deal is dilutive on most valuation metrics and was disappointed there was no updated guidance for the asset.

Still, the acquisition should improve asset quality and increase the mine life for the company. Rating is downgraded to Hold from Buy. Target is reduced to $3.40 from $4.20.

Target price : $3.40 Price : $2.69 (15/04/2021) Gain to target $0.71, 26.39%

Credit Suisse - 14/04/2021, Outperform, Target: $4.40, Gain to target $1.18

Regis Resources will acquire the 30% interest belonging to IGO Ltd ((IGO)) in Tropicana gold mine for $903m. The deal would be funded by equity and debt. The main risk for this deal to go ahead is the 70% owner, AngloGold Ashanti, imposing its last right of refusal to match the offer.

In the event this occurs Regis Resources will receive a $25m break fee from IGO Ltd if exercised prior to a capital raising or $40m post a capital raising.

Credit Suisse believes Tropicana will enhance the portfolio in many respects although the transaction is dilutive, factoring in the equity raising at a -46% discount to prior value. Outperform retained. Target is reduced to $4.40 from $5.05.

Target price : $4.40 Price : $3.22 (14/04/2021) Gain to target $1.18, 36.65%

Morgan Stanley - 14/04/2021, Overweight, Target: $4.35, Gain to target $1.13

Regis Resources will buy the 30% stake in Tropicana gold mine belonging to IGO Ltd for $903m. Morgan Stanley values the asset for IGO at $551m and believes the price to be paid is expensive.

Nevertheless, Regis Resources is likely to benefit from increased scale and diversity. The long-life Tropicana fits this strategy while the debt raised appears manageable given high margins and a strong net cash position.

Overweight maintained. Target is $4.35. Industry view: Attractive.

Target price : $4.35 Price : $3.22 (14/04/2021) Gain to target $1.13, 35.09%

Citi - 14/04/2021, Neutral, Target: $3.40, Gain to target $0.18

Regis Resources has bid $903m for IGO’s ((IGO)) 30% non-controlling stake in Tropicana Gold mine. The 26% premium looks hefty to Citi especially given a lack of corporate synergies and the non-operating nature of the stake.

Even so, the broker notes the deal brings production visibility to circa 2030 at the expensive of dilution to earnings/NAV on its deck.

Citi retains a Neutral rating for Regis Resources and reduces the target to $3.40 from $3.85.

Target price : $3.40 Price : $3.22 (14/04/2021) Gain to target $0.18, 5.59%

--- ends ---

All numbers above are excluding dividends, fees and charges - and negative figures indicate an expected loss.

UBS and Macquarie have not updated their calls since February, here's what they had to say when they last provided an update to their clients:

UBS - 26/02/2021, Buy, Target: $4.30, Gain to target $1.17

First half results were in line with expectations. The main message UBS received was the business is becoming increasingly capital intensive as Duketon matures.

This capital intensity means the investment case has become very sensitive to the Australian dollar gold price.

The broker suggests recent weakness in the Australian dollar gold price creates challenges for the life extension at Duketon and restricts free cash flow available for McPhillamys.

Cash flow momentum may be poor but UBS maintains a Buy rating based on valuation. Target is reduced to $4.30 from $4.65.

Target price : $4.30 Price : $3.13 (26/02/2021) Gain to target $1.17, 37.38%

Macquarie - 26/02/2021, Neutral, Target: $3.20, Gain to target $0.07

Macquarie notes Regis Resources' strong cost performance led to an operating income that was 11% higher than the broker expected. Net profit was -8% lower than forecast due to higher D&A expenses.

The company reported stronger than expected cash flow despite higher capex. A dividend of 4c was declared that was -50% below the broker's expectation with the company conserving cash ahead of a final investment decision for the McPhillamys project.

Regis Resources' longer-term outlook is dominated by the outcome of the McPhillamys project, suggests the broker and awaits a funding strategy and the delivery of a final feasibility study.

The Neutral rating is retained, with the target falling to $3.20 from $3.90.

Target price : $3.20 Price : $3.13 (26/02/2021) Gain to target $0.07 2.24%

--- ends ---

Obviously all of those "gain to target" numbers applied on those dates only. And the Macquarie and UBS notes are probably worth not very much considering they are from February and they have not updated since the Tropicana announcement. The comments by Morgans, Ord Minnett, Credit Suisse, Morgan Stanley and Citi, which were all made in the past two days (on the 14th and 15th April 2021) are more valuable I think.

27-Jan-2021: Evolution of value potential with Regis, Silver Lake combo - MiningNews.net

That article points out that the combined value of RRL (market cap = $1.9 b) and SLR ($1.5 b) of $3.4 billion looks a LOT cheaper than EVN's $7.9 billion market cap, even though the production numbers are not too different - comparing EVN with a combined RRL + SLR. And RRL is a superior company to SLR. In other words, RRL is cheap relative to larger peers.

While my numbers above are market capitalisation figures, I believe MNN (MiningNews.net) are using Enterprise value amounts in that article which includes in its calculation the market capitalisation of a company but also short-term and long-term debt as well as any cash on the company's balance sheet.

