Pinned straw:

@Strawman I caught up yesterday with the $AVA interview, and your notes are a great summary.

There are two major question marks in my mind.

- Order to Cash: While the order book build is encouraging, none of the explanation helps me understand the timeframe by which orders convert to cash. While on the one hand Mal indicates that he has clearly modelled this for a range of outcome in his guidance model, personally, I like to have my own understanding of how the money machine works. I don't have that feeling for $AVA. This concern was reinforced by Mal's remarks of the uncertainty in the timeline for some of the large projects. (Large project executions can move around by years, particularly at the back end.)

- $TLS Deal: While I think we all understand how supply agreements work and how they aid procurement and the credentialling that comes by having $TLS as a client, I am none-the-wiser as to how material this deal might be. Furthermore, the fact that the client use case relies on software developmnet by the client leaves me wondering whether they are supplying a commercial operation or an R&D project by $TLS. If so, there is a whole execution risk component on the side of $TLS and, as a development project, I'm not sure what risk to apply to volumes even if I understood them. Then you add to that the 2-year term, and as an investor I see a lot of risk around the "materiality".

On 1. I haven't done enough of a deep dive into $AVA. So maybe the information is there and I'd be grateful if any StrawPerson can explain it.

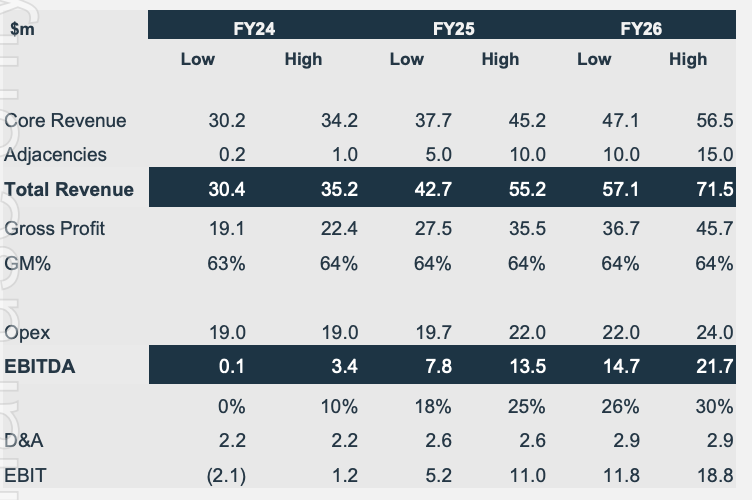

While I have briefly held $AVA on two occasions before losing confidence, I came away from the meeting without a better understanding of the value of the business. All I have is the three-year roadmap/targets. If that is delivered then I agree with you, the business is absolutely undervalued.

Mal appears to know his business, he was candid (and open where he couldn't be), and the meeting was a BS-free zone, which I like. For example, he was happy to own up to where he has got things wrong (the calendar roadmap; the time to rebuild the commercial team). However, beyond the three-year roadmap/targets I don't feel I understand enough about the business and how it makes money.

What would make me change my mind? 1) Visibility on conversion of the order book to cash, giving confidence in the three-years targets. 2) Evidence of $TLS purchases - there was a glint of light in that Mal implied there would be evidence in upcoming reports.

$AVA remains on my watchlist and I'll be looking at the next 2-3 reports to see if a thesis is supported. The industry thematic, the global market, three related segments, impressive client list, healthy gross margins, and emerging evidence of cost control and potential scalability means this could be a gem in the making.

One point of the discussion is worth underscoring - to an investor a year can seem like a long time. But for a CEO it passes in the bliink of an eye. It is entirely possible that Mal has laid some great foundations in the last 15 months or so, and that he is communicating in the best way he can the success that will come via his 3-year roadmap. We'll see.

Disc: Not held (yet).

I sold out of my small position after the H1 trading update on the fear of a capital raise, and a lack of trust in management that they didn't dilute, however still like the business in the long term, and now post cap raise, with the Telstra partnership, business restructuring and depressed SP it is an interesting setup. If Mal as CEO truly believes with strong conviction in 2.5 years they can do $12-$19m in EBIT with a current market of <$40m it would be an easy 3-7+ bagger, with EBIT multiples of just 10-15x, you would think he might want to purchase some shares beyond his 10,000 ($1,400 worth). Idk maybe the stock market and the volatility are foreign to him like many people and doesn't want to get involved, he is incentivised by the share price so there is that but would like to see him put his money where his mouth is beyond a PowerPoint presentation.

Thanks for sharing your thoughts. Has this latest sit-down with Mal altered either your view or valuation of the business?