Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

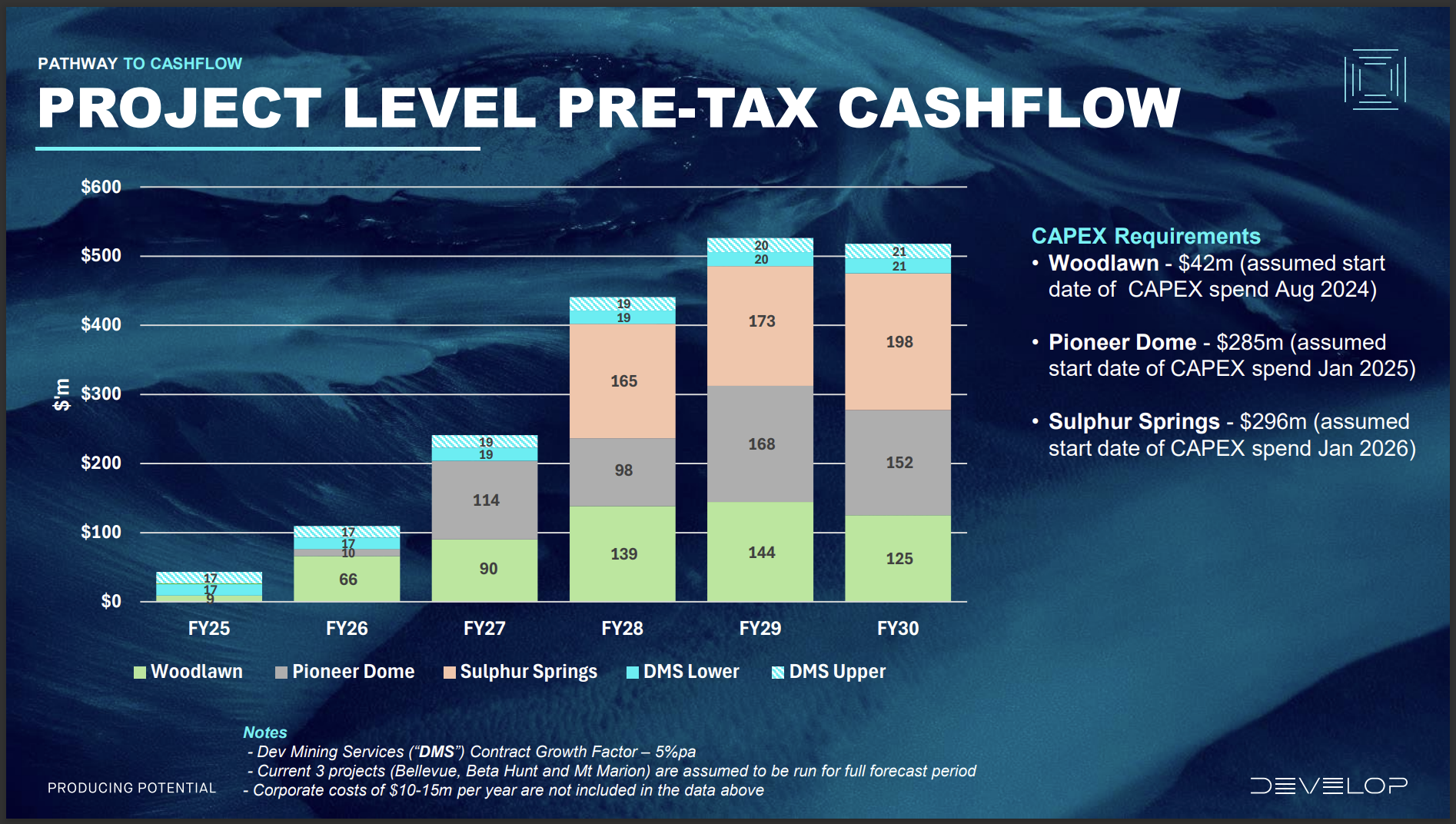

19th December 2025: Develop Global's business strategy is two-fold, to be both a miner who owns and operates their own mines and processing plants, and to also be a mining services contractor for other companies.