Either way you look at it, EVN (Evolution Mining) looks WAY more expensive than both RRL (Regis Resources) & SLR (Silver Lake Resources). Or, to look at it the other way around, RRL & SLR are a LOT cheaper than EVN. If you put RRL & SLR together, I daresay the combined company would most likely trade at a significantly higher multiple.

[I hold RRL, and EVN, but not SLR.]

14-Dec-2020: Approval of Garden Well South Underground Mine

REGIS APPROVES GARDEN WELL SOUTH UNDERGROUND MINE

HIGHLIGHTS

- Regis’ Board has approved development of a new underground mine under the current Garden Well open pit based on a recently completed positive Feasibility Study (FS) on the Garden Well South (GWS) underground gold (Au) Project.

- Maiden GWS underground Mineral Resource Estimate (MRE) of 2.4Mt at 3.6g/t Au for 270koz Au(*).

- Total material mined in the FS is 1.85Mt at 3.2 g/t Au for 190koz Au. This includes a Probable Ore Reserve of 900kt at 3.4g/t Au for 98koz Au(**) with the remainder from Inferred Mineral Resources.

- Development to commence in the March 2021 quarter.

- Processing of first underground development ore scheduled for the Dec 2021 quarter with stope production to commence in the June 2022 quarter.

- Underground ore mining rates are scheduled to be at a rate of ~600kt/a once stoping activities stabilise.

- Pre-production capital(***) is estimated at A$38 million.

- Project AISC (all-in sustaining cost) of A$950-1,050/oz with Growth Capital A$15-20m.

- Considerable opportunity exists for additional Resources down plunge of the existing GWS Resource.

- A conference call relating to GWS development decision will be held on Monday 14 December 2020 at 1pm AWST.

Regis Managing Director, Mr Jim Beyer commented:

“The development decision for a second underground mine at our Duketon Operation is another major milestone in the Regis goal of delivering increased shareholder value through organic growth projects. This new underground mine will be a key element in achieving and maintaining our aim for the Duketon Operation to become a reliable 400koz per annum producer. Further, we believe that the approved Garden Well underground is not only a robust investment in its current form but just as importantly has the potential to increase life and value through down plunge exploration.”

Note that a proportion of the production target referred to in this announcement is based on Inferred Mineral Resources. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised. The board has assessed this risk in the context of the geological and metallurgical knowledge gained in mining and processing the Garden Well open pit deposit over the last 6 years together with the existing mining and processing cost structures at the operation. Furthermore, the development of the current Mineral Resource is considered the most timely and cost-effective approach to the development and exploration of the target zones.

Notes:

- (*) JORC Code compliant MRE inclusive of Indicated and Inferred Resources at a 1.8g/t cut-off grade

- (**) JORC Code compliant Ore Reserve using a 2.1g/t cut-off grade

- (***) Expenditure required until first stope ore production

- (****) All financial amounts are in Australian Dollars unless otherwise stated

--- Click on the link at the top for the full announcement ---

[I hold RRL shares.]

25-Nov-2020: AGM Presentation plus Chairman's Address to Shareholders

Also: Annual Report to shareholders (.pdf file) or Annual Report as an ASX announcement (23-Oct-2020)

Today's AGM Presso and Chairman's Address have not yet been uploaded to the Regis Resources' website as I type this, however, previous Company Presentations and announcements can be viewed from:

https://www.regisresources.com.au/reports-2/presentations

https://www.regisresources.com.au/reports-2/asx-announcements

They also have a page that details their broker coverage: https://www.regisresources.com.au/About/regis-broker-reports.html

Unfortunately, you can't download broker reports from that page, or any other page on their website.

Here's their home page: https://www.regisresources.com.au/

[I hold RRL shares. Of the gold producer stocks that I hold, the ones I've been topping up on during the past week have been NST, SAR, RRL and SBM, which have seen the most dramatic falls. I also hold EVN, but Evolution had been holding up OK, until yesterday's -8.4% drop. I think NST is currently looking like the best value, particularly as they will probably have the strongest and quickest rebound when sentiment towards gold producers turns positive again - based on what has happened previously. However, RRL is also looking like good buying at current levels, particularly if they get the development approvals through for McPhillamys in NSW, which would give them a second gold production base here in Australia.]

[Edit: Additional: I also hold some smaller gold producers (a little further down the food-chain) such as RMS, GOR and PNR, and looking at RMS and GOR in particular, they are both looking very tasty at current levels. Sentiment around gold producers has turned sharply negative over the past week or two since most eyes are now on recovery plays, however we're not entirely out of the woods yet. There are still plenty of things that can happen from here to drive the gold price higher. I see the current situation as an opportunity to top up on some quality gold producers at sharply lower prices. I think this is likely to be a bear move within a larger bull run for gold, a bull run which I consider to be still intact.]

23-Oct-2020: Quarterly Activities Report

[I hold RRL shares.]

