28-Jan-2024: Bull Case straw for BGL - I added them to my SMSF on Thursday (25th Jan 2024).

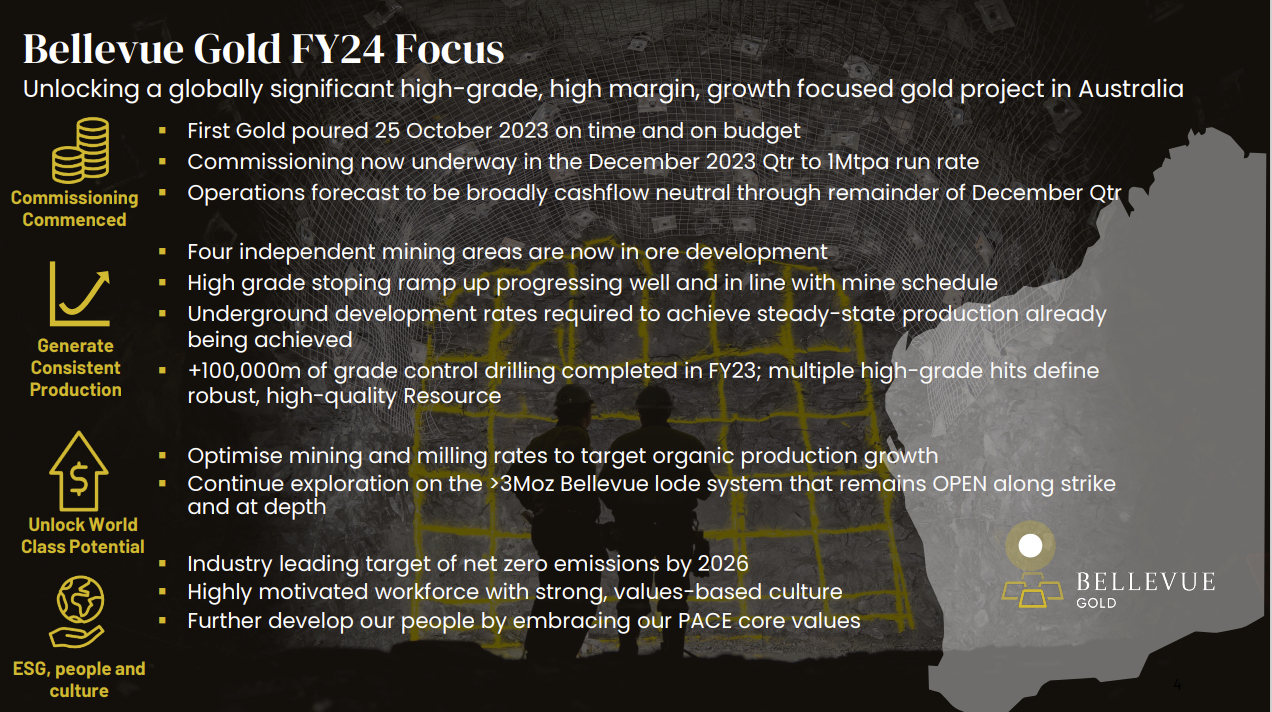

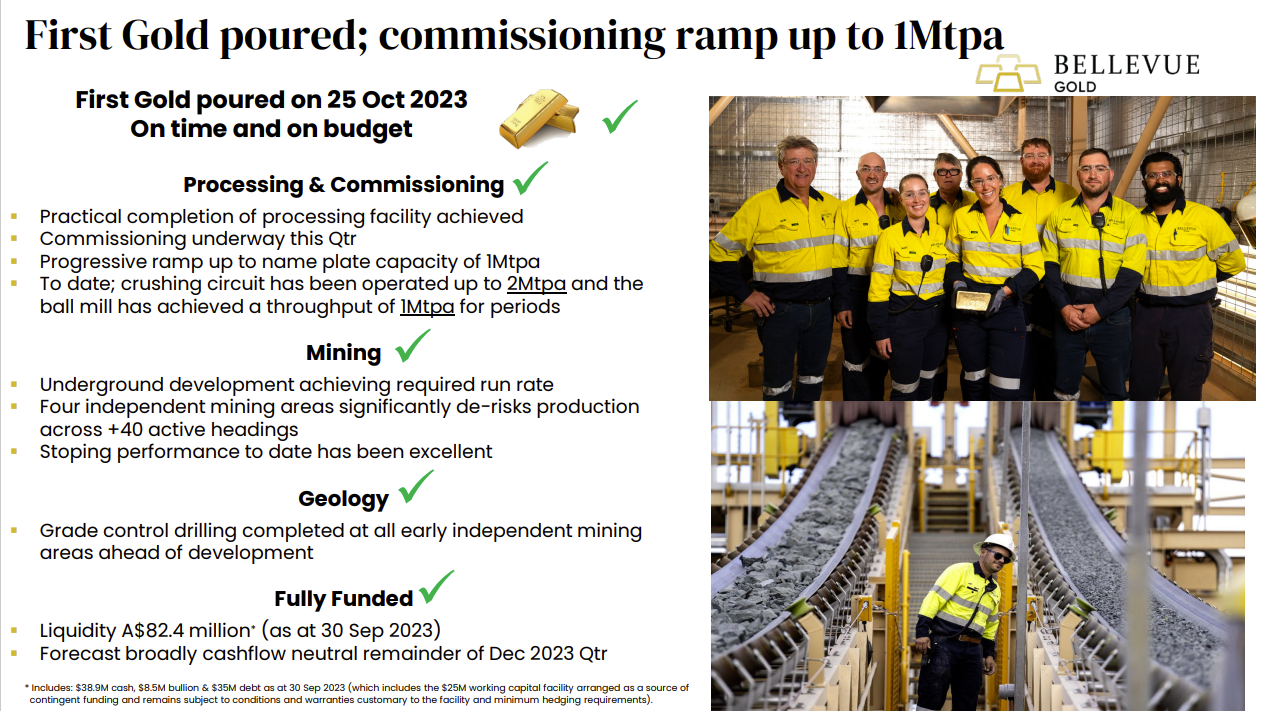

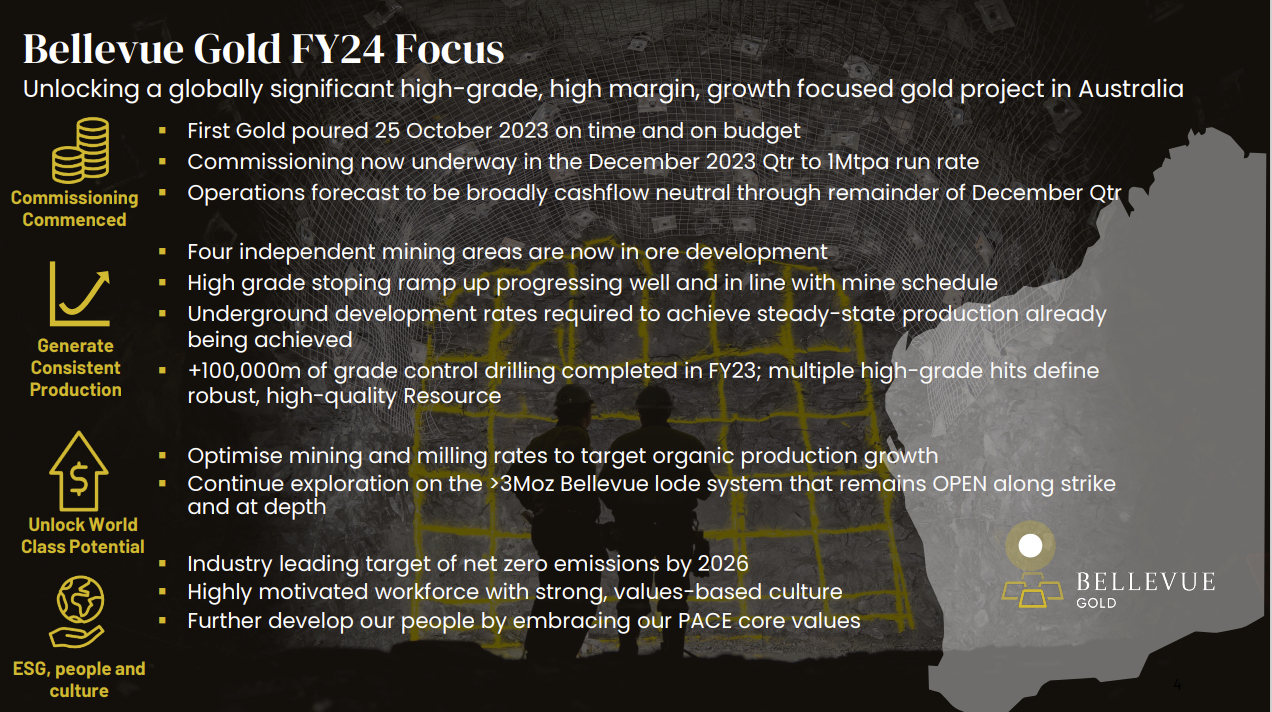

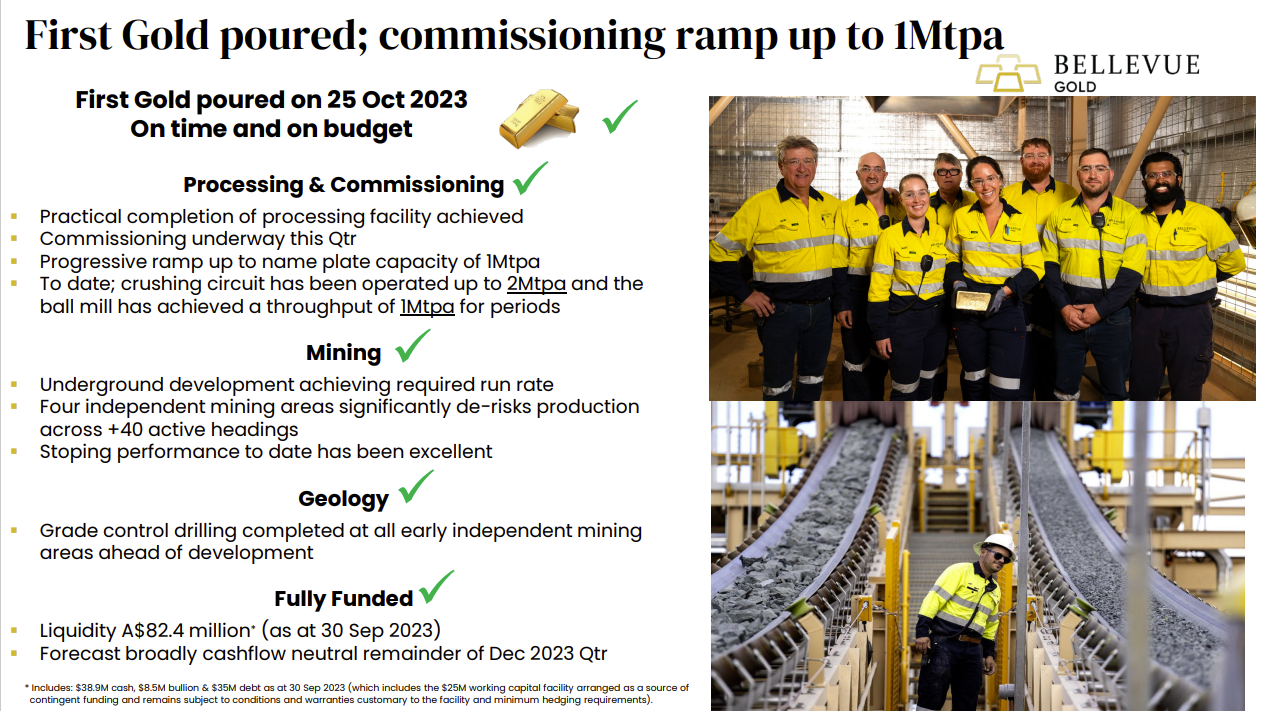

The SP has come down ~30% from a high of $1.84 in early December to $1.29 in late January. The company is going through the commissioning phase and ramping up the Bellevue gold mill to nameplate capacity currently, and the December Quarterly Activities Report will be telling in terms of how smoothly that has been going. That should be lodged by BGL to the ASX's announcements platform during the next three business days (the last 3 in January - and January 31 is their deadline for lodging that report). If things are going badly, then the share price will go even lower, but if things are going alright I reckon we could see some upside from here.