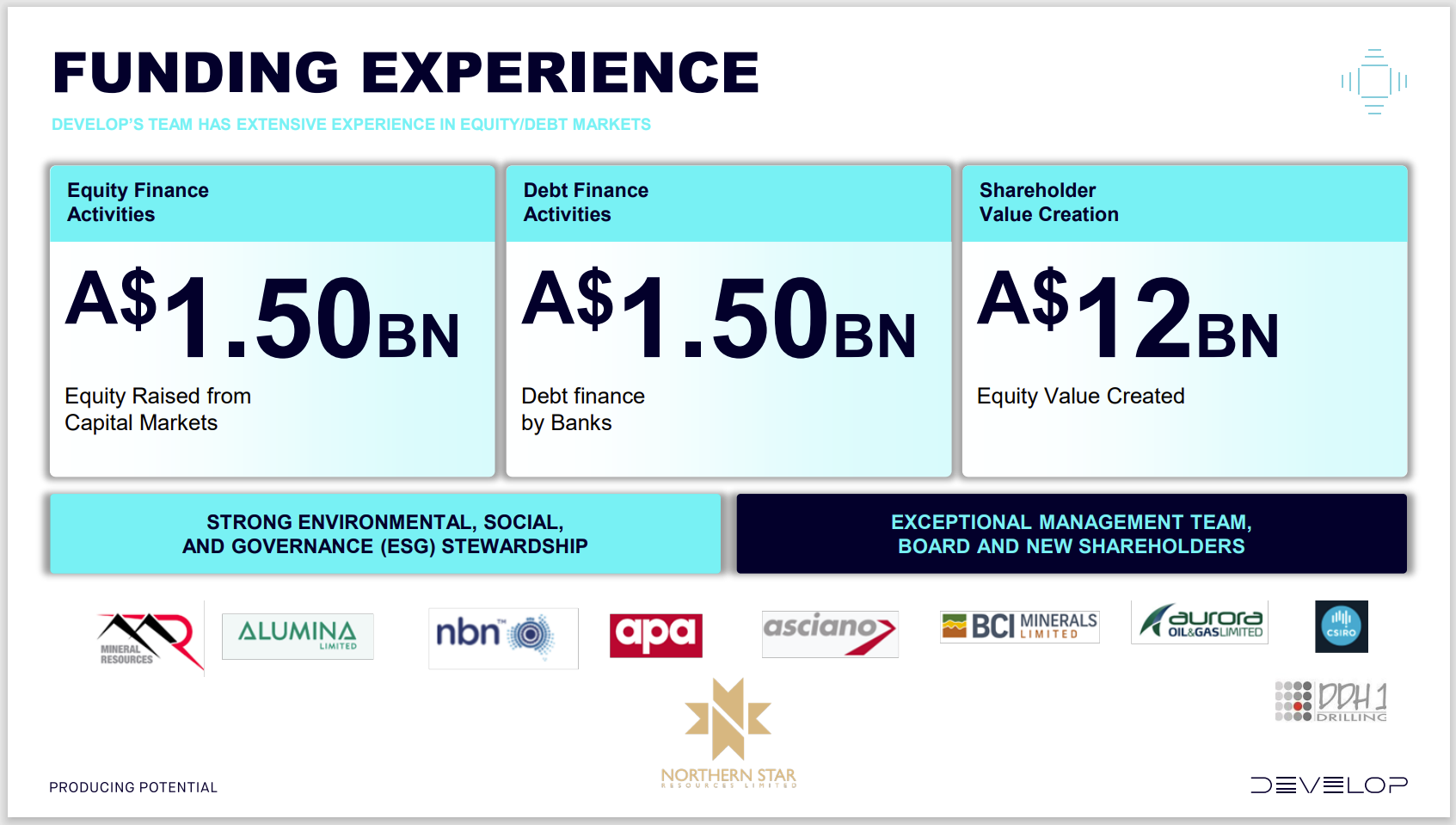

I don't mind the strategy, it's the same one Chris Ellison has used at MinRes (MIN), and it has been very successful there.

However DVP's Woodlawn Mine produces mostly base metals, primarily Copper (Cu), Zinc (Zn), and Lead (Pb), along with precious metals Silver (Ag) and Gold (Au), processed into saleable concentrates that are shipped to buyers like Trafigura, with a focus on clean energy metals. The mine is ramping up from older, lower-grade zones to the high-grade Kate Lens for increased production of these key metals.

That's their slide deck pitch however my concern is that Woodlawn is predicted to produce about three times as much zinc as copper, so it should really be viewed as a zinc mine that also produces copper plus smaller quantities of those other metals. And I'm not particularly bullish on zinc, and whenever I have briefly been bullish on zinc in prior years, I've always been wrong. Usually zinc stinks.

They have other projects sure, but Woodlawn is their only producing asset at this point in time.

And their mining services business has only one client, plus Woodlawn which they own themselves, and that one external client is Bellevue Gold which has done alright recently from a share price perspective, but has had a rough time of it with multiple production downgrades since they started producing, all with DVP as their mining contractor during that time. Bellevue's problems have been mostly grade control issues, dilution, and stope underperformance, however there have also been previous issues with development stopes taking longer to drill than anticipated because of both the rock being very hard and also a lack of basic infrastructure at times, like water supply, drainage and adequate ventilation.

In one "Hole Truth" interview that I watched a few months back Bill described the huge improvements that Bellevue (BGL, the company) had made in that area (underground infrastructure) which he said meant that there should be nothing now holding DVP back from getting on with the underground drilling at Bellevue (the underground mine; both the company and the mine are called Bellevue), which suggests that there had been plenty holding them back in prior quarters.

They also previously had a mining services contract at the high-grade Beta Hunt gold mine, which is now owned by Westgold (WGX) but was owned by TSX-listed Karora Resources Inc. (formerly RNC Minerals) when DVP were awarded that contract in 2024, then Westgold acquired Karora after outbidding Ramelius Resources (RMS) for the company, then DVP's contract at Beta Hunt finished in late November 2024. The official spin by DVP on that was:

DVP's mining services contract at Westgold's Beta Hunt Mine concluded in late November 2024, finishing as planned because the development scope was completed ahead of schedule, allowing DVP to redeploy its teams and equipment to other high-value projects like Bellevue Gold and Woodlawn.

Some additional facts are that Westgold (WGX) acquired Karora in August 2024 and Westgold tends to use their own teams and equipment for mining, so they have an owner/operator model, same as what Bill Beament himself established at Northern Star during his time building that company up from nothing to become Australia's largest gold miner. Ral Finlayson's Genesis Minerals (GMD) also employ an owner/operator model at all of their mines. Additionally, Westgold do use MLG Oz (MLG) for road haulage between some of their mines and their processing plants, but in terms of the actual mining at Beta Hunt, Westgold do that themselves, so it makes sense that DVP finished up at Beta Hunt 3 months after Westgold took ownership of the mine.

I asked Google, "How many mining services contracts have Develop Global had during their history and how many do they have right now?" and Google answered with:

Develop Global's Mining Services division has rapidly grown, achieving its 5-year plan target in 18 months and currently holding three major contracts, generating significant revenue, with projections for even more in FY2025, showing strong historical growth in contract numbers and revenue. While the total number of contracts throughout their entire history isn't specified, their recent performance highlights rapid expansion from fewer contracts to a strong portfolio.

That's not actually true today - the reference for that spiel was this: https://www.listcorp.com/asx/dvp/develop-global-limited/news/mining-services-set-to-generate-c-175m-revenue-3010001.html which was from March 2024.

DVP's own website (https://www.develop.com.au/) does not list their mining services contracts either current or historic, however my understanding is that they are only currently active on two sites, being Bellevue Gold (BGL) and DVP's own Woodlawn Zinc-Copper mine.

Until today's news:

Source: Develop-awarded-A$200m-contract-with-OceanaGold.PDF [19-Dec-2025]

While the market did appear to like this announcement, sending DVP's SP up +4% to $4.36 today, they remain below their $5.19 year-high achieved mid-year (in July).

DVP's chart has been choppy, and while this new mining services contract announcement is welcome news, the project is in New Zealand and is only a one-off mine development project rather than an ongoing mining contract. It's a A$200 million underground development contract to establish access tunnels at OceanaGold’s (OG's) Waihi North Project in NZ.

So not recurring revenue and I would suggest while it is certainly material, it isn't a game changer for them. It could be if it leads to ongoing work in NZ, but that is by no means guaranteed.

So for now, DVP have a number of irons in the fire, but they only have one advanced development project (Sulpher Springs, zinc, copper and silver) plus one producing mine (Woodlawn, zinc, copper, lead, silver and a little gold) where they are owner/operators, plus one external mining services contract (Bellevue Gold) and one external mine development contract (OceanaGold's Waihi North in NZ).

I like Bill Beament and greatly respect everything he achieved at Northern Star Resources (NST), but this isn't gold, and it hasn't got those gold tailwinds - except for Bellevue and the jury is still out on whether Bellevue has further production guidance downgrades or upgrades to come from here - it could go either way, except it doesn't really impact DVP either way because they are on a fixed price rates schedule there as I understand it, so as long as Bellevue keeps operating the mine and mill, there is still going to be contract mining work for DVP there, but DVP don't share in the higher gold price upside there because they're just the mining contractors, not the project owners.

OG's Waihi North is also a gold mine, but again, it's not owned by DVP, they're just providing $200m worth of services there during 2026 and probably into 2027 - until those access tunnels are completed. No gold price upside there for DVP.

Sure, DVP certainly do have copper exposure, but what concerns me is that both Woodlawn and Sulpher Springs are going to produce far more zinc than copper so the outlook for zinc does impact DVP, and in my opinion it probably matters more to them than price movements with copper or any other metal.

