Dermal and wound repair company $ARX published their quarterly today.

Overall, incremental progress on all fronts. I don't hold (RL or SM) but continue to monitor as part of my focus on the sector, where I have a significant holding in $PNV.

Some lumpiness in results is driven by the restocking behaviour of their US Partner TELA Bio.

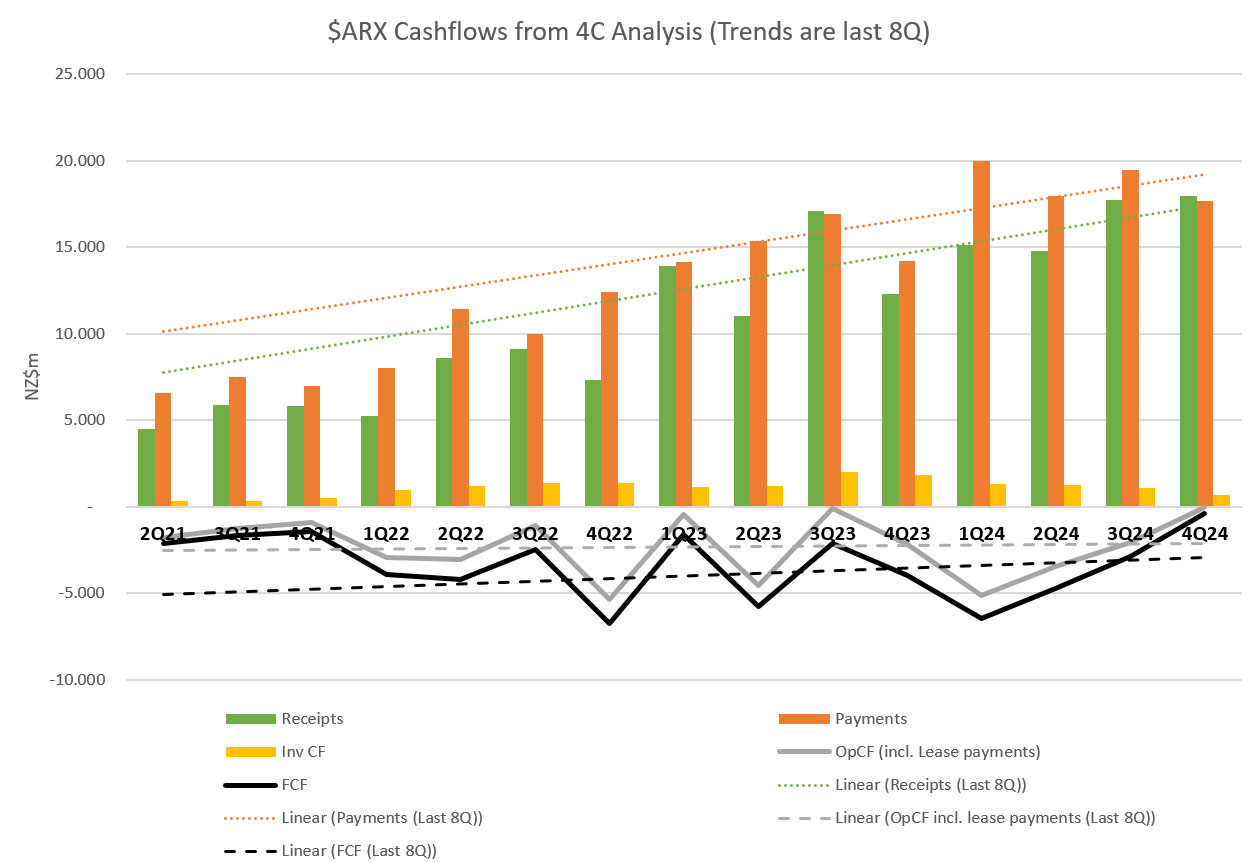

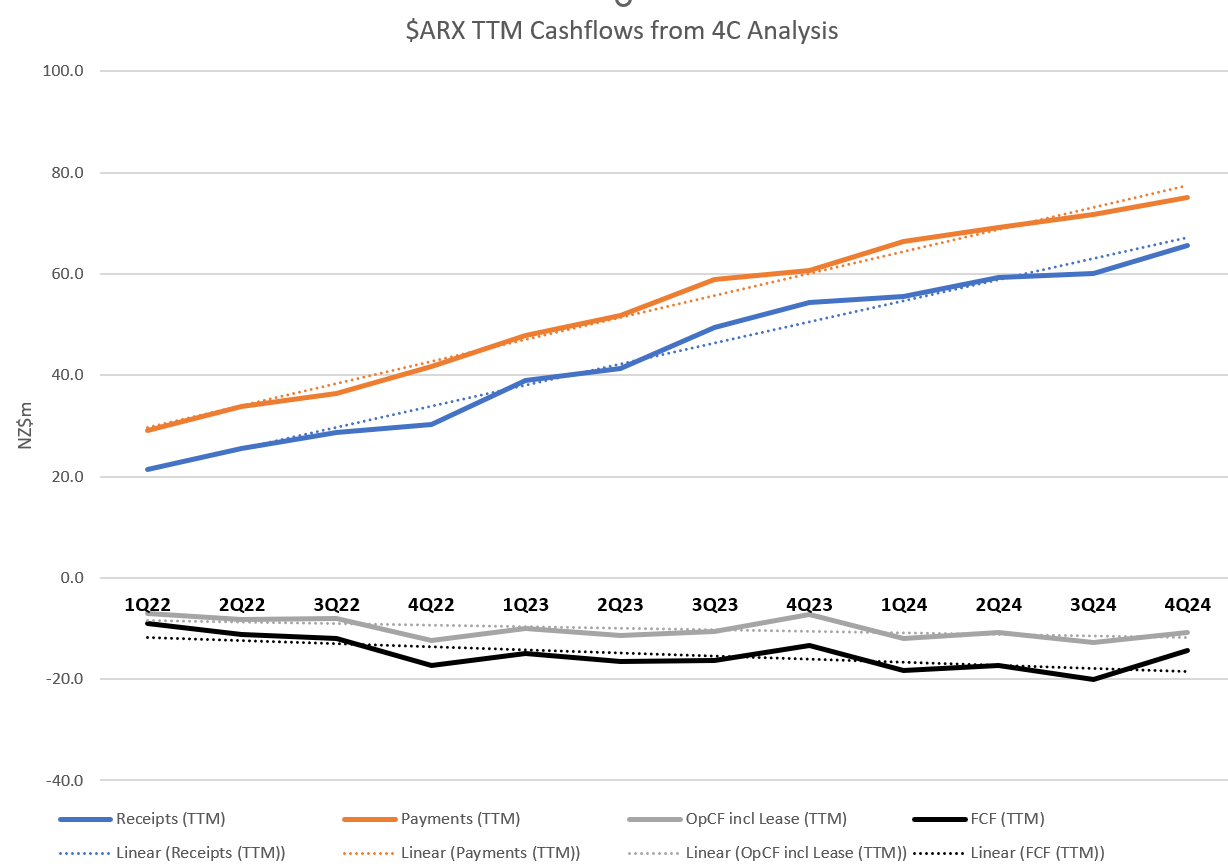

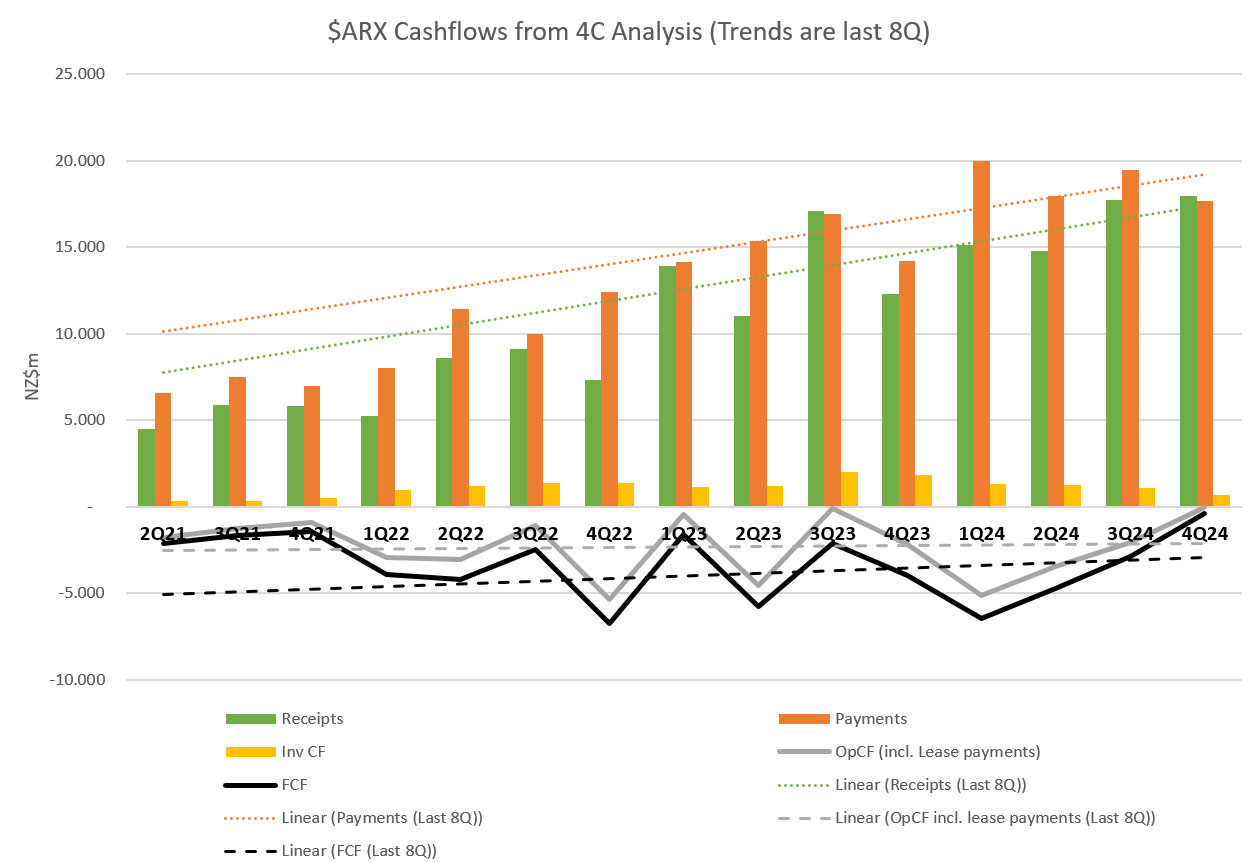

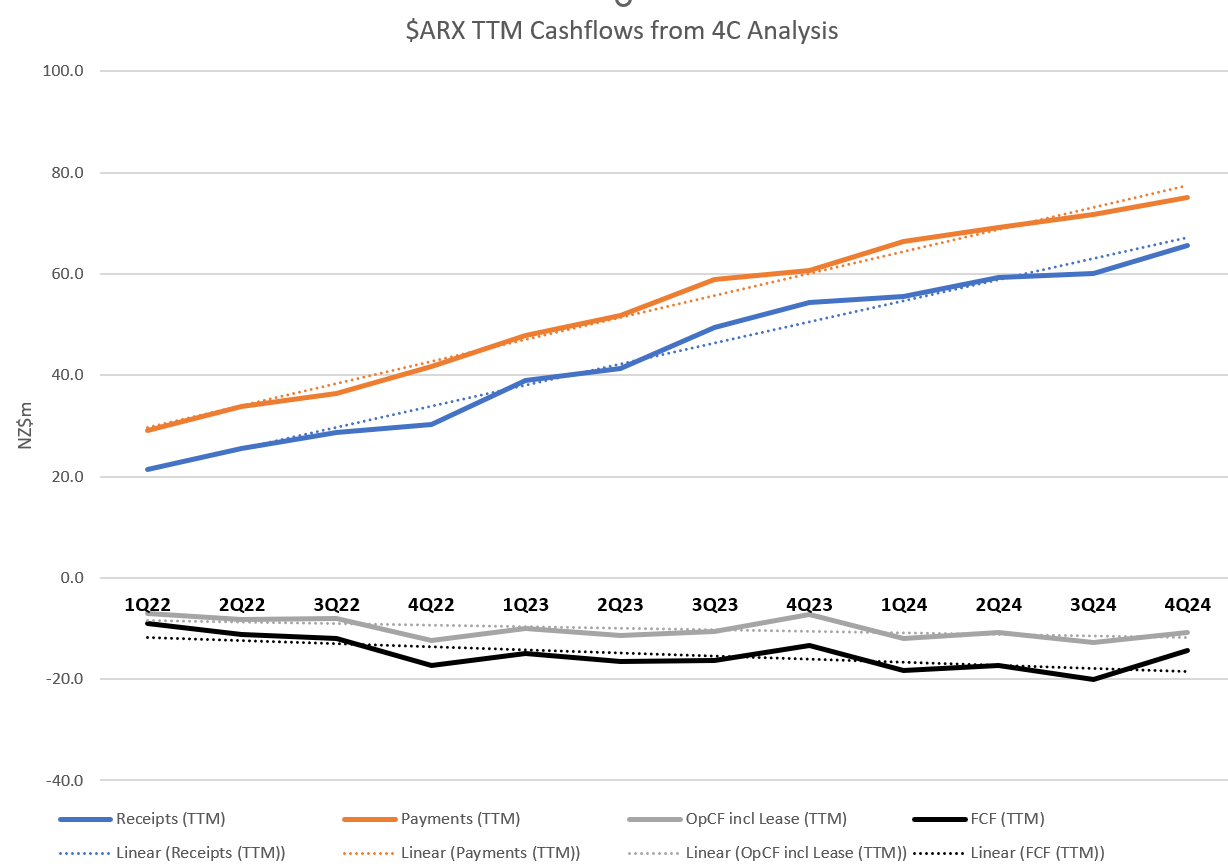

Improving (i.e. reducing) cash burn appears driven more by government grants and a lower rate of investment in new facilities than the product growth itself. (See bottom of post for my cash flow analysis.)

I have held previously, but won't because growth trajectory is modest compared with sector peers, and cash generation is not in sight. Overall revenue growth appears to be in the range 20-30%, having declined from 40-60% over FY22 and FY23.

