Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Overall comment - business still going sideways to backwards. Still very happy to stay away.

- Revenue of services down 9% compared to PCP and not growing on a quarterly basis.

- HPC really struggling. Looks like this will become a small side business.

- No mention of Middle East! This was previously reported as an important driver of growth over the last few quarters reports.

- Positive is good operating cash inflow of $US3.3m and new services of $22.7m in quarter.

Overall comment - Still glad I got out when I did last year (probably some confirmation basis in comments below!). Business is going backwards. An investment in DUG needs to assume a strong growth trajectory which isn't occurring at the moment. CFO issue remains unresolved in my opinion.

- Revenue was down 4%, EBITDA down 26% and NPAT now negative at US$3.9m. Negative operating cash flow for the half.

- No third-party compute required during the half which would be an improvement to EBITDA compared to PCP, however, EBITDA down significantly. No third-party compute shows they are now keeping up with demand but not surprising given revenue hasn't grown.

- Cash flows show that the raising was important to reduce the lease liabilities of new compute. Still hasn't completely paid for the new compute though.

- Order book at US$42m as of January with January being a strong month. However, this has been higher in the past. Probably a sign the next half will be better but not a return to strong growth.

- CFO issue still remains.

- A lot of money being spent in Middle East. Over the next year this will need to start providing revenues to justify the cost.

Red flag for me. Current CFO is leaving after only joining DUG in November and taking over the role in December. See previous revolving door post for more info.

There have now been a number of outsider CFOs that have come into the business and then left relatively quickly. The last CFO had a "long" tenure of around 2 years by DUG standards. "Insider" and previously long term CFO, Louise Bower still remains on the board. There is obviously something wrong within this area of the business that is causing the outsider CFOs to quit.

The wording of the announcement was "mutually agreed to part ways on 29/8". All happened very quickly by the sounds of it... Right after results as well...

The temporary new CFO is Daniel Lamont. While no relationship to founder Mathew Lamont is clear from the announcement, would be more than a coincidence if they are related... Not a great look on top of the CFO revolving door.

While I only just sold out of DUG so have no current position, this was a red flag sell condition that I had as part of my thesis.

Overview Comment:

Sold out on results. While the numbers present as a great FY24. I believe DUG is overvalued and showing some signs that the revenue growth of the past year is slowing down. Off to the sidelines to see how this plays out over the 6-12 months. Will be more than happy to jump back in. I think the key to further growth will be the ability to sign large Middle Eastern client's, which the CEO admitted they haven't worked out how to win these contracts yet.

General notes:

- From call (first part missed):

- Pipeline for Middle East is large but rest of the world is similar to the past.

- Under evaluation phase in Middle East by potential clients.

- Contracts happen in stages, you don't just get into big contracts with large clients.

- DUG doesn't have the reputation yet that the largest player has. As per CEO''s words their competitor has "you don''t go wrong with choosing IBM" reputation.

- Geraldton site was not economical without government grants.

- Difficult to understand where the underlying economics of the business sit given the cost of new compute isn't in operating cash/EBITDA figures which are significant items to the business, NPAT is probably showing a worse figure the real underlying amount. Making it harder is the third-party compute costs that are a one off for the year.

- More compute may be required if big contracts are won. Is this just a revolving cycle where the bigger they get the more compute they need? Potential of over investment if revenue then goes backwards after investments are made.

- Looking at client relationships graph, top 4 clients make up approximately $26.5m of revenue, which is approximately 40% of revenue.

Positives:

- Overall, an exceptionally good financial year, revenue up 29% to $65.5m, EBITDA $16.6m which includes cost of $6.6m of third-party compute. Operating cash inflow of $12.1m.

- No more need for third party compute costs. Have some headroom with compute now.

