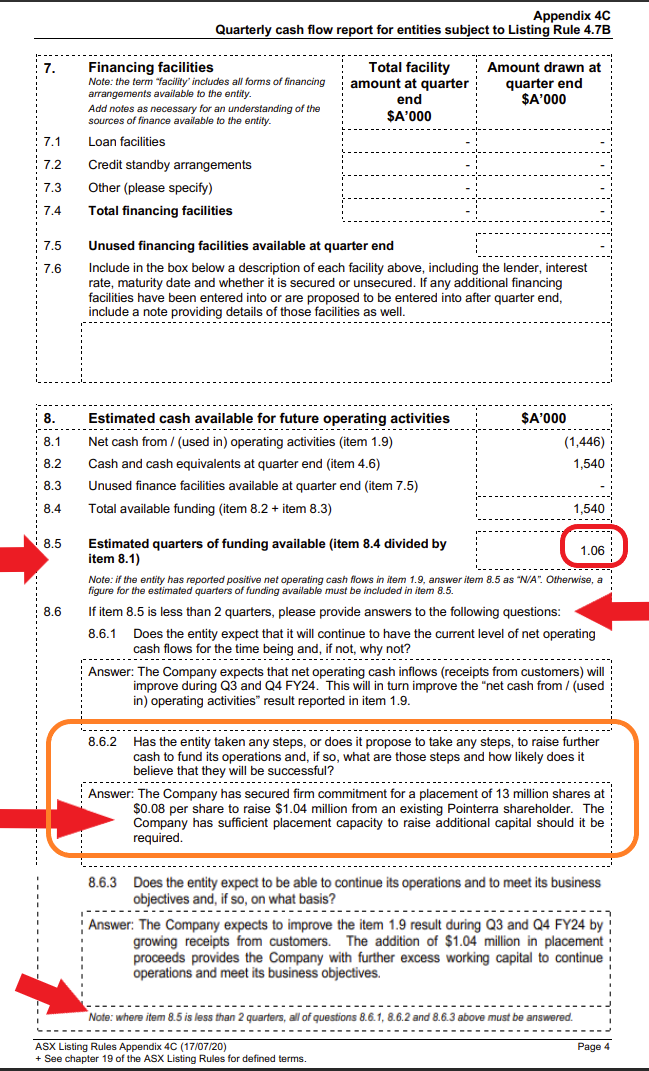

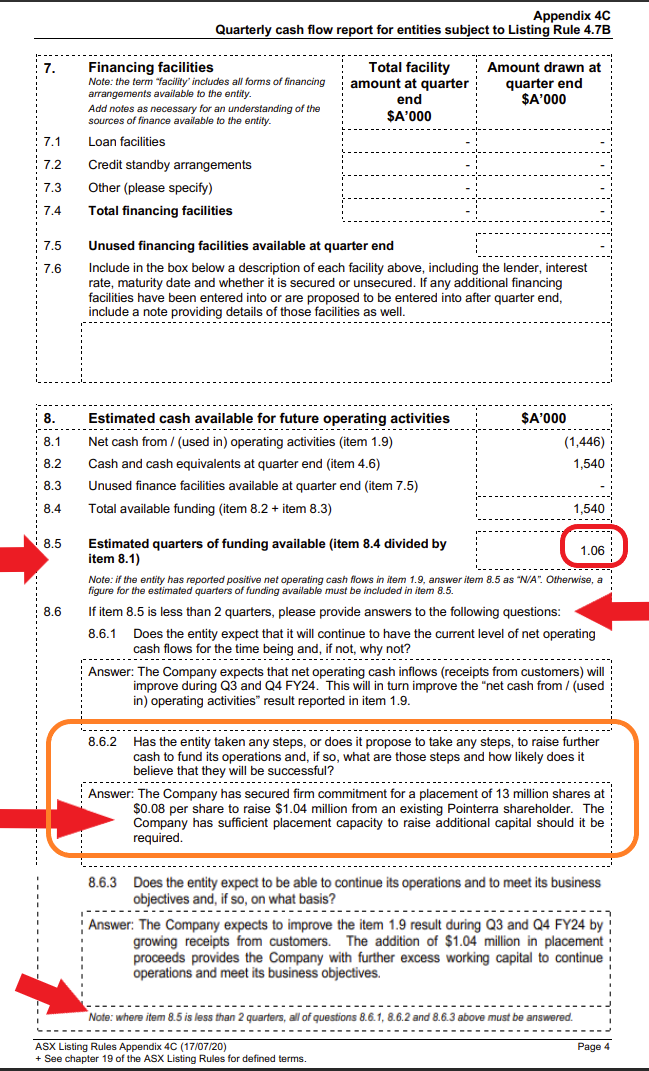

WHY they are doing the placement is very obvious:

Source: 3DP Quarterly Activities/Appendix 4C Cash Flow Report 31 Jan 2024 (for Qtr ended 31 Dec 2023) [taken from pages 4 and 5 of the 4C]

Because they do not really have any choice - they have zero financing facilities in place (top section, above), and they have less than 2 quarters worth of cash based on their cash burn over the most recent quarter, as shown above, so hope and optimism doesn't cut it; they need cold hard cash just to keep the lights on (and to keep paying the salaries of their employees). They also need to satisfy the ASX that they deserve to be listed, hence the questions that are triggered in the 4C if they go below 2 at question 8.5. The $1.04m raising is probably the very minimum they need to raise IF they can achieve cashflow neutral or cashflow positive during the current quarter, because if they end up with another quarter of similar cash burn (in the current quarter), they are going to be below "2" at Q.8.5 on their next 4C as well even WITH this $1.04m raising, so they are doing the bare minimum to survive as a listed company for another quarter, in my opinion.

As for "Why @ 8c/share??", that's likely because of options A, B & C in @Nnyck777 's post in this thread (a mix of all three). I think the founder does still have confidence that the company will survive and will be worth more than 8 cps in the future, and can afford the $1m. I hope they are right, but I wouldn't touch this company with a barge pole. They just haven't lived up to their own hype. Too many lofty aspirations and not enough sales. Not nearly enough. It's always coming, but it never quite does.

I also think the founder reckons it's worth tipping another $1m in to see if they can get through to cashflow positive instead of burning through cash. If you've put this much time and effort into trying to build a company, and you can afford to give that company a short-term lifeline to ensure it doesn't hit the wall just yet, then I can understand the thinking behind doing this.

