Yes @Tom73 , Pantoro has a tendancy to overpromise and then underdeliver, so they're trading at a discount as a result of that poor track record of not achieving what they say they will within the time they specify. They appear to have stopped discussing their current AISC in H2 of FY2024, instead highlighting how they think they'll be a cheap producer in FY2025 and FY2026. I would suggest their AISC is VERY high at this point considering their cash receipts (total revenue) for H1 was $93.8m and their cost of sales was $131.6m for a $37.9m loss (on page 7 of their Pantoro-Half-Yearly-Report-and-Accounts-H1-FY2024.PDF) and after asset sales receipts and other costs were added in, their total comprehensive loss for the half was $15.8m (loss). No wonder they're focusing on the future instead of the recent past or the present.

See also: Pantoro’s Scotia underground mine surges ahead - Australian Mining [18-Jan-2024]

They keep projecting optimism but their results suggest something else. I don't hold PNR shares, except for a tiny virtual position here which I just trade because they're so small and often lack volume so their SP can bounce around a bit. I have held them IRL in prior years - from early 2020 through to 2022.

They have one positive currently; they are completely unhedged, so fully exposed to the very high spot gold price. The bad news is that their costs recently have been even higher than that very high gold price.

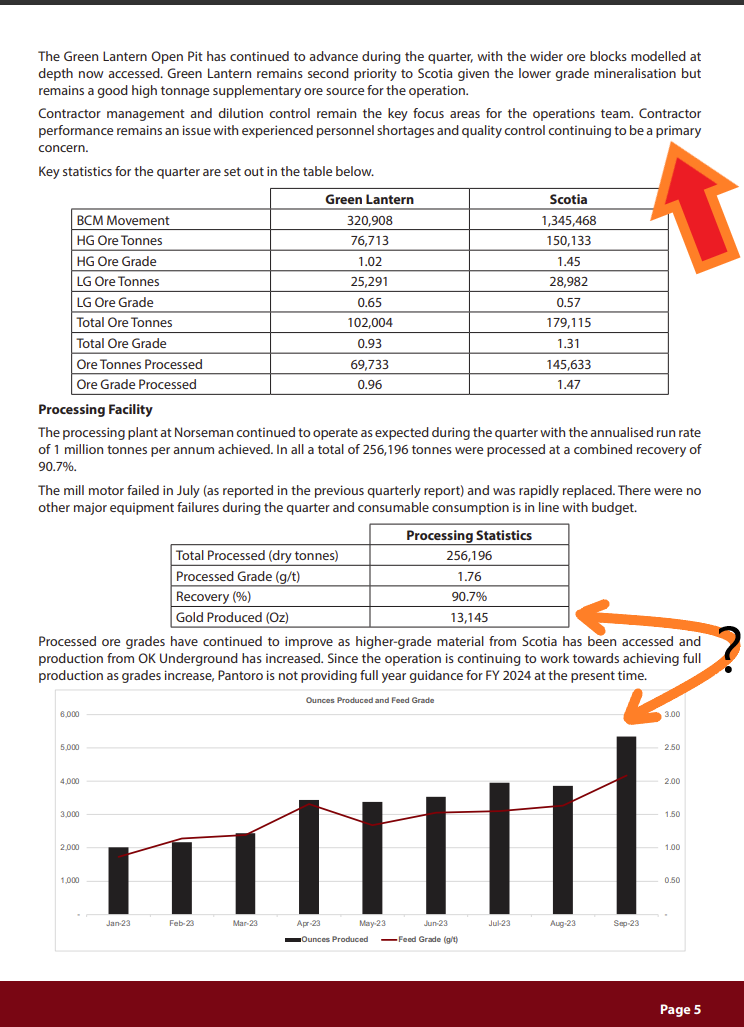

PNR have had a lot of troubles with the ramp up at Norseman, after experiencing "construction challenges" during the build (see page 5, 2nd paragraph, H1 report - Pantoro-Half-Yearly-Report-and-Accounts-H1-FY2024.PDF), including a mill motor failure in July 2023 where the mill motor manufacturer accepted responsibility and replaced the motor under