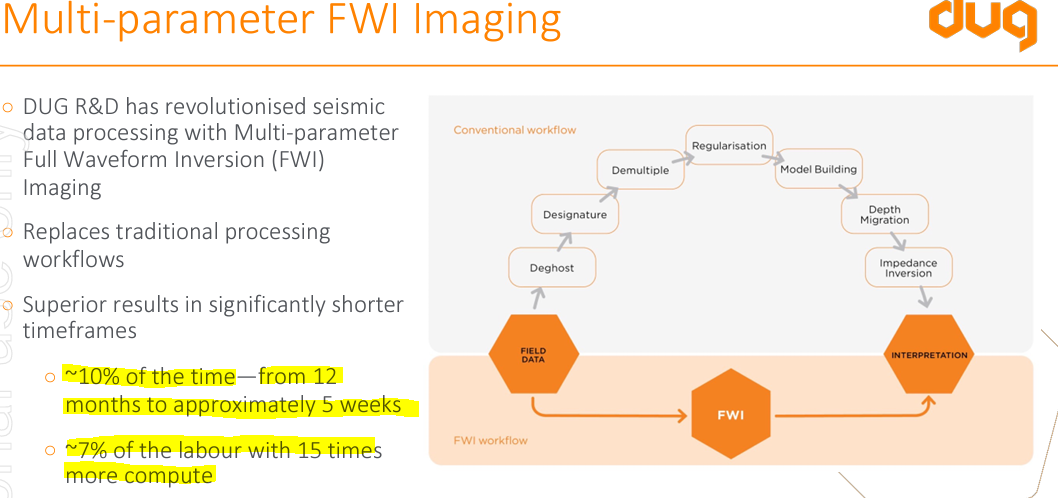

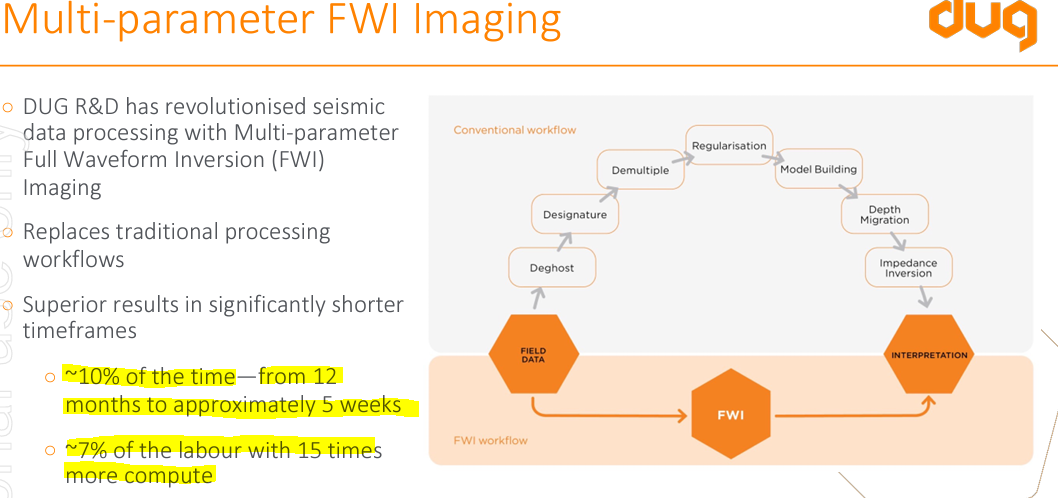

- MP-FWI will create higher margins and require less staffing.

- Recent announcement of deal with Baltimore Aircoil Company, a very large company in terms of cooling solutions worldwide. Leads to royalties up to 5% of net sales and BAC taking over R+D.

Negatives:

- Order book down from Q3 results to $36.5m. Indicator they have cleared some of the backlog, but revenues are flat QoQ so is this the new stable state?

- Seems like future growth will be dictated to by Middle East contracts but they haven't been able to get into the market for Middle Eastern cultured companies. Only middle eastern contract was very western company.

- HPCaaS going backwards. No more committed compute. Not a growth segment.

- Net debt $14.5m due to need to purchase compute.

- Don't see how DUG Nomad could be a large revenue/profit raiser over the longer term, seems like wasted resources.

Has the thesis been broken?

- Yes, due to the slowdown in revenue growth and my concerns that revenues will remain flat over the next year or so. At current prices it also seems overvalued so taking profits to sit on the sidelines and wait and see. Have been selling over the past few months as I saw an overvaluation and yet to have high conviction in management or see a high growth path from here. By no means is this a sell out and move on, it is a sell, wait and watch.

Valuation:

Unchanged at 20X FCF of $10m USD. Approximately $2.50 a share.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Revenues start to grow again.

- Signing of significant contracts with Middle Eastern majors to show that they can crack this market.

Note: All amounts in USD unless specified.

Overview Comment:

Cash from operations looks good while profitability down. Extra costs throughout the half due to the ordering of new compute and cost of 3rd party compute appear to be temporary issues. Revenues and order book continue to grow as expected so the growth narrative is still there.

General notes:

- A wild swing in the share price throughout the day. Started at $1.80 and closing at $2.44. Price down 4.3% for the day.

- $12.2 of capex in the half (for new compute).