Shareholders would understandably be furious if the placement was at the current share price or lower. I think the company will get sold down regardless tomorrow, but perhaps not as badly as if the placement had been priced lower.

3DP appears to not have any current debt (based on their answers to 7.1 through 7.6 above), but if they did have debt, there would often be banking/lending covenants in place, and one of those might be to do with minimum market capitalisation, which is of course based on their share price. 3DP's "Interest and other cost of finance paid" for the quarter was $20K (Q 1.5 on p1 of the 4C, link above) and if that $20K was interest on debt, that would likely be a fairly small loan I would have thought - so probably not very material. But that's one possible reason why the founder (or the company) might be sensitive to a falling share price. Another is if it affects any of their (the management and board members') STI or LTI payments or entitlements.

Another possible reason for trying to keep the SP as high as possible during a CR is to try to avoid the wrath of their shareholders. At this point, they don't have much support left, so they probably don't want to piss off the few supporters that they still have any more than they really have to...

Another thought is that they may have sounded out some brokers and realised that the only way they would get a normal/usual-style CR done at this point would be at a VERY dilutionary price, i.e. well BELOW the current SP, and they found that option too unpalatable. Better to project confidence from the founder (and existing shareholder) and try to instil some confidence back into the stock. And perhaps $1m was all he/she could either spare or scrape together.

It does kick the can down the road for one more quarter, and if this current quarter turns out to be cashflow neutral or cashflow positive - as they have indicated it should be - then this small placement will have kicked the can down the road for two quarters - i.e. through until the end of June, to be reported by the end of July, and maybe that will be enough.

Maybe...