Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Macquarie Group Limited ('MQG')

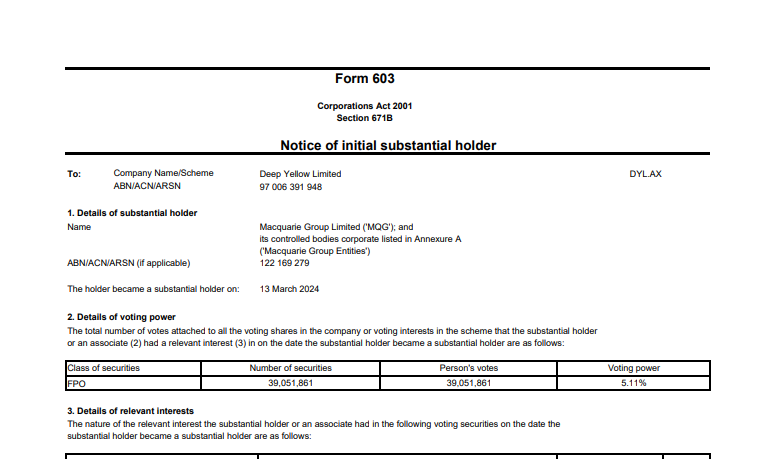

What is Macquarie doing buying into DYL Uranium? - Are they shorting this DYL?

Some people might be surprised to find out that Australia's highest paid boss (CEO/MD) of all listed Aussie companies is actually a Woman, the CEO & MD of MQG, Shemara Wikramanayake.

That's the Good news. The Bad news is that the other 9 on that list above are all men, and that she wasn't even the highest paid executive at Macquarie last year, just the highest paid MD/CEO, as explained below.

Her large payout is in part in thanks to the Macquarie Group’s profit share arrangement, which richly rewards executives when the company does well.

And the listed financial group did do well in 2022, securing net profit of A$4,706 million, 56% up on the year before.

Founded in 1969, Macquarie provides clients with asset management, banking, leasing, advisory and risk and capital solutions. The Sydney-headquartered firm employs more than 18,000 people and has offices in 33 markets globally and A$871 billion assets under management.

Driving the financial group’s success since 2018, Shemara has a three-decade-long career at Macquarie Group, most recently serving as Head of Macquarie Asset Management before taking the CEO role in 2018.

Since joining Macquarie Capital in Sydney in 1987, aged 25, she has worked in six countries and across various business lines, establishing and leading Macquarie’s corporate advisory offices in New Zealand, Hong Kong and Malaysia, and pushing the emerging asset management division of the business to become the bank’s most profitable venture.

Shemara, who is UK-born and of Sri Lankan descent, is the first Asian-Australian woman to head an ASX 200 company and has been instrumental in driving diversity at Macquarie, where at least half of female employees identify as coming from a culturally diverse background, while globally, more than a third of Macquarie female directors identified as ethnically diverse.

Despite this, the firm remains male-dominated, with less than 30% of the senior management ranks female.

--- ends ---

Source: https://businesschief.asia/corporate-finance/these-six-ceos-are-australias-highest-earning-heres-why [27-July-2023]

That top 10 list (of highest paid CEOs/MDs from 2022) above is based on the ASX100 Index, so Australia's largest 100 companies, generally speaking. If you expand that out to the full ASX300 Index, and look at the top 50, Shemara is still at #1, but the Bad news is she is still the only woman on the following list. Well there are two others, Liz Gaines (FMG) who quit that role late last year, and Jeanne Johns from Incitec Pivot (IPL) who left in June this year.