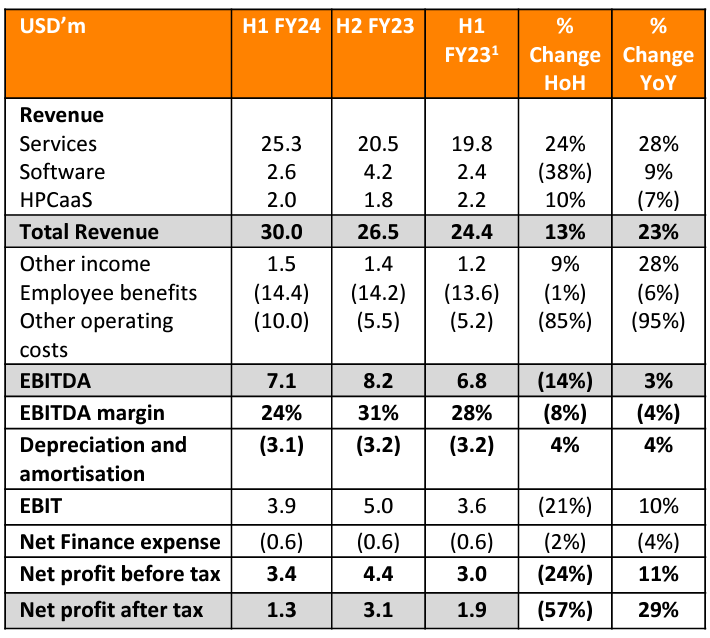

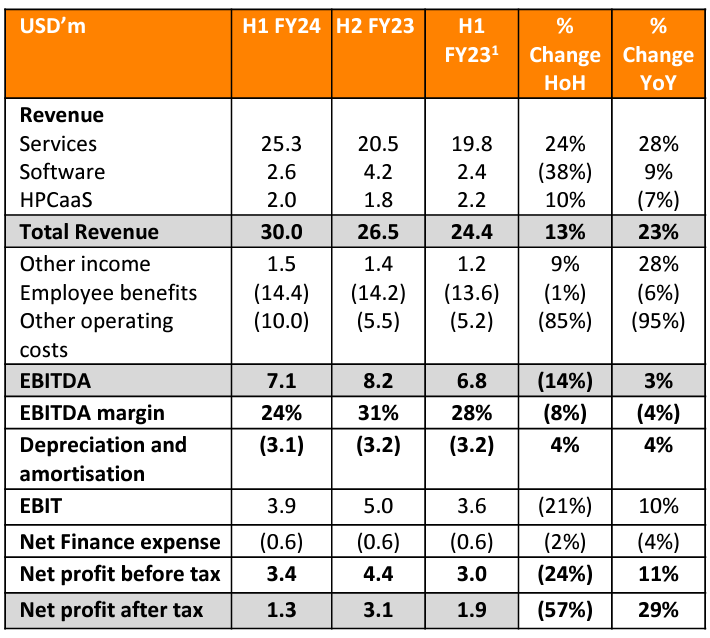

- Financial figures half by half:

Positives:

- Strong revenue growth to $30m. Up 24% HoH or 28% PcP. MP-FWI imaging is gaining momentum and key driver of revenue growth. Record high half for revenue for the company.

- Order book as of end 1HFY24 $40.6m. Up 45% from FY23 end.

- Operating cash flow of $6.2m and expected to strengthen further in H2.

- New compute expected to be available by late April, at this point compute power would have doubled.

- The significant cost of third-party compute compared to DUG's own compute shows their relative efficiency and justification of their business model to complete the compute themselves.

Negatives:

- Still do not have enough compute to meet demand. Started using external compute. This reduced profitability due to the additional cost. Debt levels have increased due to asset financing of new computers.

- Profitability down HoH and PcP.

- HPCaaS still not looking like it will take off as a product.

- New graph showing client relationship length and value. Negative is it showed one client provides around 20% of revenues.

- Cost of construction for Geraldton HPC campus significantly higher than expected.

Has the thesis been broken?

- No, as long as revenue continues to grow and temporary costs such as 3rd party compute can be removed due to DUG getting on top of the compute demand of orders.

Valuation:

- Unchanged at around $2.40-2.50.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- New compute is able to meet the demand of customers and remove unnecessary extra costs associated with this. I expect higher profitability into the future as a result.

- Start to pay down financing debts as expanded compute meets demand.

- Still watching the CFO revolving door from the past.

- Order book continues to grow. Even after compute starts to meet demand.

- Share price has been on a run. I think it is fairly valued for the growth at $2.40-2.50. Maybe consider trimming at prices above $2.75 unless there is news which justifies a higher valuation.

Note: USD used for all figures except share price.

- New "Multi-Parameter Full Waveform Inversion" (MP-FWI) product had US$11mil of new project awards in the last quarter.

- New project announced. "DUG Nomad" which is a mobile supercomputer installed inside a shipping container. Using the DUG Cool immersion system, the mobile contain can be deployed anywhere for "edge solutions" such as defence, mining and education.

- Generally high tendering activity continues, good outlook.

- Still constrained by computer power and expecting new computers in December.

Trading notes after AGM.

- MD Matt Lamont has sold 2.5mil shares (in wife's name), he still owns around 24 mil shares.

- Wilson asset management has sold down their position to under 5%.

Image from presentation of "DUG Nomad":

General notes:

- Third of new orders at MP-FWI workflows, showing the product is gaining traction.

Positives:

- $30.9m of new services award. Last 12 months services project wins of over $70 mil.

- Order book continues to increase to $47.2m

- Revenue = $12.9m up 15% on PCP.

Negatives:

- Operating cash flow neutral for the quarter. Would have liked this to be a bit more positive. However, I noted at the end of FY23 the cash flow was stronger than expected, could be some lumpiness here.

- Revenue constrained by compute resources. DUG operates on a just in time basis for expansion so I hope not to continue to see this occur. $7 mil of equipment is due in November and were also upgrading RAM in Houston which created down time.

- HPCaaS and software divisions are not growing. HPCaaS as a major growth driver is definitely not going to occur with the services business being the focus area.

Has the thesis been broken?

- No, revenue still increasing and DUG appears to be winning more and more projects. Need to start seeing the equivalent jumps in revenue as the order book over the next year. Additionally, waiting for the cash flows to come through from the extra revenues.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Compute resources don't continue to constrain revenue longer term. DUG is meant to operate on a just in time basis for compute power.

- Converting increased orders into strong positive operating cash flow over time.

- CFO revolving door doesn't continue.

Note: All figures in USD.

Again, another CFO gone. This time they held the role for just under two years. While this is a yellow flag given DUG's history of being unable to maintain someone long term in the role, this appears to be an orderly transition with the new CFO starting on 6th November and current CFO leaving at the end of the year. This announcement was made on 2nd October for reference to the dates above.

Overview Comment:

Very positive results for DUG. Order book is looking very strong already for FY24 so hopefully results can continue to improve from here. Seems like a step change has occurred driven by oil and gas exploration.

General notes:

- NPAT = $4.9m. Slightly below what I hoped but inline with my valuation. However, cash flow was stronger than NPAT.

- Order book at $27.9m. About the same as what it was at during Dec 22. However, in July 23 $18.6m of work was signed.

- Op cash flow seemed very strong but not sure if this was a result of timing?

- Outlook for oil and gas remains strong according to the company.

