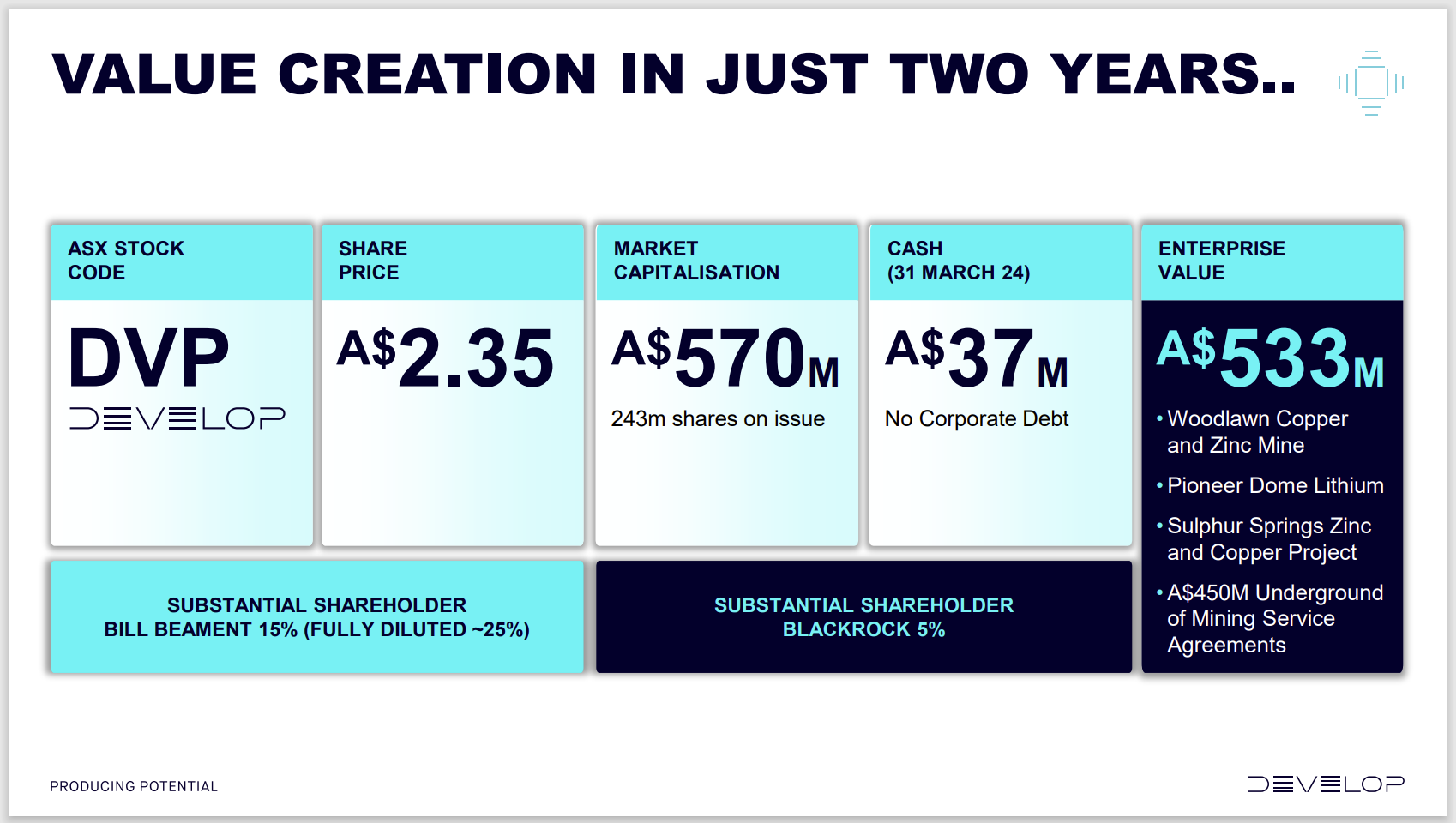

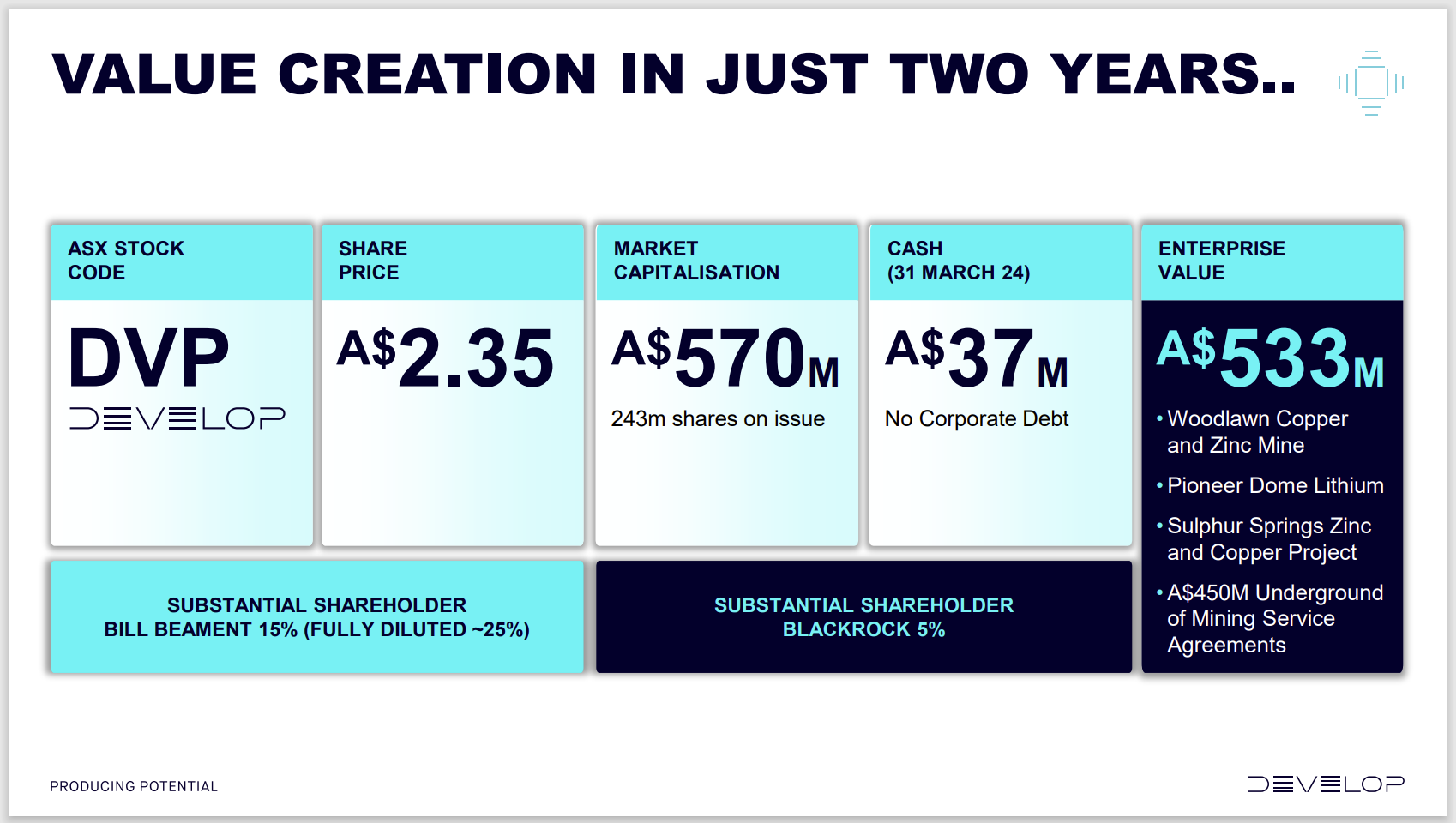

Monday 13th May 2024: Having a look at Bill Beament's Develop Global (DVP) again today, which I do hold (both here and IRL) and they are making steady progress towards their objectives. Cornerstone shareholder MinRes (MIN) sold their 14% stake in DVP around this time last month, and Bill Beament has increased his own stake in DVP to 15.08% (held through his company Precision Opportunities Fund). Chris Ellison's MinRes was under pressure to reduce MIN's debt levels, so there have been some "non-core asset" sales, including having 49% of MIN's dedicated 150-kilometre private haul road corridor in the Pilbara up for sale - the road connects MinRes’ Onslow Iron project at Ken’s Bore mine to the Port of Ashburton on the northern WA coast.

But back to DVP: Here are their latest announcements and presentations:

08/05/2024 8:23 am: DVP-Investor-Presentation-Pathway-to-Positive-Cashflow-May-2024.PDF(11 pages, market sensitive)

07/05/2024 8:24 am: Updated-Pioneer-Dome-Scoping-Study-(DVP).PDF (38 pages, market sensitive)

24/04/2024 8:24 am: DVP-March-2024-Quarterly-Activities-Report.PDF (18 pages, market sensitive)

24/04/2024 8:23 am: DVP-Quarterly-Appendix-5B-Cash-Flow-Report-March-2024-Qtr.PDF (5 pages, market sensitive)

From the Investor Presentation:

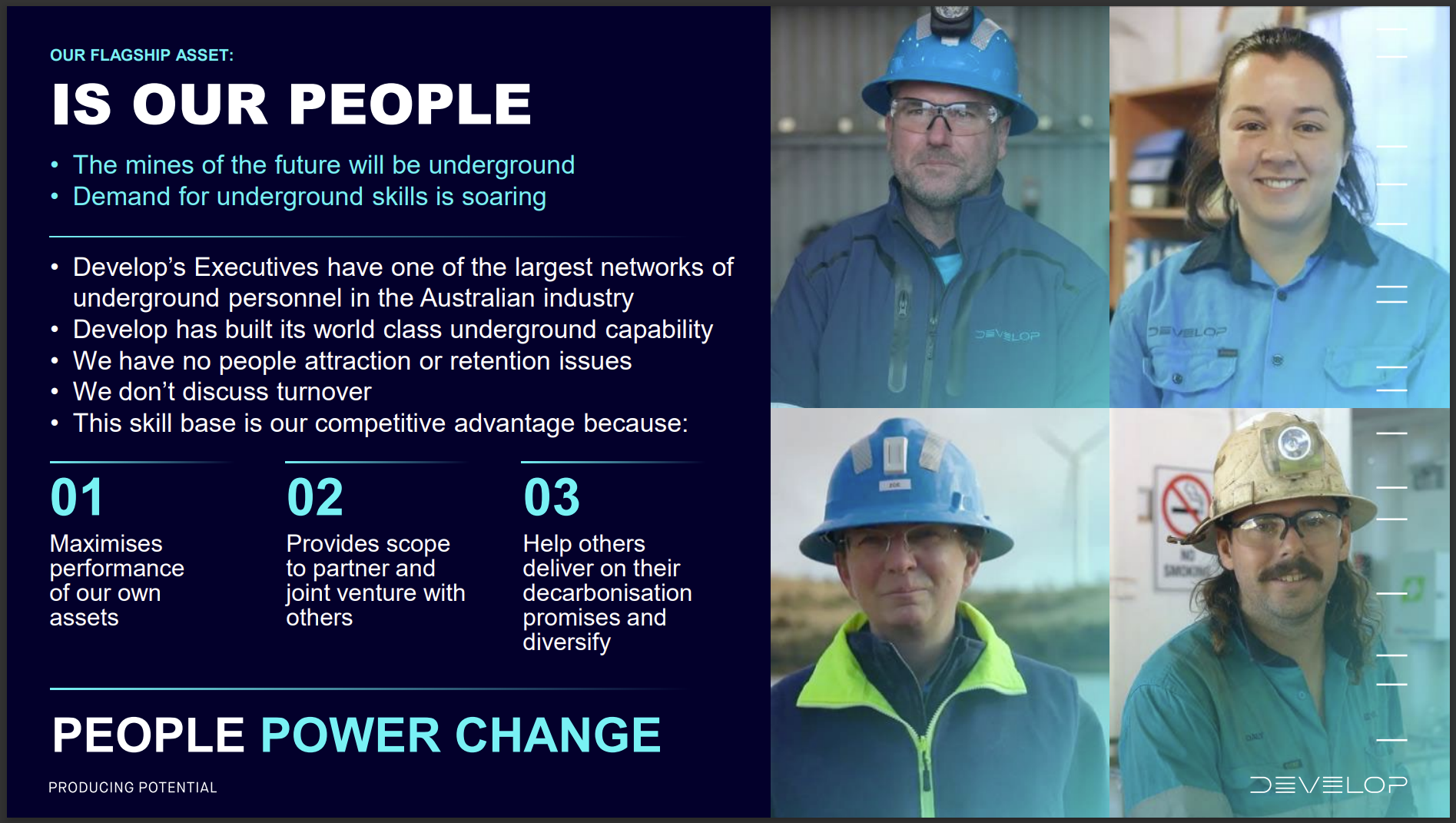

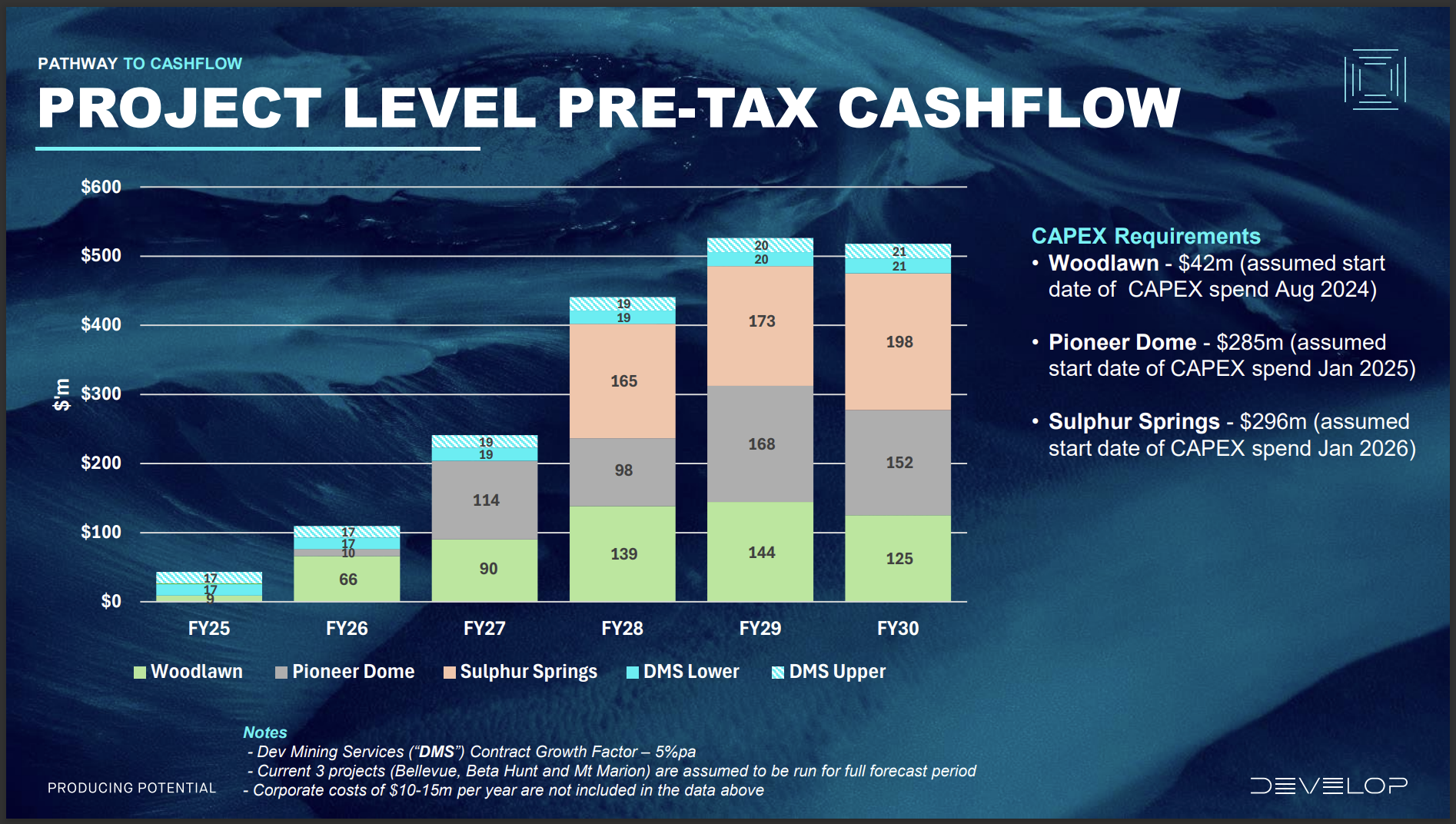

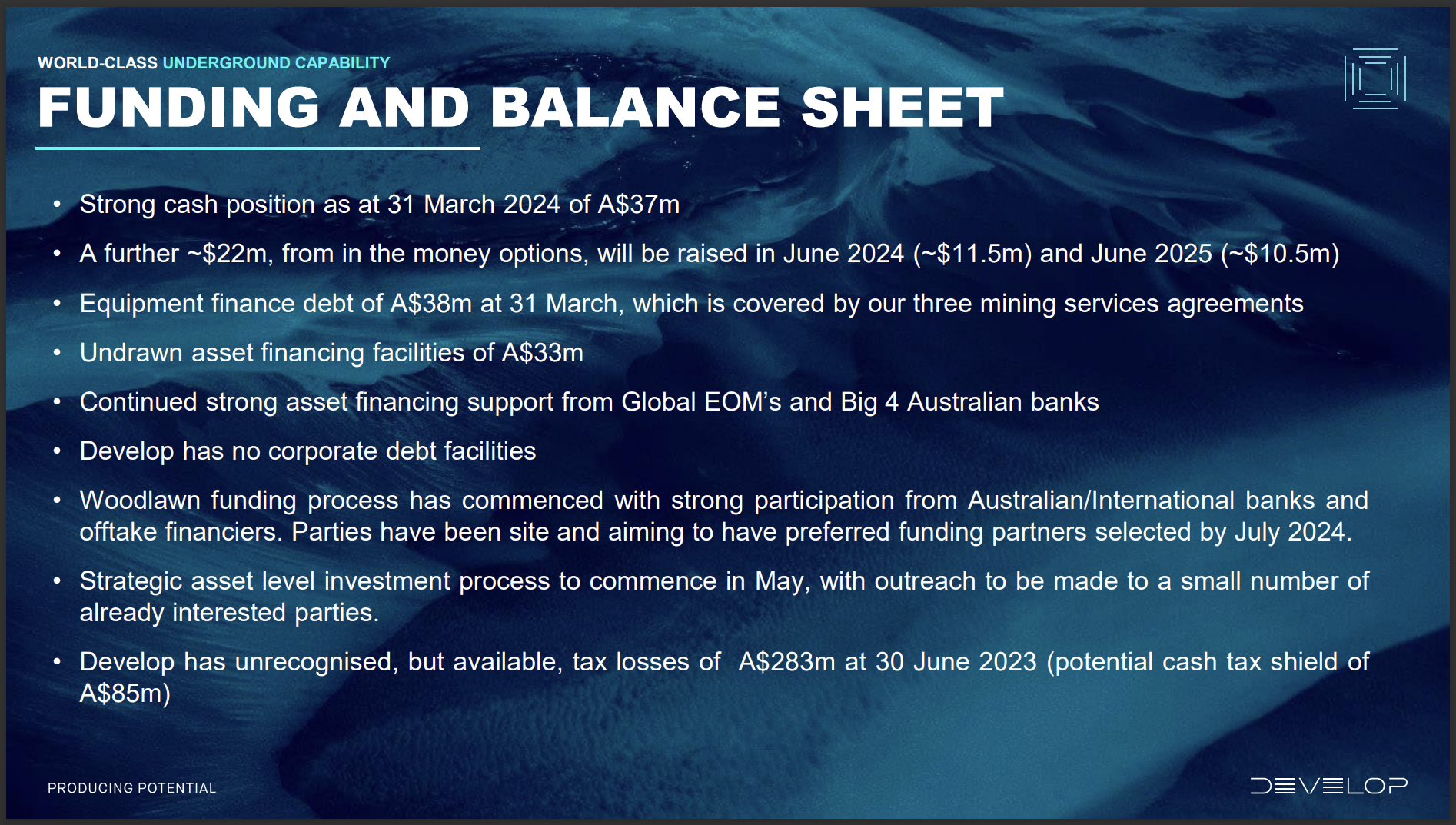

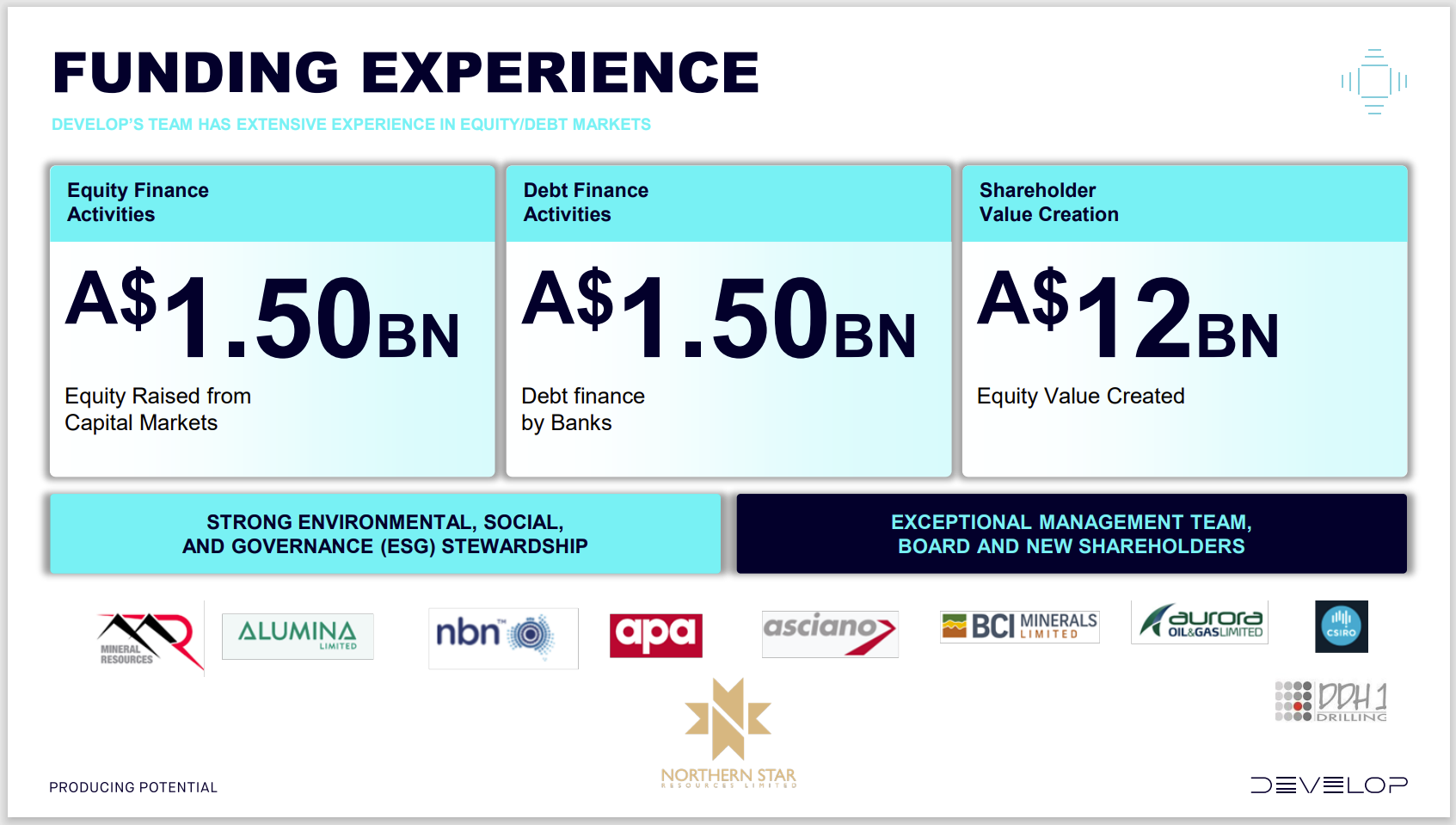

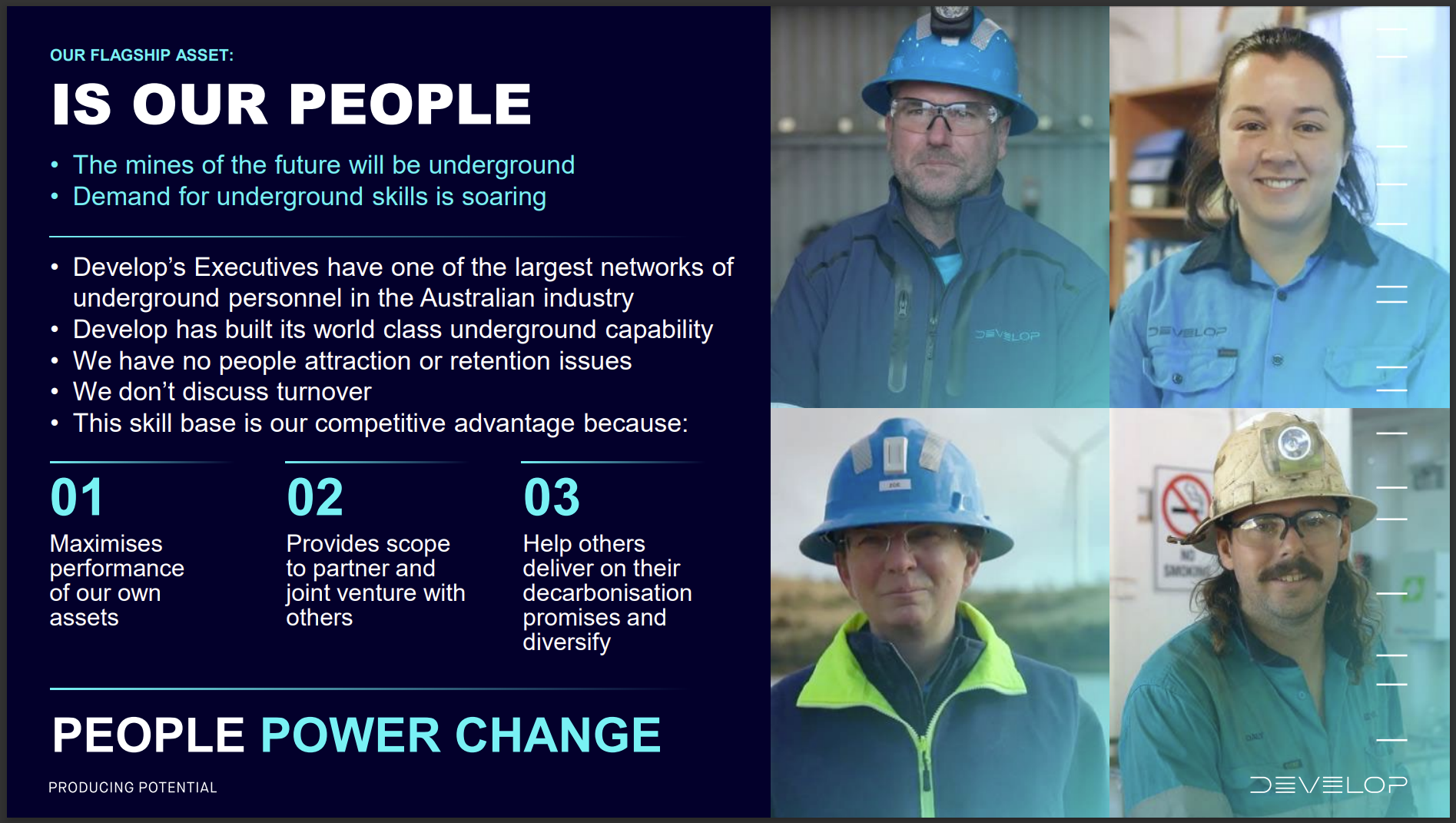

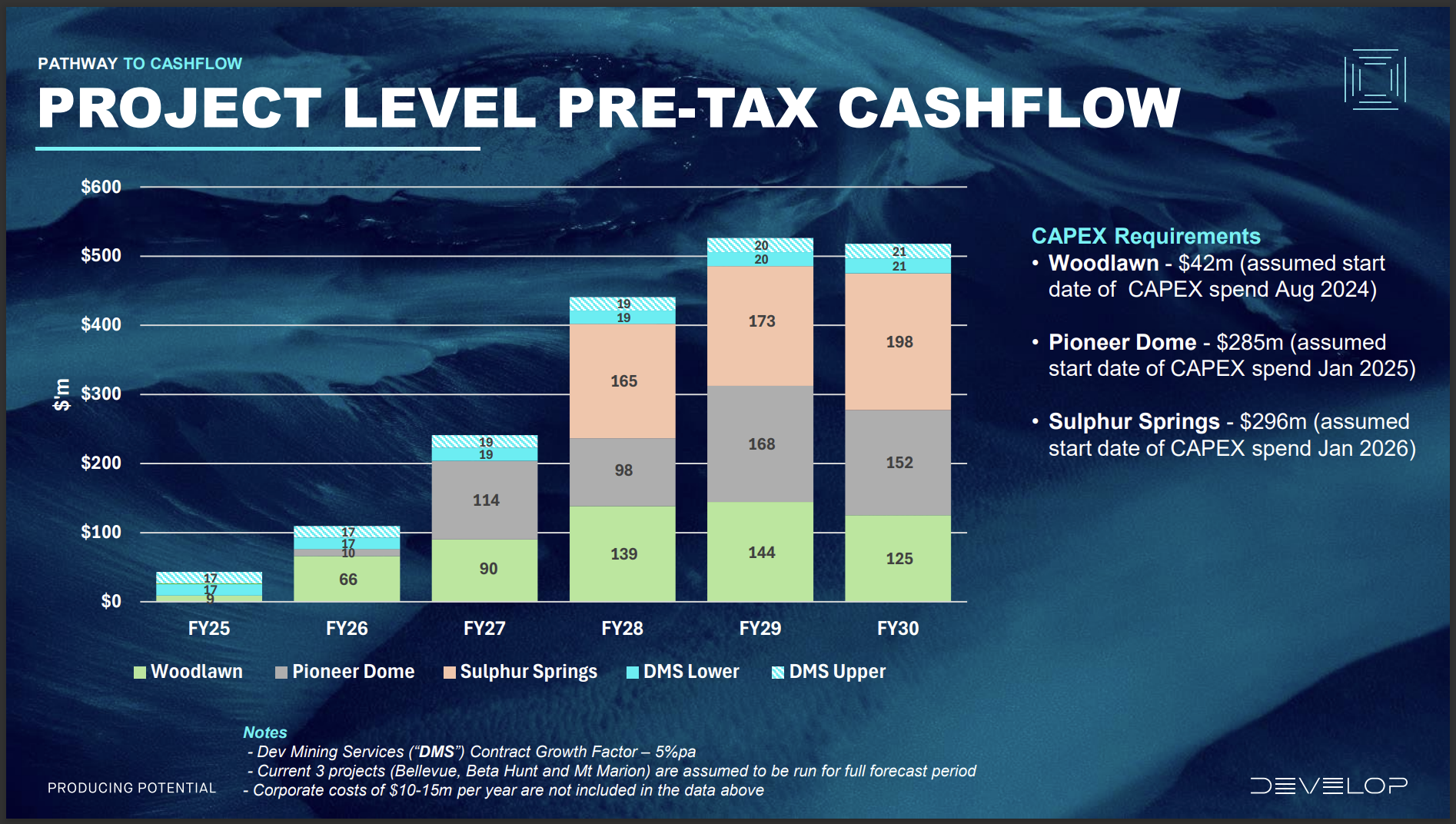

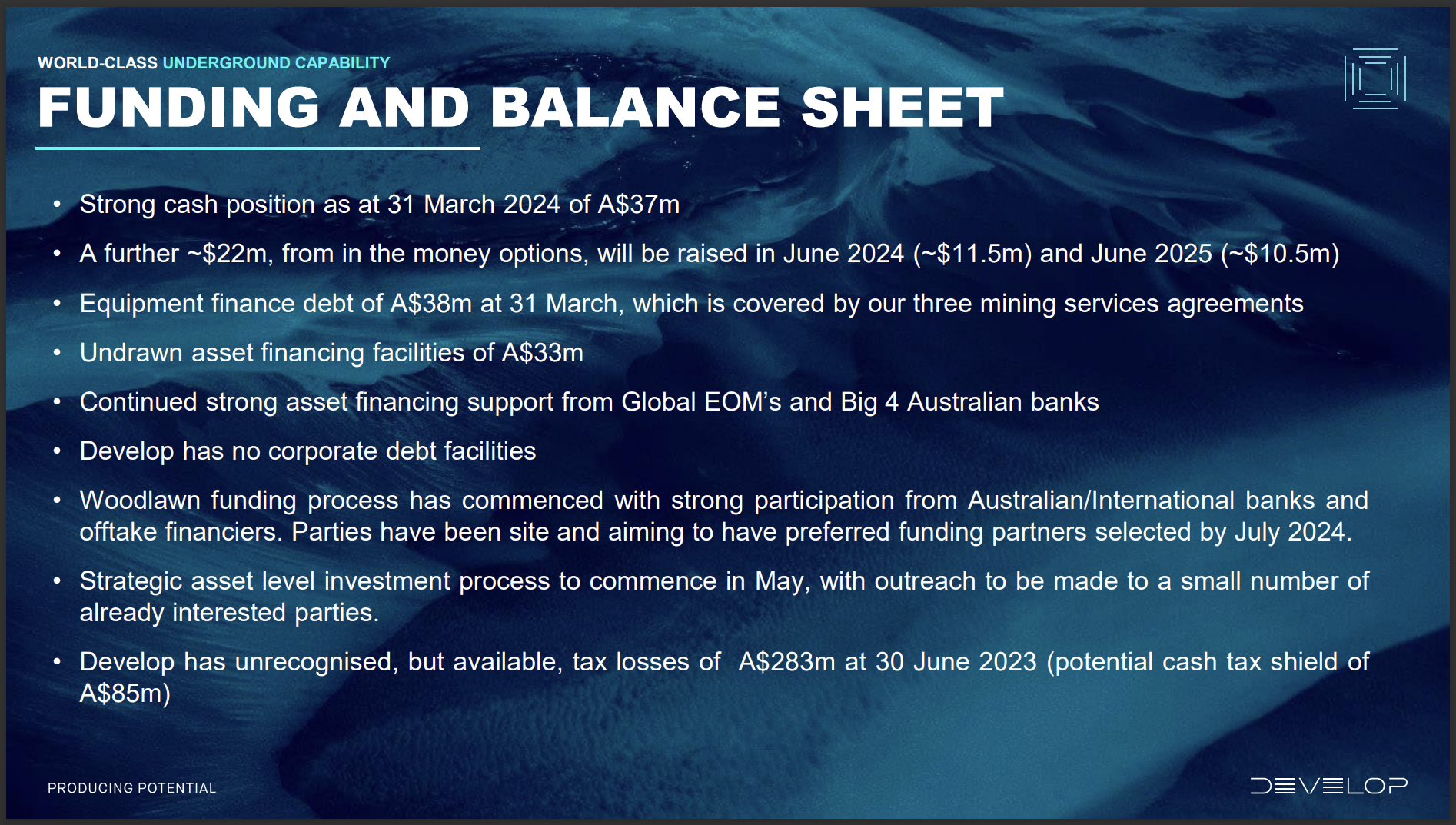

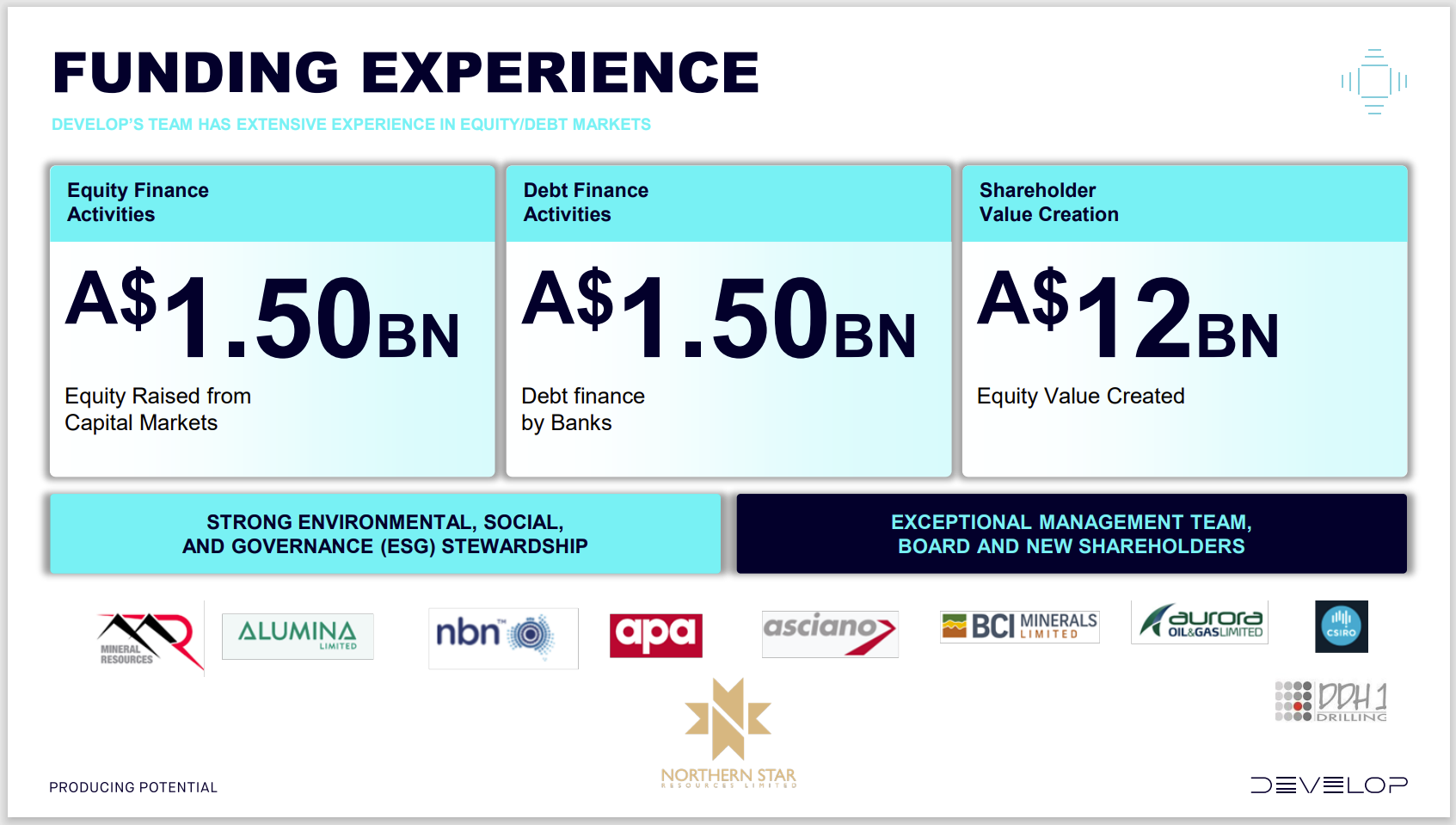