Jeanne Johns was replaced by Paul Victor as an interim CEO at IPL (and he's still in that role today), while the changes at FMG were a little more complicated. Liz was offered a new role as an executive director and global ambassador for Fortescue, and is paid around $1.3 million p.a. for that, and her old CEO job was split into two - Metals and FFI - with the CEO of Fortescue Metals job going to Fiona Hick who left after only 6 months and was replaced by Dino Otranto who had been their head of operations. The other CEO role at FMG was called CEO of FFI (Fortescue Future Industries) and is now called CEO of Fortescue Energy - which includes:

- Fortescue Future Industries (FFI) - Green energy technology and production;

- Fortescue WAE (Williams Advanced Engineering) - Battery and fleet technology development and manufacturing; and

- Fortescue Hydrogen Systems - Electrolyser and hydrogen production systems development and manufacturing.

...and that role was given to Mark Hutchinson.

So while there are three women on the following list of the 50 highest paid CEOs from Australia's largest 300 listed companies (i.e. from the ASX300 Index), only one of those three, Shamara Wikramanayake, is still a CEO or MD today (Shamara is both).

Source: https://www.afr.com/work-and-careers/workplace/revealed-australia-s-50-highest-paid-ceos-in-2022-20221205-p5c3o6 [9-Dec-2022]

Well done to Shemara obviously - she has done very well - however - while it's great that she tops these lists, it's not too great that all the other CEOs and MDs are men. At least the well paid ones seem to be dominating these lists, and despite a fair amount of progress getting better representation on company Boards, women are not getting anywhere near equal representation in very senior roles within Australian listed companies. I'm am seeing more women CFOs these days and heaps of women are in senior HR, "People" and "Safety" roles, but we do need to see more women CEOs and MDs. I find that many women tend to have superior multi-tasking skills, they are more willing to listen and take other ideas on board and work collaboratively (maybe that's a testosterone and/or ego issue with many men), they tend to have less anger management issues, and from my limited experience with middle-management, they tend to deal with stress more appropriately and effectively. And the good ones also know bullsh!t when they hear or see it and don't accept it. Being a strong, decisive and effective leader doesn't mean you automatically have to be a dick - or have one.

Macquarie chief Shemara Wikramanayake topped the ranks of CEO pay again in 2022. Bloomberg

Further Reading: https://www.smh.com.au/business/small-business/it-s-despicable-kim-jackson-calls-out-lack-of-funding-for-women-led-companies-20190701-p52333.html

Venture capitalist Kim Jackson wins business award (afr.com)

How I made it podcast: Carolyn Creswell and Carman’s, from checkout chick to $170m empire (afr.com)

Manning Cartell co-founder Gabrielle Manning on how to create a successful fashion brand (afr.com)

Topic | Female Founders | Australian Financial Review (afr.com)

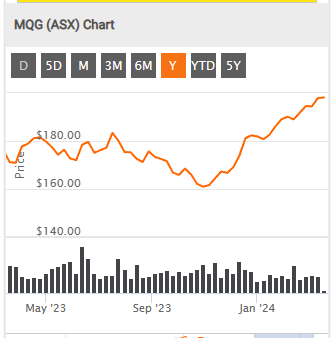

March, 2021: I think MQG can get to $165/share within 24 months (2 years), so by March, 2023. However, in a market crash, or a big correction, or a bear market, they will go down, and possibly by more than the market average, so if we enter a bear market then all bets are off. I am not holding MQG currently. If I was, I'd be thinking about selling at least half. Not enough upside potential compared with the downside risk. I would be a buyer under $120 I reckon, with a view to start lightening above $150.

27-Nov-2023: I haven't updated this price target for 2 years and 8 months (since March 2021) and I don't hold MQG, so that's probably why. Interesting that they shot through that $165 level but that they keep coming back down to it... Perhaps $165 is a good buy zone for MQG, based on their chart... if you want to hold them.

I don't really think of them as a bank these days. They are a global asset manager that has a banking arm, and the assets that they manage are varied, but they do include a LOT of infrastructure these days, like toll roads, airports, etc., but they are far more than just a bank is what I'm saying and they have management which are highly incentivised to continue to find new ways of making money, regardless of prevailing conditions. They just keep morphing as they need to, and they always will. They don't call it the millionaires factory for nothing.

