Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Updating an old straw from one year ago. This is to keep track of Rhodotron numbers which is crucial in the production of Cu67 - not that anyone here is keeping track. But it is important visual to see Clarity's target geographies for therapy. Note that Cu67 has a half life of 2.5 days so just maybe Oz may be included???

This is the current number of Rhodotron deployments which hasn't grown in over a year (April 2024). Can't really say for sure if this really is a true picture or IBA has been too lazy to update their website.

Of course Australia is still behind the eight ball behind other developed nations such as Japan, Korea, Phillipines (??) and even China

Original content below for comparison

Clarity Pharmaceuticals Webinar Nov 22

https://www.youtube.com/watch?v=_9G8Gyjx-TI

At the 9 minute mark there is a discussion about using Cyclotrons to produce Cu-64 and Rhodotrons for Cu-67

All in all, not the disaster that Telix and myself made it out to be in the previous straw that copper isotopes are hard to find. And If they were hard to find, then FDA trials would be much harder to proceed.

ANSTO does have a cyclotron and a synchrotron. However, it looks most of the Rhodotrons installed are based outside Australia, the closest being in Singapore/Malaysia. Could see some share price upside if ANSTO decides to purchase a Rhodotron for local use.

Source: IBA industrial

Also have to note the IPO price was $1.40 so in the meantime the price could drag along the current range (0.8-1.00) for longer.

[held]

Doesn't look like Dr Alan Taylor is participating in the latest placement.

And non exec director Dr Christopher Roberts also did not take any recent placement

Also long termer TM ventures not taking any of the insto placement.

Maybe a clue that I should not take the retail placement?

Maybe the bears will be proved right and this is overvalued

[held]

David Williams who is chairman of PolyNovo pens a few thoughts on Clarity Pharma

Full version from the AFR behind the paywall:

I'm still considering whether to take the entitlement.

[held]

Why picking ASX biotechs is mostly for the crazy brave

Tom Richardson

3 April 2024

The Australian Financial Review

Sharemarket It's a space with a reputation for rollercoaster returns, but some investors get really lucky, writes Tom Richardson.

The Australian biotechnology sector has produced massive winners such as the $140 billion blood products giant, CSL, but is also notorious for its unnerving volatility and costly clinical trials.

The ASX has 171 companies in the healthcare sub-sector, 85 in the pharmaceuticals sub-sector and 39 in a biotech sub-sector. Aside from gems like CSL, it is a space with a reputation for rollercoaster returns and outlandish claims about "breakthroughs" that never materialise.

Hugh Dive, the chief investment officer at Atlas Funds Management, says picking biotech winners is tricky because each company is underpinned by inherently complex science. "So much rests on understanding the science, so you get a very binary outcome - either it works fabulously, or it goes to zero," he says.

"Unless you have extreme specialisation in an area, it's hard."

Dive points to CSL's recent setback with a drug known as CSL112 to treat heart attacks, as an example of how failure can occur despite positive market expectations and a $1 billion investment by an already wildly successful company.

On the other hand, one of the sector's biggest recent winners is $4.1 billion cancer diagnostic radiotherapy group Telix Pharmaceuticals. The stock is up 1453 per cent over the past five years and has added 1880 per cent since its November 2017 float price of 65¢. It was trading around $12 yesterday.

Biotech investor David Williams, who runs corporate advisory firm Kidder Williams, says Telix's success shows Australia's radio pharmaceuticals sector is "hot as Hades" in producing huge winners like Telix and Sirtex. Sirtex, which is best known for its technology to fight last-stage colorectal liver cancer, soared on the ASX before snaring a $1.9 billion takeover bid in 2018.

"I got China Grande [China Grand Pharmaceutica] to take 8 per cent of Telix about a year-and-a-half ago when it was worth $300 million, and now it's worth more than $3.5 billion," he says.