17-Oct-2020: In his latest "Under the Radar" report on small cap companies, Richard Hemming has listed Regis Resources (RRL) as a spec buy. They had previously recommended Saracen (SAR) but SAR are now merging with NST, so they've been looking for a new up-and-coming gold producer to replace SAR.

You can get free access to all of their research by taking advantage of their free trial offer - see here:

https://www.undertheradarreport.com.au/

I personally have a bundled subscription to UTR (run by Richard Hemming) and FNArena (run by Rudi Filapek-Vandyck, a regular "expert" analyst on Ausbiz's "The Call").

Here's an excerpt from UTR (Small Caps) issue #417 (from this past week):

REGIS RESOURCES

With Saracen removed from the list of independent gold producers, Regis well and truly fills the vacuum, currently producing 370,000 ounces, forecast to grow and potentially become a 600k ounce producer in the next two to three years.

INVESTMENT PROPOSITION

Regis controls 90% of the Duketon Greenstone Belt, north of Laverton in WA. The belt remains very prospective for greenfield and brownfield discoveries, offering considerable potential to the company’s existing WA resources of 5moz. The production rate in FY21 will be approximately 370koz and is tracking higher as mines are extended. The company’s McPhillamys gold project in NSW, with 2.7moz resources, offers potential for a 200kozpa step up in gold production from 2023, which would transform the company into a 600k ounce gold producer.

STRONG PROFIT GROWTH AND CASH FLOW

The company increased net profit after tax to $200m in FY20, up 23% on FY19. Earnings per share of 39.3 cents increased at the same rate. EBITDA was $394m while cash flow from operations was a mighty $424m. Cash and bullion was $209.3m at 30 June 2020 with no debt. The company declared dividends of 16 cents per share, equivalent to 21% of EBITDA.

CORE AND SATELLITE OPERATIONS WITH SEVERAL GROWTH PROJECTS

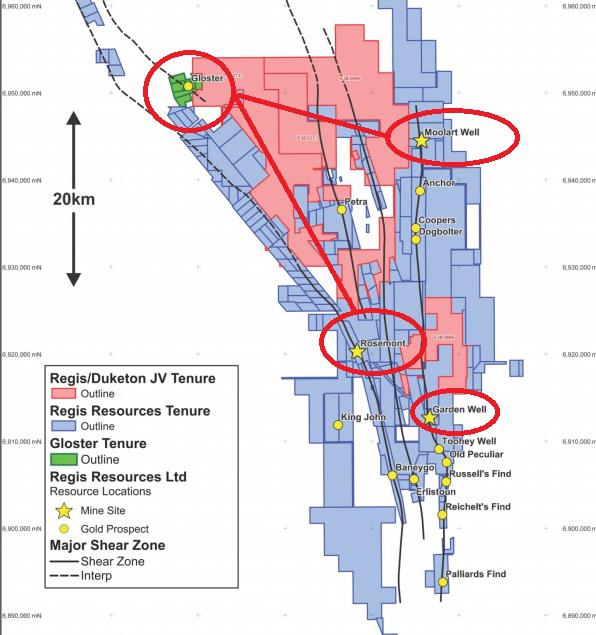

The main operations are at Moolart Well, Garden Well, 30km to the south and Rosemont, 9km NW of Garden Well. There are approximately 10 individual mines, including satellite operations. There are treatment plants at Moolart Well and Garden Well and a crushing/milling circuit at Rosemont with ore slurry transported to Garden Well by pipeline. There are also a number of mining projects:

- The most significant is an underground development at Garden Well where there is a zone of continuous mineralisation up to 10m true width, 80-100m in height, 300m along strike and extending 300m below surface. The deposit remains open.

- Other projects include drilling of the Ben Hur open pit where there is a high grade southern plunge and drill testing the Rosemont underground, where the company believes there is considerable mine life extension potential. There are also significant low grade oxide resources at Moolart Well which could potentially extend the mine life for up to five years if costs can be reduced

ACCELERATING GREENFIELD EXPLORATION

Regis is accelerating exploration in 2021 on its landholding that now covers 90% of the Duketon Greenstone Belt. Over time 8moz has already been discovered in the belt and Regis is giving itself every chance to find more, having tripled its landholding through acquisitions and plans to generate new targets (+1moz) and significantly increase the chances of new discoveries.

At the Risden Well basin, to the west of Moolart Well and Rosemont, there are signs of a large hydrothermal system with potential to host a sizeable gold deposit. Aircore drilling has defined a 5km long geochemical anomaly. An aircore and RC drilling programme is underway.

MCPHILLAMYS – POTENTIAL FOR ~200KOZPA STEP CHANGE LIFT IN PRODUCTION

McPhillamys offers the potential for a step change lift in Regis gold production of approximately 200kozpa. The project has a mineral resource and reserve of 2.3moz and 2.0moz respectively with additional resources of 390koz at Discovery Ridge.

GOLD HEDGING – AN OPPORTUNITY COST

Regis has a hedge position of almost 400koz at an average of A$1,614/oz with the range from A$1,400 to 1,900/oz. Because the hedging is spot deferred, the company has flexibility in the selling process. The company is selling into the lowest priced hedges and is delivering into its most out of the money hedges to 20koz per quarter.