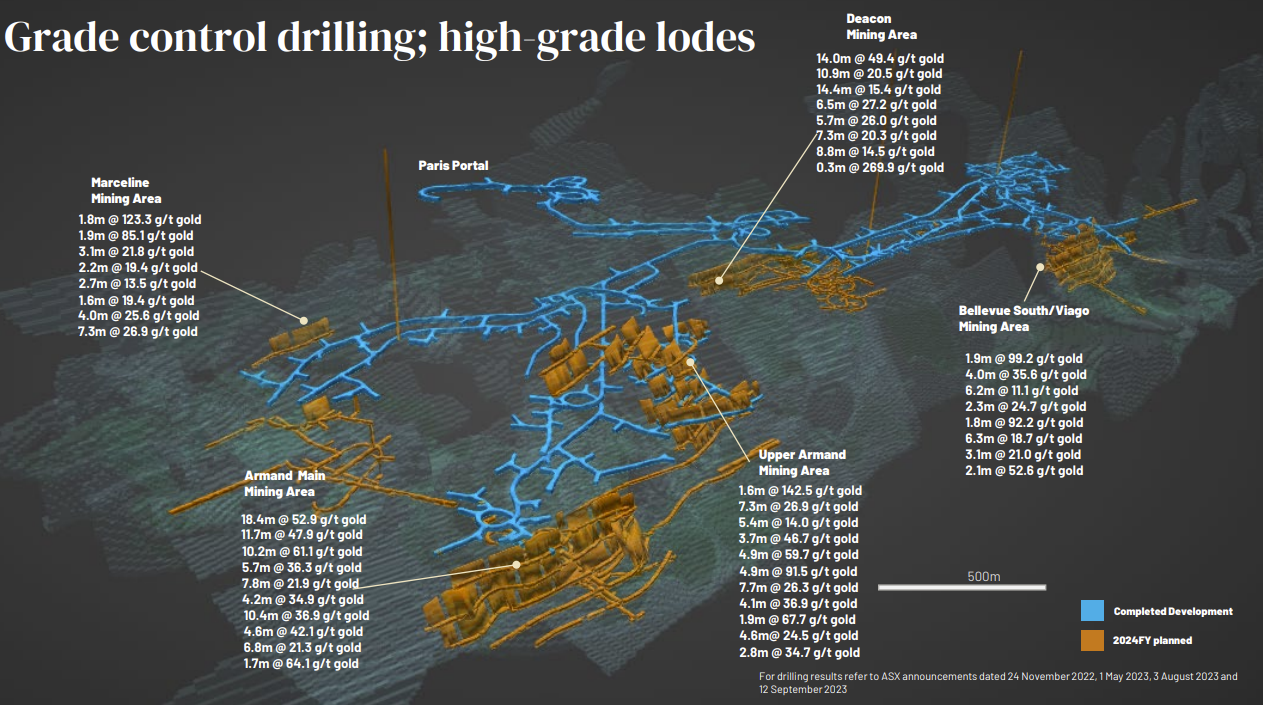

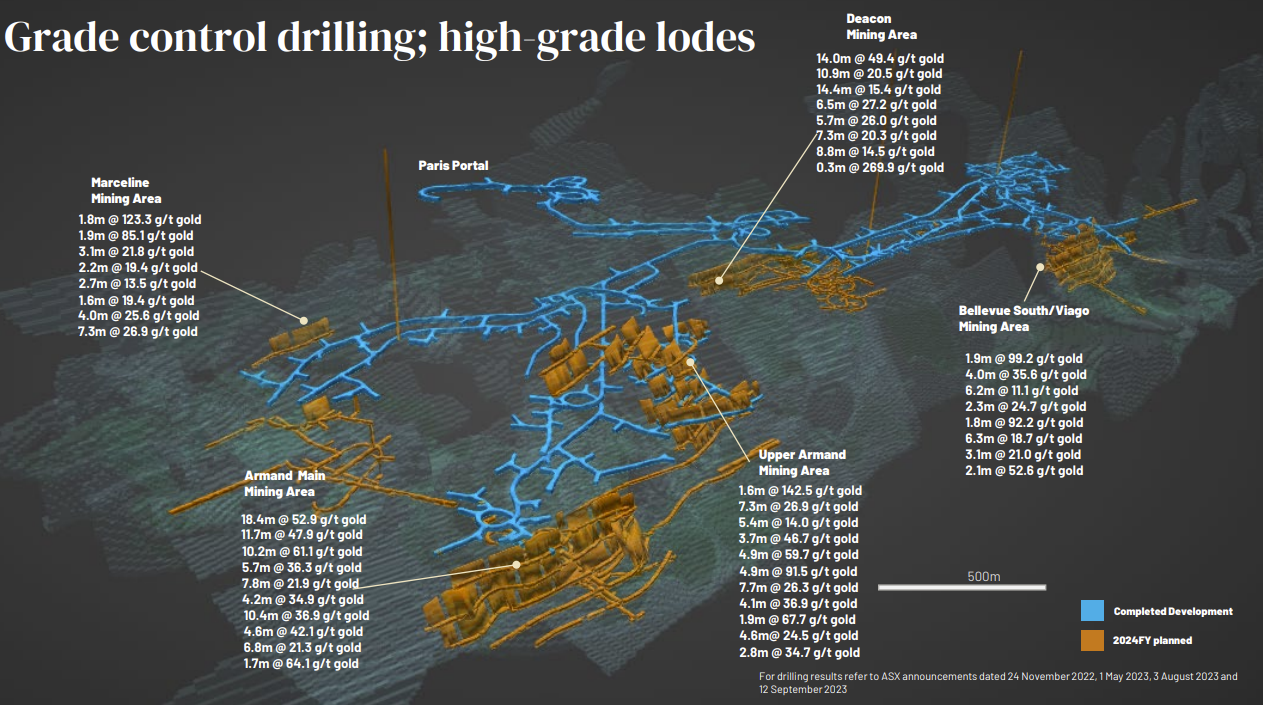

The following slides are from their November East Coast Roadshow Presentation slide deck:

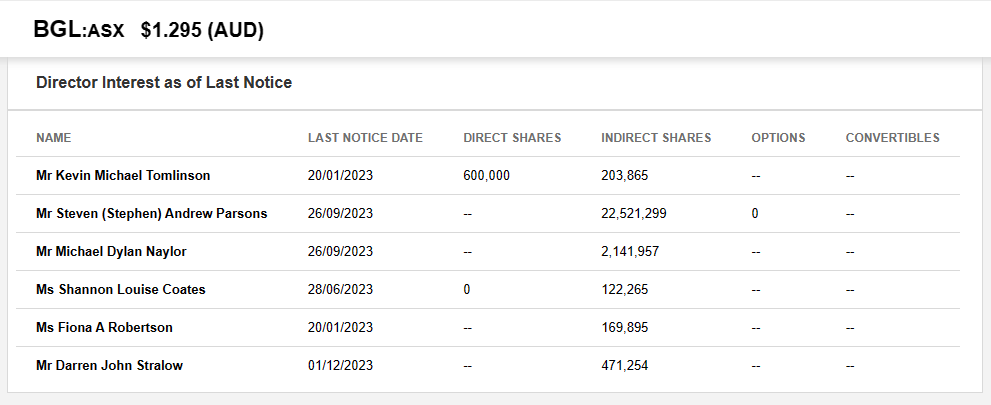

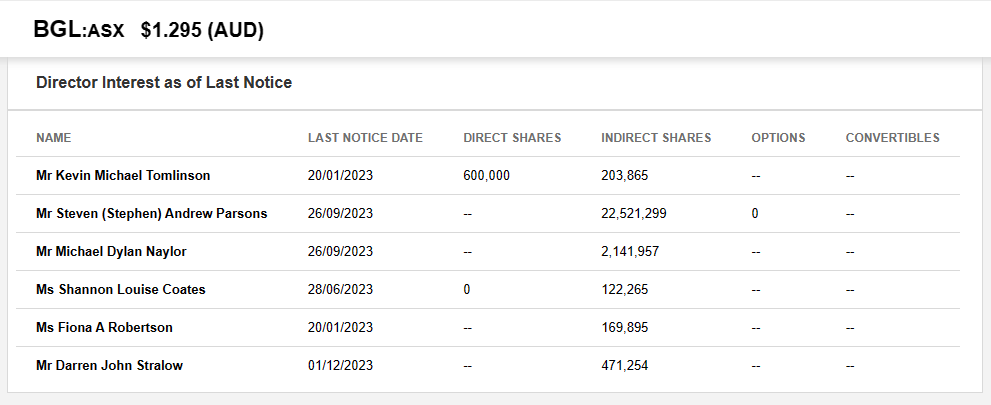

Some skin in the game - some more than others, but all directors own some shares:

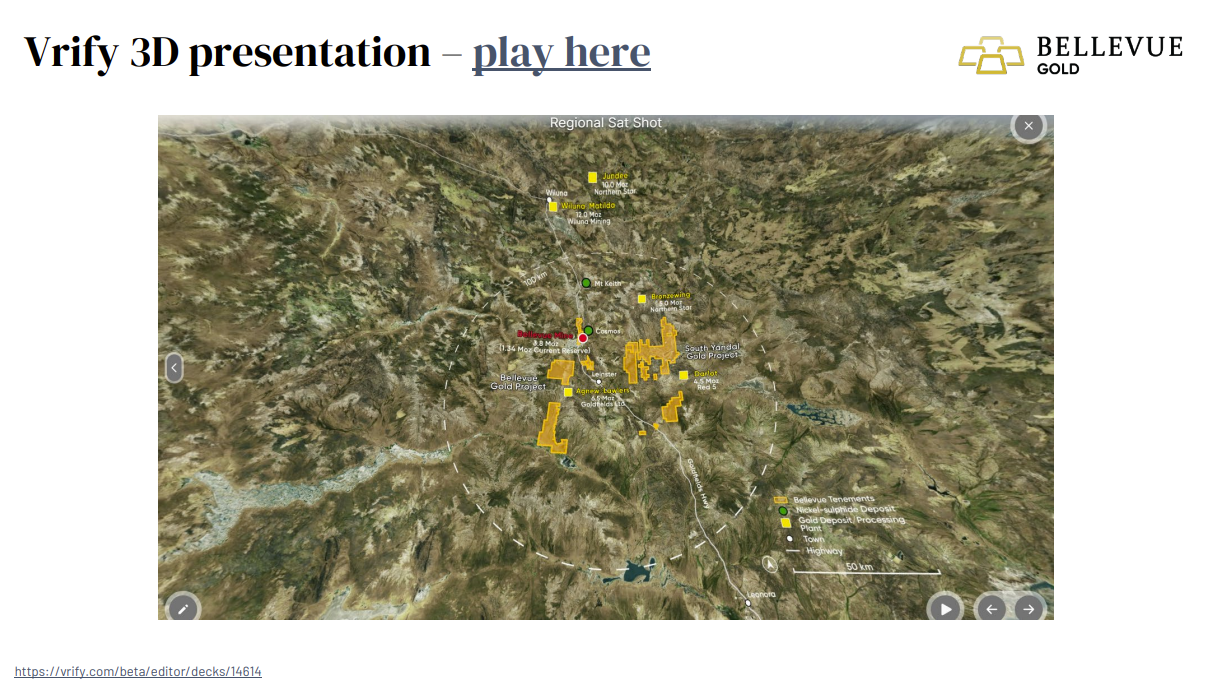

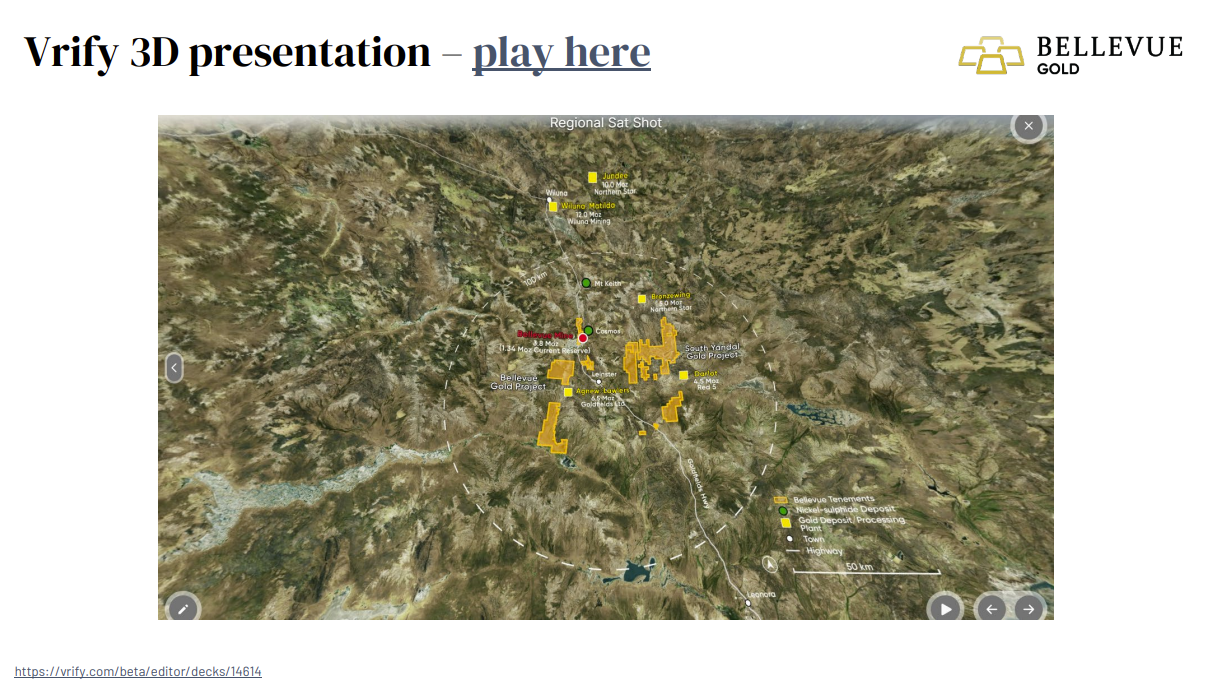

https://vrify.com/decks/14614

Bellevue (BGL) currently have three substantial shareholders:

- 15.16%, Blackrock, the world's largest asset managers, they own and manage iShares ETFs and their IAU iShares Gold Trust ETF has US$25.6 Billion in AUM and their IAUF iShares Gold Strategy ETF has US$34.5 Billion in AUM.

- 5.71%, Van Eck, another ETF provider, Van Eck specialises in mining and materials ETFs and they have their NUGG Physical Gold ETF as well as their global gold miners ETFs, GDX (VanEck Gold Miners ETF, with US$11.4 Billion of FUM) and the US-listed GDXJ (VanEck Junior Gold Miners ETF, with US$3.8 Billion of FUM, available through NYSE Arca - or NYSEARCA - which is an electronic communications network - or ECN - used for matching orders - rather than a physical stock exchange.) and GDXJ holds BGL.

- 5.03%, Vanguard, the OG of ETFs, Vanguard's founder Jack Bogle is credited with inventing Index Funds (ETFs), and Vanguard have included BGL in at least two of their ETFs - see below.

