MACQUARIE GROUP LIMITED (ASX:MQG) - Ann: Macquarie Group Moodys Ratings Upgrade, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

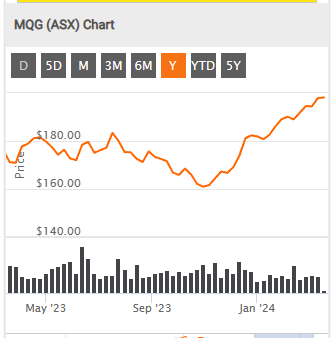

MQG below:

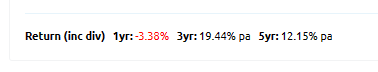

Return (inc div) 1yr: -1.24% 3yr: 19.43% pa 5yr: 13.19% pa

Return (inc div) 1yr: -1.24% 3yr: 19.43% pa 5yr: 13.19% pa

MQG Return peak to trough is 100% 1- 2 = $200/$100

Compare Growth performance:

While here - A look at CBA over the last 5 years.

Conclusion: MQG vs CBA ends up at the same destination in recent times..........x Return( inc Div ) Compared..

MQG - i guess, can have certain assets that generate returns. CBA and the big 4 have more banking rules around how they can grow their assets., to grow profitability.

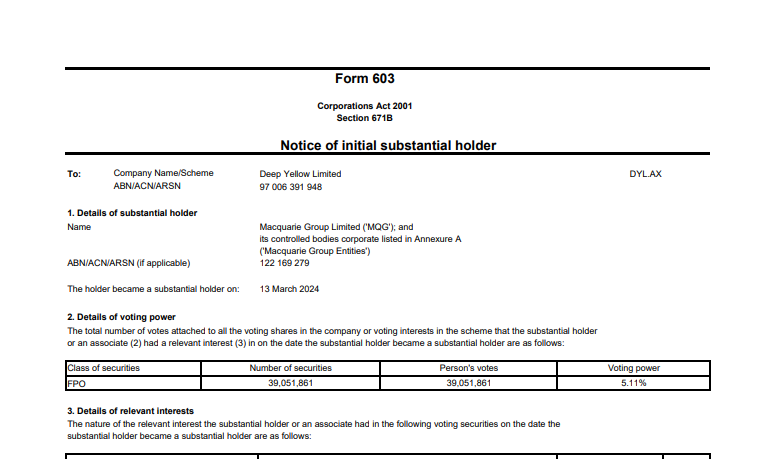

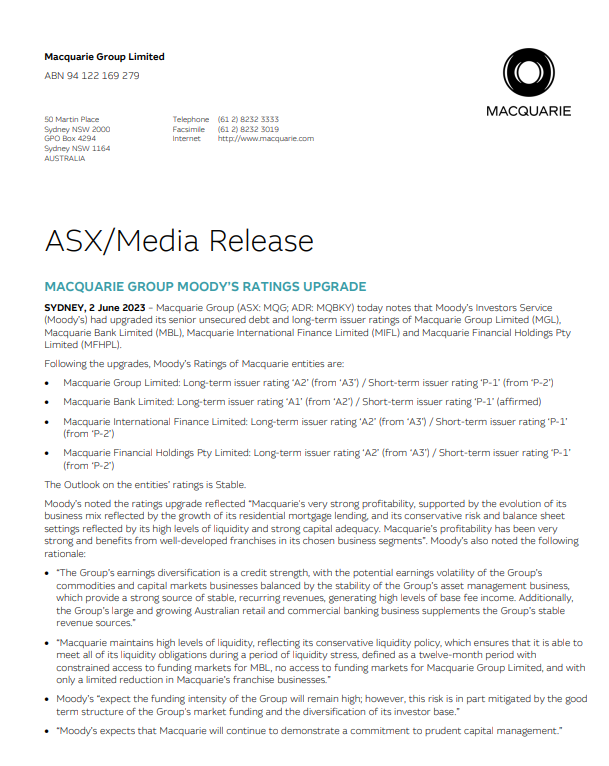

CBA chart Below:

CBA Calculate from the chart here:

Peak to trough is 66% 1- 1.666 1.666'=100/60

( so CBA less growth 66% vs MQG 100% ..not including dividends ...)

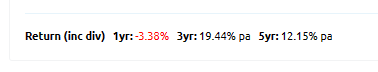

Return (inc div)

Return (inc div)

Return (inc div) 1yr:

Return (inc div) 1yr: