I found this story below about the history of IDP Education (IEL) fascinating. It was covered by Julie Hare from the AFR in June 2023.

After reading this story I felt like the headwinds IDP Education is currently facing, including the temporary international student and spousal visa caps in Canada, Australia and UK, and opening up the International English Language Testing Scheme (IELTS) to competition in Canada will be viewed in future years as a temporary ‘blip’ in the history of a growing global business.

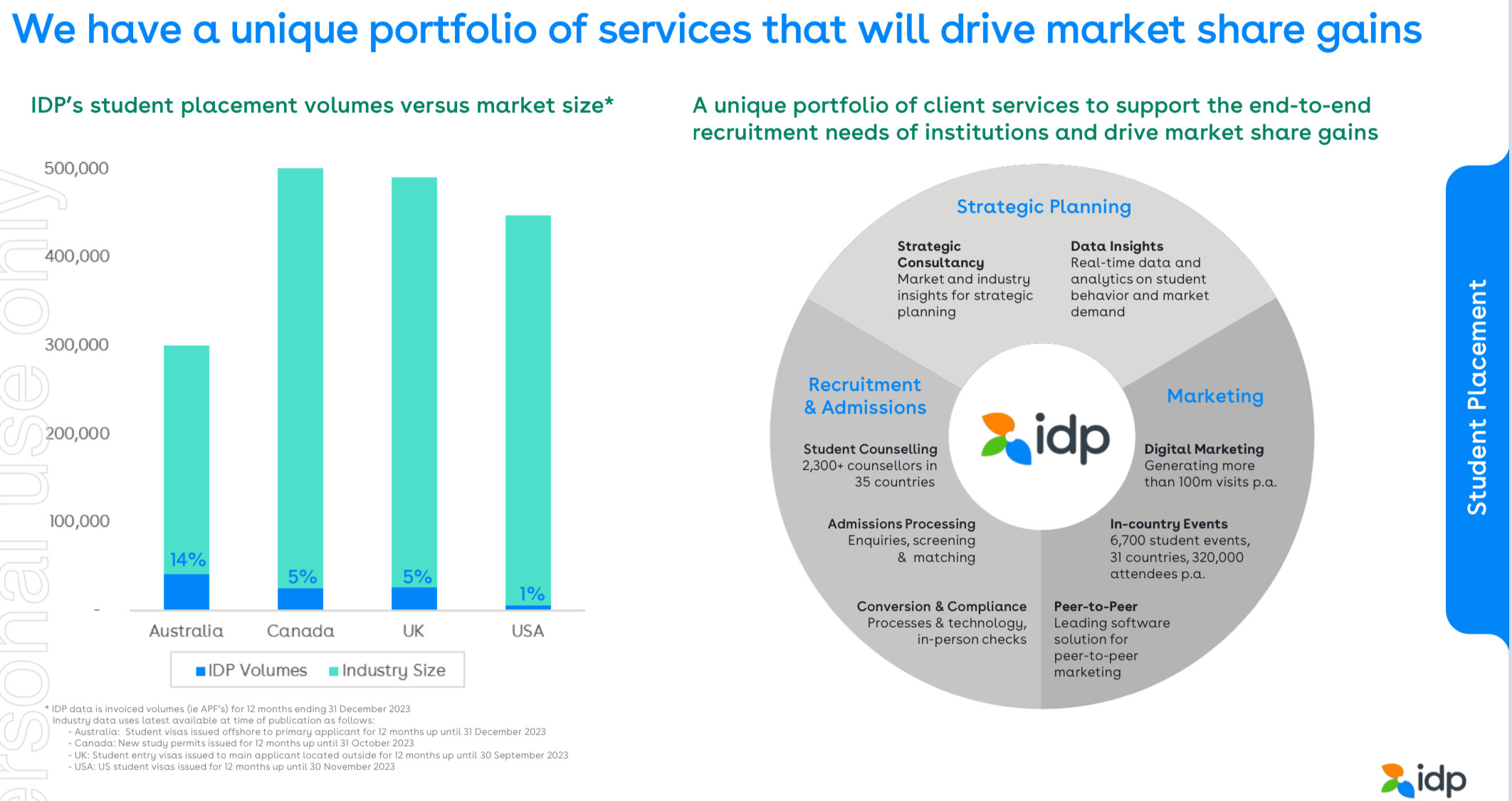

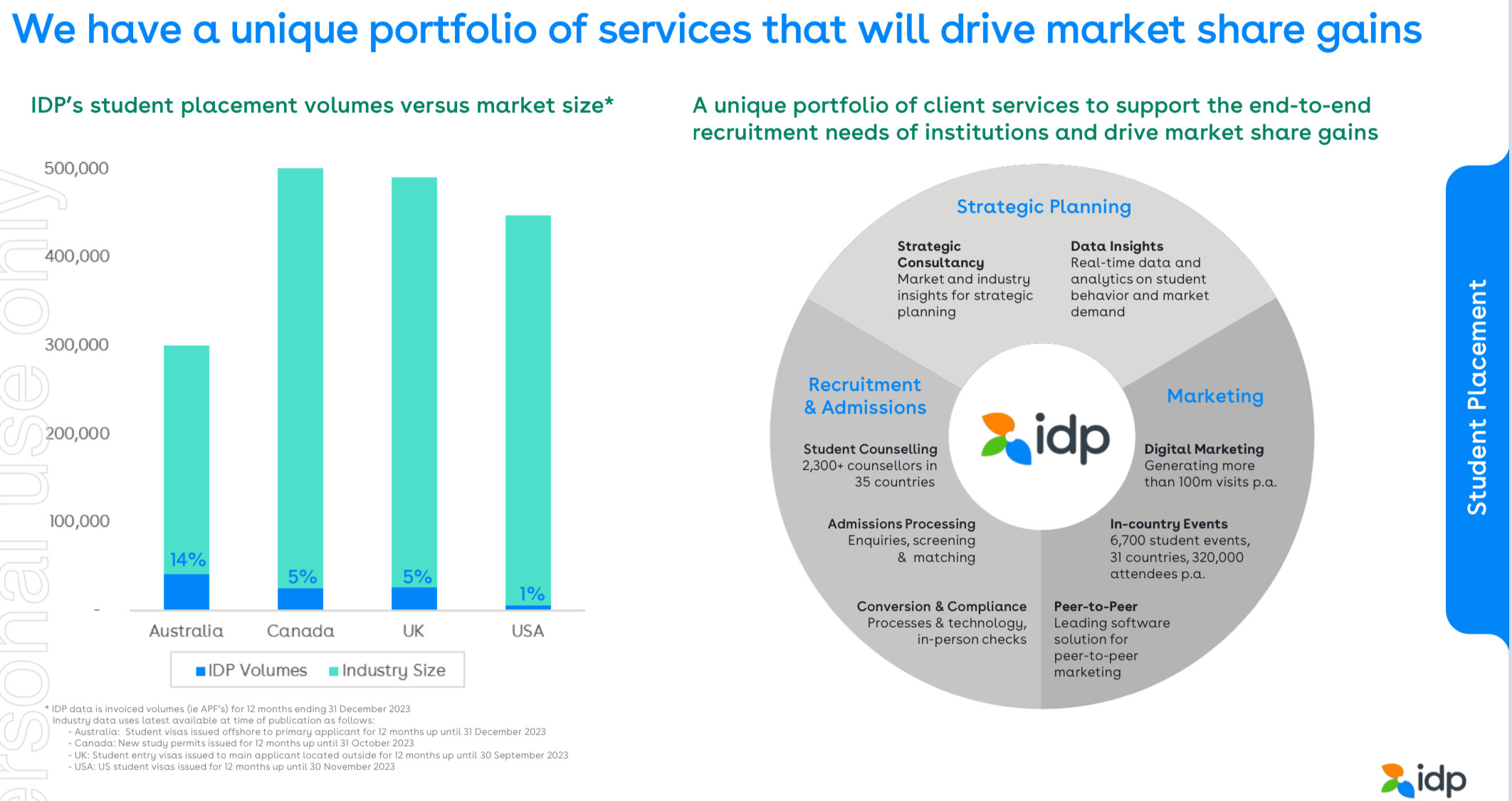

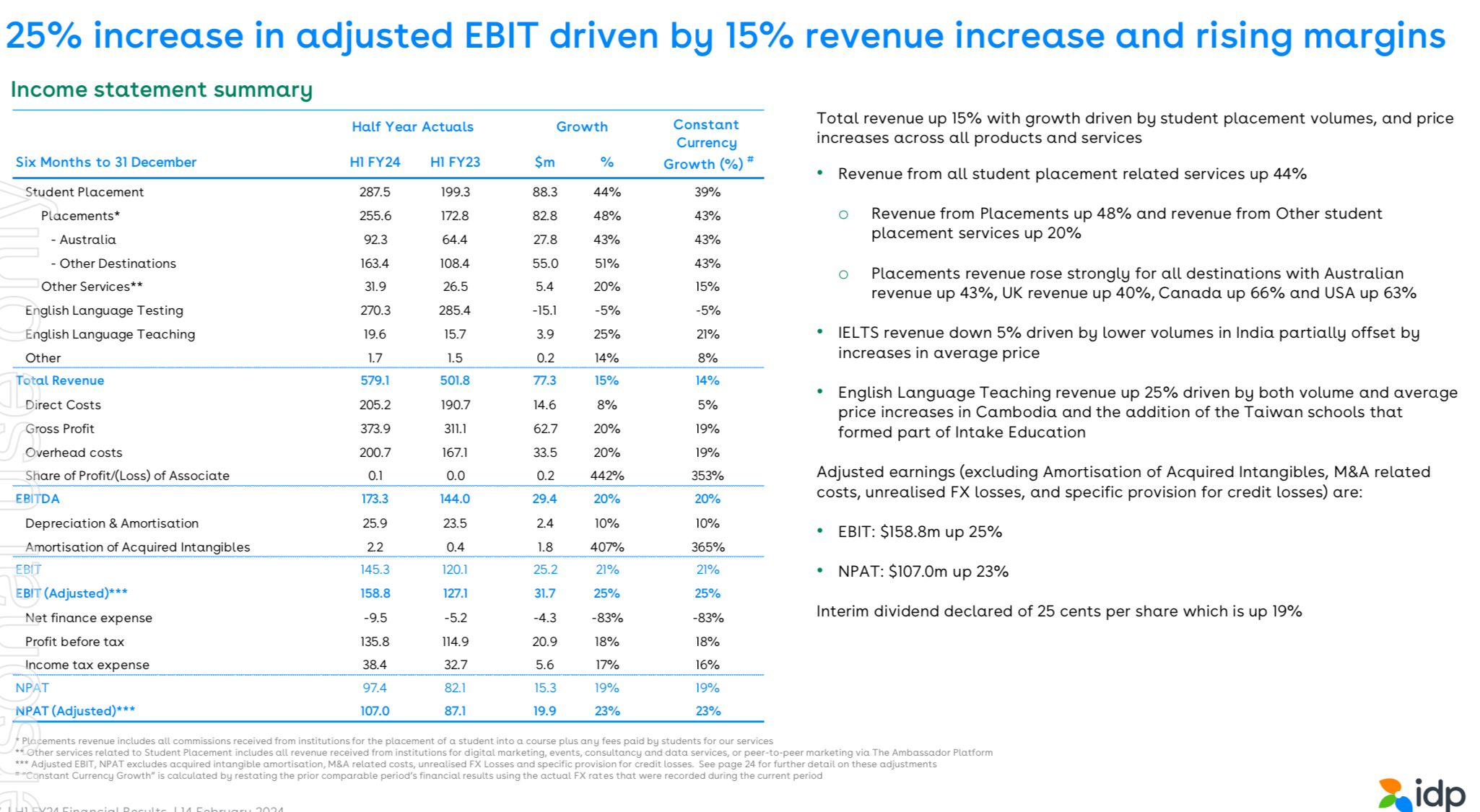

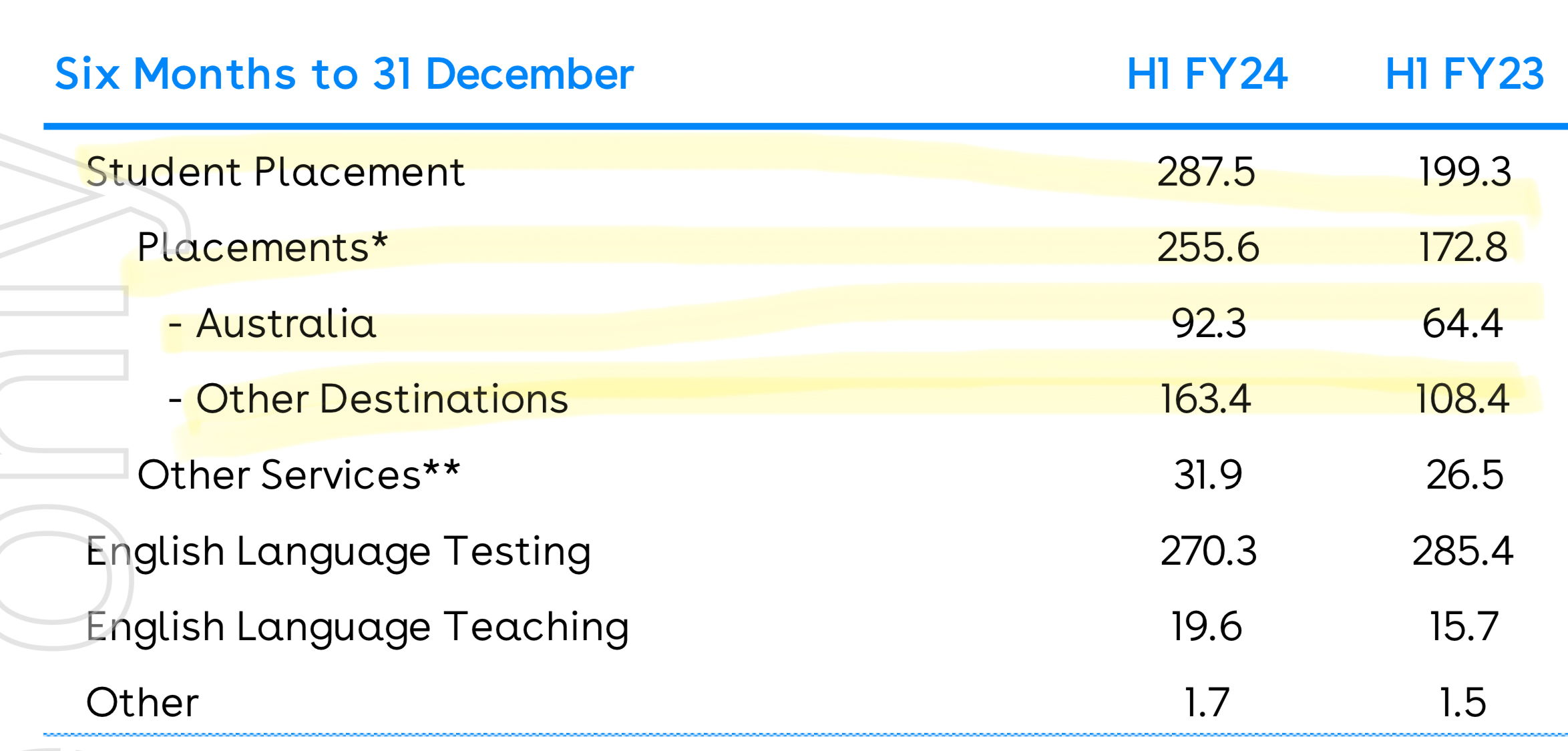

The future of IDP Education is swinging more toward international student placements where they have significant pricing power in a huge total addressable market (TAM), as this chart from the 1H24 Investor presentation shows. IDP Education student placement volumes in the US are only 1% of the total potential market.