- Making a $7m investment in the install of new hardware in Houston to support new services projects (this will be asset financed).

Positives:

- Revenue = $50.9m up 51% and 70% in services division.

- My "FCF" = $7.6m.

- Strong operating leverage. Employee and other expenses only rose by $5.6m while revenue grew by about $17.2m.

- July order of work worth $18.6m is a strong start to FY24.

- Turnaround in services is due to expansion into new markets and commercialisations of DUG's "multi-parameter FWI imaging".

- Net cash of $5.2m. Very positive that the company is no longer in debt. Additionally $7.1m cash was received i August due to repayment of a loan funded share plan.

- Market liked the results up 10%.

- Given some numbers in the presentation the FWI product appears to be a leap in magnitude type better product. It can replace traditional processing of imaging of seismic data. The improvement for customers shown below in presentation:

- Multiple examples provided by the company in their presentation of the significant value proposition they provide to their customers. See bottom of post for copied quotes.

Negatives:

- HPCaaS only up 2% to $4.0m of revenue. Clearly not a focus anymore for growth. No sign of the graph of monthly sales again.

Has the thesis been broken?

- No, opposite, all seems to be going well. Starting to see DUG make some real progress and becoming a valuable resource for its customers. Examples of order of magnitude improvements such as FWI will help adoption. Lots of investment in increasing computer side indicators expected growth in compute time which directly relates to revenue, especially given the just in time format of their computer setups.

- Worried about valuation here but all depends on what happens with profitability. The order book as been a very rough guide as to the revenue over the next 6-month period over the previous year. As of end of July this figure is indicting a large improvement in revenue potentially. Given the operating leverage that has appeared in this year's results if things go well DUG will probably look cheap, if not expensive. Adding to position very cautiously.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- It is clear oil and gas through FWI imaging is a key driver for revenue growth for the business. If oil and gas explorations slows DUG will be impacted.

- If DUG continues to grow revenues rapidly it will be through the continued expansion of FWI.

- Revenues to be above FY23. Order book at the end of FY23 $27.9m with $18.6m added to that in July. Order book as of June 30 22 was only $22.2m.

- Watch the order book numbers. Does it continue to grow?

- Share price has been on a run. All news has been generally positive in recent times. Watch out if some bad news hits, I would expect a pull back.

NOTE: All values in USD unless otherwise specified.

Value proposition quotes in company presentation:

Expectations:

- Revenues to be the highest ever. Multiple announcements throughout the FY of high numbers of new services revenues awarded.

- Order book was $28.8m at end of Dec 22. Has this increased further? I would have expected it to given the $18m new services in 3Q.

- Debt is continued to be paid down.

- Continued movement to a company that grows from operating cash flows.

- Improvement in HPCaaS segment or is this dead?

- Unknown date of results release.

- Financials:

- Revenues = $50m+. Hopefully $55m+. Expecting to at least match 1H of $25.2m

- NPAT/FCF of $6-6.5m+. Remember there is the bolstered NPAT from Searcher announcement in January.

- Growing margins.

Questions to be Answered:

- Any further details on the grant funding recently announced?

- What is happening in the HPCaaS space? 3Q results didn't have the normal table. Is this part of the business failing to take off? Is DUG actually based on oil and gas exploration as its revenue source rather than the need for HPC.

- Are the tailwinds of FWI still there?

- How is the debt situation looking?

- What is the valuation like now? DUG has gone on a run while owning it. I am looking to add but is it too expensive?

- What are the plans for any spare cash?

Note all values in USD unless specified otherwise.

Notes below are reference this announcement

Summary

DUG announced on 18/7/23 that they will receive $5mil AUD worth of grant funding from the WA state government. The funding from the "Investment Attraction Fund" will be used by DUG to build its first data hall at DUG's Geraldton High Performance Computing Campus. The funds will be dispersed as milestones are achieved. A lease has been signed for the 44.5-hectare site which will include space for onsite sustainable energy solutions.

Data Centre Size

The first data hall will have a capacity of 400 petaflops of compute, enabling 13x growth in DUGs compute power once fully established. This will make it one of the largest super computers in the world. The campus could accommodate ten data halls with a potential 4 exaflop capacity. The latency from Geraldton to Perth is only 3ms so the location isn't an issue.

Other Funding

The company will fund the remain cost of the build through operating cash flows.

My Comments

- Net cash figure of US$5.2m is a significant improvement from net debt of around US$2m at end of first half. Total cash on hand = US $8m. Given we don't have the payables vs receivables change it is hard to interpret the result. If the assumption is there is no change in the difference than the second half result will be very positive.

- The fact the company will be able to fund the rest of the project through operating cash flows is a very positive sign the company is cash flow positive and expects to continue to be.

- This investment will enable the future growth pathway of the company by creating capacity to significantly increase revenues (potentially by multiples?) using their just in time build method within the data halls. However, it should be remembered while the growth pathway is enabled by this project, we will need to see how DUG will actually bring in the extra revenues as a result of having the extra compute power available.

- Well done to management for being able to secure this significant amount of grant funding. It de-risks the investment and accelerates the growth of the company.

- Thesis on track and DUG is performing very well, somewhat better than expected (assuming no surprises at FY end results).

Buying back into DUG with a small starting position as a result of recent turnaround in the momentum.

Main Thesis:

A HPCaaS provider that has carved out a niche. The PUE of its computers if very low which allows them to be competitive on cost. On top of the efficiency of their HPCs they run, they provide services on top to allow companies to gain the insights they require from raw data without requiring the know-how of the ins and outs of HPC.