warranty (see 9th dot point on page 1 of Pantoro-Quarterly-Activities-and-Appendix-5B-Cash-Flow-Report-Sep-2023-Qtr(Q1-of-FY2024).PDF), plus issues with the actual mining, with mining rates still behind schedule (see 3rd paragraph on Page 5 of the H1 report), and this resulted in an alternative operational strategy being developed during Q2 (the Dec Quarter) which was shared with the market on 17-Jan-2024 (Addendum---Underground-Development-to-Commence-at-Scotia.PDF). The strategy resulted in reduced scope in the immediate open pit operations, the early termination of the previous open pit mining contract (which was hidden in the announcement in the middle of page 2) and the subsequent mobilisation of a new contractor to site (also mentioned on page 5 of Pantoro-Quarterly-Activities-and-Appendix-5B-Cash-Flow-Report-Dec-2023-Qtr.PDF). They also said the following in that quarterly report - at the top of page 4:

"The underground contractors were impacted during the month of December initially by a COVID outbreak which affected a number of operators and maintenance personnel. Additional illness and attendance issues were experienced during the festive season affecting output during December. Contractor personnel numbers on site were restored to normal levels by the second week of January 2024."

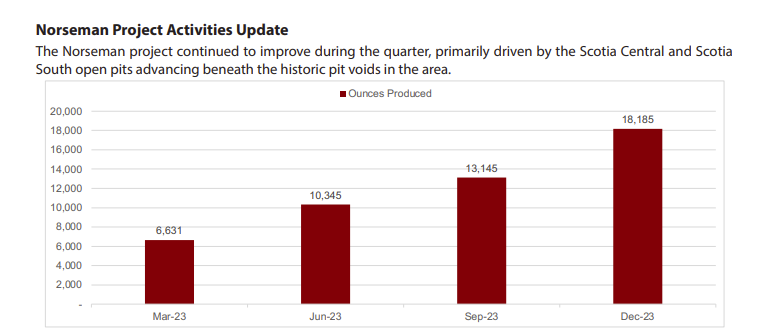

Fun and games! If you just look at their graphs, you'd think they're ramping up really well:

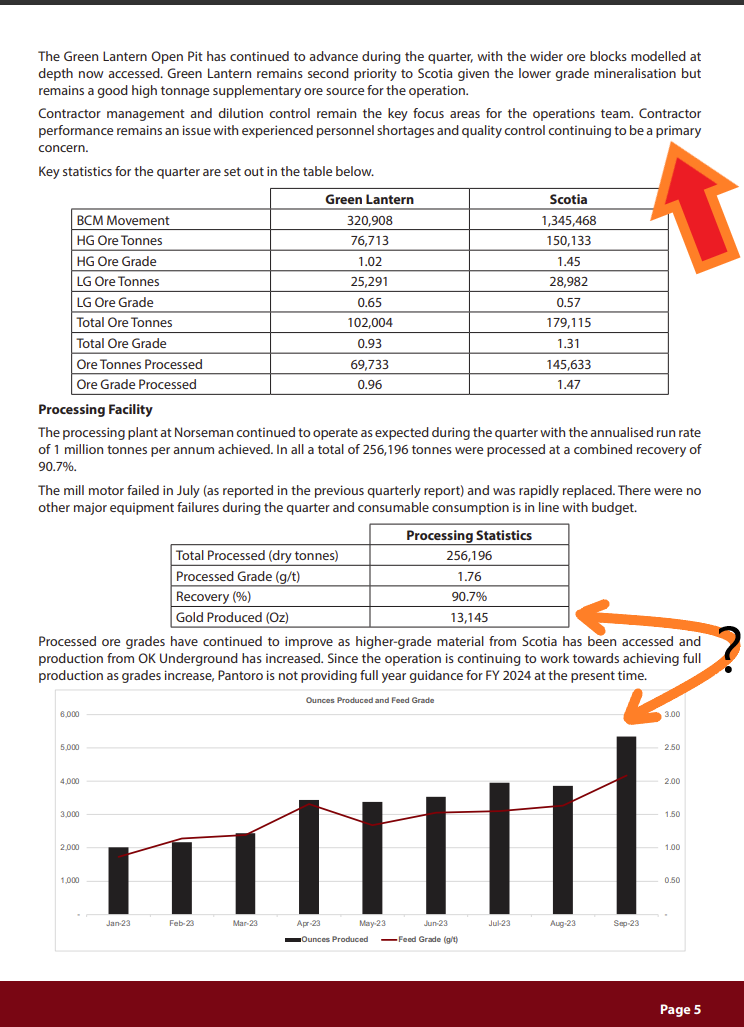

From Page 5 of their Q1 Report:

They are highlighting big issues with their mining contractors at the top of that page, but the production graph looks reasonable, even if the numbers on either side of the graph do not match up to the numbers in the table above because the table is for the quarter (3 months) and the graph is monthly production.