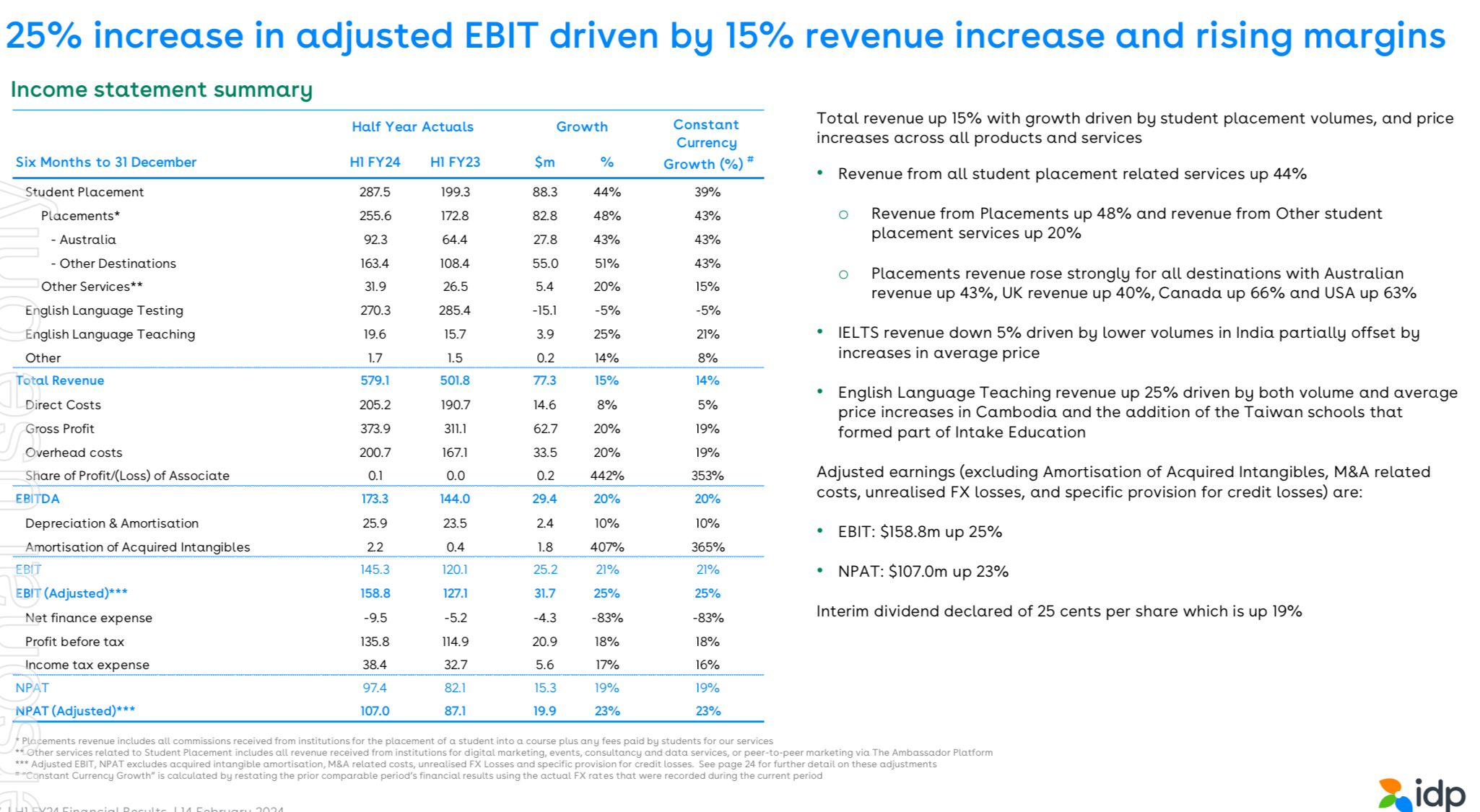

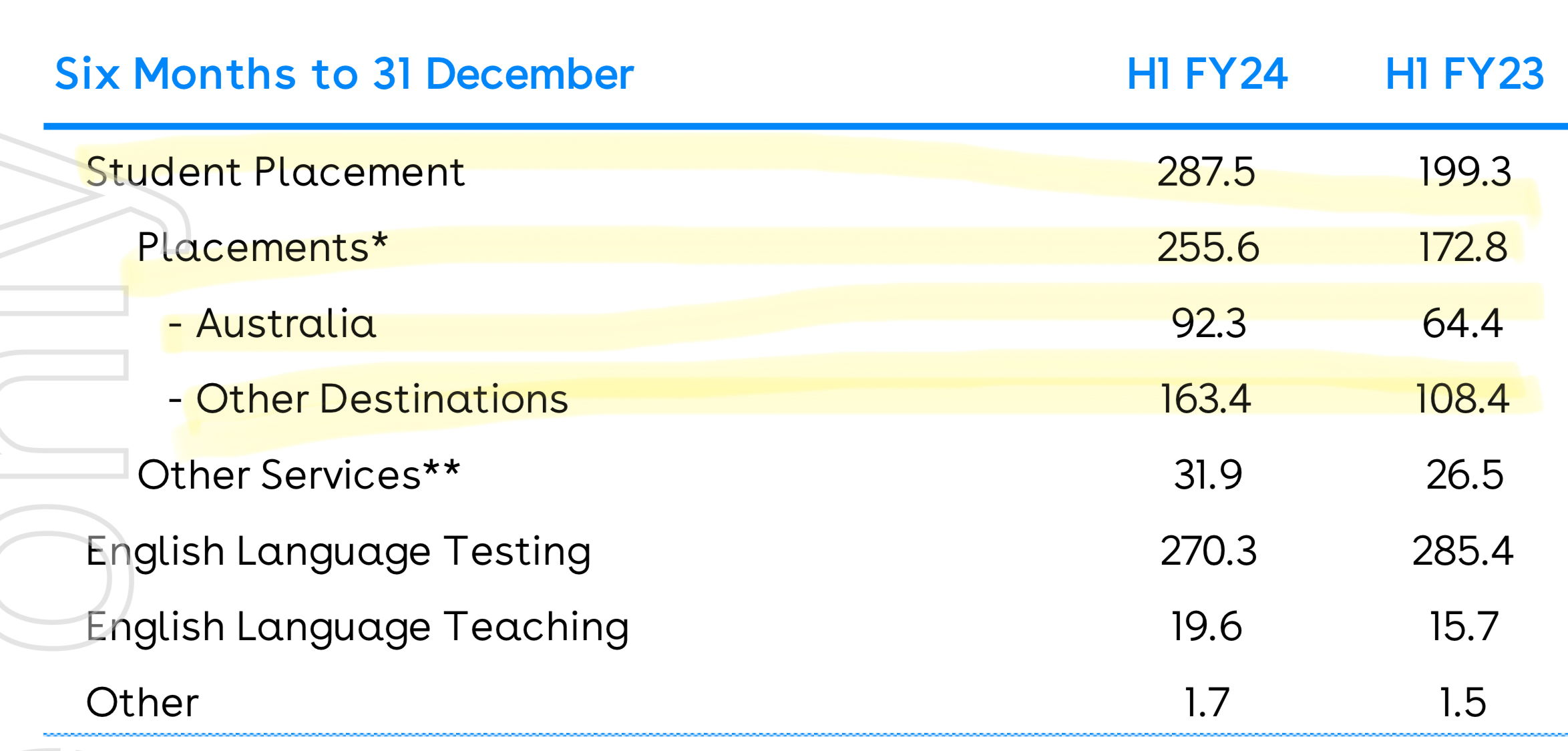

The slide below shows how quickly IDP Education is transitioning toward student placements where they have more pricing power and higher margins. EBIT for student placements was up 43% in twelve months and now surpasses IELTS as the major source of EBIT.

And now to the history of IDP Education…

How this company created its own multibillion dollar industry

IDP Education has one of the most peculiar origin stories of listed companies, creating from scratch a world-first industry that is now Australia’s third-largest export sector.

The first-ever student recruitment agency has surfed a tidal wave of demand for study in English-speaking destinations. Six million people now travel to another country to study.

The groundbreaking company was also integral to the introduction of the world’s first English-language proficiency test but, according to its new chief executive officer Tennealle O’Shannessy has never, in its 44-year history, veered from its central mission: connecting people to a transformative future.