Recent years have been poor for DUG, however, fortunes seem to be turning with increases in revenue that I believe will provide a point of operating leverage for the company to become sustainably profitable, especially after the cost cutting in recent years. There have been multiple recent announcements stating new/improving revenues and increased profitability. The balance sheet is in a much better position. Tailwinds of the oil and gas industry exploration and new FWI imaging will help improve revenues further.

Risks:

- Revenues stop growing or go backwards again.

- The CFO revolving door issues come to light as to why this occurred. IE there was something actually wrong.

- The business doesn't have the margins you think it might.

- Oil and gas industry stops exploring again.

- This isn't a good business that has sustainable margins that increase with revenue growth.

- The HPCaaS is unable to make significant revenue outside of the revenue made from services and software part of the business.

Definitely a company to watch closely while holding to make sure recent momentum continues. Will also have a personal stop loss level as a soft check point as to whether the momentum I think the company and/or share price has will be maintained.

DUG announced today the extension of CBA term loan facility until 1 July 2024. The facility will be reduced to US$4.5 mil and US$7 mil will be repaid. The working capital facilities of a A$1 mil overdraft and US$1 mil bank guarantee facility will continue. DUG will be able to obtain funding from alternative lenders for purchase of new equipment.

DUG provided some guidance, stating the company expects to be operating cash flow positive over the second half.

Still very much watching from the side lines but this is a positive development in reducing the likelihood of a capital raising being required. While operating cash flow positive I doubt the company will be FCF positive over the half reading between the lines.

DUG has some favourable tailwinds caused by current environment with regards to oil and resource companies. If DUG cannot significantly increase revenues over the next 1-2 years this will be a telling sign of the long-term prospects in my opinion.

General notes from Q3FY22 Quarterly activity and 4C reports (all amounts in USD):

- Operating cash flow for the quarter was positive, $2.26 mil with YTD outflow of $950 k. This is showing some general improvement in the cashflow.

- Revenue was $8.22 mil for the quarter with YTD $25.24 mil. FY21 was $41.4 mil and FY20 was $49.6 mil. I would be surprised if DUG beat FY21 based on current tracking for the year.

- Some new contracts signed.

- DUG net debt position as of 31/3/22 was $320k. However, $12 mil finance facility is due by 1/7/22. Given the net debt is very low a refinancing should be reasonably expected in my opinion.

- The January HPCaaS revenue level was a one off with the March figure matching the start of FY22.

Overall, very happy to be sitting on the sidelines still with DUG for the following reasons:

- The financing situation needs to be sorted.

- The revenue isn't growing. I would buy DUG for the growth but there isn't any at the moment from what I can see.

- Cash flow profitability is appearing but not yet consistently positive.

- CFO revolving door issue. Need to see some continuity here.

Another new CFO for DUG since listing. This is now a big yellow/red flag!

CFOs since listing (around 12/8/20):

- Louise Bower - was CFO for 11 years pre-IPO and executive director. On resigning became non-executive director.

- Bhavesh Morar - from 2/11/20 till 7/12/20.

- Louise Bower - steps back in an a role to "assist with comprehensive transition to a new CFO and oversee half year audit and results". Some company reports note she is CFO, some just executive director. No CFO listed in FY21 annual report. Timeline from 7/12/20 till 1/10/21.

- Greg Haskis - from 1/10/21 till 8/3/22.

- Sam Cruickshank - from 9/3/22. Appointed "interim CFO".

Not a great look. No outsider CFO has lasted more than six months. Now it makes sense why the financials of the company haven't looked great since IPO, no one has been steering the ship consistently. Is there a cultural issue at the top that CFO's want to leave or is there something dodgy going on? With that much turnover it is surely one of those?

Overall Comments:

Burning cash with revenues flat. The current debt is an issue, but I am sure they will be able to refinance a smaller amount by the end of the FY. DUG almost has the required cash to pay off the debt.

The reason to buy DUG shares is because of the potential for growth in the HPCaaS services they offer, with the services business driving underling revenues and profitability. Traction is not yet there and the grand plans for growth won't be implemented with current revenues or profitability issues. The lack of investment currently in the oil and gas industry is impacting DUG significantly as these revenues provided the baseline of revenue for the business to expand on.

Continuing to watch on the sidelines until there is consistent revenue growth and capital structure improvements. DUG needs to become operating cash flow positive to thrive.

General notes

- Total revenue slightly down on Q1 to US$8.36 mil and the 1H comparison to FY21 is also down slightly.

- Net cash outflows from operating and investing activities of US$1.26 mil.

- Management reports the restructure of the services business line has resulted in improved operating margins.

- External advisors have been brought in to assist with the debt structure/refinancing.

- Some cost saving measures have been implemented include: MD and COO deferring salary, reducing headcount, improving productivity of workflows, creasing third-party R&D projects and rightsizing office space.

- Business unit managers in services business line now have increased autonomy and focussed on profitability improvement.

- Record revenue for HPCaaS in January 2022. This is a good sign but is due to a high burst compute for the month. This could be a one-off rather than an indicator of growth in the HPCaaS business.

- Very little cash needed for investment in line with the "just in time" approach management uses. Indicator not much growth is occurring or about to occur.

- A$15 million share placement conducted during the quarter. Company still net debt after cash proceeds. Debt reduced to US$12.45 million and is due 1 July 22. Cash balance at quarter end was US$10.54 million (A$1.59 million from placement not included in this figure that will be received in Q2)

- Maturity of loan is of concern given quarter was cash flow negative and company is in a net debt position.