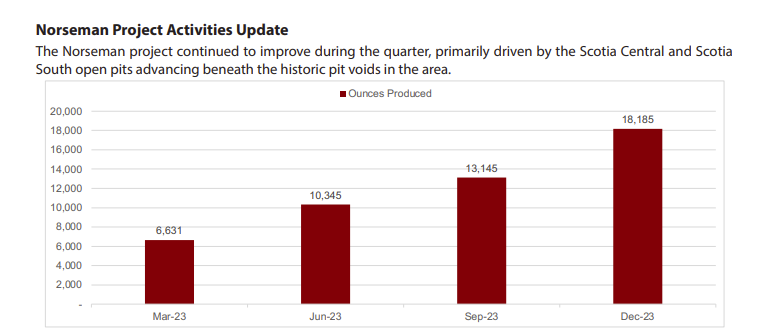

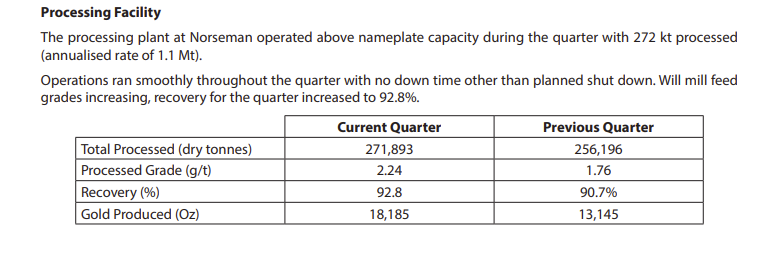

And then in the December quarter (Q2) - we get the graph on page 3:

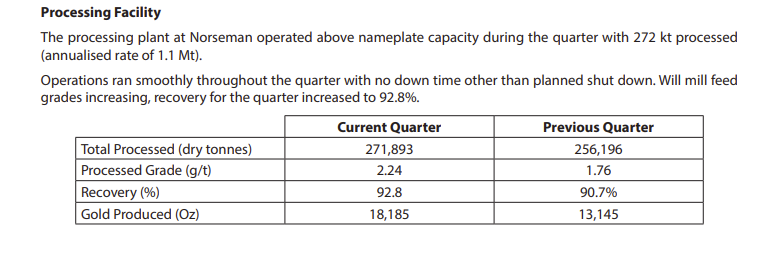

This time showing quarterly production, as you should in a quarterly report, and then the corresponding table down on page 5 for some reason:

I assume they mean "With mill feed grades increasing...", instead of "Will mill feed grades increasing..."

The reporting is a little rushed, or at least not properly proof-read, and certainly not consistent, so it can make it a little hard to follow, especially when they haven't given us their AISC for the past 6 months. My overall impression is that they've had more than their fair share of hurdles and setbacks to deal with, and they've pushed through it all and seem to be coming out the other end, but I would caution you to be wary of any management team who consistently overpromise and then underdeliver. If they do come good and continue to ramp up and meet that FY25 and FY26 cost guidance - which I highly doubt by the way - but that's just me (naturally sceptical) - I don't trust management who won't tell you what's really going on now in terms of costs but promise that things are going to be rosy in a few months time - but if they do manage to meet that cost guidance... then they will prove to be a bargain buy at current prices, all other things being equal, however the market is clearly sceptical, as I am, so that's why they look cheap, because they've earned the discount.