Disclosure: I have held DVP in the past. I do not hold them today. I look at them regularly, but I'm not sure they're worth over $4/share with what they've got right now in terms of their business, their assets and their direct commodity exposures.

If track records are important, and they are, Bill Beament has one of the best track records you could ever come across over at NST. But that was gold, and DVP is primarily a zinc producer right now. (IMO)

So they remain on my watchlist for now.

First maiden profit for the group

Driven by none other than deferred tax assets from prior years

Without this DVP still made a loss although it has narrowed

Meanwhile it will be a pivotal year for DVP. Some aspirational numbers being quoted

These are the last quarterly numbers from Woodlawn which is still low

Let's see if DVP delivers and lives up to its hype.

[held]

Barry Fitzgerald article on DVP at RRS conference

I have to disagree that there was a 1100% return on my investment though!

It's more like only 1 bag. We should note that Bill and others threw a whole bunch of equity as part of the refinancing package to transform VXR into DVP.

[held]

Been a bit slow on updates here while I catch up

These pics of Sulphur Springs progress few days back was not what I was expecting - in a good way!

I thought it would be more rugged like the Grand Canyon. Shorts must be nervous right now seeing these photos if there are any.

It is good to see progress here as Sulphur Springs was the main reason why I invested in VXR/Develop.

[held]

Bill on the front foot today quashing rumours about any bad news about the BGL trading halt on work for DVP

Reassuring to know there is no reputational or business damage as I alluded to earlier but better to wait and see what BGL will release after the TH.

[held]

I prefer not posting on Develop as it does not appeal to anyone's radar here.

I guess it's because it is resources which appear to be rallying hard at the moment and people here are probably double dipping on tech and market faves lately.

Personally I don't see the volumes that encourage me to dip into any market darlings. Examples include AMZN, WES and BVS.

Anyway, Develop seems to have shifted back toward base metals which is a good sign as I originally invested for Sulphur Springs even though we know transport infrastructure will be a challenge. Key date will be June 2025. If nothing happens by then it will probably be a sell.

Comp table to really "sell the story". I don't pay much attention to these

Also the ASX comp has started and I recently bought in below 2.80 along with ALQ, mainly because no one talks about these here in Strawman so I'm going opposite of this site at the moment. Now both up which is good.

Market trend looks encouraging too.

[held]

What do you mining investors think of this @Bear77 and others? Sounds pretty good to my untrained ears....

Bear77, a great podcast with Ed Cowan on Scaling Up about Develop Global https://podcasts.apple.com/au/podcast/the-king-of-kalgoorlie-bill-beament-founder-and/id1486108522?i=1000662252721.

Bill does tick a few boxes.

