Pinned straw:

One red flag I noticed, hidden mid way through the investor deck was the comments about the Geraldton project to build HPC. They flagged the construction costs have come in “significantly higher than expected” however gave no further info. That is scheduled for 2025 so that could drag capex numbers along for a while.

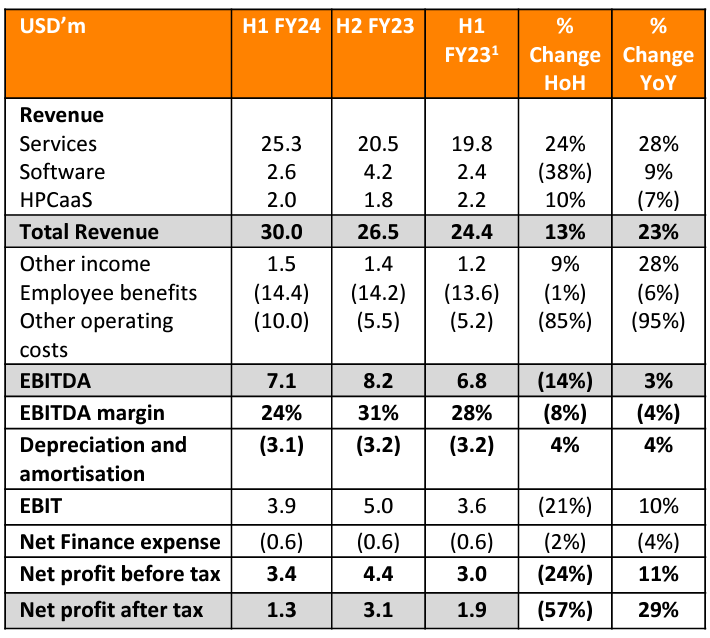

I also noted that 30m of revenue this quarter with contracted revenue of 40m signed. But no mention of how long this is to be realized over. So another thing to keep an eye on is that pipeline conversion to revenue.

my big takeaway today for @Strawman …. I sat down to have a go at some basic spreadsheeting of these numbers and realized I have no skills in this department. So perhaps a meeting on “101 of spreadsheeting and valuations” could be considered.