What I do like about management is their level-headed and balanced reporting. For example, they could have highlighted that Q4 reciepts were up 46% to PCP, but they didn't because that would be cherry-picking a favourable prior period and lumpiness.

$ARX follows a Mar-Mar FY, so financials will follow in a few weeks.

Their Highlights

Financial Highlights

• Strong cash receipts from customers of NZ$18.0 million, reflecting a continuation of the prior quarter’s step-up in Myriad™ and OviTex™ /OviTex PRS sales.

• Positive net cash inflows from operations of NZ$0.3 million, exceeding Q4 breakeven expectations.

• Net cash outflows from investing activities reduced to NZ$0.7 million, reflecting continued planned investment into additional manufacturing plant & equipment capacity with completion expected by Q3 FY25.

• The Company achieved a 71% reduction in quarterly cash burn to ~NZ$1 million, ending the year with a strong closing cash balance of NZ$29.5 million.

Operational Highlights (My tuncated list)

• Continuing expansion in Myriad sales access during the quarter, with Myriad active accounts increasing from 205 to 218 during the quarter.

• Strong CY23 OviTex™ PRS and OviTex sales, with TELA Bio, Inc. (‘TELA Bio’) reporting CY23 revenue of US$58.5 million (41% ‘pcp’ 3 growth) and providing CY24 revenue guidance of US$74- 76 million (27-30% pcp growth).

• Product shipments to TELA Bio continue to re-align with its sales trajectory (following a reduction in shipments during H1 FY24) with H2 FY24 cash receipts from TELA Bio increasing 20% compared to H1 FY24.

• US launch of OviTex IHR, a new AROA ECM™ product specifically designed for use in laparoscopic & robotic-assisted inguinal hernia repair and co-developed with TELA Bio under the parties’ existing license arrangement.

• Enrolments completed for two clinical studies; the pilot study assessing Enivo™, AROA’s new tissue apposition platform technology, and the Myriad Augmented Soft Tissue Regeneration Registry (‘MASTRR’), AROA’s largest prospective study to date. AROA expects to commence publishing study results from Q3 FY25. AROA’s Symphony™ randomised control trial continues to progress well, with a total of 90 patients enrolled by the end of the quarter (n=120).

• A peer-reviewed publication of three case reports indicates that Myriad Matrix™ and Myriad Morcells™ may complement existing negative pressure wound therapy (‘NPWT’) protocols, reduce the frequency of dressing changes associated with NPWT usage in abdominal soft tissue defects and decrease the overall healing time of complex abdominal defects.

My Cash Flow Analysis

While there is a weak positive trend toward FCF generation emerging over the last 8Q, the improvement of the last 3-4 quarters is driven more by reducing investment and some government grants, than underlying strength in the operating economics. That said, the last year has seen improvements in cost control, while growth is continuing.

Quarterly view below in Fig 1, and TTM pic in Fig 2. On the quarterly plot, the trend line is last 8Q only.

Figure 1

Fig 2

Disc: Not held