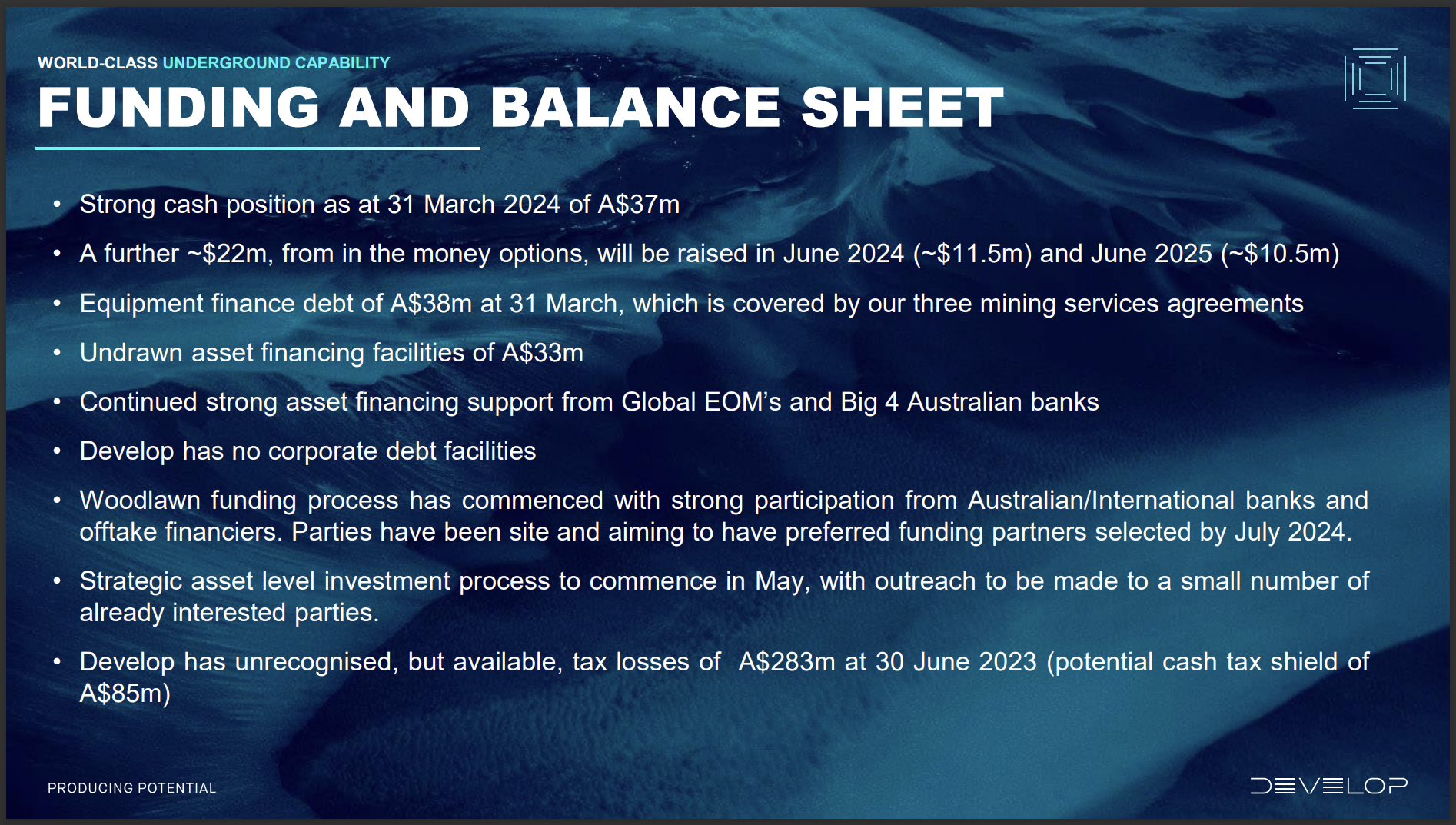

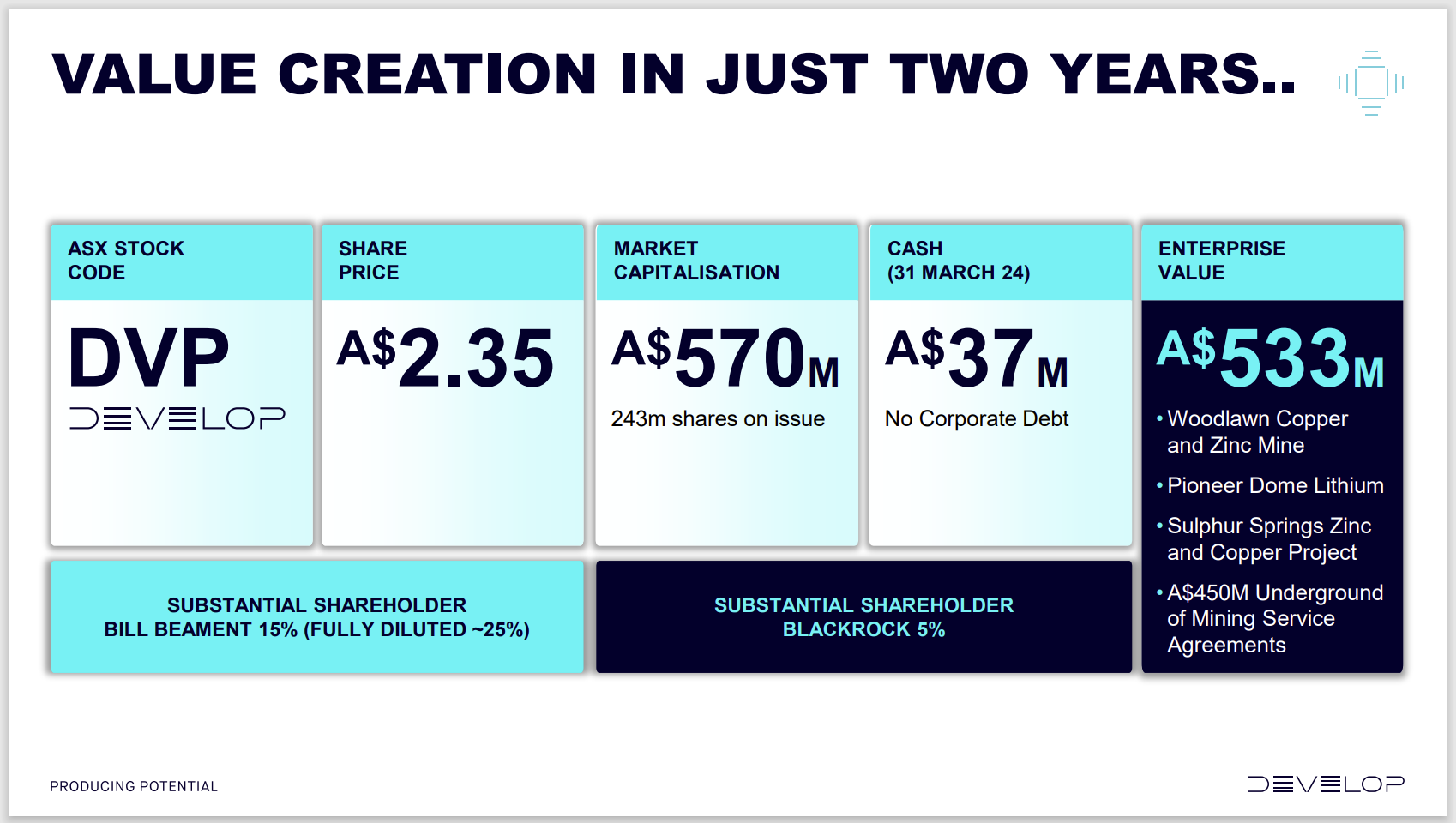

Monday 13th May 2024: Having a look at Bill Beament's Develop Global (DVP) again today, which I do hold (both here and IRL) and they are making steady progress towards their objectives. Cornerstone shareholder MinRes (MIN) sold their 14% stake in DVP around this time last month, and Bill Beament has increased his own stake in DVP to 15.08% (held through his company Precision Opportunities Fund). Chris Ellison's MinRes was under pressure to reduce MIN's debt levels, so there have been some "non-core asset" sales, including having 49% of MIN's dedicated 150-kilometre private haul road corridor in the Pilbara up for sale - the road connects MinRes’ Onslow Iron project at Ken’s Bore mine to the Port of Ashburton on the northern WA coast.

But back to DVP: Here are their latest announcements and presentations:

08/05/2024 8:23 am: DVP-Investor-Presentation-Pathway-to-Positive-Cashflow-May-2024.PDF(11 pages, market sensitive)

07/05/2024 8:24 am: Updated-Pioneer-Dome-Scoping-Study-(DVP).PDF (38 pages, market sensitive)

24/04/2024 8:24 am: DVP-March-2024-Quarterly-Activities-Report.PDF (18 pages, market sensitive)

24/04/2024 8:23 am: DVP-Quarterly-Appendix-5B-Cash-Flow-Report-March-2024-Qtr.PDF (5 pages, market sensitive)

From the Investor Presentation:

If you're not into Mining Services, copper, zinc and to a lesser extent lithium, then this one won't be for you, but with Bill Beament running this company, there's every reason to expect the company to be highly successful in future years, and he's done a reasonable job so far, since he left NST to head up Venturex, renamed the company ("Develop Global") and built up this portfolio of mining services clients and base metals and lithium projects.

I rarely buy into early stage companies like this - i.e. at this point in their history - however I'm happy to make an exception when we've got Bill Beament running the show. He has a truly exceptional track record.

Further Reading:

MinRes sells Develop Global stake; Bell Potter on the ticket (afr.com) [08-April-2024]

First-round offers in for MinRes $1b pit-to-port haul road sale (afr.com) [06-March-2024]

(25) DEVELOP: Overview | LinkedIn

Q+A: Aussie mining legend Bill Beament talks stonker copper hits and facing the future - Stockhead [17-May-2023]

Bellevue Gold Develops $400m contract - Australian Mining [14-April-2022]

MinRes awards Mount Marion decline contract - InvestMETS [01-Dec-2023]

Develop achieves five-year business plan - Australian Mining [22-March-2024]

Mining Services set to generate c.$175m Revenue - Develop Global Limited (ASX:DVP) - Listcorp. [21-March-2024]

I was watching this money of mine interview with metalurgist Nathan Stoitis. The did an under/over rated section at the end. They asked him about Woodlawn and he said he can't talk as he was involved with it and then changed his answer to underrated with a cheeky grin. at 1:18:16 mark.

Worth watching the interview as he is clearly very knowledgeable and it shed a lot of light on an aspect of resource investing that I had underappreciated.

He gave Chalice and over-rated label.

09-April-2024: MinRes sells Develop Global stake; Bell Potter on the ticket (afr.com)

Disclosure: I hold MIN and DVP shares. I think that this does remove an overhang, and if zinc, copper and lithium prices rebound, DVP's share price will likely rise significantly from current levels. It may not happen overnight...