Speaking of which, I just posted a straw about their CEO & MD, Shemara Wikramanayake, and how she was Australia's highest paid CEO for 2021 and 2022, and likely will be again in 2023. She was paid $23.7 million by MQG in 2022 and despite having the top job there, she's not even the highest paid executive at Macquarie!! Nick O'Kane was paid $57.6 million by Macquarie last year.

That's a lot of cheddar...

- A look back at 27/07/23:

*Difficult for the 'Millionaires Factory " the increasing high interests is the wrong environment for MQG the strategy.

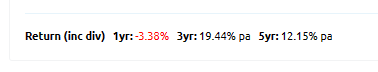

Return (inc div) 1yr: 2.99% 3yr: 16.67% pa 5yr: 11.59% pa

Return (inc div) 1yr: 2.99% 3yr: 16.67% pa 5yr: 11.59% pa

Glenny's report a bit here:

Mr Stevens said “The Group delivered a record profit of $A5.2 billion, for a return on shareholders’ equity of 16.9 per cent. This was an exceptional outcome, achieved by a high-performing management team who deliver for shareholders by delivering for clients.

Macquarie’s diversification was again evident – even as some business lines faced difficult trading conditions, others were able to expand profitably by servicing a growing client base

MQG below:

Return (inc div) 1yr: -1.24% 3yr: 19.43% pa 5yr: 13.19% pa

Return (inc div) 1yr: -1.24% 3yr: 19.43% pa 5yr: 13.19% pa

MQG Return peak to trough is 100% 1- 2 = $200/$100

Compare Growth performance:

While here - A look at CBA over the last 5 years.

Conclusion: MQG vs CBA ends up at the same destination in recent times..........x Return( inc Div ) Compared..

MQG - i guess, can have certain assets that generate returns. CBA and the big 4 have more banking rules around how they can grow their assets., to grow profitability.

CBA chart Below:

CBA Calculate from the chart here:

Peak to trough is 66% 1- 1.666 1.666'=100/60

( so CBA less growth 66% vs MQG 100% ..not including dividends ...)

For those that want some Australian history and a look into the history of Macquarie I'd recommend the new book Millionaires' Factory: The inside story of how Macquarie Bank became a global giant. Only half-way through but finding it very interesting.

24 Jan 23 - Morgan Stanley Price target $218.00

"Stronger commodities revenues could boost Macquarie's earnings in FY 2023, say Morgan Stanley analysts in a note. The investment bank raises its FY 2023 earnings estimates by 2.5% on 9.0% stronger commodity revenues, with both U.S. and EU seeing near historical high volatility on MS tracking. Still, MS says this is partly offset by lower M&A related fees. "We move 2.0% ahead of FY 2023 consensus earnings," MS says, adding that it still expects a subdued 3Q FY 2023 trading update with 2H FY 2023 earnings per share down 19% year-over-year.

Another deal being negotiated by MQG

--National Grid PLC's disposal of a 60% stake in its U.K. gas transmission business will be reviewed by the U.K. government amid increased concerns about energy security, the Financial Times reports.

--The sale to an international consortium led by Australia's Macquarie Group Ltd. is to be reviewed under the National Security and Investment Act, the FT says.

Aug 7 (Reuters) - French waste and water management company Veolia Environnement SA is nearing a deal to sell Suez SA's UK waste business to Australia's Macquarie Group Ltd (MQG) for about 2.5 billion euros ($2.5 billion), Bloomberg News reported on Sunday.

The deal, aimed at resolving antitrust concerns, could be announced as soon as Monday, the report added, citing people familiar with the matter. ()

An investor group led by Meridiam SAS and Global Infrastructure Partners, which bought Suez's business in France and several other countries, has the right to make an offer for the Suez UK assets by matching the price Macquarie is offering, Bloomberg said.

