$BRG are presenting at Macquarie Conference today.

Conference Presentation

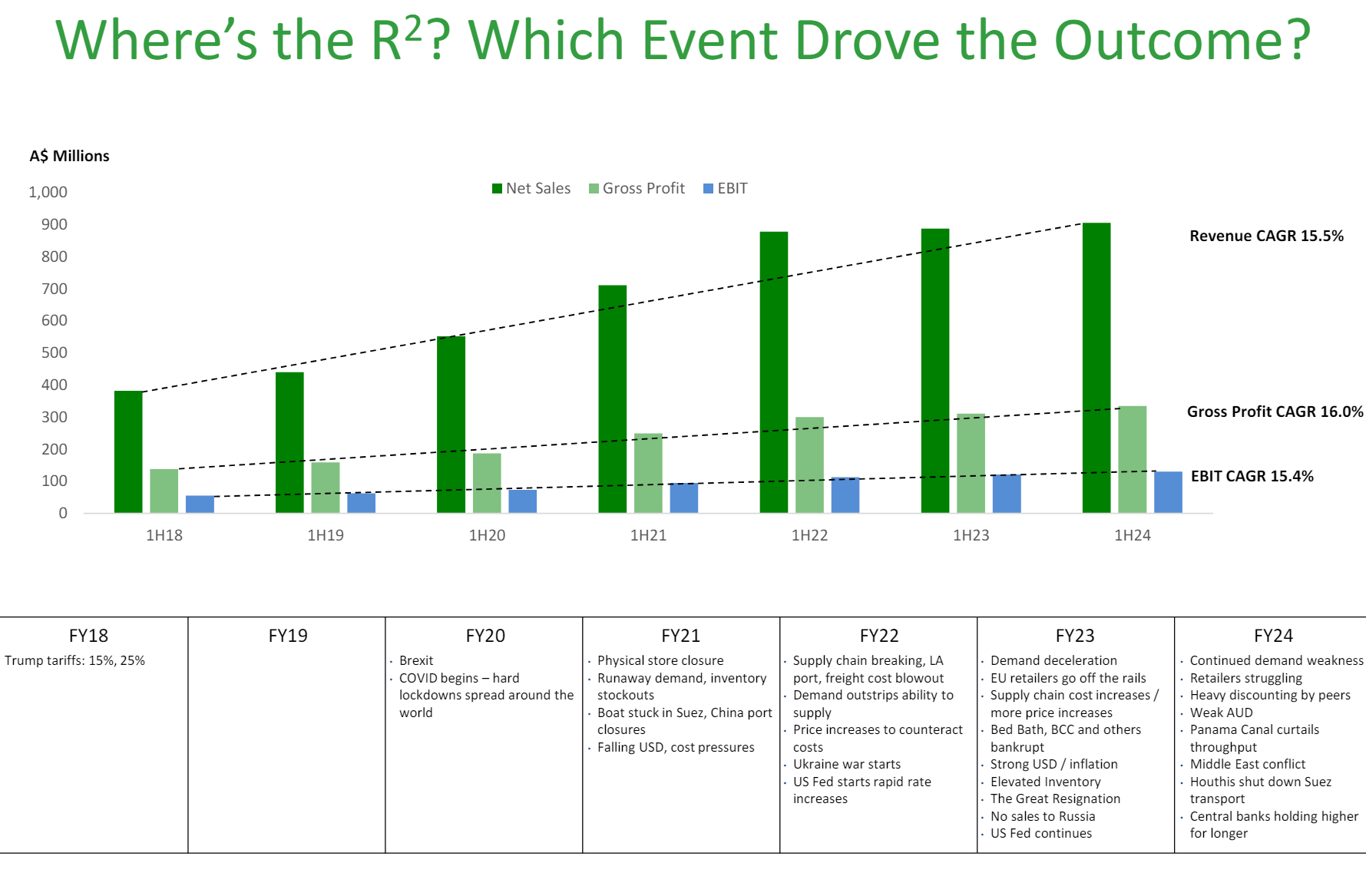

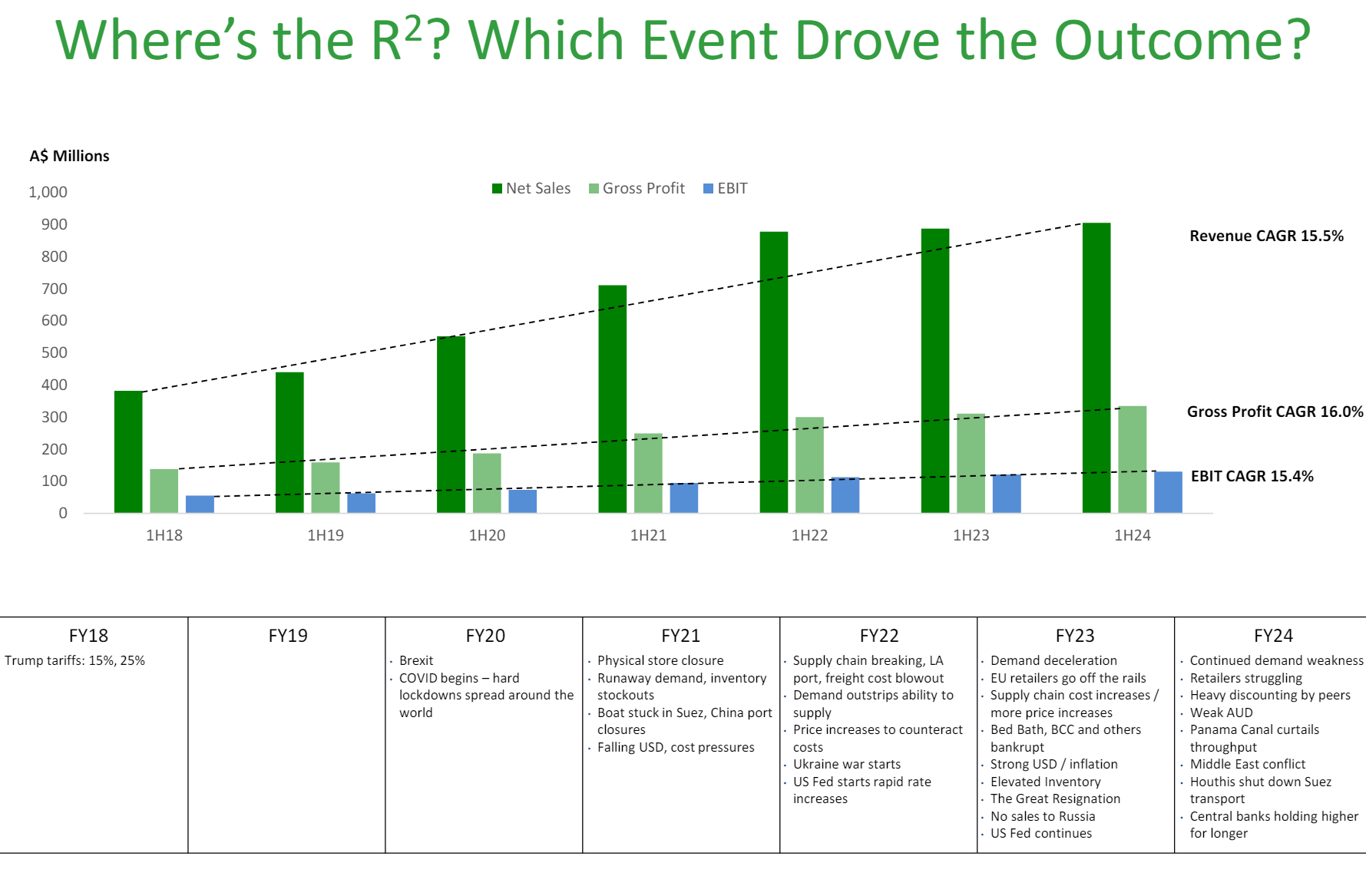

The presentation takes a step back and considers the progress of the business over the last 7 years in Jim Clayton's characteristically thoughtful way. Given everything that has happened over recent years, the steady progress has been remarkable.