From March 18th, 2024, Develop Global (DVP) and the 13 other companies listed in the table below will all be added to the ASX300 Index - which is important for people such as myself who have their SMSF within an industry fund (CBUS, AustralianSuper, HostPlus, etc) or for any other SMSF where the rules only allow the additions of ASX300 Companies, so they prohibit the inclusion of any company that is not in the ASX300 or above (ASX200, ASX100, etc.). This restriction generally does NOT apply to fully self managed SMSFs where you arrange the auditing of the fund yourself, but does apply to those within industry super funds and a few other low-cost SMSF providers/facillitators that have the same restrictions.

Full announcement: SP-DJI-Announces-March-2024-Quarterly-Rebalance.PDF

I've been waiting for GNG, LYL and XRF to be added to the ASX300, but I'll have to wait longer clearly. The criteria isn't just based on the company's market capitalisation (m/cap), it's also based on the "free float", so the amount of shares that is nominally available to trade excluding shares held by insiders (Board and Management, Founders) and long-term institutional (insto) shareholders. This means that companies like GNG & LYL, where the Board, Management and Founders own 55% and 36% of the company respectively, and insto's own another 15% and 26% respectively (leaving a "free float" of just 30% of their SOI [shares on issue] for GNG and 38% of their SOI for LYL), will have to grow their market caps further than most other companies before being considered for inclusion in these indicies - due to their relatively small "free floats".

It will be good to be able to add DVP to my SMSF from March 18th anyway.

29-Jan-2024: I was talking over the weekend about quarterly reports over in the gold forum - see here - and today we got DVP's FY24 Q2 Reports: DVP-December-Quarterly-Activities-Report-29Jan2024.PDF and DVP-Quarterly-Appendix-5B-Cash-Flow-Report-December2023-29Jan2024.PDF

Firstly - here's the first page of their activities report:

I like that Bill is calling out the opportunity that he sees in "the softness in some parts of this market" - Agreed - there's nothing like buying at or near the bottom, if indeed this is at or near the bottom. Let's hope it doesn't turn out to be "nothing like" the bottom.

After all, Bill did make a name for himself by buying decent gold projects with plenty of turnaround potential at low points in the market (at NST) and then turning those projects around - increasing their profitability by reducing their costs while increasing productivity. It was his background in mining services - before he got into gold mine management - that enabled him to be able to think like that and allowed NST to achieve the success that they enjoyed while he was at the helm.

Speaking of bottoms, it would be good if last Tuesday was the bottom for the DVP share price, but you know what they say about trying to pick bottoms...

Technically they're probably still in a downtrend despite that +11.4% bounce today after rising +10.3% on Thursday - the DVP share price is up by just over +23% since last Tuesday - in 3 trading days - but their chart (above) still looks nasty...

I also liked this:

Note they "only" have 22 quarters (5.5 years) of available funding ($32.5m cash/cash equivalents plus $41.7m in unused finance facilities = $74.2m) based on their December Quarter cash burn (of $3.35m).

Yeah, I can see why the market MAY have considered today that DVP appeared to be oversold and was due for a minor positive re-rate; but... will they go on with it, or fall back and resume that downtrend... ? That is the question...

From The Helm - With Bill Beament, Managing Director of Develop - YouTube [19-Dec-2023]

Bill Beament, Managing Director of Develop - YouTube [24-May-2022]

Bill Beament, Can He Do It Again? | DVP.asx | Mining News - YouTube [27-April-2023]

Yes, I believe he can!

Disclosure: Yes, of course I hold DVP shares! It's Bill Beament!

Not directly related to DVP but still relevant since Savannah is an underground Nickel mine

I think Panoramic going into VA is more of a internal issue in relation to their troubles ramping up operations.

But news such as Panoramic going in VA as a result of low nickel prices is not good as this just reduces the market for mining services operators such as DVP.

Hard to say if this is the bottom yet.

[held]

01-Dec-2023: Develop-Awarded-Mt-Marion-Lithium-Underground-Development-Contract.PDF

Develop Global Limited (DVP.asx) is pleased to announce that it has been awarded a A$46 million underground development contract to establish and develop an exploration decline at the Mt Marion lithium mine in WA.

Mt Marion, which is a joint venture between Mineral Resources Limited (MinRes, MIN.asx) and Ganfeng Lithium Co. Ltd, is located 40km south-west of Kalgoorlie. It is also 95km from Develop’s Pioneer Dome Lithium Project.

The contract has a term of 18 months and is expected to start in early 2024.

The key works to be completed by Develop under the contract include:

- Surface facilities to support underground mining activities

- Portal Establishment

- Installation of underground mine infrastructure

- Excavate underground capital development and exploration drill platforms

- Develop through the orebody underground to obtain important geological and operational data for future mining activities

- Set up the underground for an extensive diamond drilling campaign to grow the maiden underground resource of 9.5Mt at 1.52% Li2O (see MIN ASX release 22 September 2023)

Develop Managing Director Bill Beament said, “The award of this contract to Develop is a significant vote of confidence in our world-class underground mining team.

“We have built a world-class underground mining team with immense experience in developing and operating underground operations, especially in WA.

“The strength of this team is shown by the outstanding results we are generating at the Bellevue gold mine, where the project is running on time and on budget.

“The Mt Marion contract is consistent with our stated strategy of securing two to three contracts within our mining services division.

“Our team is eager to make a significant contribution to the Mt Marion project by applying its extensive skills and experience to the underground development”.

--- ends ---

This contract award was widely expected - as the MoM (Money of Mine) podcast boys discussed earlier today - see below, so it didn't move the share price - in fact DVP closed -4.58% lower (14 cps down) at $2.92/share this arvo, and MinRes (MIN) closed down -0.93% (-57 cps) at $60.60/share as lithium names continued to slide - along with lithium prices.

Source: MarcusToday.com.au [MT don't include DVP in that graphic, but MIN is there in the "Lithium" section as well as in the "Mining Services" section, but not under "Iron Ore" despite Iron Ore being MIN's second largest revenue earner, behind Mining Services (mostly iron ore crushing, loading & hauling); MIN do not currently earn any revenue from lithium as their lithium mines are not producing anything yet - Wodgina was, but it's been on C&M - Care & Maintenance - so hasn't produced any spod for a couple of years now due to low spodumene prices. MIN has substantial lithium assets, they're just not producing assets at this point. Their revenue right now comes from mining services, iron ore, and probably a little from energy/gas as well.]

In Today's "Money of Mine" Podcast...

Who’s Failing AGM Season? + Don’t Believe the “Substantial” Hype | Daily Mining Show - YouTube

... the boys did discuss this contract award, at the end...

0:00:00 Preview

0:02:04 The key link in TG6 History

0:04:38 How is mesh made?

0:08:30 AGM strikes

0:11:32 Euro Manganese funding announcement

0:16:19 Ballarat Gold Mine swallowed up by Acheron Capital

0:18:19 Aus Super buying PLS

0:21:35 Orecorp deal update

0:24:45 Wild Magnus AGM scenes

0:27:29 Develop get Mt Marion contract

Click on that image above of the lads discussing Develop and MinRes to go straight to that part of today's podcast.