KEY RISKS: THE GOLD PRICE, WILL MCPHILLAMYS BE APPROVED?

The gold price is inherently volatile, even within a trend. While we believe the current gold price trend is up, there is no certainty this will continue. With regard to McPhillamys, we believe the market is cautious on the prospect of the project being approved, so the impact of a no decision may have limited impact on the share price. However, a positive decision could have a surprise effect and start a re-rating.

REGIS IS ACCELERATING EXPLORATION IN 2021 ON ITS LANDHOLDING THAT NOW COVERS 90% OF THE DUKETON GREENSTONE BELT. OVER TIME 8MOZ HAS ALREADY BEEN DISCOVERED IN THE BELT AND REGIS IS GIVING ITSELF EVERY CHANCE TO FIND MORE, HAVING TRIPLED ITS LANDHOLDING THROUGH ACQUISITIONS AND PLANS TO GENERATE NEW TARGETS (+1MOZ) AND SIGNIFICANTLY INCREASE THE CHANCES OF NEW DISCOVERIES.

- RADAR RATING: SPEC BUY

- ASX CODE: RRL

- CURRENT PRICE: $5.09

- MARKET CAP: $2.6BN

- DIVIDEND YIELD: 3.1% (FY21 forecast 16 cents per share)

- NET CASH: $209M

BULL POINTS

- Major gold producer with exploration potential

- Highly profitable dividend payer

- Potential step change in production

BEAR POINTS

- Uneconomic hedging

- Development risk

WHY WE LIKE IT

We like the low cost WA based gold producer because it is trading on metrics such as prospective PE ratio, EV/ EBITDA and ROE that are lower than most of its peers despite the quality, scale and growth potential of its existing gold operations and the McPhillamys project in NSW, with 2moz ore reserves, included for free! Production of 355- 380koz projected for FY21; it has gold resources of 5moz, reserves of 1.6moz in WA and strong exploration potential. Among its peers, it is one of the lowest cost producers at A$1,230-1,300/oz all in sustaining costs.

WHAT’S NEW

Regis achieved another milestone in the development of the McPhillamys Gold Project, located near Blayney, NSW, lodging a Development Application in early September, with a possible decision by the regulator during the first half of 2021. The mine could add another 200k ounces to Regis’s 370k current production. It’s a big deal, putting Regis into the next league with 600k plus of gold production.

--- end of excerpt ---

[I hold RRL shares.]

If you found this helpful, or liked the style of the report, please check out their free trial offer here and have a look at all of the other companies the UTR covers.

03-Sep-2020: Ben Hur Resource Acquisition Complete

REGIS COMPLETES ACQUISITION OF BEN HUR RESOURCE WITH DRILLING SET TO COMMENCE

Highlights

- Regis completes the acquisition of valuable resource and tenement holdings from Stone Resources Australia Limited (ASX: SHK);

- Regis will issue a total of $10 million worth of Regis shares to SHK and a pay an NSR royalty;

- Significantly the acquisition includes the Ben Hur Mineral Resource – 5.8Mt @ 1.6 g/t Au for 290koz which has potential to add further life to the Duketon Operations. For details of the Ben Hur Resource and associated tenement package refer to the ASX release 12 August 2020 “Resource Acquisition Adds to Duketon”;

- Regis will issue SHK with $9,750,000 worth of shares today (being 1.82 million shares based on a 5-day VWAP of 5.35/share) and $250,000 worth of shares will be issued on or about on 11 November 2020 minus any expenses Regis incurs to keep the sale tenements in good standing;

- A royalty will be payable after the first 100,000 ounces of production from M38/339 at a 1% NSR and revert to 0.0025% NSR for four years after $5 million has been paid under the royalty; and

- Infill drilling that seeks to upgrade and extend the resource will commence as soon as permitting is approved.

Comment

Regis Managing Director, Mr Jim Beyer commented: “The acquisition of this resource and tenement package enables Regis to pursue the addition of the Ben Hur deposit to the Duketon Operation production portfolio. We are excited about our plans to drill both the extensions to the resource and upgrading the inferred material, enabling open pit mine design work to commence. This and the exploration targets identified during our due diligence are exciting opportunities for growing our resources and ultimately our reserves at the Duketon Operations.”

--- click on link for more ---

[I hold RRL shares.]

26-August-2020: Record NPAT $200m and 8cps Fully Franked Dividend and FY2020 Financial Results Presentation

plus Appendix 4E and FY2020 Financial Report

RECORD NET PROFIT AFTER TAX OF $200 MILLION AND A FINAL FULLY FRANKED DIVIDEND OF 8 CENTS PER SHARE

Key Points (All figures expressed in Australian dollars unless stated otherwise)

- Record net profit after tax of $200 million, with a net profit after tax margin of 26% and a Return on Equity of 24% reflecting the strength of the business

- Revenue of $757 million from 353,182oz of gold sold at an average price of $2,200/oz

- EBITDA of $394 million with a very strong EBITDA margin of 52% (!!)

