Education services provider $IEL announced their 1H FY24 results today.

ASX Announcement

Overall a minor beat to consensus on revenue, EBIT and NPAT, however, from my perspective its a result that is strongly supportive of my investment thesis, which I'll discuss briefly below.

Their Highlights

- Record revenue of $579 million, up 15 per cent on H1 FY23, driven by strong student placement revenue growth of 44 per cent.

- Adjusted earnings before interest and tax (EBIT) of $159 million, up 25 per cent and adjusted Net Profit After Tax (NPAT) of $107 million, up 23 per cent, demonstrating strong operating leverage in the business model.

- Record student placement volumes of 57,300, up 33 per cent.

- English language testing (IELTS) volumes of 902,000, down 12 per cent.

- English language teaching volumes of 51,600 courses, up 15 per cent.

My Analysis

So first, the bad news, and there is some.

Testing took a hit due to a significant slowdown in India, particularly wth respect to the Canadian market. This reflects increased competition, economic and sentiment factors, and rules changes. Without India, IELTS volumes grew 17%, with $IEL noting that the testing network spans 87 countries. At it is, IELTS revenues fell 5%.

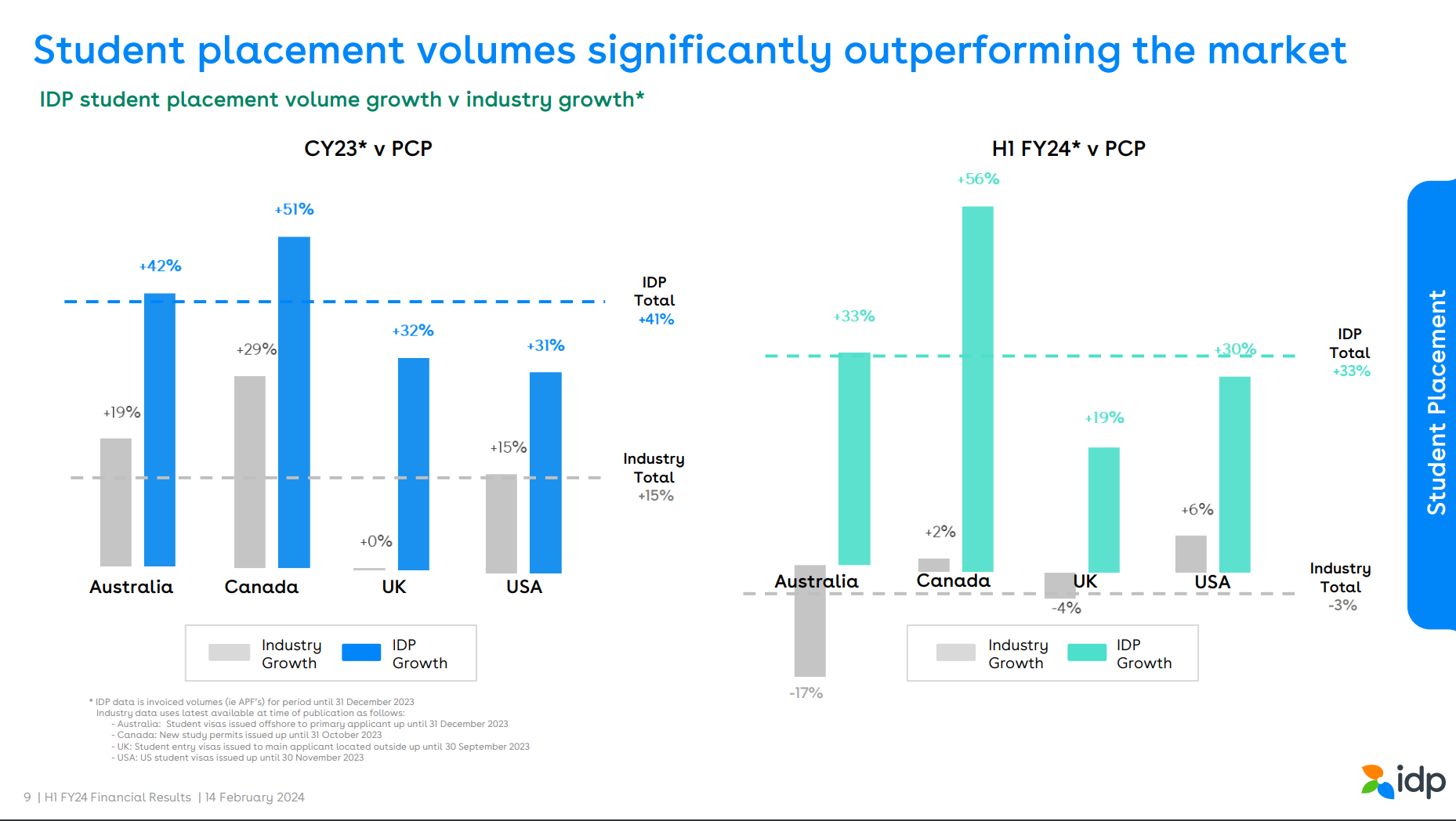

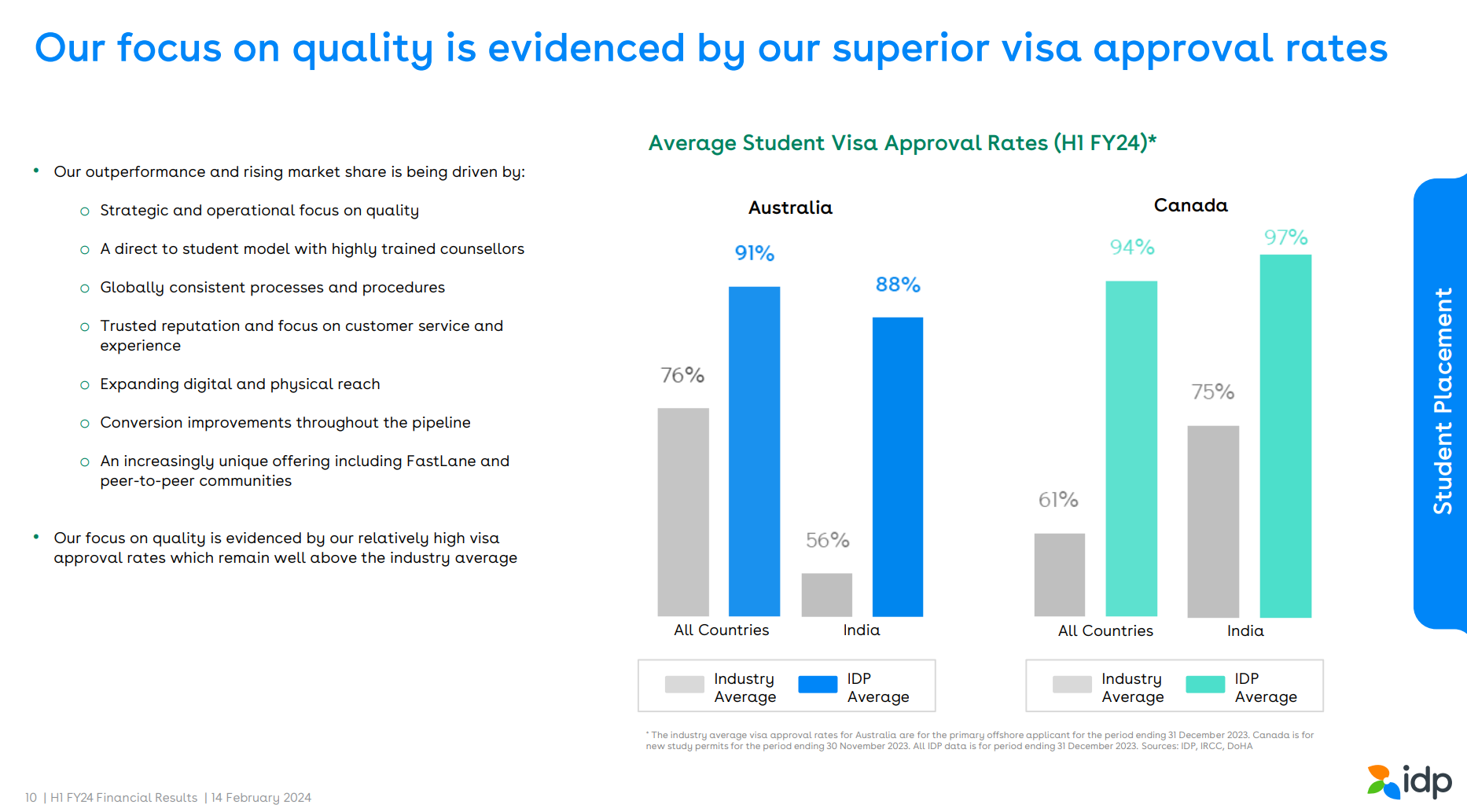