Veolia said in June this year it was proposing to sell off its former rival, Suez's UK waste business, after Britain's Competition and Markets Authority (CMA) raised objections to the Veolia/Suez combination.

21-Mar-2021: Most of the companies that are popular here on Strawman.com do not have a lot of major broker coverage, so I don't look at this too often, but I was having a look at Macquarie today and I was surprised by how varied the broker opinions and targets are. Obviously MQG is a leveraged play on the stockmarket, in that they tend to outperform in a bull market and are absolutely smashed in a bear market, i.e. they tend to overshoot the general market in both directions when the markets are moving. Broker views on MQG are therefore based on their outlooks for markets globally, as well as whether or not they think MQG has already run too hard. Here's what they most recently had to say, as summarised by Rudi Filapek-Vandyck at FNArena.com:

Morgans - 23/02/2021 - Add - Target: $162.30 - Gain to target $13.93

Macquarie Group has upgraded recent guidance for profit (NPAT) to be “up around 5%-10%” on pcp from "slightly down on FY20”. This was driven by increased demand for gas and power as a result of severe weather conditions across North America, explains Morgans.

After upgrading forecasts, the analyst notes the diversification of the Macquarie business has come to the fore and will help deliver an impressive profit growth outcome. It's considered the group remains well positioned to seize opportunities on the other side of covid-19.

The Add rating is unchanged and the target price increased to $162.3 from $147.

Target price : $162.30 Price : $148.37 (23/02/2021) Gain to target $13.93 9.39%

Credit Suisse - 23/02/2021 - Neutral - Target: $145.00 - Loss to target $-3.37

Macquarie Group has upgraded guidance for FY21 earnings to be up around 5-10%, having previously guided to "slightly down" on FY20. Accordingly, Credit Suisse upgrades estimates, anticipating an improved performance from the commodity markets.

Macquarie Group has indicated extreme winter conditions in North America have increased demand from clients for its services in relation to gas and power. Neutral rating retained. Target rises to $145 from $141.

Target price : $145.00 Price : $148.37 (23/02/2021) Loss to target $-3.37 -2.27%

Morgan Stanley - 23/02/2021 - Overweight - Target: $160.00 - Gain to target $11.63

Macquarie Group now expects FY21 profit to be up 5-10% compared with the prior guidance of "slightly down". Morgan Stanley expects a mildly positive reaction in the share price.

Winter weather in North America has driven stronger commodity trading conditions and the broker calculates new guidance implies an extra $500-600m in revenue in the commodity market segment.

This will be a one-off trading gain, with no flow to FY22. Overweight rating, $160 target and In-Line industry view maintained.

Target price : $160.00 Price : $148.37 (23/02/2021) Gain to target $11.63 7.84%

Ord Minnett - 23/02/2021 - Accumulate - Target: $158.00 - Gain to target $9.63

Macquarie Group has upgraded first half guidance, now expecting net profit to rise 5-10%. Extreme weather in North America has increased demand for the company's capabilities in the gas and power business.

Ord Minnett increases assumptions regarding multiples, to better reflect the value of the long volatility position that pays off sometimes when conditions are supportive. This leads to an increase in the target to $158 from $155. Accumulate retained.

Target price : $158.00 Price : $148.37 (23/02/2021) Gain to target $9.63 6.49%

Citi - 23/02/2021 - Sell - Target: $125.00 - Loss to target $-23.37

Macquarie Group has upgraded its FY21 net profit guidance by 5-10% implying a profit of $2.85-$3bn. – The upgrade was led by severe cold weather in Texas that has caused prices in the pipeline to spike.

Citi believes the upgrade suggests the group's commodities and global markets' division earned $600m in revenue in just 2 weeks. The broker upgrades its FY21 profit to $2,934m or 7.5% higher than FY20 while leaving the outer years unchanged.

Sell rating is maintained with a target of $125.

