Pinned straw:

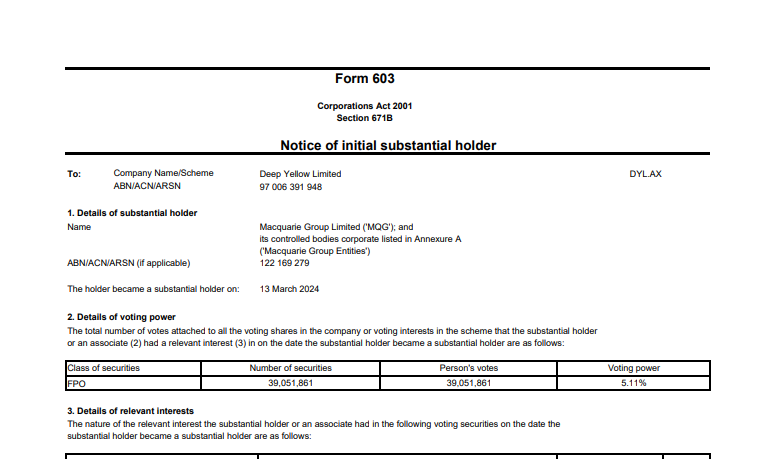

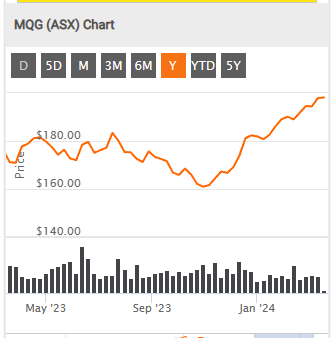

Hi @raymon68 - MQG is trading the stock - for a few cents worth of gains often - as shown on pages 20 through to pages 151, and they are also lending some of those shares to shorters - as per the agreement outlined on page 152, and the counterparties (shorters) are listed on page 153. There are plenty of long-short funds and other banks, brokers, and other people prepared to short companies, even though there is clearly a limit on how much you can make going short (along with heaps of risk if you are wrong), and the upside of going long is virtually limitless, but people will still short - often to try to balance risk - in their opinion - against a long call somewhere else for instance.

Becoming-a-substantial-holder-for-DYL-from-MQG.PDF

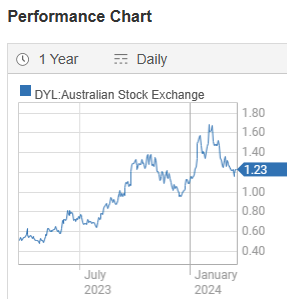

The MQG trading records (in that announcement, pages 20 to 151) started in mid-November, at prices around $1.20/share, and DYL fell from there to around 96 cents/share in mid-December and then went into a strong uptrend, reaching $1.68/share on Feb 2nd, before going back into a downtrend again from Feb 8th to now. There was money to be made trading the stock clearly, and more money to be made by lending the stock out to Blackrock, Citibank, JP Morgan, State Street, etc, for a fee. And at the end of it all, despite all of the ups and downs, DYL are still a few cents above where MQG started buying in mid-November (at $1.20), and they've been making fees on it throughout by lending it out to those muppets.