- Revenue for quarter = US$8.69 million.

- HPCaaS and software as expected.

- HPCaaS on average seemed flat. September was the highest month in recent times (and highest ever if you disregard one month with a large amount of burst compute). See if growth continues... However, over the past year, growth has only been $100k extra compared to the previous year ($200k to $300k per month). DUG really needs to be doubling every year given the very low base if they are going to become a much larger business.

- Services revenue is experiencing difficulty. No change in outlook even with oil price increases.

- Cash flow negative for quarter. US$2.1 million operating cash burn.

- Option to lease 44.5 ha in Geraldton to build “climate positive” HPC campus, powered by renewables.

- Applied for patents in relation to the hydrogen energy storage system they are developing. This system will create a low-cost maintainable solution for hydrogen electrolysis at megawatt scale. The patent process is expected to take four to five years. This is a free option as a DUG shareholder. What if DUG could commercialise the use of this technology?

- DUG is applying for defence industry security program in Australia.

- Restructure of services business-line:

- Expects realised cost savings in FY22 of approximately US$4.2 million.

- Savings through smaller office space, redundancy of staff, selection of projects based on profitability, cessation of third-party R&D projects.

- Geographical business units will have more responsibility and accountability.

- Executives deferring salary payments.

Overall comment:

Burning cash and all very negative besides the free option on the hydrogen technology. Another raise will be required if debt cannot be refinanced. HPCaaS needs to really take off or this company is going nowhere, even with the grand plans they have. One to watch from the sidelines until HPCaaS shows significant growth

Summary of Capital Raising Announcement

DUG has announced a capital raising consisting of a $15m institutional placement and up to a $5m share purchase plan for all shareholders. The issue price is $0.90 with approximately 22 million new shares issued if all of the SPP is taken up.

DUG plans to spend the cash on:

- Military and space business development

- Renewable initiatives

- Building a structured "sales areas" oriented global sales team

- Purchasing computer equipment

- Working capital/deb reduction

Most of the placement shares will be issued on 13th September with the issue of SPP shares and tranche 2 of placement shares on 19th October.

Personal Thoughts on Capital Raising

I expected a capital raising to take place and is the reason I sold DUG. This capital raising is approximately the amount I expected they would need to raise to fund their plans, especially considering the poor 2HFY21 result. While DUG produced a list of items I see the majority of the cash going towards paying of debt, working capital and purchasing equipment. I do think management has timed the raise correctly, waiting would have put them in a position of weakness and DUG appears to have some strong institutional investors who backed the raise. I think the share price will be subdued at under $1 until at least the end of October given the quick free cash available for current holders with an offering price of 90c.

A re-entry into DUG still requires the sales growth to recover after the poor 2HFY21 result. I will need to see at least one set of sales numbers before considering re-entry, more likely two. I will be waiting to confirm the company is actually gaining the traction required to grow and that an additional capital raising will not be required before re-entry is considered.

Overall view: HPCaaS, signings and future looks good but how do they get there? Looks like a gap that needs to be bridged unless revenues suddenly improve, so a capital raising is likely. Due to these risks I will be selling but waiting on the sidelines to reenter when these issues are resolved.

These notes cover FY21 results presentation and preliminary report plus some recent announcements. All amounts in USD.

General Notes

- The drop in revenue indicates a potential point of operating leverage after $50 mil of revenue. Costs were slightly higher than last FY but revenue down, profit significantly affected.

- Power usage effectiveness as low as 1.03. This is very low showing DUGs tech works.

Positives

- HPCaaS revenue up significantly, from $1 mil to $2.6 mil. Chart of HPCaaS revenue sources showing growth continuing but not sure on the rate.

- DUG sales has branched out over the past year with many new signings outside the oil and gas industry. Multiple new announcements in the past couple of months with new customers from different industries. I think DUG needs to continue down this path to grow its HPCaaS offering.

- EBITDA margin of HPCaaS around 38% is being maintained. However, I think NPAT matters in the end due to the lifecycle costs of equipment.

- Company is developing a hydrogen energy storage system using a low cost electrolyser. This is part of reducing cost of power and attracting environmentally aware customers. Company is claiming to be green positive with Geraldton data centre. Free option - if this technology can be expanded beyond DUGs exclusive use.

- $8.7 mil contract over 3 years signed for HPC services. Cant tell how much will be services or pure HPCaaS. If this is heavily skewed towards HPCaaS. HPCaaS revenue growth will be significant.

- Perth data centre is nearly at capacity. Showing the growth.

- HPCaaS deployment of capital slide shows the potential of the company. Running some numbers here shows some very favourable economics. $44 mil a year in earnings over 5 years ((EBITDA-all CAPEX)/5), that's for a half full data hall and the ability to create ten times as many. See page 11 of DUG's FY21 Presentation for referred to slide.

Negatives

- Significant drop off in revenue caused by a drop in services revenue. This was due to the activity levels in the oil and gas industry.

- NPAT = $ -15.8 mil.

- Net cash flows from operating activities = $ -2.8 mil. Down from $ 6.2 mil in the previous year. $ -9 mil change!