"Now I'm an investor in [ASX-listed] Clarity Pharma. It has a radiotherapy product for pancreatic and prostate cancer. The testing in humans is unbelievable, so it's gone from almost nothing to $800 million and [I think it] will be $5 billion someday soon."

Since listing on the ASX in August 2021 at $1.40 a share, Clarity's value has climbed 96.4 per cent to $2.75 a share, with backers including Mr Williams, former Cochlear chief executive and Clarity director Chris Roberts, fund manager Firetrail Investments and KKR-backed cancer care provider GenesisCare.

"It may sound funny, but third-party endorsement adds to a biotech's credibility," says Dive. "The presence of large corporates or well-known fund managers on a company's share register is one form of endorsement we look for, especially the multinational fund managers with vast teams of analysts."

Williams says he targets biotechs with a disruptive product that could work as a platform technology across multiple applications. He says burns treatment specialist PolyNovo, a company in which he is both investor and chairman, is an example of a rare platform technology success as the product is now used by surgeons for applications other than treating burns.

"In Australia, there's about 150 pure biotech companies listed, but 95 per cent of them have never done anything, I guess 20 per cent will fail before June," he warns. "Lots have just spent 10 years testing on mice, recycling themselves, and paying themselves.

"So you better make damn sure a company has a viable product, you've also got to raise money, there's plenty about, but you need someone who knows what they're doing, and you need great executives to run it."

He says some biotechs may get lucky if they invent a product that becomes popular for an off-label purpose. "Take botox," he says, "people take that now and go, holy shit, this is great, and Ozempic was supposed to treat diabetes but is taken for weight loss."

The S&P/ASX 200 Health Care Index, which comprises leading medical and biotechnology businesses, has gained 1 per cent over the past 12 months, versus a return of 9.3 per cent for Australia's flagship S&P/ASX 200 Index over the same period.

However, one speculative biotech that has thumped its peers and the broader market is Opthea. The biotech is running two large clinical trials in patients to develop a therapy to treat common eye diseases.

The stock has swung wildly over the past five years, with the company boasting around $150 million cash on hand as at December 31.

Gerard Satur, chief executive of MST Financial, says Opthea is among his top picks for success, alongside neuroscience success story Neuren and neurodegenerative researcher Alterity Therapeutics. "You have to be very selective to invest in biotech stocks on the ASX, there are too many stocks we believe do not offer attractive risk-return as an investment," says Satur.

"We have the largest healthcare research team in the market, we do thorough due diligence on companies like Opthea, which we like because it has the potential to be the first drug for wet AMD [age-related macular degeneration disease] in more than 15 years.

"The divergence between good and bad is massive in biotech. We turn away a lot more companies than we cover for research as we just don't feel like they should take investors, and we hate it when companies spruik too much."

Satur says the returns are lucrative if an investor manages to unearth a winner and a successful company can raise a lot of capital if necessary in Australia. "Regularly there can be five or 10-baggers," he says. "And there needs to be, as there's risk with biotech." A 10-bagger is an investment that appreciates in value 10 times its initial purchase price.

Ultimately, the speculative nature of the sector means it is an "avoid" for Dive as the risk of permanent capital loss is too great. The stock picker says he prefers to focus on established, profitable players such as CSL or Sonic Healthcare, but that should not preclude others prepared to take more risk.

"Often with small biotechs you hope they get taken out by big pharma companies that write a cheque if the tech is good, so sometimes you get takeovers and the rewards," says Dive.

"But it takes vast amounts of time and money to get a biotech through the hoops. And probably the most crucial thing is how much cash runway a company has, so if it's burning tonnes of cash and doesn't have much in the bank, you're probably facing a highly dilutive capital raising or worse.

"If the capital markets are unfriendly, the company may run out of cash prior to their therapies being approved, or may be unable to fund the next stage in the testing process."

Always get the feeling that retail is last in the queue

Retail gets one share for every 33 held at around $2.50

First it was Dimerix and now Clarity. Wonder if this is always like this in biotech land?