And if you're into lithium, they have discussed lithium every day over the past week, except for Monday - which was all about West African Gold.

Friday 24th November 2023:

Inside the AVZ’s Shareholder Meeting | Daily Mining Show - YouTube

0:00:00 Introduction

0:01:58 Turning shit ground into good enough ground

0:06:58 AVZ shareholder's day in the sun

0:23:24 Which ASX companies don't like management's pay?

0:28:04 Does the Raw Materials Act impact ASX companies?

0:31:45 We share the Bald Hill acquisition details (as MinRes won't)

0:39:00 What's the latest from Cobre Panama?

Monday 27th November 2023:

African Gold M&A is all GO! | Daily Mining Show - YouTube

0:00:00 Preview

0:00:30 Introduction

0:01:05 How Junior Miners can get more bang for their buck

0:05:17 Perseus go substantial on OreCorp, getting in SilverCorps way

0:11:02 IER deems Zhaojin's bid for Tietto not fair & not reasonable

0:18:31 Turaco do a deal with Endeavour

0:20:05 Aeris rattling the tin for 30 bucks

Tuesday 28th November 2023:

The Koala on why Lithium is Iron Ore 20 yrs ago & the Mining M&A evolution - YouTube

(No relation)

0:00:00 Preview

0:02:39 Gina needs help breaking Iron Ore

0:07:53 Why Trav and the Koala like Twitter

0:24:54 M&A at the big end of town

0:37:44 Why was Freeport sold?

0:43:05 Reconciling views on trough EBIDTA

0:46:29 WA Lithium

Wednesday 29th November 2023:

(no, not me, another Koala)

0:00:00 Preview

0:01:35 Underground Mining Trivia

0:04:34 How real is DLE?

0:09:58 Metal Price Bifurcation

0:18:03 Shareholder Activism

0:23:44 Whitehaven alignment

0:34:23 BHP growth

0:47:03 Is the Copper boom going to happen?

0:48:22 The Koala on the Banking hampster wheel

1:05:02 Over Rated - Under Rated

Thursday 30th November 2023:

All You Need to Know About Lithium Brines with Joe Lowry - YouTube

0:00:00 Introduction

0:00:08 Preview to Mr Lithium

0:01:18 Recap of the Delta Lithium AGM

0:03:48 Flying with Brooks to South America

0:06:02 Jobs on offer at JP Search

0:08:20 Joe Lowry back on Money of Mine!

0:12:20 The 101 on lithium brines

0:17:06 Is water going to be an issue for DLE?

0:26:45 What is the waste product for a brine project?

0:31:15 What are the most misunderstood aspects of brine projects?

0:34:08 is SQM slowing down or ramping up?

0:36:55 Why is the Atacama special for brines

0:43:58 Where is China going to source its product?

0:47:38 What makes a good brine development project

0:51:58 Summing up Direct Lithium Extraction (DLE)

0:56:00 Who are the DLE tech players

0:57:47 Prelude to part 2!

Plenty on lithium and lithium miners in that lot!

And Friday's (today's) podcast is discussed and linked to further up (above all the others).

Disclosure: I hold MIN and DVP shares and I topped up both today on the SP weakness and the confirmation of this contract award. BTW, MinRes recently increased their stake in DVP to a bee's whisker under 14% (13.97%) - see here: Change-in-substantial-holding-from-MIN.PDF so nobody is taking over Develop Global without Bill Beament and Chris Ellison being onboard - as both of them have their own blocking stakes. I believe that the two companies will merge (MIN will aquire DVP) at some point in the future, and that Bill B will end up running MinRes when Chris is ready to step back or retire from frontline management. No guarantees, but that's what I reckon might be on the cards.

Not sure about that chart. I'm no technical analyst, but you could make an argument about a shorter term rally within a longer term downtrend, or you could say it's starting to form a pennant and could breakout either up or down from within that pennant as it gets closer to the pointy end. Or you could look at what Bill achieved at NST and just back the man and his new company. His track record of shareholder value creation is enviable.

Some unusual trading today with DVP shares which started down significantly at 3.15 before finishing up 3.36

Could be a bit of re-balancing going on for some funds.

[held]

Nero Resources Fund cuts DVP - 27 Sept (3.20)

Not sure what the thesis is behind the exit. It is not cap related as they hold Gensis Minderals which has a market cap of over $1bn so maybe simply thinks DVP is overvalued.

Bit of background:

Nero resources fund team - http://www.nerofund.com.au/team

Money of Mine podcast from the Nero Director Russell Delroy

https://youtu.be/do8JPnDI9VA?si=SHARU-32WHgf__7r

[held]

I'm sure lots of people would like to see a lower share price below $2 as mentioned by the BDO Independent Expert Report

Below is the reason why BDO still feels the merger is not fair due to their valuation of $1.73 published a few weeks ago.

Response from Bill Beament.

BDO’s recommendation, however, is based on a preferred post-deal value for Develop Global of just $1.73 a share, well under Friday’s closing price of $3.20.

Mr Beament, Develop Global’s managing director and an 18.3 per cent shareholder, unleashed on BDO, questioning the gap between its valuation and the market price.

“Please tell me where I can buy Develop shares at $1.73,” he said.

“I have spent more than $10 million buying Develop shares in recent months and I paid up to $3.20 a share. And I certainly believe that I got more than fair value. It was great value.”

Market was switf to respond to the latest repeat announcement today, sending shares up $3.46 ( 10%)!

Was good accumulation under $3 while it lasted. My post valuation merger still stands at 3.25.

[held]

Recent application grants to Develop at Sulphur Springs marked in light blue (E 4506033, E 4506034)

Purple dots are Lithium occurences which happens to be Pilgangoora. Dark yellow is copper. Bright yellow is gold.

Don't know what the filled shapes represent but I know they are different types of bedrock.

[held]

Wondering if anyone had thoughts even though this is more related to Zinc than Develop.

https://www.ecu.edu.au/newsroom/articles/research/move-over-lithium-ion-zinc-air-batteries-a-cheaper-and-safer-alternative

If viable this could impact lithium even more

Also a new batch of results were announced from Woodlawn yesterday

Held

The Kathleen Valley contract was awarded to Byrnecut for $1 billion dollars.

Seems like a huge opportunity missed by Develop but without studying the detail it is hard to say if the contract offered good value given Bill's assessment of the project.

Also beginning to think this was the work that was keeping afloat the share price above $3.

In addition there is probably lots of loose shares from the undersubscribed SPP (my guess is Cannacord has too much Develop shares on their books and is trying to offload),

Maybe good value here or given the macro picture, maybe not. Will need to wait further if Bill's comment on underground services demand is true and Kathleen Valley was worth a pass.