- Cash flows from operating activities of $343 million

- Cash and bullion of $209 million (note 1) after the payment of $81 million in fully franked dividends

- Final fully franked dividend of 8 cents per share declared for a full year fully franked dividend of 16 cents per share for FY20 for a basic yield of 2.9% and a grossed up yield of 4.1% (note 2)

- Gold production of 352,042oz for FY20 at an All in Sustaining Cost (AISC) of A$1,246/oz

- Another strong year of operations expected in FY21 with gold production guidance of 355,000-380,000 oz at an AISC of $1,230-$1,300/oz

Comment

Managing Director, Mr Jim Beyer commented: “Regis Resources has delivered another year of solid production for FY20 and in the process generated a record net profit after tax of $200 million, a net profit after tax margin of 26% and operating cash flows of $343 million. While delivering this record profit we also brought into production three new open pits and an underground mine. We have made significant investments to increase our mine life by way of the acquisition of nearby high potential land and stepping up our greenfields exploration efforts, while also progressing the significant and valuable McPhillamys Project.

With this solid performance we are pleased to again announce an 8 cent fully franked final dividend to bring the total dividends declared to 16 cents per share for 2020 for an impressive basic yield of 2.9% (or 4.1% grossed up)2 and, notably, bring the total dividends declared over the past seven years to almost half a billion dollars. At Regis, we continue to build on our reputation for both production growth and consistent dividend returns”.

Notes:

- Includes bullion on hand classified as inventory and valued as at 30 June 2020

- Grossed up for 100% franking. Annualised dividend yield of 16cps at a closing share price of $5.55 on 25 August 2020

--- click on links above for more ---

I hold RRL shares. Of all 25 companies listed on the ASX who currently produce gold where gold is their main focus (greater than 70% of their production is gold) and where their primary listing is in Australia and they are headquartered here in Australia (so excludes KLA, AQG and AGG), Regis (RRL) have the second lowest AISC (costs) behind Gold Road (GOR), however Gold Road only own half of Gruyere and are only entitled to around 134 koz of the 267.5 koz (mid-point of FY21 guidance) that GOR are planning to produce this financial year. Regis have guided for FY21 production of 355 to 380 koz of gold, so will be selling roughly three times the gold that GOR will. So RRL beat their larger rivals, NCM, NST, EVN and SAR, in terms of RRL having lower costs. RRL are currently the 5th largest pure-play Australian-HQ'd gold producer on the ASX, and have the second lowest costs (behind GOR). And they're flying! Of those I've just mentioned, I own all of them except NCM, so I hold shares in NST, EVN, SAR, RRL and GOR. It's a good time to be holding Australian gold producers.

24-Aug-2020: Resources and Reserves Statement and Organic Growth Update

GROUP RESOURCES AND RESERVES AS AT 31 MARCH 2020 AND ORGANIC GROWTH UPDATE

HIGHLIGHTS

- Group Ore Reserves estimate updated to 104Mt at 1.1g/t gold for 3.6 million ounces at long term gold prices of A$1,400/oz for McPhillamys and A$1,600/oz for Duketon, depleted for mining to 31 March 2020

- Group Mineral Resources estimate updated to 249Mt at 1.0g/t gold for 7.7 million ounces constrained by optimised open pit shells and a long-term gold price of A$2,000/oz

RESERVE GROWTH

- Garden Well Underground Resource drilling complete with a maiden Mineral Resource and Ore Reserve expected in H1 FY21

- The Ben Hur Mineral Resource acquisition1 of 5.8Mt @ 1.6 g/t Au for 290koz adds to the Company’s Mineral Resources and has potential to grow and add further Ore Reserves to the Duketon Operations

- Pre-feasibility studies are ongoing for the Discovery Ridge Project in NSW. A maiden Ore Reserve is targeted for the coming year along with a pre-feasibility study

- Gold price appreciation of around A$1,000 per ounce in the past 18 months provides an opportunity to add substantial mine life at Moolart Well

RESOURCE GROWTH

- A large focus is on the Garden Well, Gloster and Baneygo Mineral Resource extensions with the aim of declaring maiden UG Mineral Resources for these zones over the following year

GREENFIELDS EXPLORATION – MINERAL INVENTORY GROWTH

- Increased Exploration budget for FY21 of A$35m for Duketon with $25m focused on Greenfields discoveries

- An aggressive exploration programme across the expanded Duketon Project continuesto be focused on potential areas for the identification of both new Mineral Resources and expansions of current Mineral Resources. Many promising early stage targets have been generated and will be tested over the coming year.

Regis Managing Director, Mr Jim Beyer commented:

“While this past year has proven to be a challenging one for replacing depleted reserves, the Regis Team is now working hard on feeding the exploration pipeline for new growth. We are actively pursuing specific high-potential targets within the Duketon Greenstone Belt and are confident that with this effort, along with the current significant Ore Reserves and other highly prospective target areas within trucking distance of existing operations, the 10 million tonne per annum processing capacity at Duketon will be fully utilised for many years to come.”

