Kitchen Appliance maker $BRG announced their 1H FY24 results this morning.

SP reacted negatively down in the range -8% to -12% so far this morning, due to a 5% revenue miss vs. consensus, and with FY EBIT guided at +5.0-7.5%, that a range of $181m-185m, which is slightly softer than the consensus this morning of $187.5m (n=13). More on all that below.

ASX Announcement

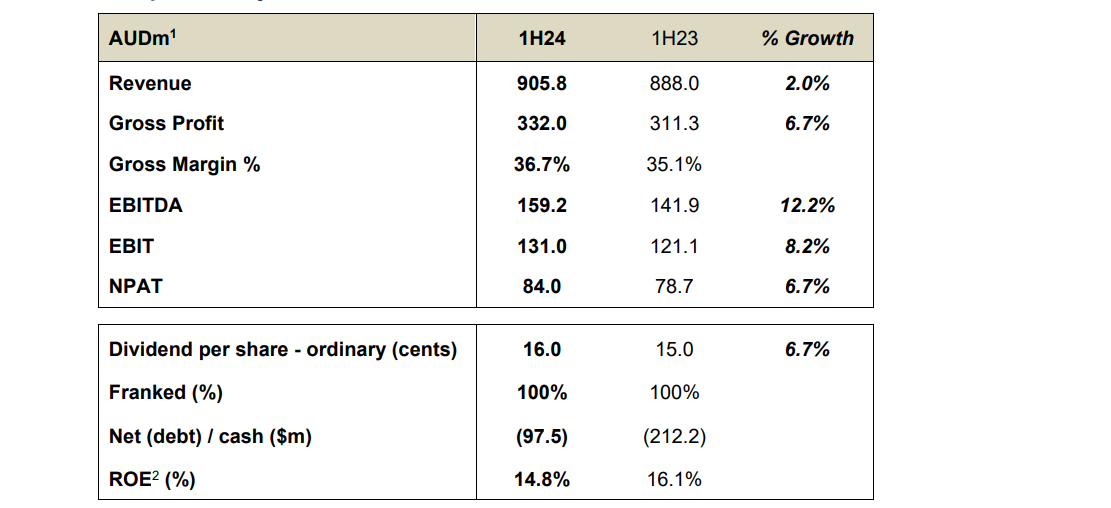

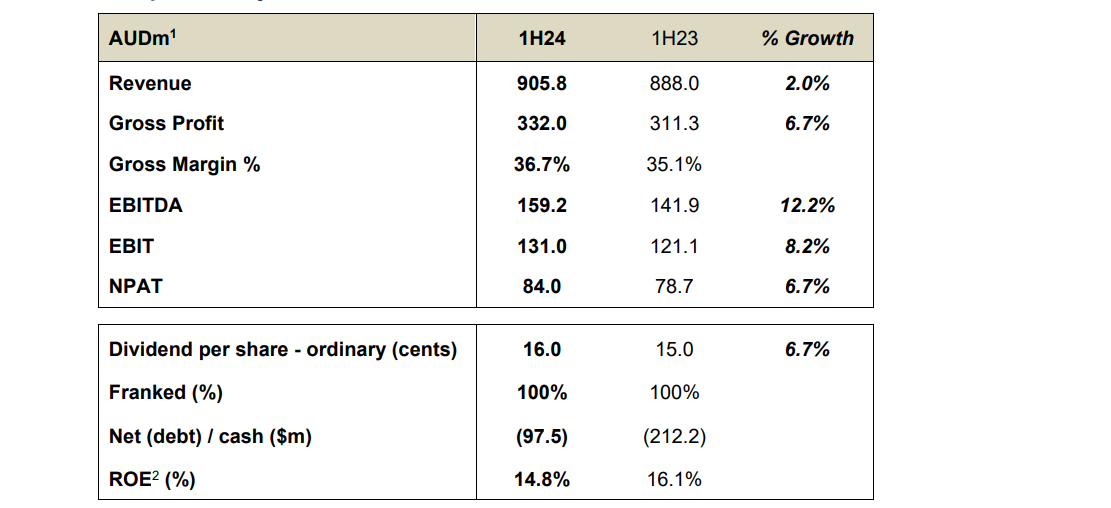

Their Summary

- 2.0% revenue growth against a challenging consumer backdrop

- 5-year Global Segment CAGRs (compound annual growth rate) still strong at 15.5% in constant currency terms

- Gross Profit grew by 6.7% with gross margins strengthening as input costs abated and investment into promotion was well controlled

- Operating costs contained to 5.7% growth

- Forecasted increases in D&A (depreciation and amortisation) occurred following acceleration in new product launches. Other operating costs held broadly flat

- EBIT growth of 8.2%, ahead of sales, and in line with plan

- NPAT growth of 6.7%, after absorbing higher interest costs

- Forecasted inventory and net debt reductions were both delivered. Further inventory reduction and cash inflow is forecast in 2H24

- Interim dividend of 16.0c cents per share (100% franked)

My Analysis

I feared running into today's result that the market had gotten ahead of itself. In fact the SP has had a strong run with yesterday's close up 45% from the retail-funk trough of March-23. (However, I didn't have the conviction to trade it!)

Overall, consensus aside, it was a pretty decent result, and I always enjoy listening to CEO Jim Clayton explain how they manage the business.

Revenue

Their key Global Product segment grew evenue at only 1.6%, which was actually a decline of (1.3%) in CC. Of course this is masked by the strong growth in new markets of 73%, albeit off a small base (Mexico, Portugal, Spain, France, Italy, Poland and South Korea)

The Distributon Segement grew more strongly at +4.6%, driven by a recovery of Nespressor sales in the Americas.

Looking on a cc basis, Americas was weak at (2.2%) as was APAC (5.7%) while EMEA recovered to grow at 5.5%. The weak Americas and APAC numbers have triggered the surprise, as these were not expected based on the results of competitors or ther overall market segements.

Gross Margin

However, Gross Margin was strong with %GM expanding by 160bps from 35.1% to 36.7% due to better inputs costs and well-controlled promotional spend.

Operating Profit

EBITDA was up 12.2% and EBIT up 8.2% well ahead of sales. CODB has been well-managed only up 2%, with EBIT lower due to increased D&A as a result of higher investments in production innovation and new SKUs. The new product line positions the business strongly for FY25.

NPAT

Interest was up 28% driven by rates, albeit debit is modest at 0.4xEBITDA.

Cash Flows & Balance Sheet

Inventories have continued to be managed back towards more normal ratios.

Net debt has been reduced significantly, which will reduce finance costs in H2.

Cash and equivalents stood at $146m up from $115m, with dividend increased by 6.7%.

My Key Takeaways

Revenues were indeed softer than expected, however, management consciously decided to push more for gross margin and operating profit. CODB has been very well controlled, well below inflation!

This is a business that has been well-managed through COVID, the following supply chain challenges and a softer global environment for discretionary retail. By investing heavily through that period in new products and new country entries, as well as its online platform, $BRG is well-positioned for the future.

FY EBIT guidance is slightly under the FY consensus, but at 5%-7.5% for - what could be the bottom of the discretionary cycle - I'll take that any day!

The market response is not surprising, as it brings the SP closer back towards consensus.

$BRG is part of my 9% RL exposure to discretionary retail (along with $LOV and $NCK). I'm looking at the market response and thinking this could be an opportunity to increase my position slightly. However, I'll wait a day or two in case any broker downgrades lead to any further selling.

In my view - a solid result, by a well-managed, global business serving the retail market.

Disc: Held in RL, not on SM