- A capital raising looks likely for expansion and if the term debt facility cannot be pushed back again. Payment of $6.25 mil required this FY, this is a sizeable amount of the $10 mil of cash on hand. To add to this the company has moved into an operating cash flow negative position. If debt cannot be refinanced again then company will require a capital injection from a very weak position. DUG does have strong institutional backing so might be able to get funding on reasonable terms but I suspect there will be a decent discount. This is before any cash is used for expansion. My guess would be a raising of $10-20 mil is required which would likely dilute holders by 15-25% after discounts.

- New auditor has resulted a lot of changes to the books. Does this answer the questions around why the new CFO left quickly after starting the job? Most issues appear to be moving to a more conservative method of accounting. Looks like a reframe of the numbers. Will need to wait for full annual report. However, generally doesn't look good.

- Significant drop off in services revenue in H2, approx 1/3 of H1. Costs also higher due to research. Is this temporary due to the previous oil price drops or a sign of something worse?

Has the thesis been broken?

- Yes. Looking short term there are some hurdles with a likely capital raising required to reduce debt and fund expansion. Additionally, the reduction in services revenue is very worrying as this segment created the required cash while HPCaaS grows. Longer-term DUG appears to be executing and surprising me to the upside in terms of their ability to reduce any costs in the HPC ecosystem. There is a clear plan on how to expand HPCaaS effectively. There are small indicators such as Perth DC reaching capacity, the hydrogen energy storage system, $8.7 mil contract announcement and the onboard of clients from multiple industries which exceeded my expectations. It really all comes down to what is going on with the oil and gas services income, is the 2H income figure the new norm or is the drop due to the previous oil price declines and now that the oil price has recovered will the revenues from this sector will return? The likelihood of a dilutive capital raise on top of the services revenue issues is my reasoning for selling. However, I will be sitting on the sidelines ready to jump back in when these issues are fixed. If DUG can execute on their plans over a ten year period it will be a multi-bagger. In my opinion, jumping in at say $1.50-$2 with the risk of a capital raise and growth concerns removed would provide a better risk to reward ratio than holding at the current time and price. Given I feel that way I cannot continue to hold with my current concerns.

Positives:

- NTA per share up significantly to 33c US per share (=44c AUD).

- Improvements over H2FY (but not better than H1FY20).

- HPCaaS and Cluster revenue significantly up. Though still a tiny portion of revenue.

- Capex mainly used for increasing computer and storage for Houston supercomputer.

- Many 'proof of concepts' have been completed or are underway relating to many different industries. This work evaluates DUG's HPC for use in different industries.

- Multiple signings for HPCaaS platform in the half.

Negatives:

- Little bit of trickery with the numbers. Trying to hide some of the negative results compared to 1HFY20. COVID and oil and gas industry hit is managements excuse.

- $4.4mil loss and 710k negative operating cash flow.

General Notes:

- Revenues in Australia and US up while UK and Malaysia down.

Has thesis been broken?

- No big red flags or results that were unexpected.

- Cashflow and profitability while negative are not substantially negative. However, something to watch.

- Improvements over 2HFY20 which was the baseline.

- HPCaaS the basis of the thesis has grown significantly (off a low base) as required for thesis to play out. Australia and US revenue growth is positive. This is the main base of the company and where the biggest supercomputer is located (respectively).

All figures in USD if not stated otherwise.

DUG Technology is a high-performance computing as a service (HPCaaS) company based in Perth. DUG started as a company focused on geoscience processing and related services but is now leveraging their HPC knowledge to provide HPCaaS in the cloud. Most revenues still flow from the scientific expertise within DUG that use HPC to provide the client with the solutions they require.

DUG's HPCaaS is different to many other data centres in that they have a modular system of immersion of the computing power into dielectric fluid rather than using air and fans for cooling. Their modular system design has focussed on removing any losses of power (at all stages) and reducing capital costs to a minimum. The design allows for maximum density of computing power which helps reduce costs. The modular design also saves on costs as it is able to be installed "just in time". If you are interested in the details this video presented by DUG's CTO best explains how DUG's computers waste so little power compared to other data centres: High Performance Computing Conference - Phil Schwan.

What makes them different from the big tech clouds/other supercomputer providers?

- The Power Usage Effectiveness (PUE) is extremely low due to the modular design and a strong focus on removing as many costs as possible associated with running a HPC.

- DUG provides specific services to clients. DUG has 250+ data scientist and software engineers on staff. 25% of staff have a masters or PhD. These staff members help clients leverage the HPC to provide the solutions they require.

- DUG has the knowledge and expertise on the scientific side as well as the HPC side to create a complete solution for the customer. This is a niche compared to the big tech giants that only provide the computing power not the expertise and toolkits.

- On demand expertise and services for customers.

- Toolkits that allow customers to more easily create the solutions and models they require.

Positives:

- Great potential for growth in HPCaaS. The computing power required for greater accuracy of computed solutions in the scientific field are normally exponential (multiple powers). The greater accuracy of solutions provides significant value to geoscience customers by saving costs/increasing profitability of projects. Global cloud storage growth at 25% p.a. for the next 5 years. Standard file sizes for some of DUG's geosciences work is approximately 1.3PB.

- The scalable nature of DUG's HPC design. DUG is ready to build and install the modular design based on demand. IE DUG build's the building and installs the compute and storage just in time.

- Currently, DUG's computer power stands around 30PF (somewhere around 21MW). Houston is currently a 21PF computer which can be increased to a 150PF in the current building. The facility can be expanded to facilitate a 1000PF computer.