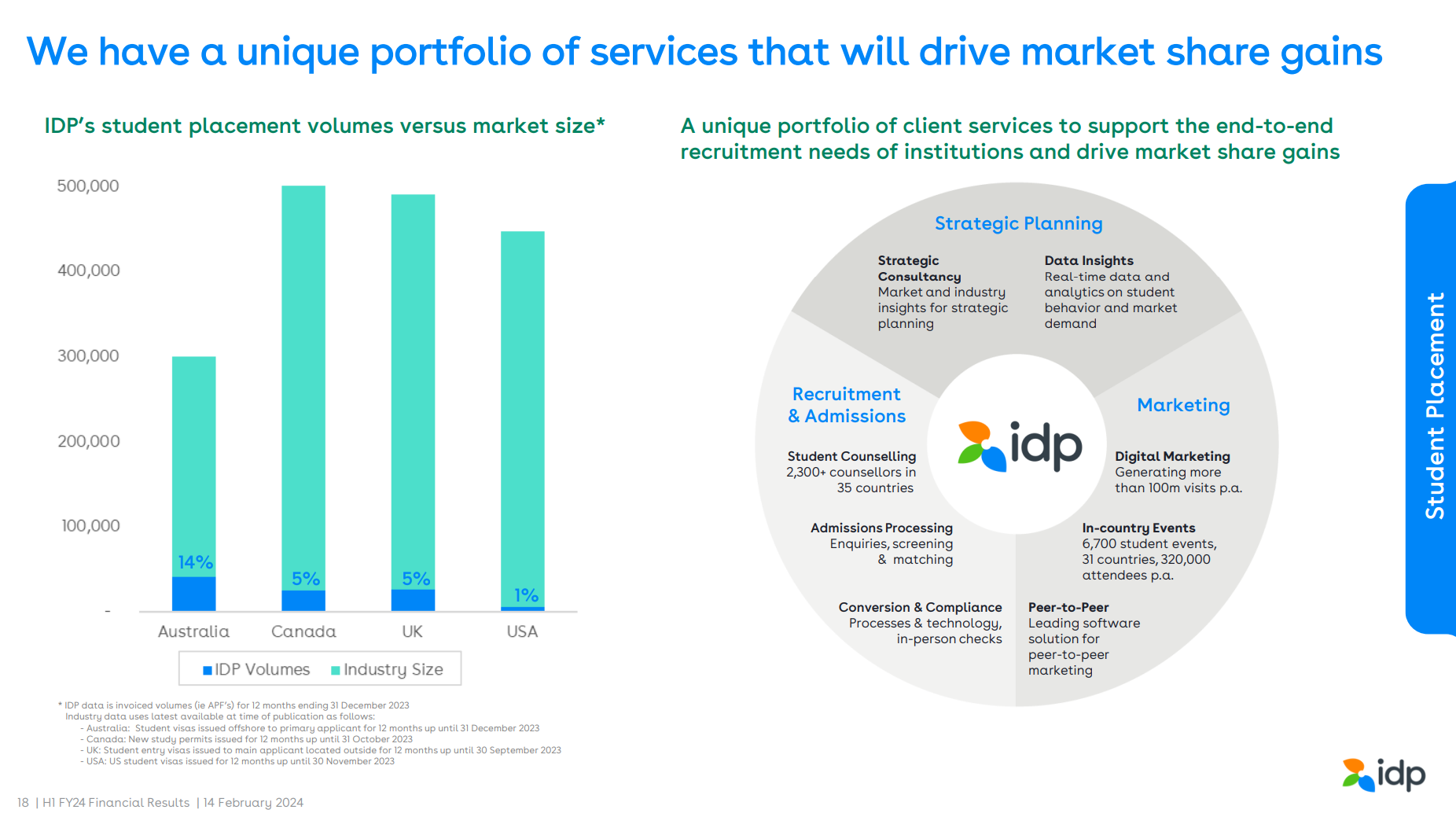

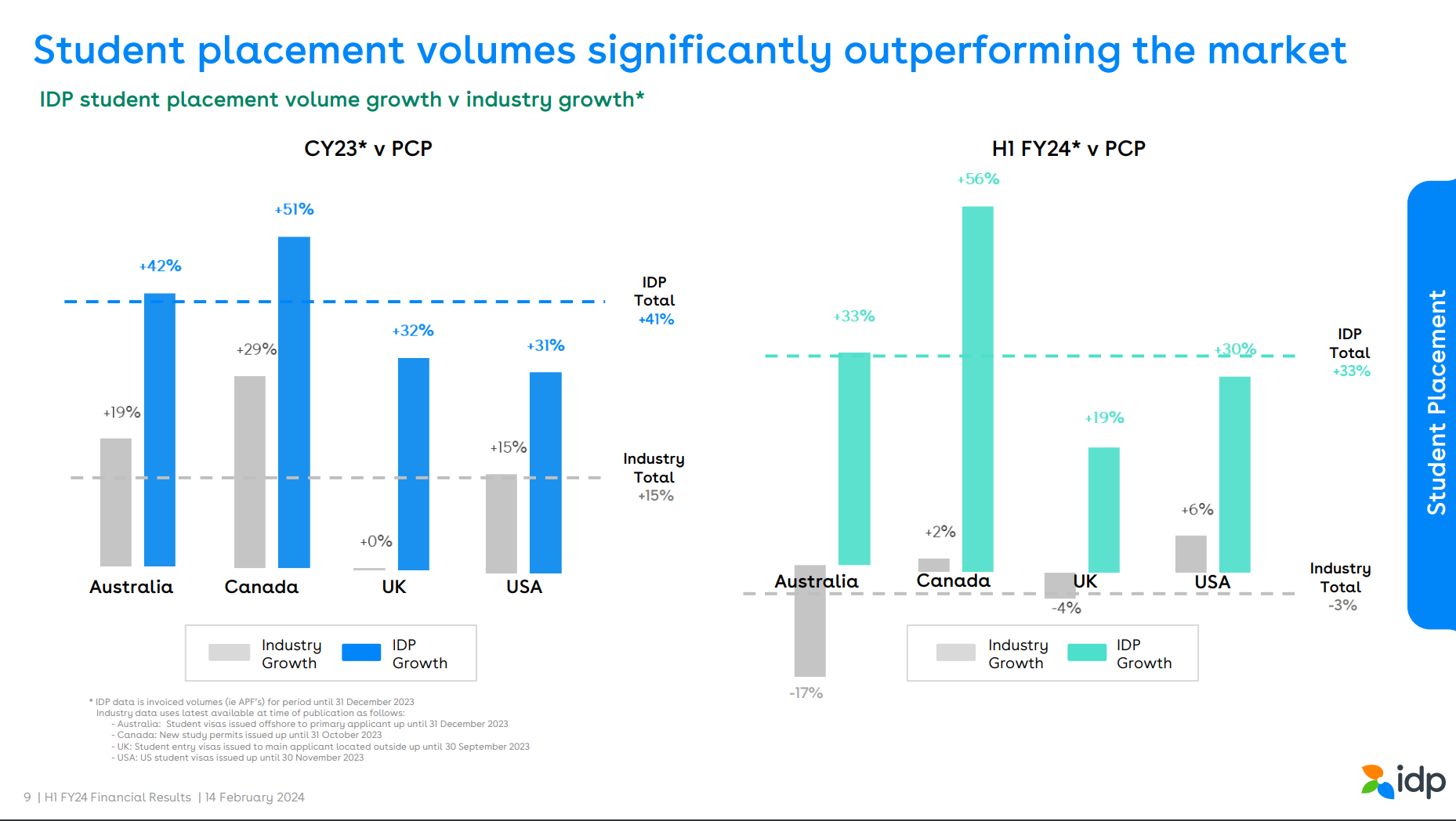

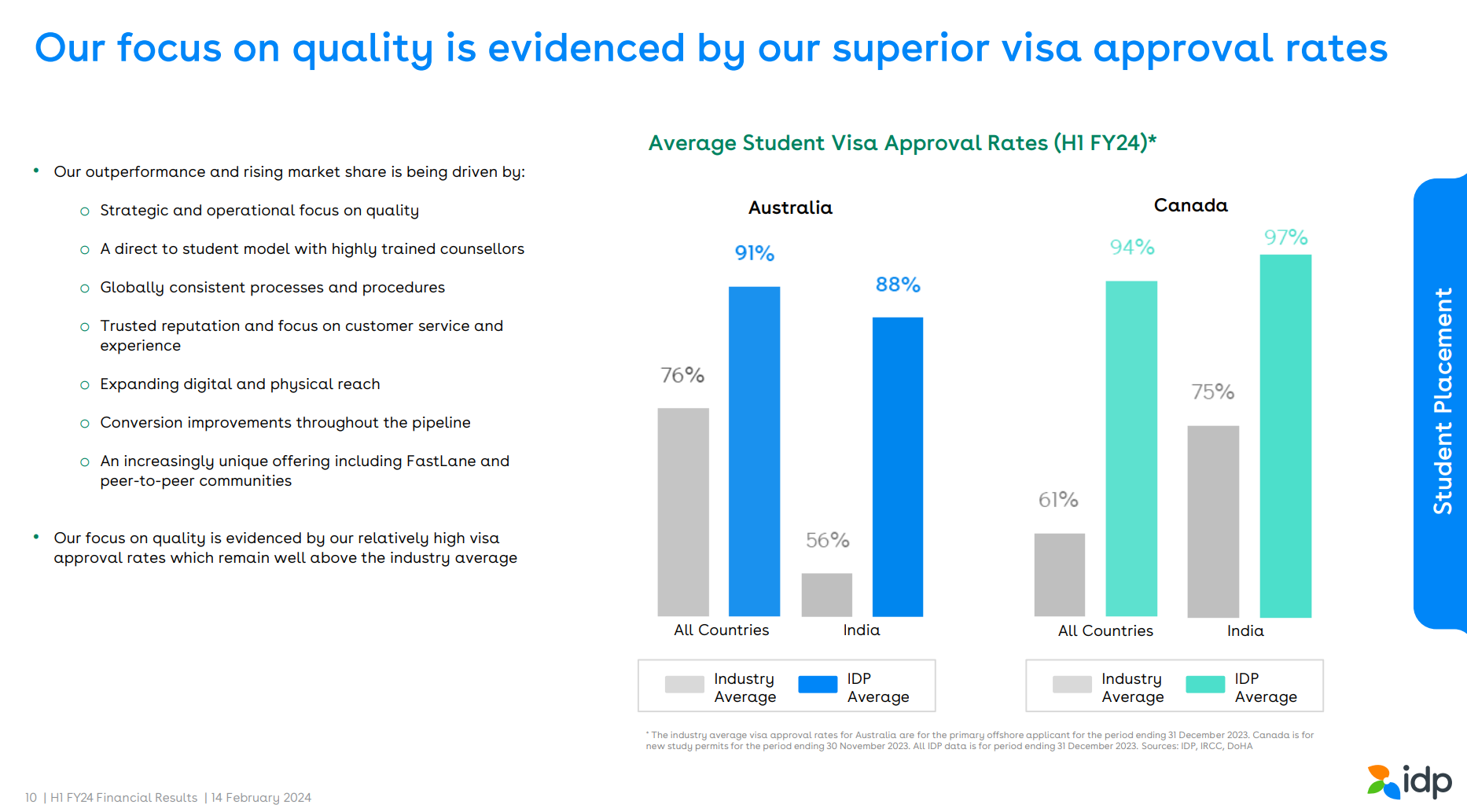

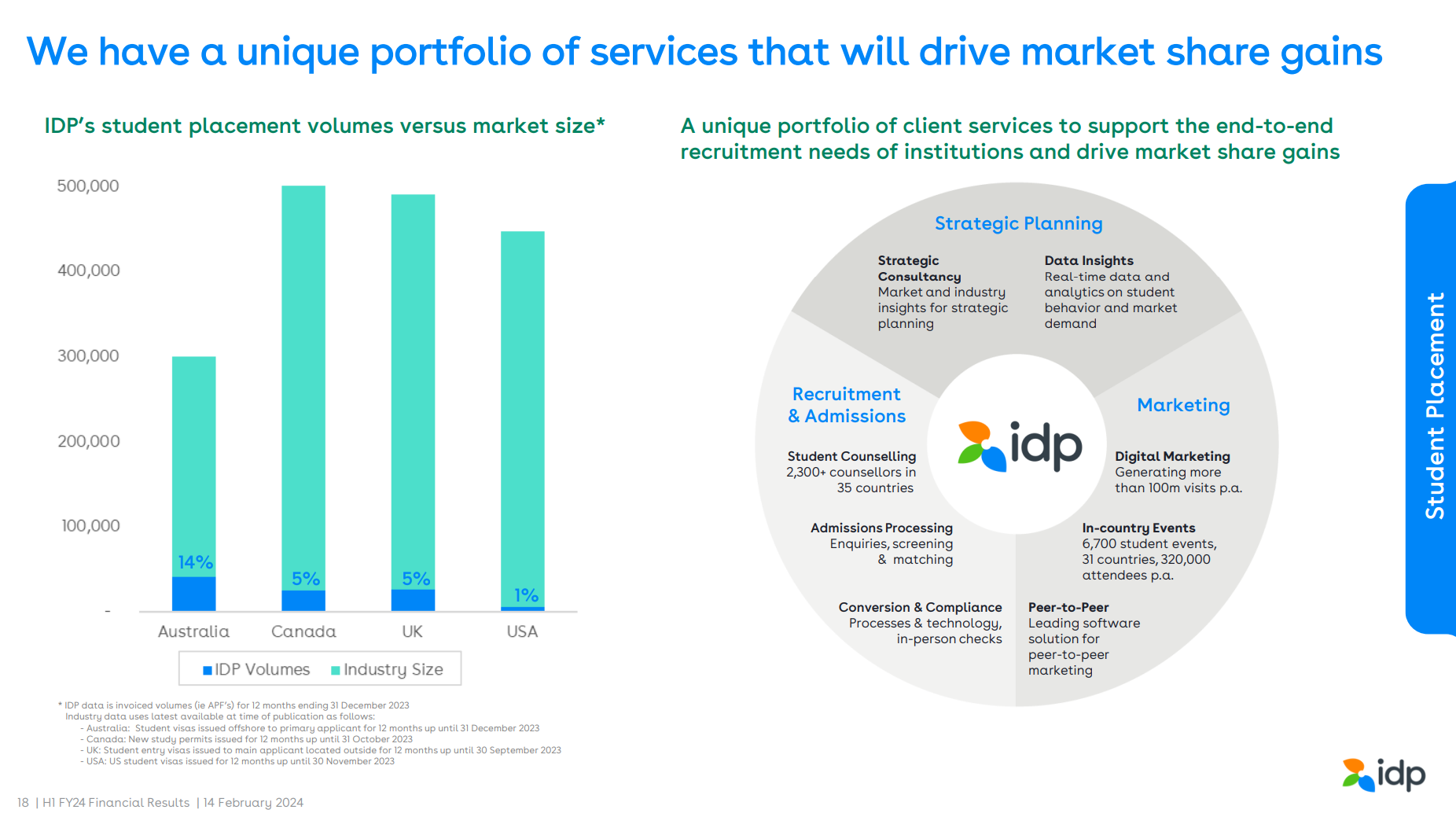

Good news - Student Placements. Placement revenues grew strongly up 44%, with volumes up 33% and with pricing increases on top. This is the thesis-supporting result. Student placement and the suite of services around it represent the core part of the $IEL offereing where it can differentiate itself. And in an environment where governments across the board are tightening up on student admissions and visa approvals, what is an industry headwind is perhaps allowing quality providers like $IEL to take market