If you're not into Mining Services, copper, zinc and to a lesser extent lithium, then this one won't be for you, but with Bill Beament running this company, there's every reason to expect the company to be highly successful in future years, and he's done a reasonable job so far, since he left NST to head up Venturex, renamed the company ("Develop Global") and built up this portfolio of mining services clients and base metals and lithium projects.

I rarely buy into early stage companies like this - i.e. at this point in their history - however I'm happy to make an exception when we've got Bill Beament running the show. He has a truly exceptional track record.

Further Reading:

MinRes sells Develop Global stake; Bell Potter on the ticket (afr.com) [08-April-2024]

First-round offers in for MinRes $1b pit-to-port haul road sale (afr.com) [06-March-2024]

(25) Bill Beament | LinkedIn

(25) DEVELOP: Overview | LinkedIn

About - Develop

Board & Management - Develop

New study encourages Bill Beament’s Develop Global to push on with Pioneer Dome lithium project | Kalgoorlie Miner (kalminer.com.au) [13-May-2024]

Q+A: Aussie mining legend Bill Beament talks stonker copper hits and facing the future - Stockhead [17-May-2023]

Bellevue Gold Develops $400m contract - Australian Mining [14-April-2022]

MinRes awards Mount Marion decline contract - InvestMETS [01-Dec-2023]

Develop achieves five-year business plan - Australian Mining [22-March-2024]

Mining Services set to generate c.$175m Revenue - Develop Global Limited (ASX:DVP) - Listcorp. [21-March-2024]