According to https://fintel.io/so/au/bgl, "Bellevue Gold Limited (AU:BGL) has 63 institutional owners and shareholders that have filed 13D/G or 13F forms with the US Securities Exchange Commission (SEC). These institutions hold a total of 266,994,874 shares. Largest shareholders include AIM SECTOR FUNDS (INVESCO SECTOR FUNDS) - Invesco Oppenheimer Gold & Special Minerals Fund Class C, INIVX - International Investors Gold Fund Class A, GDXJ - VanEck Vectors Junior Gold Miners ETF, SPROTT FUNDS TRUST - Sprott Gold Equity Fund Institutional Class, VGTSX - Vanguard Total International Stock Index Fund Investor Shares, FKRCX - Franklin Gold & Precious Metals Fund Class A, PRAFX - T. Rowe Price Real Assets Fund, Inc., ASA Gold & Precious Metals Ltd, Dfa Investment Trust Co - The Asia Pacific Small Company Series, and VTMGX - Vanguard Developed Markets Index Fund Admiral Shares."

From Bellevue's own website: (https://bellevuegold.com.au/)

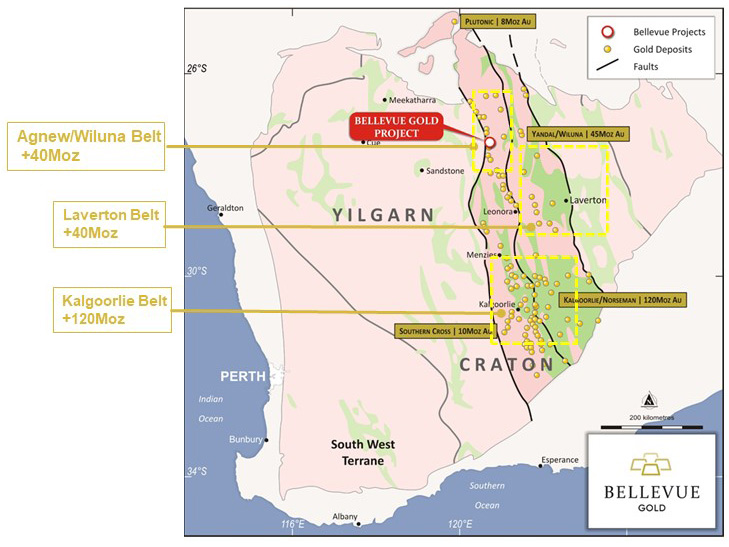

Bellevue Gold Limited is an Australian Securities Exchange (ASX) listed company developing the high-grade Bellevue Gold Project. The Project has a current global Mineral Resource of 9.8Mt @ 9.9 g/t gold for 3.1 Moz, including a Probable Ore Reserve of 6.8 Mt @ 6.1 g/t gold for 1.34 Moz, making it one of the highest grade gold discoveries in the world and the highest grade gold development project in Australia.