--- click on link above for the full report ---

[I hold RRL shares.]

Note: Regis (RRL) are due to report their FY20 results on Wednesday (26th) August.

12-Aug-2020: Resource Acquisition Adds to Duketon

RESOURCE ACQUISITION ADDS POTENTIAL LIFE TO DUKETON AND FURTHER CONSOLIDATES THE REGIS EXPLORATION HOLDINGS

Highlights

- Acquisition of valuable resource and tenement holdings from Stone Resources Australia (ASX: SHK) for $10M in RRL shares and a capped 1% NSR royalty payable after the first 100,000 ounces of production

- Acquisition includes the Ben Hur Mineral Resource – 5.8Mt @ 1.6 g/t Au for 290koz (JORC2012 Standard) which has potential to add further life to the Duketon Operations

- Expands further the ongoing Duketon Greenstone Belt (DGB) exploration programme and consolidates the DGB for Regis

- Immediate work on the tenement holding will commence once the acquisition is completed and will include infill drilling that seeks to upgrade and extend the resources.

Regis Managing Director, Mr Jim Beyer commented:

"The acquisition of this resource and tenement package is significant to us. The deal will enable Regis to potentially add the Ben Hur deposit to the Duketon Operation production portfolio. At the same time the exploration tenure acquired with the Ben Hur deposit has the potential for additional ounces to be discovered and added to our already substantial Resource and Reserve holdings. We are very excited by the potential for exploration success and I look forward to keeping investors informed as we move forward on these tenements.”

--- click on the link for the full announcement ---

[I hold RRL shares]

28-7-2020: Quarterly Activities Report

Highlights

Operations

- The 12 Month Moving Average Long-Term Injury Frequency Rate to the end of the Quarter dropped 20% to 3.6 from 4.4 at the end of the prior Quarter.

- Quarterly production of 87,260oz giving a full year gold production of 352,042oz.

- Quarterly Sales of 100.5koz at an average price of A$2,381/oz for a total revenue of A$239m.

- Record cash flow from operations of A$109m for the June Quarter.

- Cash and bullion increased by A$41m to A$209m at the end of the Quarter, a 24% increase.

- Cash cost before royalties for the Quarter were A$1,000/oz and A$914/oz for FY20.

- Quarter AISC was A$1,358/oz giving a Full Year AISC was A$1,246/oz.

- Guidance for FY21 sees an increase in production to 355,000 – 380,000oz for an AISC of A$1,230 - 1,300/oz as above LOM average stripping ratios continue.

Growth

- The assessment phase of the McPhillamys Open Pit Development Application continues as planned with Responses to Submissions expected to be submitted in the coming weeks.

- Diamond drilling at the Garden Well Underground Project confirms a wide, robust high-grade mineralised zone beneath the pit. Results included 10.1m @ 16.3 g/t gold from 307m. Work on the underground PFS is expected to be completed in December Quarter.

- Drilling at the Baneygo Underground Project continues to support the potential for Resources.

- Regional exploration is progressing well with some specific targets being identified including a large 5km long gold aircore anomaly at Betelgeuse on the Western side of the Duketon Greenstone Belt.

Regis Resources Managing Director, Jim Beyer, said: “Regis has achieved another solid Quarter with an improved safety performance and a record cash flow from operations. This led to our cash and gold balance increasing by a healthy A$41 million during the Quarter to A$209.3 million at the end of June. This is a pleasing result considering the challenges and hardships for our people in the responses to COVID-19 that had to be managed.

Operationally the improvement in our LTI rate was very satisfying as was meeting full year production guidance with production of 352,042 ounces for the year and this was despite the impacts of an unplanned two week mill outage at Garden Well, the startup of Rosemont underground and impacts on operational efficiency due to COVID-19. After adjustments, the Company was marginally above the upper end of guidance with a portion of this being driven by the more recent cost of responding to COVID-19.

Rosemont underground continued to ramp-up during the Quarter and is now an integral part of our output as we declared commercial production on 1 June. While still building in capacity and confidence, we expect to see continued improvements in ore production and grades across the September Quarter.

On the new growth front the Garden Well Underground Project continues to shape up as another potential exciting addition to our internal production growth as we are nearing completion of the PFS.

Added to this, the team continues to progress well with the McPhillamys Gold Project in NSW and anticipate having the Responses to Submissions associated with the lodged Development Application completed during the September Quarter.

In relation to our ongoing organic growth through exploration, we are very pleased to see our increased exploration efforts starting to deliver potential life extending Resource targets.

Our drive to 400,000oz pa rate at our three Duketon operations continues to get stronger with FY21 guidance seeing a solid increase in our production to 355,000 – 380,000oz at a consistent A$1,230-1300/oz AISC while we continue to mine at strip ratios above the LOM strip ratio."

--- click on the link at the top for the full report including their COVID-19 response and the minimal impact the virus is having on the business ---

[I hold RRL shares]

07-May-2020: Macquarie Australia Conference Investor Presentation (to be presented today)

Regis Resources (RRL) is Australia's 5th largest listed gold miner (not including companies who produce gold as a byproduct of other production).

CORPORATE HIGHLIGHTS

- A$2.3B company with 8.2Moz in Resources and 4.0Moz in Reserves

- Production Guidance of 340,000 - 370,000oz gold at upper end of A$1,125-$1,195/oz AISC(*1) and Growth Capital of ~A$83m for FY2020

- Strong dividend stream with cumulative payments of A$448m since 2013

- Among the lowest cost gold producers globally with a clear production growth profile

- Strong financial position - with A$169m cash and bullion and NO debt

- Significant internal growth projects

- Transparent ESG and Sustainability reporting

Note (*1): AISC assumes a A$1,750 gold price - and excludes royalty cost (~A$27/oz) impact associated with higher prevailing gold price [A$ gold spot prices are $2,600 to $2,650 per ounce today].

[Disclosure: I hold RRL shares]

29-Apr-2020: Quarterly Activities Report

Key Points (All figures expressed in Australian dollars unless stated otherwise)

- Regis’ response to COVID-19 was initiated during February and has included establishment of a Crisis Management Team to coordinate its response to the pandemic. Initiatives continue to be developed and actioned.

- The 12 Month Moving Average Long Term Injury Frequency Rate to the end of the quarter was 4.4, up from 3.5 at the end of the prior quarter. The Company has commenced a review of its Health and Safety standards, processes and culture.

- Quarterly gold production was 86,300 oz (Dec 19: 90,849 oz).

- Cash flow from operations increased by $7.4m to $107.4m for the March quarter.

- Cash and bullion was $168.8m at the end of the quarter (Dec 19: $168.8m), after payment of $40.7m in dividends, $30.0m in capitalised mining costs, $7.7m on exploration and feasibility projects, $15.6m in income tax payments and $12.1m on a number of discrete capital projects.

- Cash cost before royalties for the quarter were $880/oz (Dec 19: $866/oz). The minor increase in quarterly cash costs was primarily driven by the reduced gold production for the quarter.

- AISC for the quarter was $1,174/oz (Dec 19: $1,219/oz). The decrease in AISC was driven by lower strip ratios and ore stockpile build-up at Duketon South.

- Assuming no further COVID-19 related impacts:

- Full Year Production Guidance remains unchanged with a production range of 340,000-370,000 oz; and

- After excluding the royalty cost impact associated with the higher prevailing gold price (currently ~$27/oz), full year AISC guidance is maintained at the upper end of the $1,125-$1,195/oz* guidance range.

- The assessment phase of the McPhillamys Development Application is now well underway with Responses to Submissions (RTS) expected to be complete by the middle of the year.

- Diamond drill testing of the Garden Well underground target confirms a wide, robust high-grade mineralised zone beneath the pit. Results in fresh rock include 16.0m @ 4.9 g/t gold from 314m. Work defining underground potential expected to be completed in December Quarter.

- Drill intercepts at the Baneygo project continues to support the potential for underground resources.

*Full year AISC guidance assumes a A$1,750/oz gold price – see page 5 of ASX release 23 July 2019.

Comment

Regis Resources Managing Director, Jim Beyer, said: “Regis achieved another solid quarter of production and cash generation and its strong performance to date in FY20 saw it return another $40.7 million in dividends to its shareholders.

We are currently well placed for the June quarter and not withstanding any further impacts from COVID-19, remain on track to deliver our production guidance for the year of 340,000 to 370,000 ounces with our AISC expected to be at the upper end of the guidance range of $1,125 to $1,195 per ounce after excluding the impact of higher gold prices on royalty costs.

I am very pleased to see the good progress with our McPhillamys Gold Project and also at the Rosemont Underground Project where we are commencing stope production. Our potential Garden Well Underground Project is also proceeding through to completion of a PFS.

Overall Regis remains in a strong position to weather the COVID-19 related uncertain economic environment. This is due in no small part to the hard work and effort of our staff, contractors and our families to help manage this challenging time. To all of these people I would like to take this opportunity to say thank you on behalf of the Regis Board and management.”

--- click on link above for more ---

[Disclosure: I hold RRL shares.]

29-Apr-2020: The following was part of the Quarterly Report that Regis (RRL) released today (the bulk of which I've included in a different straw):

GENERAL COVID-19 STATUS UPDATE

The Regis response to COVID-19 was initiated during February and has included establishment of a Crisis Management Team to coordinate and implement the Company’s COVID-19 Response Plan to the pandemic.

The wellbeing of our employees, contractors and local communities remains Regis’ priority. Accordingly, the Company has implemented a range of measures across its business consistent with advice from State and Federal health authorities. These measures help ensure the health and welfare of our employees and their respective communities and includes the following:

- Implementation of systems and procedures for health monitoring which includes health checks prior to check-in for travel to site;

- Initiating social distancing protocols across the business including on aircraft, which has included chartering additional flights for travel to the Duketon sites;

- Implementation of site management protocols for dealing with potential COVID-19 cases;

- Relocation of interstate and international personnel to Western Australia;

- Temporarily extended roster arrangements for our operations;

- Implementation of ‘work from home’ arrangements for Subiaco and Blayney offices;

- Increased mental health awareness and support for both employees and their families;

- Implementing plans to limit the potential impacts in the local communities in which we operate; and

- Actions to ensure maintenance of adequate inventories with major contractors and suppliers.

To date there have been no confirmed cases of COVID-19 across the business. To assist communities in WA to deal with the ongoing impacts of COVID-19, Regis has joined with fellow resource companies in providing financial support to the WA Royal Flying Doctor Service, Foodbank WA and Lifeline WA through the Chamber of Minerals and Energy Community Support Fund. These donations are providing essential supplies, medical and mental health support to vulnerable communities.

Regulatory and guidance changes remain dynamic, but at this time the increased restrictions are not expected to have any material impacts on the Company. Regis continues to have regular and frequent communications with mining industry representative bodies and Government about actual and potential changes to requirements and is responding accordingly.

--- --- ---

Click HERE for the rest of that quarterly report.

17-Feb-2020: Half Yearly Financial Results Presentation

Also: Half Yearly Report and Accounts

RRL is up over 6% (so far) today on the back of this positive result:

Key Points (All figures expressed in Australian dollars unless stated otherwise):

- Record Net profit after tax of $93.4 million and net profit margin of 25% reflects the ongoing strong profitability of the Duketon operations.

- Revenue of $371.4 million*, with 182,807 ounces of gold sold at average price of $2,063* per ounce.

- EBITDA of $185.6 million with a strong EBITDA margin of 50%.

- Cash flows from operating activities of $147.2 million.

- Cash and bullion of $168.8 million**, after the payment of $40.7 million in fully franked dividends, $20 million on the strategic tenement acquisition from Duketon Mining Limited, $33.0 million in income tax, $19.9 million on exploration expenditure and feasibility costs, $23.2 million on the development of the Rosemont underground and new satellite projects, $32.0 million on capitalised mining costs and $35.9 million on other capital including a significant TSF expansion, the Duketon airstrip uprgrade and land acquisitions in New South Wales.

- Fully franked interim dividend of 8 cents per share declared.

- Gold production of 178,482 ounces for H1 FY20 at an AISC of $1,226 per ounce.

- Duketon operations continue to be on track to deliver the annual production guidance of 340,000-370,000 ounces with all in sustaining costs at the upper end of annual cost guidance of $1,125-$1,195 per ounce after excluding the extra royalty cost impact associated with the higher prevailing gold price.

Comment:

Regis Managing Director, Mr Jim Beyer commented: “Regis has produced another strong performance, recording a record half-year profit after tax of $93.4 million and operating cash flows of $147.2 million. This outcome again demonstrates the reliability and quality of the operations at Duketon.

We continue to deliver solid cash flow with robust net profit margins of 25% which has allowed the Company to undertake a period of significant capital investment towards the development of the Rosemont underground and new satellite deposits at Dogbolter-Coopers, Baneygo and Petra.

The Company’s solid performance has meant that in addition to investing in our future, we can continue to provide returns to our shareholders with a declared dividend of 8 cents per share which is a very pleasing result.”

The board of Regis Resources Limited is pleased to announce a strong half year net profit after tax of $93.4 million for the six months ended 31 December 2019. This represents a 17% increase from the first half net profit after tax of $79.9 million reported in FY2019 and is a record result for the Company.

*Gold sold from preproduction assets not included in revenue.

** Includes bullion on hand valued at $2,220 per ounce.

---

[continues... click on link above for more]

Disclosure: I don't currently hold any RRL, but I have in the past. My current gold exposure is via NST, EVN, SAR & SBM, plus a much smaller position in PNR. I also hold shares in some companies that produce gold as a byproduct of other production, such as SFR (whose main game is copper). There's nothing wrong with Regis (RRL), it's just not one I currently hold. However, they're always on my watchlist. This was a good report, and the market has responded positively to it.

19-August-2019: Regis (RRL) have reported this morning:

Appendix 4E and FY2019 Financial Report

FY2019 Financial Results Presentation

Prior reports can be reached from here: https://regisresources.com.au/reports-2/reports.html

25-Jan-2019: RRL - Corporate Update Presentation - January 2019

23-Jan-2019: To view Regis Resources' December quarter report - see here.

I also note that RRL have awarded the underground mining contract for Rosemont to Barminco (which is now owned by Ausdrill - ASX:ASL) - see here (and for ASL's announcement - see here). MACA (ASX:MLD) are still doing all of RRL's open pit mining.

19 Oct 2018: Regis (RRL) have released a presentation to the ASX announcements platform titled, "SEPTEMBER 2018 QUARTERLY REPORT & EXPLORATION UPDATE" - see here

Highlights:

- Q1 gold production 90,879 ounces at AISC of A$923/oz

- Another very strong operational quarter at the Duketon project