Not known how much the proportion of the 20.6m going to costs of the offer (ie: Bell Potter)

Not known how much the proportion of the 20.6m going to costs of the offer (ie: Bell Potter)

The raise was always going to happen soon, given only 40m left from the last report which is a few quarters of cash.

Given the breakdown above and the lofty market cap compared to the small recruitment target in the SECuRE trial (see my previous straw) will give this a pass for now and see if the shares I don't take up get sold at a lower price.

I also need to spend time going through some of the recent takeovers by Big Pharma but I believe most of those (Fustion, Point, RayzeBio) were more advanced in their trials and thus more attractive acquisition targets.

A takeover could be a long wait for Clarity.

[held]

You heard it first from me 2 weeks ago :)

https://strawman.com/member/forums/topic/8550

https://www.afr.com/street-talk/clarity-pharmaceuticals-preps-110m-raise-wilsons-on-the-tools-20240325-p5fex4

Street talk thinks the raise will be around $2.60 which was around the time those options were excised @ $2.50.

[held]

Table to visualise current progress of the SECuRE PSMA therapy trial

Cohort trial design and dosage below

Alternative table from the Wilsons Broker note

Data from the announcement "Clarity’s theranostic prostate cancer trial advances to multi-dose phase"

Cohort 1 result can be found in "Ann: Theranostic prostate cancer trial advances to cohort 2" 24th May 2023

So in summary 12GBq is most effective.

[held]

Despite the lofty market cap of 700m (and higher than Develop Global and a few others that made it), Clarity is still not in the ASX 300!

I must admit I broke my rule on the valuation and did buy those shares that got excised recently that tanked the share price down to $2.50. Could be a bad omen but hasn't dipped below that level since.

And congratulations to those that bought Clarity at 70c at a time when Genesis was selling. A little bit of research on the forced selling by Genesis goes a long way and I wished I did more digging on it.

But with Frazis currently giving this one some attention, I can understand that Clarity will be at the bottom of the pile in terms of valuation.

[held]

Good deep dive of the radiopharma landscape from the Frazis substack and where Clarity sits against other companies

https://fraziscapital.substack.com/p/clarity-pharmaceuticals

[Held]

Looks like Telix is getting on the Cu64 bandwagon

I thought I'd post this to Clarity instead to start a discussion on how copper isotopes are being used external to Clarity

Latest slide from 08/01/2024 - JP Morgan Healthcare Conference Presentation

Appears Telix is using Cu64 as the diagnostic agent with Ac225 as the therapy.

Only phase 1 trial so this is still early compared to some of Clarity's studies. But it does look like copper is getting some attention and could be a bit of a negative as now Clarity is no longer the go-to pharma for Copper diagnostics or even therapy.

[held]

Received this note from Frazis Capital Partners for anyone not yet subscribed to his email updates

Clarity Pharmaceuticals

This is the most exciting company I’ve come across in Australia lately. Clarity has been steadily releasing data from patients treated with their copper therapies with late stage prostate cancer.

Clarity has been on a bit of a tear lately. If their data continues to hold, this is still early days, and it remains a fraction of the value of recent acquisitions in the space with early stage data.

I will send out a note on the space shortly.

Current players include Novartis, which entered the space through their US$2 billion acquisition of Endocyte, Lantheus, which offers a radiodiagnostic, and Telix which is rapidly gaining diagnostic share from Lantheus. The whole space itself is growing fast and expanding into new areas.

M&A activity has been intense.

Two days ago Bristol Myers Squibb bought RayzeBio for US$4.1 billion, with early stage data for their alpha-particle emitting Actinium-based radiotherapy targeting gastroenteropancreatic neuroendocrine tumors. The company is enrolling patients in a Phase III trial.

And Novartis paid $2 billion for Endocyte in late 2018 with only Phase II data. This has proved a big winner, with first year revenues for their first product Pluvicto forecast at over US$1 billion.

