It seems shorters of IDP Education (IEL) are looking for any excuse to put further downward pressure on the share price.

Today, IEL announced the appointment of Kate Koch to replace Murray Walton who is stepping down at the end of this week (31st March, 2024).

Kate comes with excellent experience and credentials, previously holding CFO roles at SEEK, RMIT, Tesco and Peason (London). Kate seems like a perfect fit for the role with her experience in the education and technology sectors.

The only issue is there is a 6 month delay between Murray Walton finishing in the role and Kate commencing with IEL (by October 2024). In the interim period the CFO responsibilities will be shared by the Finance Leadership Team, other members of the Global Leadership team and the CEO.

I don’t see this as a problem, but the shorters are having a field day using it as an excuse to drive the share price down another 4% in this mornings trade.

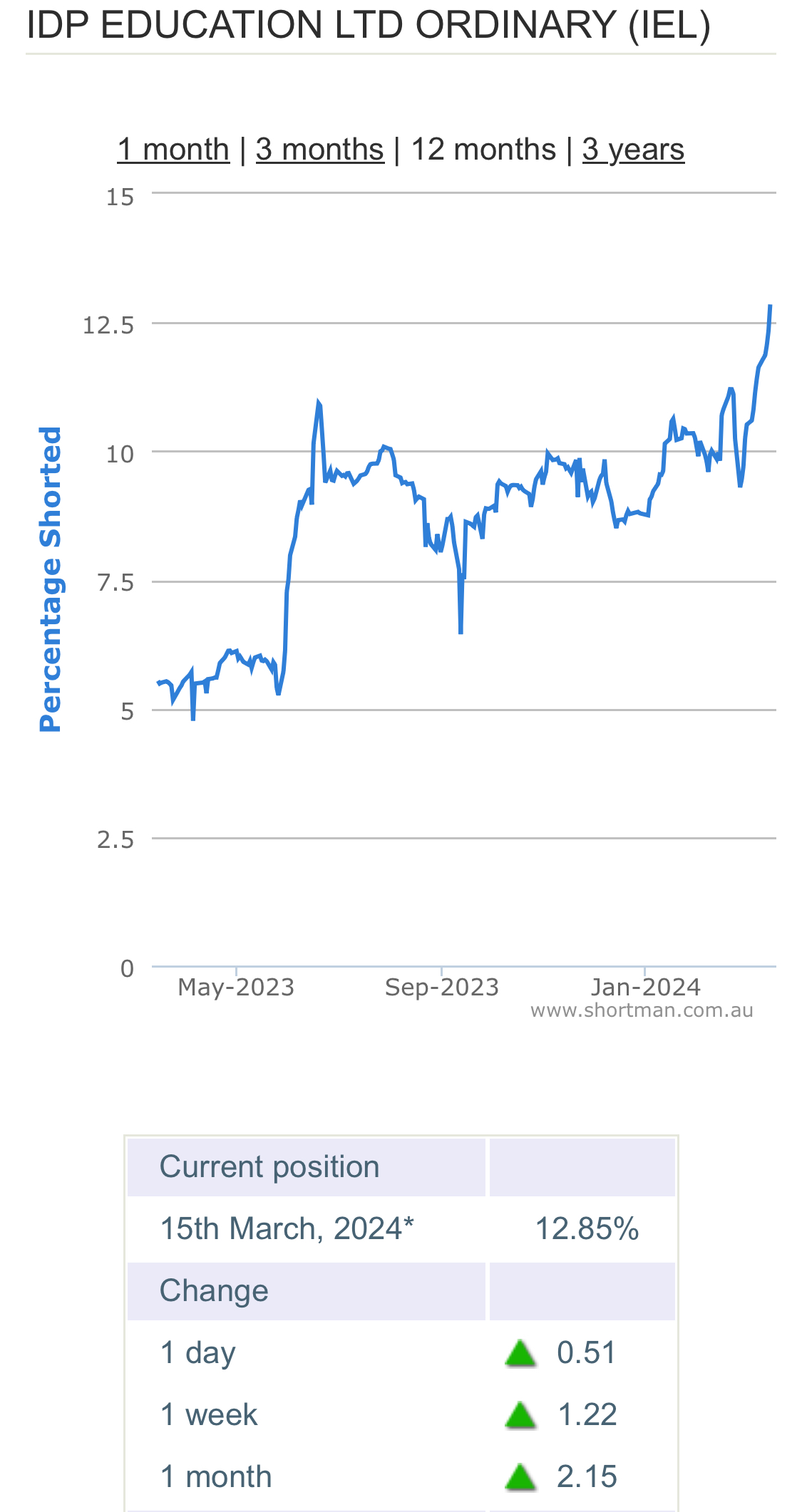

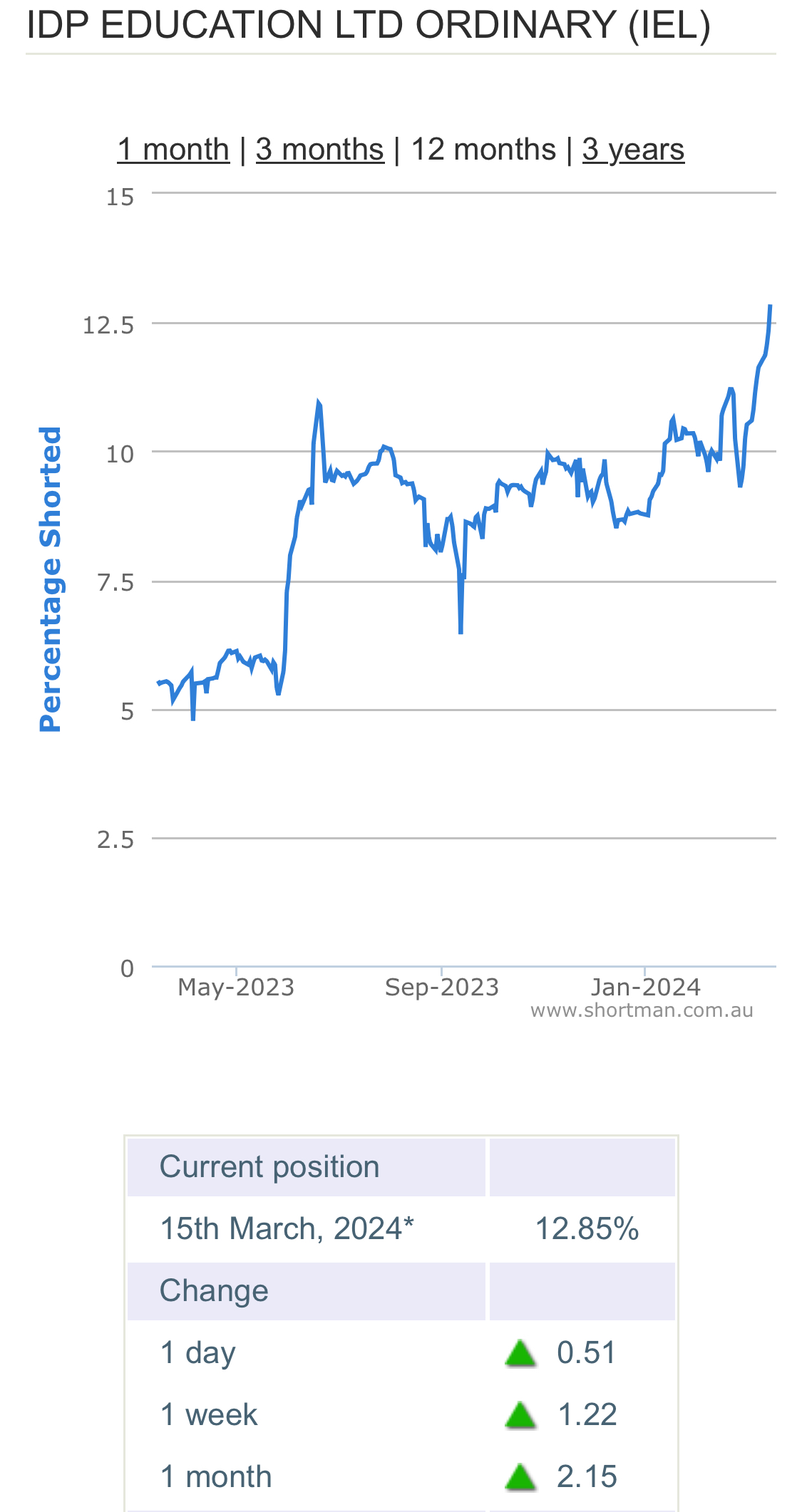

Short positions are now the highest on record with 12.85% of the stock now shorted (Shortman.com.au, 15/03/24).

For patient investors with a long time horizon (2 to 3 years), I think IEL is a tremendous buying opportunity at today’s prices. At least I am excited by the opportunity and have filled up my shopping trolley this morning. Now I just need to be patient for a few years!

Held IRL (7.9%), SM (13%)

Kate Koch to join IDP Education as Chief Financial Officer

Following an extensive global search, IDP Education Limited (ASX:IEL) is pleased to announce that Kate Koch has been appointed to the role of Chief Financial Officer.