share. Given their low penetration of the markets in Australia, Canada, UK and USA, to achieve 44% revenue growth is encouraging. Of course, the environment has changed significant over the last year and indeed over recent months, so it will be interesting to see to what extent this kind of performance can continue through H2 FY24 and into FY25. But so far, so good. I call out some more detail on this below from the presentation.

The rest of the financials looks, at first glance, to be a good story of reasonable operating leverage. Total expenses have been reasonably well controlled at +13% below revenue growth.

Interest at $11.3m is up 70% reflecting higher rates and the higher debt being carried as a result of the acquisitions of Intake (in FY23) and the smaller acquisition of Ambassador in May 2023, which gives a small, unquantified boost to the Ohter Student Services.

On the cash flows, there were strong investing cash outflows for the acquired business deferred considerations ($22m) and opening of 11 international offices (PPE $8.5m) and investment in the technology platforms (intangibles of $19.3m).

Operating Cashflow was actually quite weak, almost flat on the prior period. There is nothing remarkable on receipts and payments (in line with the financials). The big difference is on cash taxes paid, which at $52m (up 67%), so this will be a timing issue and, as there has been nothing untoward on recent reports on taxes reported in the P&L, I'll just make a note to look at this at the FY.

On the balance sheet, while borrowing rose from $209m to $285m to fund acquisitions and expansions, net debt to EBITDA is modest at about 0.83 (144/173) by my estimate.

Student Placements - a deeper dive

I include 2 charts from the presentation on students placements. They speak for themselves.

In the context of low market penetration, in a more challenging environment, $IEL as a quality provider is well-positioned to take market share. This is a service where quality (incl. chances of success in getting a Visa approved) can be a very strong reputational driver.

My Key Takeaways

Good results in line with my thesis. However, like most analysts I didn't quite foresee the strength of placements and the weakness of IELTS.

My previous valuation of $IEL is $24-25. Today's result probably lifts that slightly, although some caution is advisable given the industry headwinds. So, I'll probably sit with the valuation unchanged until the FY result is in.

I suspect we'll see a positive market reaction today to the result, so I will await the next price weakness opportunity, as I'd like to increase my holding.

Disc: Held in RL, not on SM