[held]

06-Aug-2023: Update on DVP from Euroz Hartleys here: dvp-040823.pdf It was published on July 28th and distributed by the ASX on Friday (4th August). I've reproduced the first page below:

Disclosure: I do not hold DVP shares at this point in time, but I probably should...

Wednesday 26th July 2023: INSIDER MAGAZINE: Bill Beament on life outside of mining and Develop Global | The West Australian

Plain Text Link: https://thewest.com.au/business/insider/insider-magazine-bill-beament-on-life-outside-of-mining-and-develop-global--c-10894035

We put Develop Global’s managing director Bill Beament in the hot seat to ask ...

What’s the best financial advice you’ve ever been given?

My old man was very adamant on this one. If you’re paying tax then you’re making money, and you’re making a contribution to everything else in society too. I’m paying a fair bit of that (tax) right now.

How do you manage a work-life balance?

I really do believe this is a hard one. I don’t think I’ve come across anyone in similar type roles in the past 15 years that gets the balance right.

A very wise, old and extremely successful entrepreneur told me last year at lunch: in your career you have spurts and steady periods, and in those steady periods, get that time with your loved ones.

What’s something that others have underestimated about you?

I think my energy, it catches people out. Those that have worked with me get it ... I’m like the Energiser bunny, I never say die. I’ve got a pretty big battery, that’s what my fiance says to me — she can’t keep up.

What drives you to succeed?

I just love the mining industry and I love the people in it, and I love seeing them develop and also succeed in all areas of life that goes with it. That’s been a big driver in the last seven or eight years of my career — watching the next generation of CEOs and entrepreneurs come through. For me, it’s never been about money.

I also love challenging the status quo and making a difference in the industry ... I love it when someone says I can’t do something, it’s like, I’ll find a way.

Beament with his Dad’s personal number plates. Credit: Ross Swanborough/The West Australian

Favourite holiday destination?

Being with my family and my loved ones is first and foremost and then it has to be the Duke of Orleans caravan park east of Esperance, where I grew up. I love that place.

I took my kids seven years ago on a big fancy holiday around America and Europe — it was an expensive bloody holiday, and a year later I said, ‘What’s your favourite holiday?’ and they said, ‘Out the Duke, Dad’.

Chocolate or cheese?

Both, and with a nice Italian red.

What are you binge-watching right now?

I’m watching Below Deck and I reckon it’s the best trash TV I’ve seen in a while. You can miss an episode and pick up where you left off, it’s fantastic.

Read any good books lately?

I failed English in high school so I actually hate books and don’t read them.

If you were to invite three dinner guests, dead or alive, who would they be?

Richard Branson first, I’ve always followed him — I just think he’s an amazing entrepreneur. I’d throw Kerry Packer in there and Margaret Thatcher.

What was the last band you paid to see?

Eskimo Joe.

Childhood hero?

My Dad and my Mum. Dad was a mechanic by trade and Mum was a house mum and housewife, but Dad ended up being a bit of an entrepreneur with his mechanical side and the rest is history.

Dad took great care to buy the best ute available at the time for his purposes, which I took out of the estate. It has personal number plates from the small region where I grew up (Condingup), just east of Esperance.

Who would play you in the movie of your life story?

Probably Tom Hanks; I grew up watching him. He can do any role and looks to be a genuine, nice guy.

--- end of excerpt ---

Here's a link to Google Maps showing Condingup (where Bill grew up) and his favourite holiday destination - the Duke of Orleans Caravan Park.

Duke of Orleans Bay Caravan Park - Google Maps

Nice part of the world!

Could be a bit chilly on the South Coast at this time of year, but a fair destination for a summer holiday for sure!

Interesting insight into the man who built up Northern Star Resources from scratch to become Australia's second largest gold mining company and is now back in Mining Services (where he started before NST) - building up Develop Global (DVP).

Closure of Tara Mine in Ireland which is one of the largest in the EU due to low Zinc prices and high gas prices.

https://www.rte.ie/news/leinster/2023/0628/1391541-tara-mines/

Perhaps explains why the move to Lithium by Develop.

[held]

Using the capital raising price for the acquisition of Woodlawn back in may 22

Price and date at time of update: $4.00 on 27 January 23 (up 12% and can't believe I'm downramping my own holding!)

Adding further to my theory of labour shortages in my South32 straw on Cannington Underground Mine.

Develop made a couple of key appointments who were former employees of Northern Star and Barminco back in November 2021.

Also it is already probable Northern Star experienced labour shortages as a result of the above key appointments of former NST employees.

While there's no proof key staff at Cannington or Golden Grove (29Metals) got headhunted by Develop, it is hard not to ignore the correlation of Develop having hardly any report of labour shortage and other underground mines being short staffed.

[held]

Map of the Woodlawn site from NSW Planning Portal submitted by Heron Resources.

Now the suspicions from Keith et al. that were spread during the Diggers conference seem justified that parts of the underground workings crosses the void and hence might not be good mining conditions.

From the presentation can see the mine void and lenses although quite small:

Close up (bit hard to see where the void is where Veolia is tipping the waste)

New drill drive (perhaps to get around the void)

So from the above slides, I believe Bill is aware of the problems faced (in my opinion). DVP will conduct a tour of the site with major investors and hopefully have a more detailed plan on addressing the "rumours"

Also note the project was acquired for 34m but a total of 340m was spent by previous owners.

As usual I could be wrong and Keith, TTC and Datt could be correct. In which case myself and Beament take the loss and eat humble pie.

DYOR.

[held]

On face value, the Woodlawn mine acquisition appears to be a bargain for Develop which includes significant pieces of infrastructure including 1Mtpa plant and a state of the art ISAMill developed by Glencore for extracting ore from tailings (mentioned many times during the Heron conferences). Initial payment of $30m to be made through cash and equity raising.

For some that do not know, Heron Resources went into administration after trying to ramp up production operations at the Woodline zinc-copper mine. Heron's haphazard approach to extract Zinc/Copper from both development ore and tailings as they worked towards the high grade lens to generate cashflow combined with mismanagement within the company and with their subcontractor Sedgman/CIMIC was all part of Heron's undoing. Heron spent $300m in total developing the project

Bill is coming into this project with a totally new approach. This includes more drilling in depth to find the extent of the orebody which was not done properly by Heron. More importantly, he is continuing to put the mine in care and maintenance and has not set a date to restart production to try and preserve capital until he can expand the deposit further.

If Bill is right and the deposit expands, Develop needs to make upfront payments of 12.5m for 550Kt of ZnEq and 5.5m for 750Kt of ZnEq contained resources. Then further payments will be made for final investment decision (20m) and continuous production for 18 months (30m).

Overall it looks like the deal is fair as Bill is making payments only if milestones are achieved. And if things don't turn out as planned, then the upfront payment payment is written off at the minimum.

Webcast link - https://webcast1.boardroom.media/watch_broadcast.php?id=620c9a0e1c785

Disc: Held (on the fence with taking my entitlement)

FYI: thanks for putting me back as premium member, will try and type a bit more now :)

@firedup

I'm surprised no one has given an answer to your straw regarding options.