Point Biopharma, in partnership with Lantheus, was itself bid for by Eli Lilly for US$1.4 billion - again with only Phase II data. Last week Point’s data came in a little soft, leaving open space for new entrants like Clarity.

This is going to be a large market. In prostate cancer, the trend is towards increased monitoring and (where possible) fewer surgeries and hormone therapy, which involves the unwelcome side effects of incontinence, impotence, low testosterone and depression.

These companies are focused on heavily pre-treated patients. But the hope is that these targeted treatments, with their milder side effects, will move further up the treatment timeline, which could double or even triple industry revenues.

This will take time, given the high hurdle for changing standard-of-care, but is looking more likely than ever today.

In the meantime, a steady rise in the incidence of prostate cancer, combined with an increase in monitoring, suggests the market will expand significantly regardless.

In a space where companies with promising data are being acquired for billions of dollars, and Clarity’s early indications look best-in-class, the company’s post-runup US$340 million valuation looks cheap.

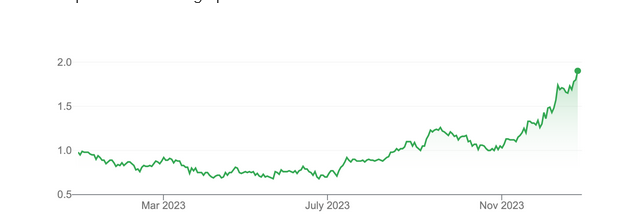

And just today (28 Dec 23) the share price reached an all time high of $2 before settling back down to $1.89

I presume the rally was on the back of coverage from this email update.

Michael Frazis of Frazis Capital Partners is known for ignoring financial metrics in favour of more unconventional measures of customer satisfaction, loyalty, addressable markets and ideas that involve cutting edge technology and science. His style is more inline with ARK invests Cathie Wood

For the record, I'm not as enthusiastic as Frazis on the growth of the PSMA market, I think the rise of drugs such as Ozempic could slow the rate of growth in Prostate Cancer and the underperformance from Lantheus and Telix is evidence of this. Frazis could be just a victim of wanting to catch the CU6 uptrend late in the cycle while ignoring his bad call on Paul Hopper's Radiopharm Theranostics.

[held]

CU6 has really been on a tear recently

Apart from the latest report from Wilsons shared by @Bear77, there was also an earlier update on the SeCURE Therapy trial for Cohort 2. Although there were only results from 3 patients, the update on page 1 looked promising but as usual I brushed it off

The more significant part is on page 2 where I have highlighted the update where patients has had radiogland therapy with not much success but has showed progress in the SeCURE trial

While the radiogland therapy is not named, we can probably guess that the one they could be referring to is either Novartis (Pluvicto) or maybe others from Lantheus (can't think of the name) or Telix (TLX591)

In either case, the news seems significant enough to justify the current rise.

However this is still early stage with only 3 patients tested (cohort 2). And still a "science experiment" with no revenue till 2026 and why I've held back on putting any more in CU6. Seems fairly priced now.

[held]

Interesting to see Clarity getting bid today.

There was a Bell Potter conference a few days ago

Milestones to look out for

[held]

Seems like lots has happened since my last straw so I will attempt a summary

Clarity reaches 50% recruitment milestone for Phase II SABRE prostate cancer trial - 26 July 2023

SABRE (Copper-64 SAR-Bombesin in Biochemical Recurrence of prostate cancer) is a Phase II Positron Emission Tomography (PET) imaging trial of participants with PSMA-negative biochemical recurrence (BCR) of prostate cancer following definitive therapy. It is a multi-centre, single arm, non-randomised, open-label trial of 64 Cu-labelled SAR-Bombesin in 50 participants.

Objectives of the trial are to investigate safety and tolerability of the product as well as its ability to correctly detect recurrence of prostate cancer. 25 of 50 participants recruited.