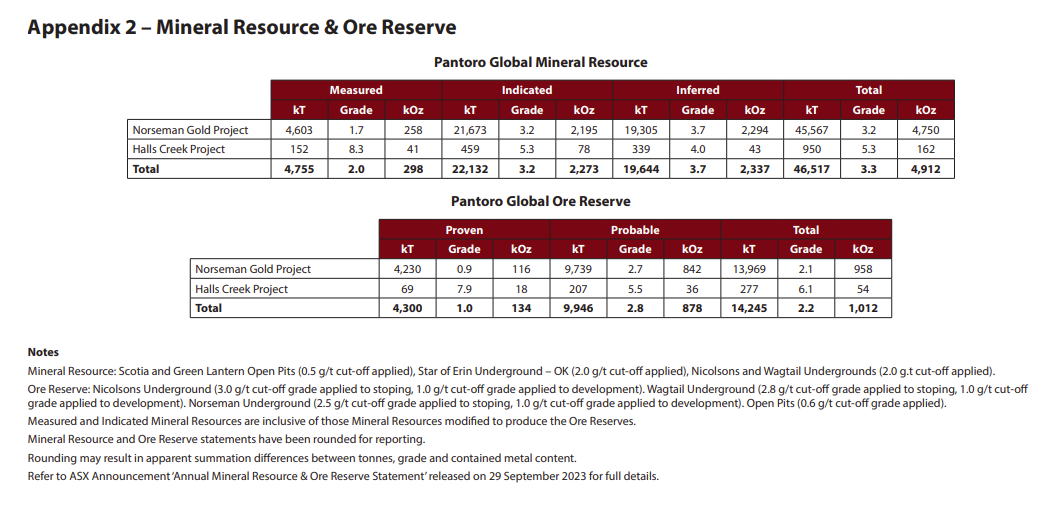

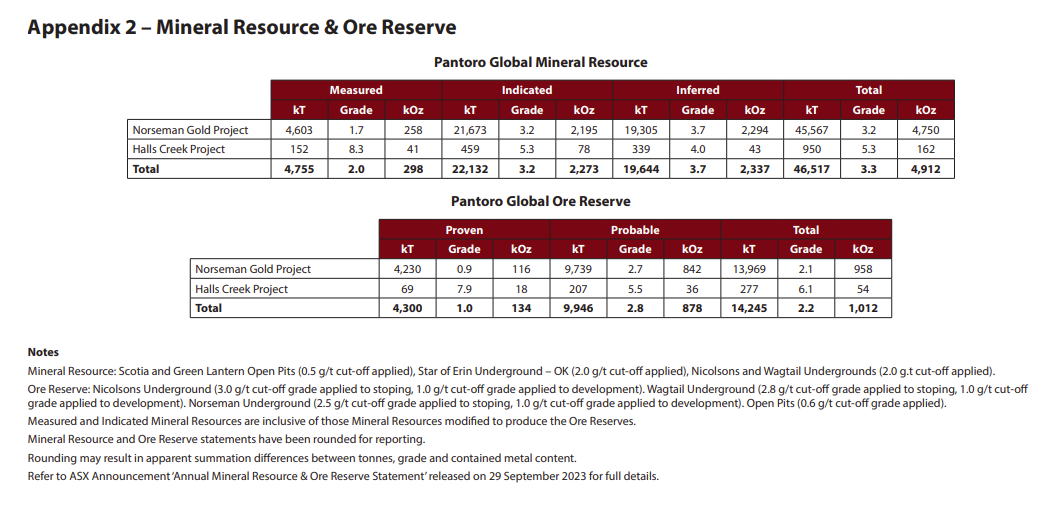

Putting the company in perspective: You get a strong impression from a lot of their announcements that they have a lot of gold there, especially in Scotia underground, however they have produced just 48,300 ounces of gold over the past 12 months, and their Appendix 2 – Mineral Resource & Ore Reserve tables on page 12 of their Q2 report states that they have a Global Mineral Resource of just under 5m ounces of gold, and a Global Ore Reserve of just 1m ounces, and that includes both Norseman and Halls Creek.

...and so far the gold at Norseman has proven harder to get out of the ground than anticipated, as demonstrated by their various issues with their mining contractors.

Even if they could produce 25kOz in Q3 and 30kOz in Q4, they'd only produce around 86kOz (86 thousand ounces) of gold for all of FY24.

