Received this note from Frazis Capital Partners for anyone not yet subscribed to his email updates

Clarity Pharmaceuticals

This is the most exciting company I’ve come across in Australia lately. Clarity has been steadily releasing data from patients treated with their copper therapies with late stage prostate cancer.

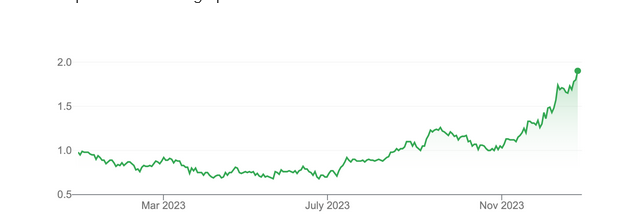

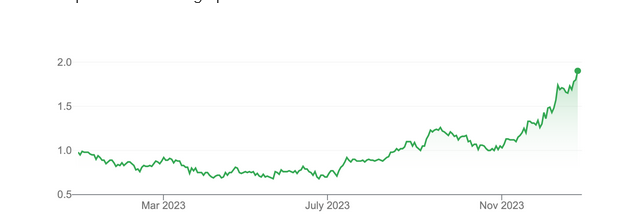

Clarity has been on a bit of a tear lately. If their data continues to hold, this is still early days, and it remains a fraction of the value of recent acquisitions in the space with early stage data.

I will send out a note on the space shortly.

Current players include Novartis, which entered the space through their US$2 billion acquisition of Endocyte, Lantheus, which offers a radiodiagnostic, and Telix which is rapidly gaining diagnostic share from Lantheus. The whole space itself is growing fast and expanding into new areas.

M&A activity has been intense.

Two days ago Bristol Myers Squibb bought RayzeBio for US$4.1 billion, with early stage data for their alpha-particle emitting Actinium-based radiotherapy targeting gastroenteropancreatic neuroendocrine tumors. The company is enrolling patients in a Phase III trial.

And Novartis paid $2 billion for Endocyte in late 2018 with only Phase II data. This has proved a big winner, with first year revenues for their first product Pluvicto forecast at over US$1 billion.

Point Biopharma, in partnership with Lantheus, was itself bid for by Eli Lilly for US$1.4 billion - again with only Phase II data. Last week Point’s data came in a little soft, leaving open space for new entrants like Clarity.

This is going to be a large market. In prostate cancer, the trend is towards increased monitoring and (where possible) fewer surgeries and hormone therapy, which involves the unwelcome side effects of incontinence, impotence, low testosterone and depression.

These companies are focused on heavily pre-treated patients. But the hope is that these targeted treatments, with their milder side effects, will move further up the treatment timeline, which could double or even triple industry revenues.

This will take time, given the high hurdle for changing standard-of-care, but is looking more likely than ever today.

In the meantime, a steady rise in the incidence of prostate cancer, combined with an increase in monitoring, suggests the market will expand significantly regardless.

In a space where companies with promising data are being acquired for billions of dollars, and Clarity’s early indications look best-in-class, the company’s post-runup US$340 million valuation looks cheap.

And just today (28 Dec 23) the share price reached an all time high of $2 before settling back down to $1.89

I presume the rally was on the back of coverage from this email update.

Michael Frazis of Frazis Capital Partners is known for ignoring financial metrics in favour of more unconventional measures of customer satisfaction, loyalty, addressable markets and ideas that involve cutting edge technology and science. His style is more inline with ARK invests Cathie Wood

For the record, I'm not as enthusiastic as Frazis on the growth of the PSMA market, I think the rise of drugs such as Ozempic could slow the rate of growth in Prostate Cancer and the underperformance from Lantheus and Telix is evidence of this. Frazis could be just a victim of wanting to catch the CU6 uptrend late in the cycle while ignoring his bad call on Paul Hopper's Radiopharm Theranostics.

[held]