And even though FY24 EBIT growth guidance is underwhelming at 5% to 7.5%, this has to be considered in the context of the current global headwinds to discretionary spend. Good news is that FY guidance is held to.

In the presentation Jim quotes the late, great Ayrton Senna:

"You cannot overtake 15 cars in sunny weather ... but you can when its raining."

I've also added 2 further slides.

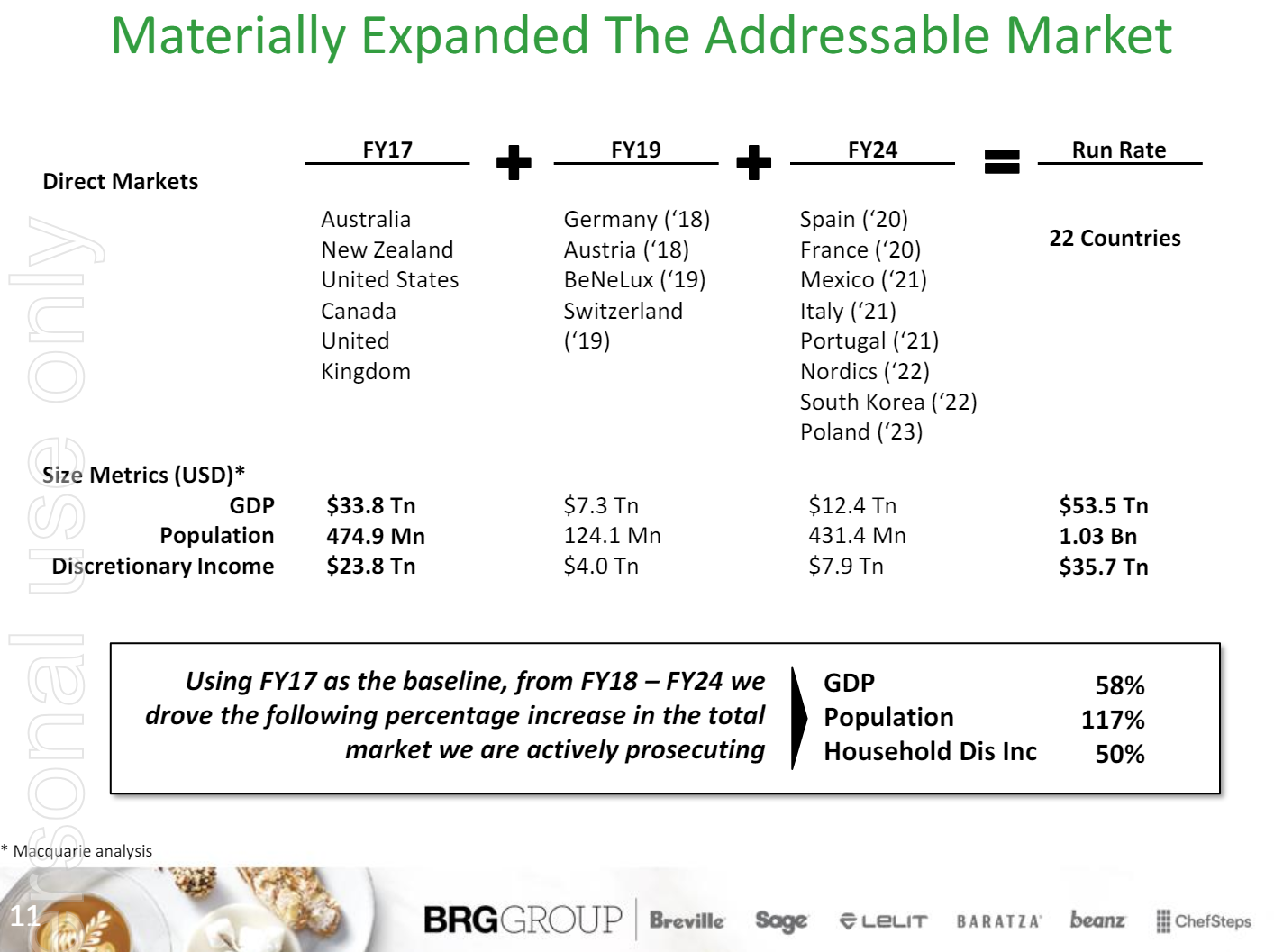

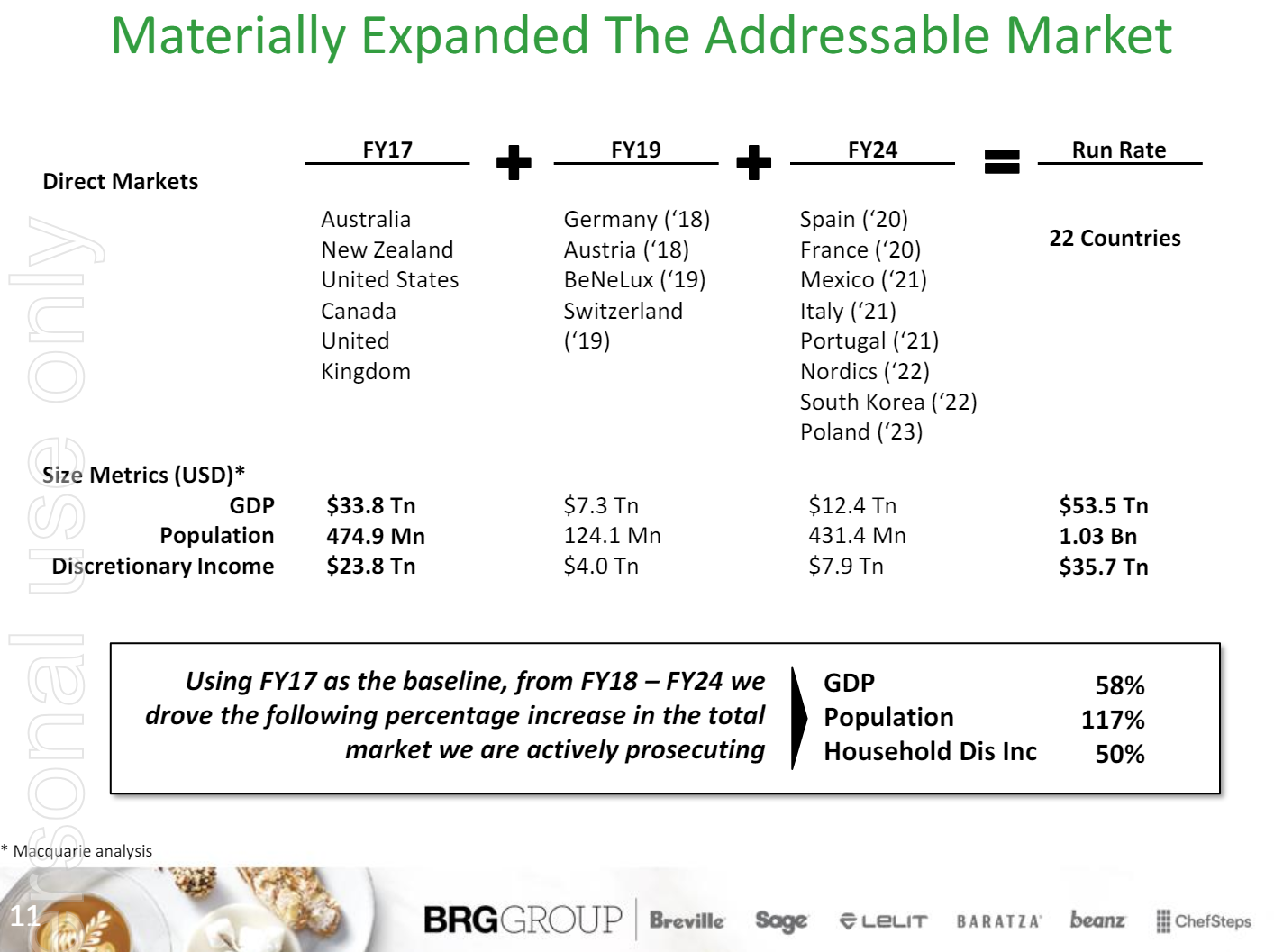

First, that shows the global geographical expansion over recent years, which indicates that $BRG is positioned to growth strongly once the macro-economic cycle turns.