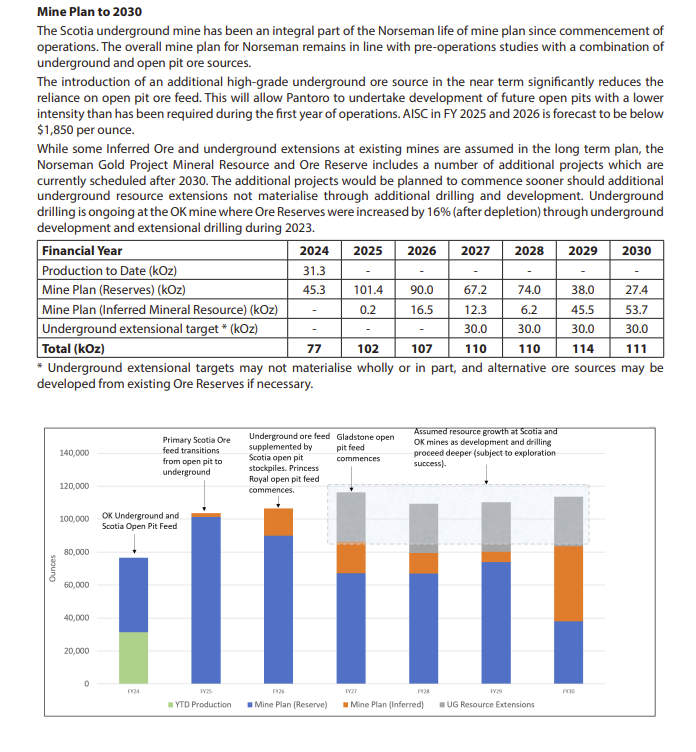

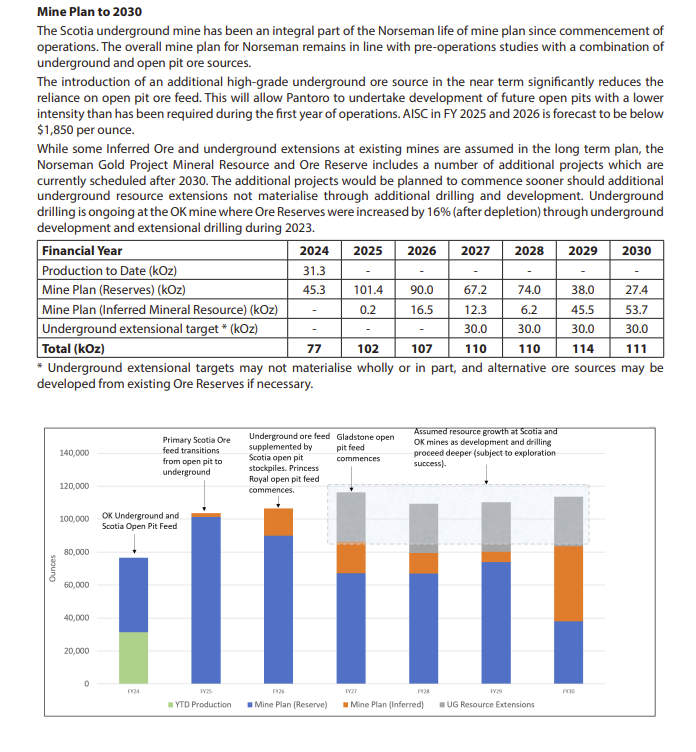

And they have now given us production guidance for FY24 - of 77 kOz (see below), just no cost guidance for FY24, and cost guidance for FY25 and FY26 of below $1,850/ounce, and production guidance through to 2030:

So IF everything goes to plan, they aim to produce up to 114kOz p.a. and around 110kOz most years for the 4 years between 2027 and 2030 inclusive. That would be good. But as shown above, a lot of things need to happen for that to become reality. However, if all of the stuff written across the top of that graph above does happen just as they hope it all does, then they could be a $110kOz/annum gold producer. They'd still be small compared to most other gold producers on the ASX, but that's OK, IF they can do it at around $1,850/oz or less, as they expect to in the next two financial years. The trouble is they haven't given us much reason to expect those projections (that guidance) will be achieved. Based on their track record to date, the market remains sceptical that they can achieve these targets. After all, they haven't achieved any of their previous targets/guidance within the time they gave.

With gold miners, you have to look at (1) the project quality - which isn't just about gold grades, it's also about costs and mine life, and (2) the company's management. Are they good at what they do. Do they set realistic targets and then achieve them? Do they show a good track record of superb capital allocation decisions, including when and how they raise money, and providing good total shareholder returns either with their current company or with prior companies they have been involved with? Are they unhedged or hedged, and what does their hedgebook look like if they are hedged? Strategically brilliant or diabollically stupid? If producers, is their EPS rising? And so on. As I said, PNR are not hedged so that's one tick, but they're also not yet profitable, and they haven't been meeting their own cost or production guidance.

