Beleaguered $ALC reported their 4C this morning, with the investor call later this morning (I won't be able to attend so will have to catch up with the recording)

ASX Announcement

Their Highlights

- Q2 new TCV sales of $21.8M; $0.7M expected to be recognised in FY24

- Signed $23.3M South Tees contract extension for an additional 8 years (to 2033 with 2 years remaining on current contract) for Miya Precision Electronic Patient Record (EPR). Further options to extend out to 2038 and add further Alcidion modules which if taken would result in a total TCV of up to $54M over the next 15 years

- FY24 contracted revenue at end of Q2 of $35.5M, up 4% on pcp

- Sold & renewal revenue over the next 5 years (excluding FY24) of $126M

- Q2 cash receipts of $8.7M; up 28% on pcp, resulting in an operating cash outflow of $3.4M. Debtor balance at end of Q2 of $7.3M (PCP: $5.6M) which included $3.9M from a major customer which was collected in the first week of January 2024

- During Q2, raised $5.4M via Placement and SPP to ensure maximum flexibility and maintain a strong balance sheet to execute on market opportunities and drive revenue growth

- Cash balance of $7.9M and no debt at 31 December 2023, strengthened further following receipt of $3.9m in early January 2024

My Analysis

2023 was a horrible year for the company, and investors voted with their feet with the SP down almost 2/3rds and the SPP component of the capital raising towards the end of the year essentially shunned by investors.