Kate is an accomplished senior finance executive with broad international experience, including in the education and technology sectors. Kate will join IDP from SEEK Limited where she has held the role of CFO since June 2021.

Prior to SEEK, Kate was CFO at RMIT University and held senior finance leadership roles at Tesco Plc and Pearson Plc in London. Through these experiences, she developed a deep understanding of the needs of international students and educational institutions, as well as leading global teams, including large shared services functions. Kate’s extensive and well-rounded experience supports a successful transition to IDP.

Tennealle O’Shannessy said “The IDP Board is delighted to have Kate join the team. Her commitment to purpose driven organisations and her passion for developing people align fully with IDP’s values. We feel fortunate to have identified someone with Kate’s unique experience of our industry, outstanding financial and commercial skills, as well as her exposure to complex international operating environments. Her appetite for creating transformative experiences for customers using technology has shone through.”

Kate’s appointment follows Murray Walton’s decision to step down from the CFO role, effective 31 March 2024, as was previously announced in December 2023. Kate will join IDP’s Global Leadership Team and report to Tennealle O’Shannessy. Kate will commence with IDP by October 2024. In the interim period between 1 April 2024 and Kate commencing with IDP, the CFO responsibilities will be shared by the Finance Leadership Team, other members of the Global Leadership team and our CEO.

-ENDS-