Buffett once said: "I always invest in companies an idiot could run, because one day one will."

That probably applies to a lot of companies that Buffett first invested in, like See's Candies, where the products they produce virtually sell themselves and management don't need to do much because the business model is so good. However, it does NOT apply to mining companies, particularly gold mining companies, where capital allocation decisions have a HUGE impact on shareholder returns - or losses. As I explained here (scroll down to the Johnny Mac stuff), legendary Aussie gold company analyst John Macdonald used to keep a spreadsheet to keep track of total revenue and total spending by Aussie gold companies over the decades and he said that when he last looked at it, a couple of years ago, there were only TWO companies that had got more money out of gold than they had spent (put back in) - and one of those operates only in West Africa (PRU) - so I won't touch them despite their success because I consider the downside risks are just too high.

The other one is SLR, which was once known briefly as Roger Montgomery's Goldmine, and there was a gelati named "Montgomery's Goldmine" in a famous gelati bar in Sydney at the time - which looked delicious - but I never got to taste it. He was spruiking the company without naming it for a while, and there was a bit of a guessing competition going as he let out more and more clues - the big thing was that he had never recommended mining companies before and had always called them price takers and did not consider them investable. Turns out it was Silver Lake Resources - this was over a decade ago - and once that news got out their share price rallied and Roger promptly sold out and never talked about them again, which coincided at the time with a rather nasty share price decline, mostly because of negativity around the sector at the time but also because of M&A concerns, including that they overpaid for Integra Mining (was IGR.asx) in the second half of 2012. SLR paid around $425m for Integra, via SLR shares which heavily diluted existing SLR shareholders because Integra shareholders ended up owning ~40% of the enlarged Silver Lake and the offer was pitched at a 44% premium to the last IGR closing price at the time and at a 40% premium to the 20‐day VWAP. Fairly generous, to say the least, and it's fair to say that while SLR has made money for their shareholders over the years, that IGR acquisition was not their finest decision.

Every gold deposit has a finite mine life, if it is viable to mine at all, and you will always eventually run out of viable gold at every mine, so they have to keep spending money on either exploration drilling to find more gold, or M&A to buy gold deposits that have already been found by someone else, or both. Most Australian gold producing companies that have been successful over decent periods of time have done both - organic and inorganic growth, however unlike normal manufacturing where you can keep making the same thing forever as long as there is still a market willing to buy it, gold miners have to constantly find or buy more gold to mine, preferably before their current mine(s) run out of mineable gold, meaning gold that can be mined and processed (gold extracted from the ore) profitably - there are plenty of gold deposits that remain undeveloped because either the grades are too low, or there's not enough gold there to make it worthwhile, or the costs are expected to be too high, so even when more gold is found, it doesn't necessarily mean that it's going to be mined, or mined by the company that found it. It has to be worth the effort, it has to be profiitable to extract at scale, at current gold prices.

I used to invest in mining companies mostly based on gold grades, thinking the higher the grades the better the assets were, but it's not that simple, costs can vary greatly and the gold is only worth what you get for it AFTER costs, and if the costs are too high, as Pantoro's obviously have been (they have been reporting losses), then the profits aren't there, so there's little benefit in being a shareholder, and a fair amount of risk, including potentially further capital raises. And even when a gold producer is making lots of money, the outcome for investors is usually determined mostly by capital allocation decisions of that company's management.

My point is that management play a HUGE part in whether you are going to make money investing in a gold miner or lose money. There are other factors, but do NOT overlook management quality and track record.

And given that quality management with a good track record is a major factor in my own decision making, I wouldn't be investing any of my real money in PNR at this point unless it was for a short-term trade, and even that would be high risk in my opinion, which is why I probably won't be doing it. I would first, at the very least, want to see them actually hit (meet) their own guidance for a few quarters, including AISC guidance, which we currently do not have. Then I'd reassess.

