Yes @edgescape - DVP was my second worst performer across my portfolios today - down -4.33% to close at $2.65 after clipping that $2.58 level on the downside. Mind you, there was plenty of red across the market...

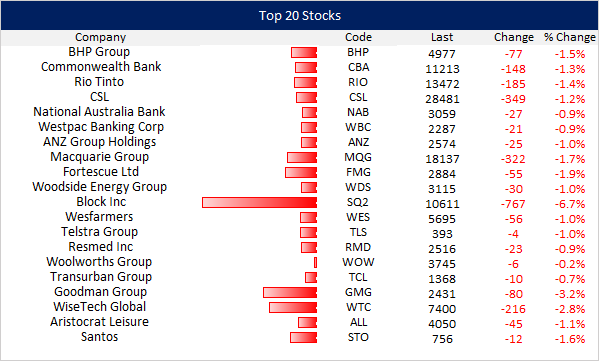

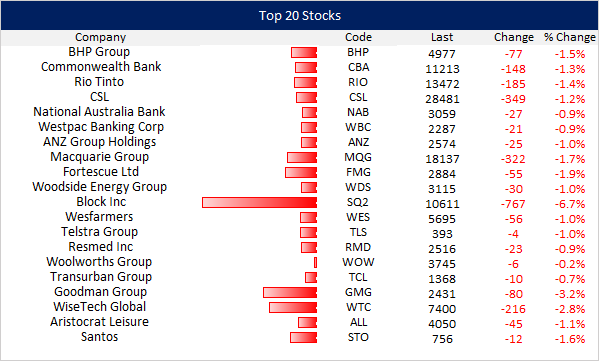

Gold and IT being the worst sectors didn't help me too much. I assume the -6.74% drop in SQ2 (Block Inc., which I don't hold) was the main contributor to IT being smashed so hard today.

In other news, the wheels haven't fallen off, but an FMG train came off the tracks up in the Pilbara for Fortescue (FMG); The incident happened on Saturday about 150 kilometres south of Port Hedland, and is the 2nd such incident in 2023 (this one on Saturday just scraped in to 2023) with Rio Tinto reporting an incident 20 kilometres south of Dampier in June.

"Perth, we have a problem..."

Back in 2018, a runaway BHP iron ore train was deliberately derailed 120 kilometres south of Port Hedland, and some of that looked like this:

Plenty of scrap metal in that lot. And iron ore. Source: Fortescue Metals Group rail operations expected to resume Wednesday after WA derailment - ABC News [02-Jan-2024]

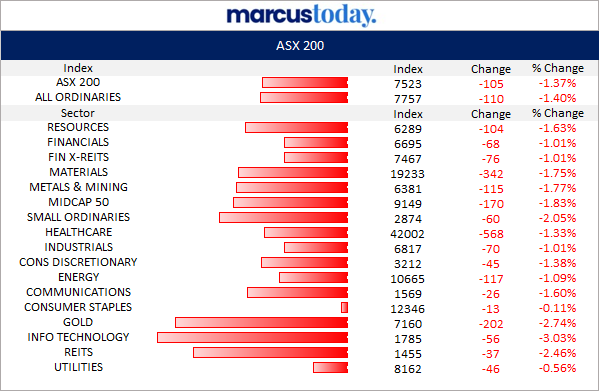

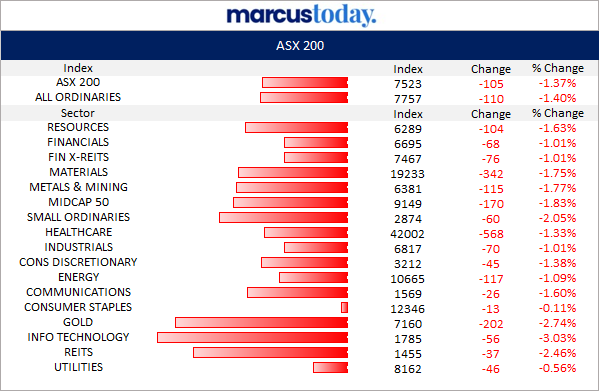

Nowhere to hide today - Small Ords and the Midcap 50 were down -2.05% and -1.83% respectively. And there was no respite at the top end either...

Consumer Staples seemed to be the safest place to be...

There was some flickering green around but hard to find amongst the red. JLG was up +8 cps to $6.16 (+1.32%) as wild weather and flooding continues along Australia's east coast - Flood news headlines - 9News

I also had one of my favourite companies continue to grind higher - GR Engineering (GNG) - which was up +4 cps to $2.35 (+1.73%). I believe there could be a fundy accumulating some GNG - and that would have to be done gradually - as they're fairly illiquid with such high insider ownership. I've been trying to increase my exposure to GNG again on a pullback, but I'm not getting one... yet. Got to be careful what I wish for I s'pose...

Having a look at the gold sector tonight, I was surprised by the market's reaction to the Gold Road's December-2023-Quarter-Production-Update.PDF

Gruyere's 2023 Annual gold production of 321,978 ounces did manage to just scrape in to the bottom end of their 320,000 – 350,000 ounces production guidance, but their explanation for lower gold production in the December quarter was a bit of a worry:

"Production was lower quarter on quarter due to disappointing mining performance arising mainly from unexpected labour availability issues during December. "

Hmmm, OK... And have we sorted those issues out now?? Sounds like something that might reoccur. Gold Road only own half of Gruyere, so they only get half of those ounces, with the other half going to their JV Partners, the South African HQ'd Gold Fields Limited, who own the other 50% of Gruyere and are the operators of the mine. Because they are NOT the operators, Gold Road (GOR) have very limited input or control in terms of operational issues such as labour availability.

I do hold some GOR shares in my SMSF and the upside of today's update (which did not include any AISC/cost details by the way), was:

- Gold Road’s December quarter gold sales totalled 37,037 ounces at an average sales price of A$3,040 per ounce. [That's a lot of Cheddar!]

- Gold doré and bullion on hand on 31 December 2023 was approximately 1,989 ounces.

- Gold Road continues to be unhedged and 100% exposed to the spot gold price.

- Cash and equivalents (cash, doré and bullion on hand at 31 December 2023) decreased to approximately $149.8 million (September quarter: $209.3 million) with no debt drawn, following investments (placements in De Grey Mining of $62.7m and Yandal Resources of $0.7m) and a $10.9m dividend payment - so without those investments and dividend payment, they'd have had another $74.3 million which would have given them a cash and equivalents balance of $212.5m at the end of December, just over $3m more than they had at the end of September. So it checks out. They're still in good shape.

- At 31 December 2023, Gold Road held listed investments with a market value of approximately $465 million (based on 29 December closing prices). That's in addition to the $149.8m of cash and equivalents.

- And No Debt!

I thought that the -8.95% selldown of GOR (from $1.955 yesterday to close at $1.78 today, that -8.95% SP fall made them my worst performer today) was a little overdone, but the market wasn't in the mood to hear anything even vaguely negative today. However, that has to be viewed in the context of their +43% rise from $1.40 in March to just over $2/share in December. They've performed well lately. Anyway, getting off track as usual - no pun intended - much!