- An example of DUGs value to customers can be shown through the SKA project reported in the Canaccord broker report. To summarise, Pawsey, a government-supported HPC facility is oversubscribed by 1.8x. The SKA had a two year backlog of data. Upon asking DUG to review and process the data. After two weeks of working on the code to process the data, DUG achieved run-times of 125x faster than that achieved at Pawsey. This allowed the SKA project to process its data backlog in one day using 1/5 of DUG's Perth HPC system. The team had previously been able to process a sixth of its total backlog over a two-year period.

- General opportunity to branch out from geoscience to other scientific research areas that require HPC for solutions.

- Extremely low PUE, I cant find any figures that beat DUG's PUE though I have suspicions there may be higher capital costs involved in the design. However, the way they approach the design of their HPC with a drive for efficiency at every step leads me to believe their design is cheap to run overall.

- Recent announcements include deals with major industry players and point to revenue growth.

- The business grew thought expanding revenues and profits that could be reinvested. Pre-IPO/IPO was the first major injection of cash with the goal of expanding HPCaaS. Currently operating cash flow positive. Produces revenues from all over the globe. Costs have been relatively stable over the past 3 years. Potential for operating leverage?

- Management:

- Founder/CEO holds 23.9% of shares

- CTO holds 7.27% of shares.

- Directors and leadership team hold around 37% of shares at the completion of recent IPO.

- High outperformance fund managers are backing the company:

- Alex Waislitz - owns 5%+ through various entities including TEK which I own for disclosure. Some buying post IPO.

- Perennial - owns 13.87%. Continual buying post IPO.

- Regal Funds - own 5.92%.

- All of these managers have a very good record of outperformance why not leverage the fact three outperforming managers came to the independent conclusion that they wanted in on this investment and continue to buy. Did they get a good look under the hood since I can't tell if they were invested pre-IPO?

Negatives/Risks:

- 33% down from IPO. Makes me ask the question what am I missing? Appears to have reached a floor around $1 per share.

- New CFO left not long after joining. Potential big red flag! Did he find something wrong, is the culture horrible, did the previous CFO try to maintain control or was it just not the right fit for one side?

- Could be subject to the cyclical nature of geoscience industries.

- Currently being sued by PGS Australia for patent infringement which could limit the success of DUG's operation in Australia. See pg 141 of prospectus.

- Will another capital raise be required for expansion?

- Selling on escrow allowed 1 year after IPO?

- Loss of capital is definitely possible if DUG is unable to increase revenues/execute on a growth strategy

- Net debt company.

- Only one broker following who is the IPO issuer and has a price target of $2.37.

- Getting in to early before the inflection point has occurred. Am I buying the potential story rather than waiting to see if the potential is real?

- Very low liquidity - management and substantial fund managers hold around 62% of shares.

When to get out:

- Any additional signs of potential issues with accounts given the new CFO issue.

- Growth in revenue stops or financials go backwards.

- Unable to show long term growth in HPCaaS or ability to acquire customers outside the geoscience space.

Expected outcomes/valuation:

- I struggled to find a method to easily value DUG. My current valuation skills are very basic. I think the figures below are conservative but still show some potential upside.... My valuation figures are just to see if I think there is significant downside risk rather than what I think the company is worth.

- Probability based valuation of $1.22:

- 20% Worst case - Drop in revenues and profits. I'll go with half current price. $0.5 per share

- 50% Flat case - Revenues remain at current levels. I'll price this at 10x proforma operating cash flow = $1.30

- 20% Reasonable growth as per Canaccord figures - Price at 10x Operating cash flow in FY23 discounting back at 15% = $1.42

- 10% Better than expected double FY23 profit from Canaccord figures - Profit of $14m with PE of 20 discounting back at 15% = $1.84

- Per MW comparison to NextDC - an extremely crude valuation:

- Next DC has 246MW planned and 79MW built as of June 2020. This gives a valuation of $23 million per planned MW (I think next DC is extremely overvalued).

- I will half the planned per MW valuation to $11.5 million per MW.

- DUG currently has around 21MW of actual compute power.

- Based on the above DUG's 21MW * 0.5*23 (Half of NextDC planned per MW valuation) = $241.5 million or approximately $2.415 per share.

- Where I see the value here is the company is currently valued at approximately 7.5x proforma operating cash flows. I don't think this is an expensive multiple. Provided with a cheapish base there is a low risk if nothing happens but there is potential for good returns if there is any upside. My next DC comparison I think shows some potential for upside given DUG has created a facility that could be incrementally expanded to many 100s of MW in a modular format.

- How I expect this play out over time:

- Next 1-2 years DUG has 10-15% revenue growth mainly through services but starts increasing revenues from pure HPCaaS. Prove the ability to scale when required and that demand for their product is increasing.

- 3-5 years. Expansion of facilities to accommodate more growth. Potential for a new Perth datacentre. Market acknowledges DUG's progress. DUG maintains operational profitability and continues to invest in R+D.

My base thesis for DUG is that I see the potential for massive growth due to the exponential requirement for high performance compute and storage in the modern world to solve problems with greater accuracy. I expect DUG to maintain profitability and be operating cash flow positive during growth. DUG's ability to combine specialist knowledge and efficient HPC systems gives them a niche to work in. I feel confident making an investment knowing that management is heavily invested alongside me and some of Australia's best performing managers are also along for the ride. I like that management has built this business from a shed to an international HPC provider and have done this through reinvesting in the business rather than relying on external capital.

Disclosure: I hold a position and waiting of 1H figures before considering further buying.

Would be very interesting in hearing any other views especially negative through a forum discussion.

Post a valuation or endorse another member's valuation.