Anyway I can't post to the forums or see any updates since maybe I'm no longer a premium member so I'll need to post here.

Although I must admit, I'm quite reluctant to post now as I'm not sure if my thoughts add much to strawman as I'm not a premium member and don't know how to become one.

My recommendation is if the price is lower than the market price and there is a positive upside, I would excise the options.

More importantly, excising the options now starts the CGT clock ticking so should you sell after 1 year, you will be eligible for a CGT tax discount.

If you excise the options much later and then sell at that time when the share price is much higher, you will not get the CGT tax discount.

Having Bill Beament and Mineral Resources on board in my view is a gamechanger. We have already seen what Bill has done since being on board which includes plans for an exploration drive under Sulphide Springs which will form a critical piece of infrastructure for underground mining before open pit operations start.

I also understand the code is different after the name change. You may need to check with the registry to double check the process.

As usual, your circumstances or thoughts on this may be different to mine (for instance you may be less positive on Bill or believe the work being done on Sulphide Springs is too much time) and you may choose not to excise. That is entirely up to you.

Disc: I excised all my options as soon as they were issued.

Highlights so far

Thought I'd come back in and put an update on DVP as my account is now restricted - apologies for not taking the premium membership in time.

- 5 for 1 Share consolidation completed in December 2021. Inadvertently this caused the market cap to appreciate by around 20% (share price now sitting at 75c pre-consolidation)

- Strong infill drilling results at Sulphur Springs with 25% of assays completed

- Planned construction of Exploration Decline

- Planned works to commence underground mining ahead of open pit.

I think out of all the other companies I follow that have projects in difficult terrain (CYL, EM2, ALK, DVP) it appears DVP and ALK are the most proactive in seeking ways to expand resources by doing exploration drives underground. Probably also explains why CYL and EM2 has been stuck where they are.

April 2021: During their webcast this month titled "March Quarter Investor Webcast", Andrew Mitchell, Director and Senior Portfolio Manager at Ophir Asset Management, interviews Bill Beament, the legend that built up Northern Star Resources (NST) to be Australia's second largest gold mining company, and took the NST share price from 10c/share when he took over the top job in 2007 to a high point of $16.56/share in November 2020:

https://www.ophiram.com.au/march-quarter-investor-webcast/

The interview starts at the 19 minute mark.

Earlier, Andrew also talks up Uniti Group (UWL), another company I hold (and so does Ophir), which is NOT a resources company. They are a competitor of Australia's NBN, selling fibre into new residential housing developments mainly, with a 30% market share that Ophir believes will soon reach around 50% market share - in new residential developments. But back to Bill B...

In the interview, Bill talks about his plans for Venturex, which is I why I'm posting this under VXR (Venturex). He has very big plans indeed. Since they announced on 24-Feb-2021 that Bill was leaving NST to run VXR, VXR's SP has 4-bagged, from 10 cps to 50 cps (currently 48 cps) while NST's SP has fallen from $10.85 to $9.07, although it was already falling before the announcement, and it has since rebounded from that $9.07 close on 17-Mar-2021 to $11.38 today (23-Apr-2021), being higher than before they announced Bill was moving on.

Interestingly, Bill does correct the Ophir boys on their description of him as being one of the best CEOs, if not THE best CEO that Australia has had over the past decade or two, because Bill has actually been NST's executive Chairman and their CEO has been Stuart Tonkin, who is staying on at NST along with all of the management team that came across with Saracen when they recently merged with NST. Bill describes himself as the visionary leader and Stuart as the leader who executes that vision, and he thinks the best businesses should have both - a visionary and an executor.

He says that one of the biggest mistakes that retail investors make when looking at resources companies, and that even goes for brokers and other analysts, is they concentrate too much on QonQ (quarter on quarter) results. He said when you're building a resources company, you are going to get some volatility in your costs and your selling prices, and therefore in your results, and you need to look through that at what management are trying to achieve. And I would add - and what they have previously achieved, i.e. their track record, should inform you of how likely they are to succeed in their current endeavours. This is particularly true in the gold industry where everybody looks at two key metrics, being costs (AISC) and production (koz produced p.a. of Au). Sometimes costs go up and it's temporary. An example I would give, and this is more YonY than QonQ, but the same thing applies (temporary, not structural) is St Barbara (SBM) over the past 18 months while they spent $100 million upgrading Gwalia's ventilation and cooling, as well as installing a PAF (paste aggregate fill) plant to mix crushed rock with cement and backfill mined-out stopes rather than truck waste to surface. Gwalia is approaching 2km vertical depth now, and it gets pretty warm 2km below the surface of the Earth. It currently takes truck drivers about two hours to make their way to the surface to dump their load and head back down the mine. Mining at Gwalia is planned to reach a depth of 2,300 metres below the surface by 2031. Gwalia is already the deepest trucking mine in the world and has been for years.

Further Reading: https://www.abc.net.au/news/2020-07-30/expansion-of-gwalia-gold-mine-nearly-complete/12503984

So SBM's costs (their All-In Sustaining Cost or AISC) rose because of the extra money being spent and the disruptions and delays associated with that work being done. And their share price got smashed because it looked like Gwalia had gone from being in the second lowest quartile of the global cost curve for gold mines to being in the highest quartile. As a long-time SBM shareholder, I was not particularly concerned. The cost increase was temporary. The work needed to be done. It ensured the next 10 years of mine life for Gwalia, and probably more. In that ABC News article (link above) in July last year, St Barbara's new (at the time) CEO & MD Craig Jetson said the investment in Gwalia's future would more than pay for itself over the next decade.

"We will certainly look to have very, very strong margins for a long period of time and a stable operation," Mr Jetson told analysts and media while unveiling the miner's quarterly results.

Gwalia produced 171,156 ounces of gold in the 2019-20 financial year, which is expected to increase to between 190,000 and 200,000 ounces a year for the two years to June 2023.

"I'm really excited about the future at Gwalia, even though it's getting deeper and we won't see the grade of yesteryear, but it will be achieving its best margins for a long time in the coming years and it will certainly be stable," Mr Jetson said.

And that's only one of their mines. They also have Simberi in PNG where they are currently modifying the plant to be able to efficiently process the sulphide ore that lies below the oxide ore pits that they are currently mining there on the neighbouring island to the one that contains Newcrest's Lihir gold mine. And they also have the Moose River Assets (a.k.a. Atlantic Gold assets) in Nova Scotia, Canada, with one mine already producing gold at a very low cost, and 3 more gold mines at various stages of development that should also have very low costs.

Needless to say (but I'll say it anyway), I do hold SBM shares, and RRL shares, and NST shares, and some other gold miners as well as a couple of gold project developers as well. I do NOT however own any Venturex Resources (VRX) shares.

Yet.

But this interview with Bill Beament makes me wish that I did.

A lot.