“It’s important to understand where IDP has come from. This is an organisation that is driven by purpose and a clear set of value that permeates through the culture and the team. That’s why it has been able to achieve so much over so many years,” says O’Shannessy, who has been at the helm of IDP since February.

“It’s been 50 years of building trusted relationships with student and institutions. That is the core of our business.”

In The Australian Financial Review’s Fast Global list, IDP Education has the largest offshore revenues in 2022 of $754.8 million. Its success reflects a diversification strategy that began in 2009 and continues to this day.

The strength of the company can be seen through its figures during the pandemic. With borders closed and students learning from home, IDP still reached $428 million in offshore revenue in 2021, down from $529.7 million in 2020.

IDP Education has a provenance unlike any other company in the ASX 200.

Its beginnings were humble, emerging in 1969 as a government scheme to link Australia’s universities research with Asia and as a soft diplomatic power. Throughout the 1950s and 1960s, students had been coming here to study under the scholarship-based Colombo Plan. Others arrived as private students.

However, in 1986, the forward-thinking Hawke government saw a new source of potential revenue for universities in educating the children of middle-class families in South-East Asia.

IDP – or the International Development Program – already had an office in Jakarta and in 1986 it introduced a counselling service to recruit students to Australian universities.

Over the next few years, it opened new offices and by 1997 had a presence in the Philippines, Singapore, Thailand, Malaysia, Taiwan, China, India, Vietnam and Mauritius.

As numbers increased, it became evident that a test was required to determine and verify the English-language skills of prospective students. In 1989, the groundbreaking IELTS – International English Language Testing System – was launched in partnership with the British Council and Cambridge University.

By 1996, the Hawke government passed ownership of IDP to Australia’s 38 universities and a corporate structure was created.

Australia was the world leader in commercialising education to international students. While wealthy families had for centuries sent their children across the globe to be educated at the world’s finest institutions – think Oxford, Cambridge, the Ivy League – Australia was the first country to see the economic possibilities of a university degree from an English-speaking country.

By 2006, numbers were booming and the 38 university shareholders came to the realisation that they did not have the necessary skill sets to run it efficiently and profitably.

So in 2005 it went looking for a corporate partner that could take it to the next level.

Brothers Andrew and Paul Bassat were riding high with their online jobs board seek.com and were on the lookout for adjacencies to their core product. Universities, they figured, was a way of connecting education and employment and improving the value chain of seek.

In 2006, they paid $36 million for its 50 per cent stake in IDP with the 38 universities retaining the other 50 per cent.

In 2007, Peter Polson was named chairman of the board, a position he still holds.

Two years later, IDP embarked on what, at the time, was a controversial and counterintuitive strategy – to recruit students to universities in countries that were competitor nations to Australia. It started with the US and now includes New Zealand, UK, Ireland and Canada. It now has more than 190 offices in 35 countries.

The next step in the company’s evolution was to list on the Australian Securities Exchange in 2015, which saw the end of seek’s involvement and the recruitment of a new chief executive, Andrew Barkla.

Barkla pushed a diversity agenda, with the company extending IELTS operations to new markets, oversaw the acquisition of aligned companies and the development of a new and sophisticated online platform.

IDP is now the world’s largest student recruitment company, which has in the past few years fortified its capabilities by developing sophisticated digital platforms. It has a 600-strong campus near Chennai in India that is dedicated to building IDP’s technical and digital innovations.

Its newest offering is called FastLane, which promises to get students an offer from an institution in seconds.

“We are focused on reducing the time in bringing offers to students earlier on in the process,” says O’Shannessy.

“The decision to study overseas and embark on an international education and possible migration is an incredibly high stakes decision for students. There is a lot of uncertainty in the process. With FastLane we aim to bring certainty more quickly around the offer process.”

In Australia alone, IDP recruits about 30 per cent of the half million or more students who come here each year.

It’s a company that has, in its many guises, been characterised by big bold visionary moves.

And yet, says O’Shannessy, it never lost sight of the need to be “deeply connected to our customer needs”.

-ENDS-