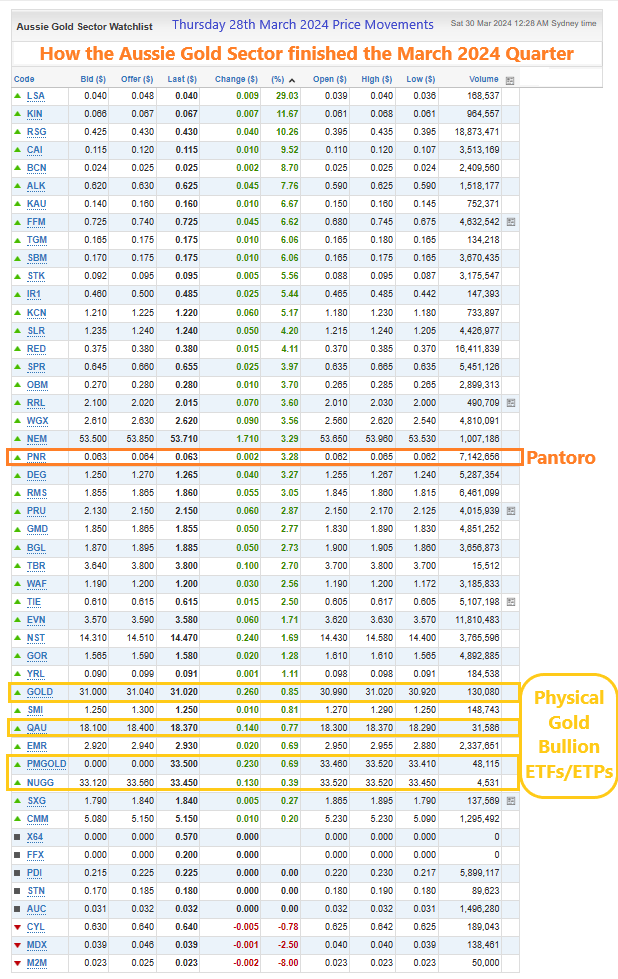

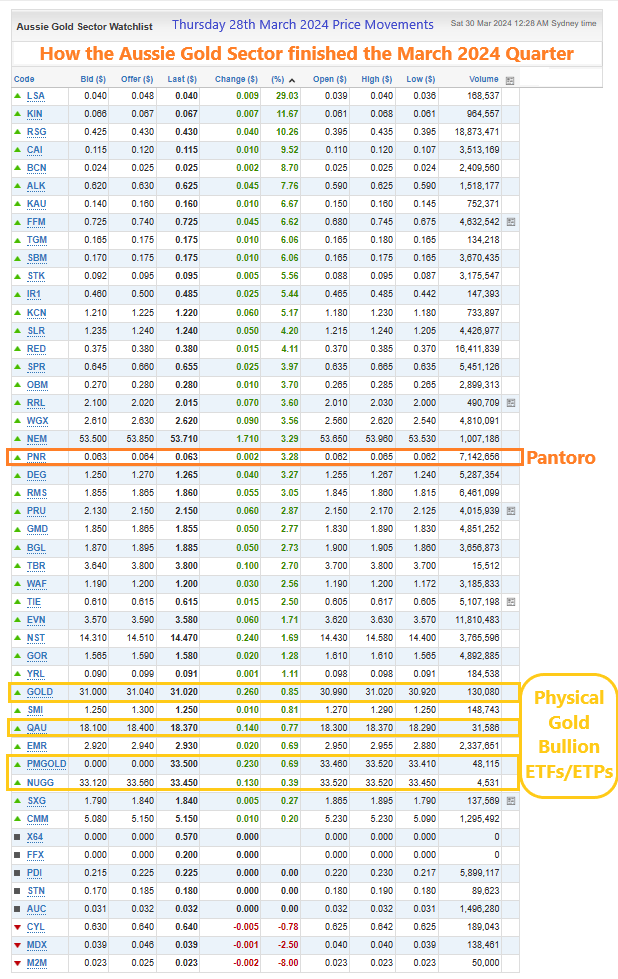

Final word - on this list below, at least 22 of those companies produce gold - i.e. they are gold producers, not just explorers or project developers, and that list includes Pantoro, however I reckon there are probably 12 to 15 companies on that list that are better companies and safer bets in my opinion than Pantoro at this point in time based on their recent track record (past 18 months), and I own shares in five of those, however that's just my opinion, not advice. Everyone has a different risk tolerance, and not everyone will read the same data and come to the same conclusions either. Hope that helps anyway.

P.S. One other thing, I know they are trying to sell Halls Creek, and they say they have interested parties, but how much do you think it's worth? It has very little gold left there (as shown above in the Mineral Resource & Ore Reserve tables from page 12 of their Q2 report). Somebody might buy it, but I don't think it's worth much at all personally. JMO FWIW.