@RhinoInvestor There are no employee breakdowns in the segment report, nor headcount of permanent employees vs contractors - probably a good thing to ask C79 for this info in the next call While these 2 costs stood out, intuitively, I was not worried based on the following rationale:

Employee Cost

- The focus is to deploy well, fast, and as parallel as possible. Given the geographic spread of the units, the hostile country and minesite environment, there cannot but be an increase in employee cost as it is key to throw resources at deployments to keep the momentum. Throttling resources now would be the worst thing C79 can do

- I suspect a good % of the employees are contractors, as is common in mining, so employee cost should flex up and down based on deployment plans

- The CFO also talked about cost savings from the hubs not being visible enough - they are working on improving the transparency on this, this will offset the rise in employee cost which is happening, but is not visible enough

- The spike in employee cost thus makes sense to me given the priority to deploy but the extent of spikes from H-to-H is something to definitely watch out for

D&A

- Am not concerned - this is a standard 10 year straight line depreciation method and hence, should already be baked into whatever their forecasting model is, is a statutory requirement, so it will be what it will be

- What I think is not clear and won't be overly clear for some time, is the actual longevity of the machines - if I recall in the chat with Dirk, he did say that the lifespan of the units would be > 10 years, with upgrades and refurb etc. I doubt anyone has modelled this as it is still early days of the deployed machines but this will lower overall D& A cost in the long run

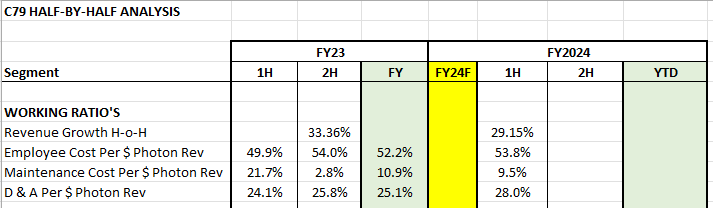

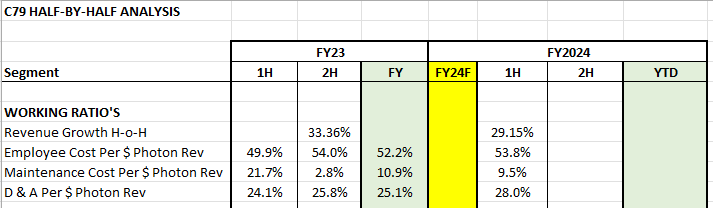

To get some science to confirm the initutive hypothesis, added some simple ratio's in my xls around Employee Cost, D&A as a % of Photon Revenue (MMAP + AAC only):

Assuming I got the formulas and math right, this was interesting:

- Employee cost per $ of Photon Revenue HoH - rather flat around 50-54%, despite the sharp hike in Photon Revenue growth - that gives me quite some comfort that this cost is being sensibly managed against deployment acceleration

- Maintenance Cost Per $ of Photon Revenue - trending lower as C79 moves maintenance in-house. Against flat employee cost overall, this is also encouraging as it feels like C79 is managing maintenance while ramping up deployment - a small sign of the hub efficiency?

- D&A Cost Per $ of Photon Revenue - ~3% uptick vs 29% revenue growth, probably due to the D&A being apportioned for the newly units. Did not show up anything to be worried about.

Capital Requirements

On capital requirements and raising, my overiding attitude is, it will be what it will be. The busines model requires upfront capital to build and install the machines so that the revenue flows from it. They have modelled the capital needs for the next 2 or so years, and then it could well run out - they will then need to work out the best funding options at that point. What we will have going in our favour is that debt cost will have come down sharply from today. If they capital raise, then so be it. In 2 years, the economics of the company will be very different from today.

I do not have the expectation that all future deployments will be fully funded by ongoing revenue, more so if we go past the 49 contracted units. I thus expect further capital raises and will be OK with it so long as the funds are used for long-term purposes rather than short term (ala ALC). I do not view capital raising as a thesis breaker at all.

So, I am comfortable where things are at now, financially, and the trajectory of deployment, but it would be great to see them get to 18 deployed by the end of this FY or as close to it. The biggest deployment risk is customer readiness and I sense C79 is getting on top of that challenge.

What I do want to see more off in the coming quarters though are (1) more tangible outcomes from the Barrick partnership - currently its all about sold units and the technology endorsement, not much more (2) making inroads into the remaining TAM beyond the 49 units locked in.

Discl: Held IRL and in SM