Target price : $125.00 Price : $148.37 (23/02/2021) Loss to target $-23.37 -15.75%

UBS - 10/02/2021 - Neutral - Target: $145.00 - Loss to target $-2.37

UBS observes Macquarie Group's update on December quarter shows a strong cyclical recovery in revenue with market conditions improving significantly. Even so, the group expects FY21 earnings to be slightly down on FY20.

The broker has a positive medium-term view on Macquarie Group as hard asset deal-flow improves and asset recycling accelerates.

Looking at the recovery in trading and markets revenue and the significant operating leverage, UBS upgrades the group's FY21 earnings forecast by 15%.

Neutral rating with the target price rising to $145 from $135.

Target price : $145.00 Price : $147.37 (10/02/2021) Loss to target $-2.37 -1.61%

Note: Excludes dividends, fees and charges - and negative figures indicate an expected loss.

MQG closed at $148.80 on Friday (19-Mar-2021). [I do not currently hold MQG shares.]

10-Feb-2021: 5 of the 6 brokers who cover Macquarie Group (MQG) - according to FNarena.com - have upgraded their guidance this morning after MQG's results announcement yesterday.

Broker (date of last update), Call, Target Price (TP), gain/(loss) to reach TP from current SP (share price):

- Citi (10/02/2021), Sell, $125.00, (-15.04%)

- UBS (10/02/2021), Neutral, $145.00, (-1.44%)

- Credit Suisse (10/02/2021), Neutral, $141.00, (-4.16%)

- Morgan Stanley (10/02/2021), Overweight, $160.00, +8.75%

- Ord Minnett (10/02/2021), Accumulate, $155.00, +5.36%

- Morgans (04/12/2020), Add, $147.00, (-0.08%).

The average across all 6 brokers is slightly positive, and an average TP of $145.50. MQG closed at $143.14 yesterday and is trading at around $147 to $148/share now (today), suggesting there is not a lot of near-term upside in the SP, and plenty of near-term downside if the market tanks for any reason, because MQG are very leveraged to the market, so do well in a bull market but are usually hit pretty hard in a correction or crash (or a bear market).

While it looks like it might be "as good as it gets" for Macquarie right now, things could actually get even better if there is some serious new infrastrusture spending around the globe, particularly in Australia, the USA, and Europe, and particularly transport infrastructure. Even more so if done via public/private partnerships (PPPs) and MQG are involved. But they do look fairly fully priced to me up here. I would only be interested in buying MQG at much lower levels when they've been sold down, not when they're flying (like they currently are). The risk/reward equation doesn't look attractive to me at current levels, despite their excellent report yesterday. They are solid enough, and a very high quality and well managed company, but there are better opportunities out there in companies who have more upside and less downside in my opinion. It would appear that around half of those brokers have similar views to mine.

09-Feb-2021: Macquarie Group 2021 Operational Briefing Media Release

plus: Macquarie Group 2021 Operational Briefing Presentation

MQG is not so much a Bank these days as a global asset manager, and they are particularly active in global infrastructure assets. This Operational Briefing has caused the pre-market indicative opening price of MQG shares to be well in the green - it looks like they are set to open between 2% and 3% higher than where they closed yesterday. While I do not currently hold Macquarie, they are the only Australian bank that I WOULD be interested in owning at this point. They tend to underpromise and overdeliver and they are very well positioned within their main sector of global infrastructure asset management. MQG tend to morph themselves into whatever they need to be to make money in any environment, and I believe they will continue to do so. They have a winning culture within the organisation as well. They don't call it the "Millionaires Factory" for nothing.

14-Sep-2020: Macquarie Group Investor Presentation and 1H21 Update

Macquarie is down by around 5% in the first 40 minutes of trading today on this first half update and investor presentation.

I like MQG a lot, but I don't currently hold them directly (only via LIC exposure). I would like to buy them directly at lower levels.