Clarity’s theranostic prostate cancer trial advances to highest dose level - 10 Aug

Cohort 2 of the theranostic SECuRE trial investigating 64 Cu/ 67 Cu SAR-bisPSMA in metastatic castrate- resistant prostate cancer (mCRPC) has been completed in 3 participants who received therapy with 67 Cu SAR-bisPSMA at the dose level of 8GBq.

No toxicities reported

Data from cohort 2 indicates positive effects of the 8GBq dose of 67 Cu SAR-bisPSMA on all patients, demonstrated by a remarkable reduction in Prostate Specific Antigen (PSA) levels within weeks of a single dose. Received recommendation to advance to Cohort 3.

Additional therapy cycles of 67 Cu SAR-bisPSMA have been requested by clinicians under the United States Food and Drug Administration (US FDA) Expanded Access Program (EAP).

In summary lots seems to be happening. I'm assuming the EAP will accelerate the development of trials for Clarity's Cu isotopes diagnostics and therapy.

On a final note, is Clarity a perfect hedge against South 32?

As mentioned before, Clarity isotopes use Zinc as main source feedstock.

And there is plenty of Zinc at rock bottom prices. But I'm only making an observation and not recommendation.

[held]

GenesisCare a healthcare provider (rather than PE) had been the main seller in February.

Explains the volatility in the share price for the last few months.

[held]

Zinc is used in the production of copper isotopes. With zinc at multi year lows this should be good for Clarity and Northstar

And eventually Zinc price as well.

https://www.claritypharmaceuticals.com/news/northstar/

Held

Webcast recording

https://wsw.com/webcast/jeff281/cu6/1621620

Hosted by Jefferies (who were co-underwrites in the IPO float)

[held]

Clarity’s theranostic prostate cancer trial advances to cohort 2

Highlights

• Cohort 1 of the SECuRE trial has been completed in 6 participants with metastatic castrate-resistant prostate cancer (mCRPC) who received therapy with 67 Cu SAR-bisPSMA at the lowest dose level of 4GBq.

• No dose limiting toxicities (DLTs) have been reported in cohort 1.

• The Safety Review Committee (SRC) has recommended that the trial continues to cohort 2.

• Recruitment has opened at clinical sites in the United States (US) at the cohort 2 dose level of 8GBq and patients are currently in screening for all available slots.

• Additional therapy cycles of 67 Cu SAR-bisPSMA have been requested by clinicians under the US Food and Drug Administration (FDA) Expanded Access Program (EAP).

• Early data from the EAP indicates positive effects of the lowest dose of 67 Cu SAR-bisPSMA on lesions, demonstrated by SPECT-CT images, with reduction in Prostate Specific Antigen (PSA) levels

My Notes:

In summary Clarity SECuRE trial is jumping straight into developing therapy treatment instead of just imaging (Propeller trial) and doctors are requesting the therapy be placed into the EAP (Expanded Access Program).

However I'm not sure if Clarity would receive any sales from being admitted into the EAP. Maybe someone with more knowledge of this subject can clarify

Some scans below from the announcement:

Clarity pipeline below although the SECURE trial needs updating after the recent announcement

Probably good news for those who bought the IPO at 1.50

[held]

A few price targets, some a bit optimistic...

Jefferies - 2.50 (Buy)

Wilsons - 1.22 (Overweight)

[held]

Clarity Pharma is working on targeted cancer treatment using Cu isotopes. Similar in the way Telix is using Ga isotopes for targeting cancer.

However, not sure if this is a veiled swipe from Telix

Will try and do a more detailed straw soon once I finished my research.

Bought on the dip yesterday but am a bit unsure after seeing the slide above... As usual this is a hype stock so I'm willing to lose some on this.

Youtube video - https://www.youtube.com/watch?v=sPGlCUXcxaA&t=1710s

[held]

Post a valuation or endorse another member's valuation.