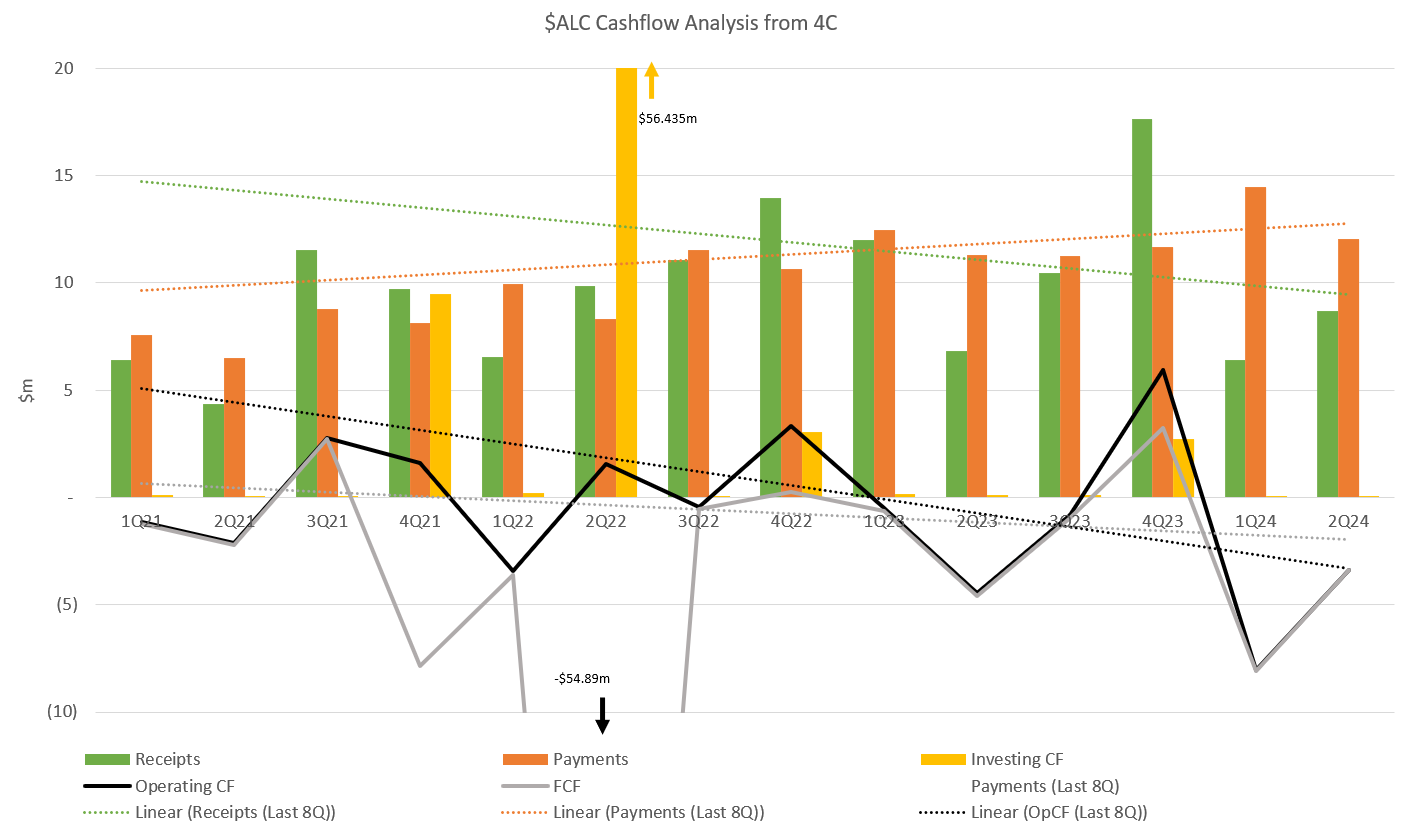

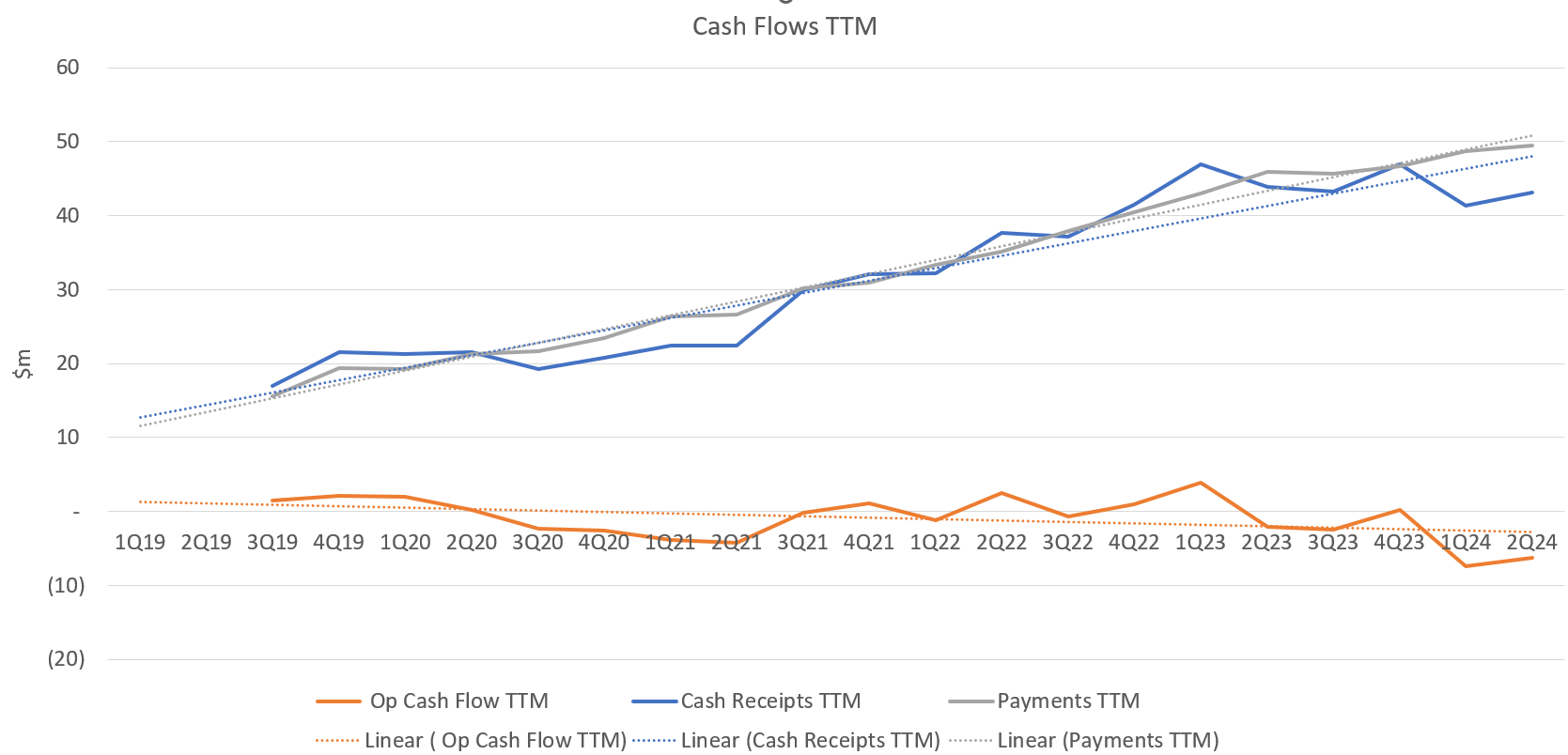

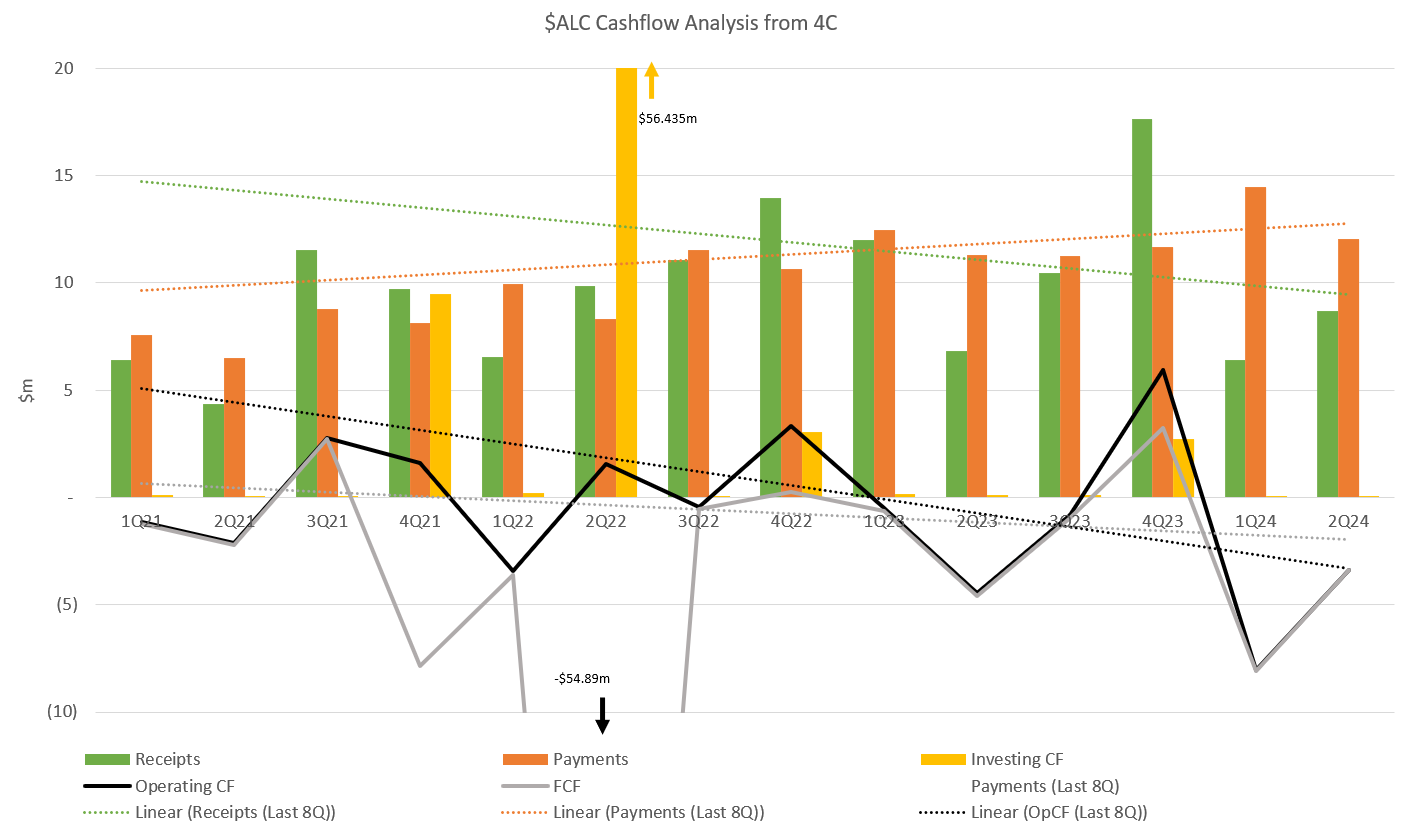

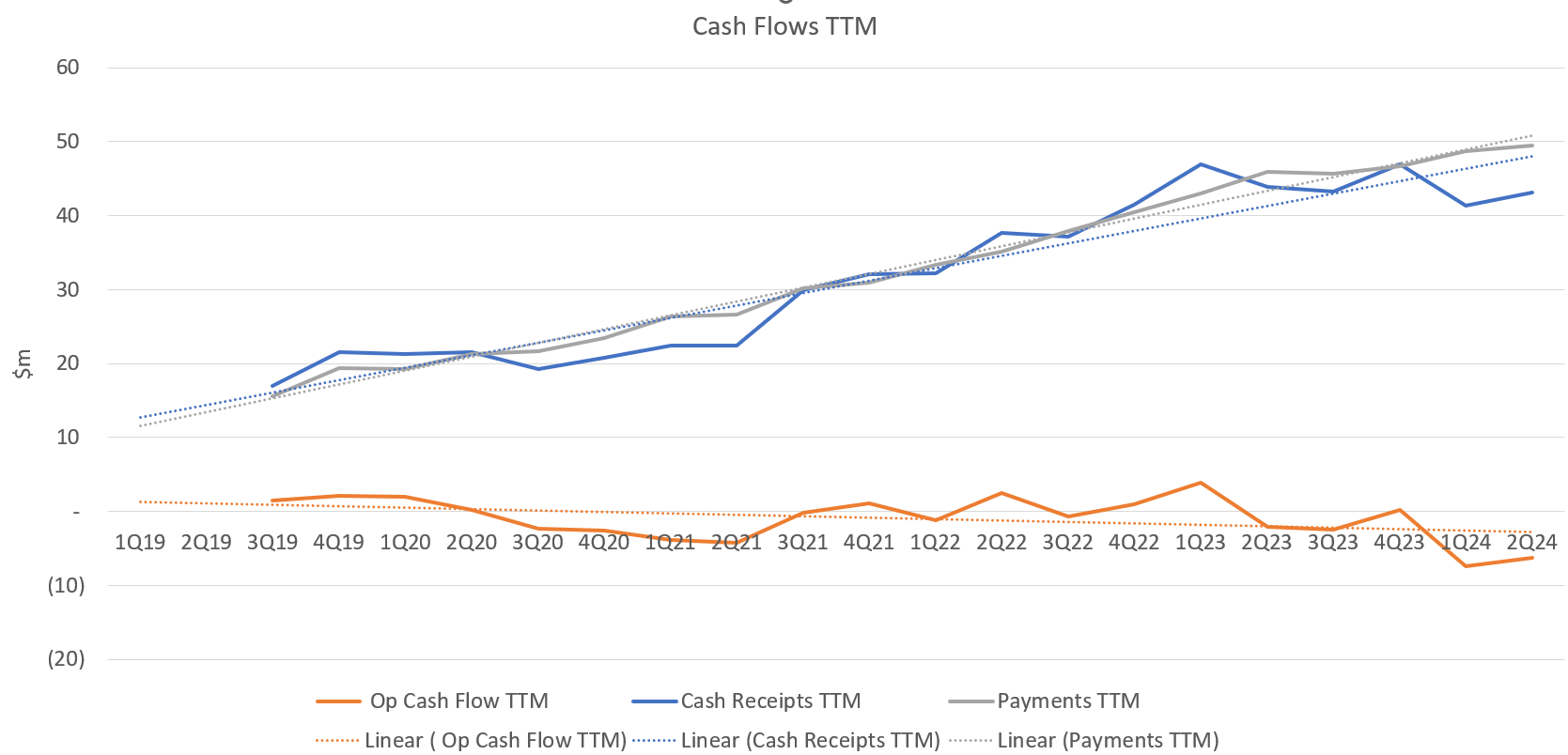

My usual 4C Cashflow picture below tells the story - no discernible growth trends, a growth stock currently becalmed with the sails flapping in the breeze. I've added the TTM picture for operating CF over a longer timeframe, so you can more clearly see the adverse inflection over the last 12-18 months.

Within all the bad news there is the good news of the South Tees renewal - previosuly announced. We don't know the full terms of the deal in terms of margin; however, this is a high gross margin business, and such a long term contract with the potential to deliver average annual revenue of $3.6m over 15 years and act as a flagship reference case. The South Tees procurement team will have struck a good deal, you can be sure.

The blame on slow procurement is placed squarely on the customers, which I am not sure is totally justified. I have previously published a sample list of recent NHS deal announcements. Product and Sales Capability are two other factors in the mix, and there has to be question-marks on both.

Kate is turning her attention to managing costs, which she has to do. Taking direct control of the UK team by not replacing the MD is a significant step, and she'll have a tough year directly running a microcap operating on two sides of the globe. But that is the work to do, as it is a fight for survival now.

My thesis is broken, and I should exit. However, with the SP on about 1.2x expected FY24 sales there is every chance that some wind might be blown back into the sales. One or more material sales deals, which are as ever said to be in prospect, even a decent upsell to an existing customer would be positive catalysts. There is also the prospect of M&A - not a reason to hold on its own - but $ALC has to be on someone's shopping list at this level.

So, I am not going to shoot myself in the foot by exiting today. My position is small (RL now only 0.5%) and the damage is done. I'm a grumpy HOLD.