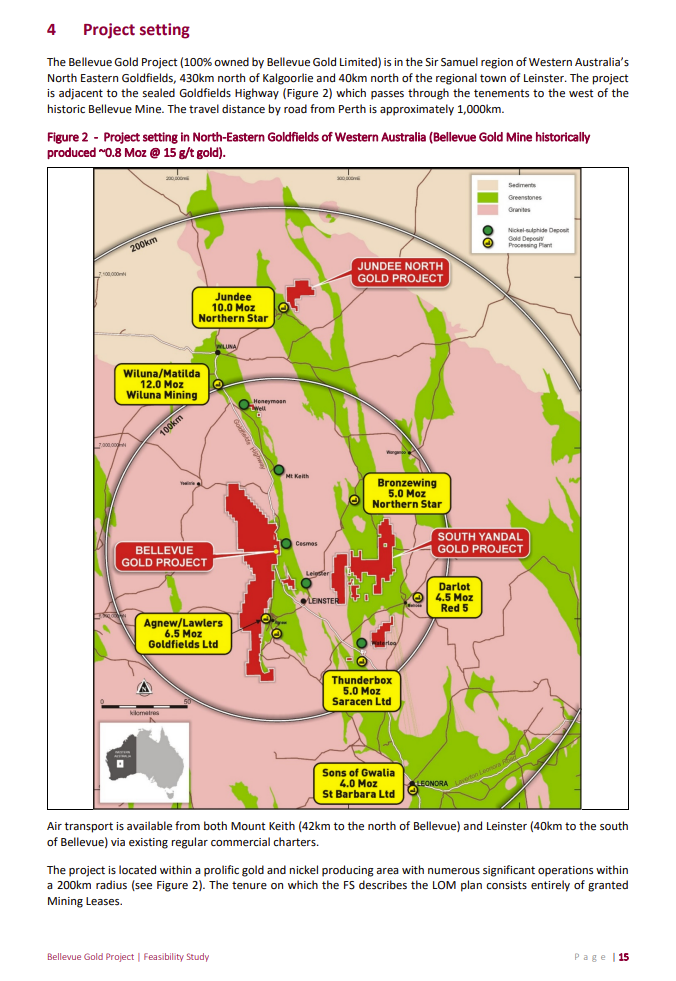

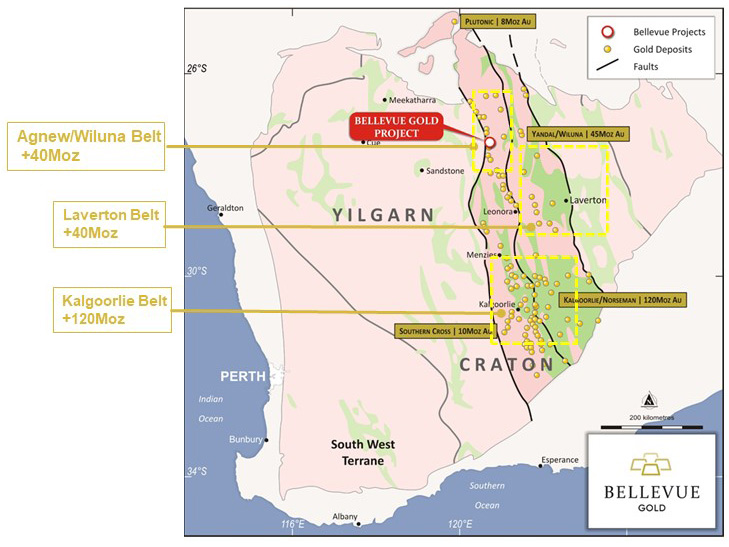

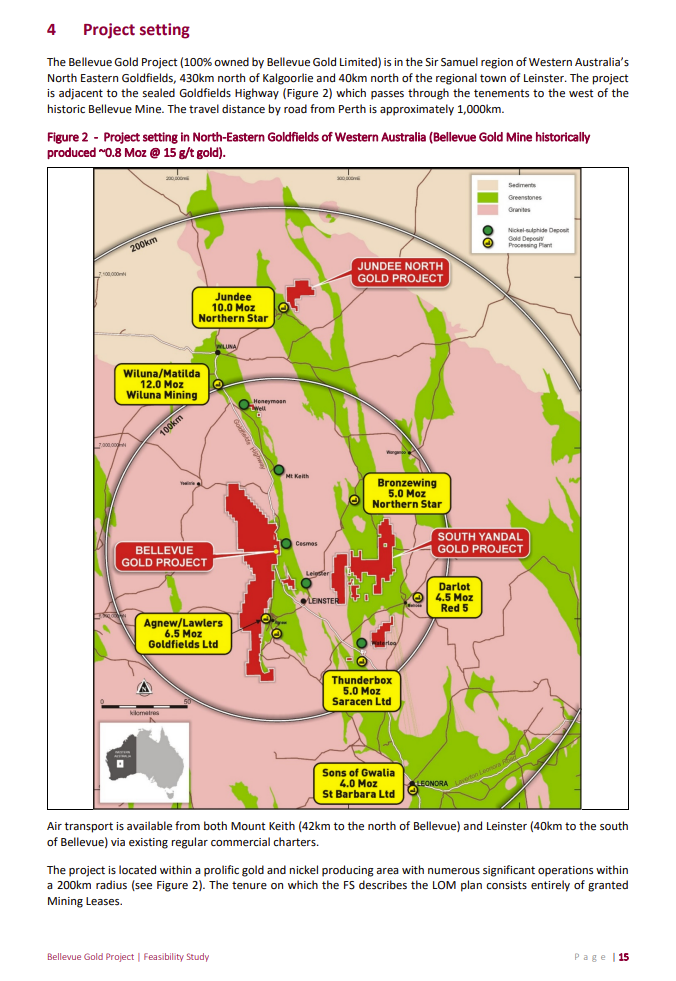

The Project is located 40km to the north west of Leinster in the Goldfields region of Western Australia and sits in a major gold and nickel producing district with mines such as Jundee (ASX:Northern Star), Agnew & Lawlers (Goldfields), Darlot (ASX:Red 5), Bronzewing (ASX:Northern Star), and Thunderbox (ASX: Northern Star) all in close proximity.

The Company has a highly skilled Board of Directors and Management team with a track record of discovery success and corporate growth and a strong supportive global institutional shareholder base.

--- end of excerpt ---

So, looking at all of that, including the number of ex-NST people at BGL (their MD & CEO, their COO, their CFO and their Chief Sustainability Officer and Head of Corporate Development all worked previously at Northern Star Resources, as I have highlighted about 8 images up), and the fact that their Bellevue Gold Project is located in close proximity to three of Northern Star's mines (Jundee, Bronzewing and Thunderbox) and also close to Red 5's (RED's) Darlot satellite underground gold mine (that helps feed RED's KOTH mill), I think it's fair to assume that there MIGHT be some M&A down the track... Economies of scale and all that. NST acquires BGL, or RED acquires BGL, or BGL acquires RED, something along those lines - I would prefer BGL to be a target than a hunter, but that would of course depend on the prices paid at the time.

Source: Bellevue Stage One FS (feasibility study) 18-Feb-2021

That map above is nearly 3 years old, so there have been some changes, including Gwalia now being owned by Genesis (GMD) instead of St Barbara, Thunderbox now being owned by NST (after the Saracen-Northern Star merger), and Wiluna Mining (formerly known as Blackham Resources) going into voluntary administration in July 2022, with mining ceasing in December 2022 and final ore processing completed in February 2023.

https://bellevuegold.com.au/bellevue-gold-project/

I'm heading back over there in a couple of weeks for a few days - to the SW of WA, SW of Bunbury. Flying, not driving, to Perth, then driving, so won't be going through the WA goldfields.

Source: Bellevue Gold Project (gres.com.au) [GRES = GR Engineering Services, GNG.asx, who I also hold shares in]

See also: Project_Focus_-_Bellevue_Gold_Project.pdf (gres.com.au)

Source: Bellevue Gold Project, Australia (mining-technology.com)

Source: https://247solar.com/bellevue-gold-mining-raises-the-sustainability-bar/

Not all positive unfortunately:

Bellevue Gold: Bellevue Gold Limited fined $41,000 after it left 'visible salt scar' (9news.com.au)

https://www.abc.net.au/news/2023-05-01/bellevue-gold-limited-fined-after-flood-killed-vegetation/102284498

https://www.wa.gov.au/government/announcements/gold-miner-fined-hypersaline-spill-0

(21) Bellevue Gold Limited: Overview | LinkedIn

Investor Centre | Bellevue Gold | ASX:BGL | Australia

Disclosure: Despite getting pissed off with management in December 2022 when they said they didn't need to raise capital and then promptly did a CR (including an SPP) when the share price rose... I have now taken a fresh look at the company in the new light of their current position and the substantial de-risking of their Bellevue Gold Project which is nearing the end of the commissioning phase now and should be approaching nameplate capacity if things are going OK, so looking at BGL as a gold producer now who should be a top 20 Aussie gold producer, so not large, but not insignificant either, and as potentially one of the more profitable ones in the future based on those high gold grades they keep finding, I'm back onboard BGL. Bought some in my SMSF on Thursday (25th Jan 2024).