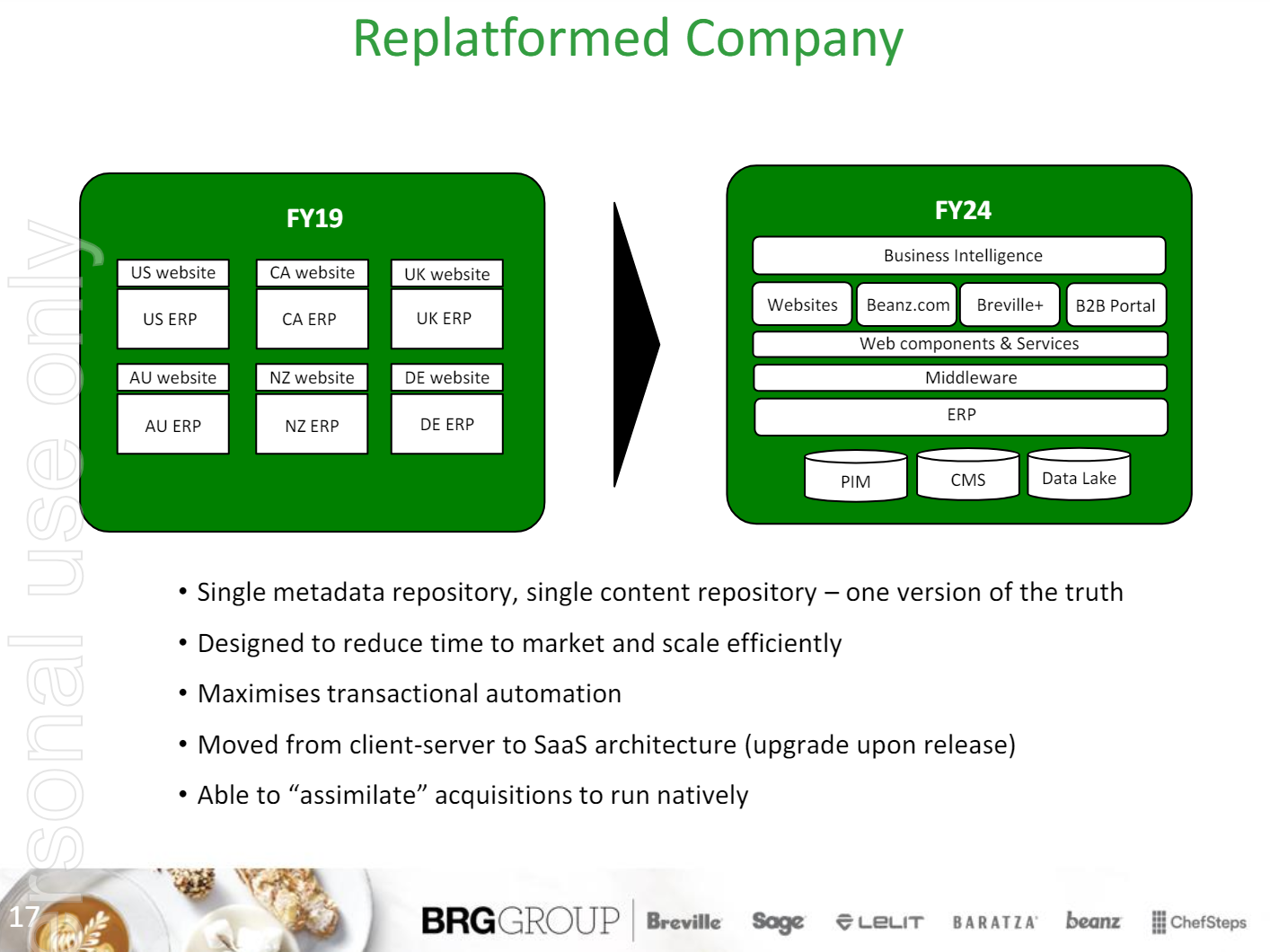

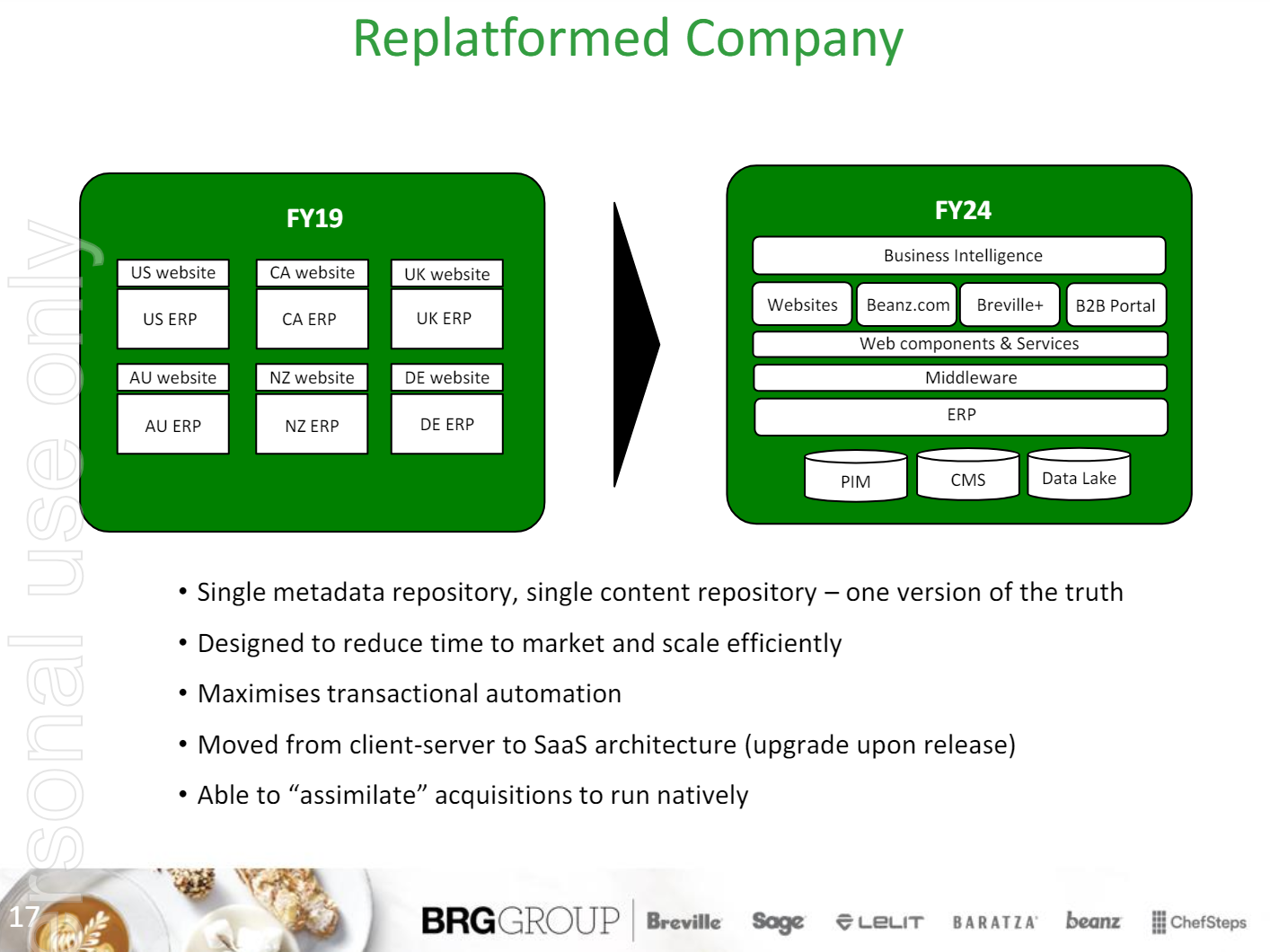

The second, gives a flavour of the recent investments made in re-platforming the business, which has developed a strong direct to customer channel, alongside its retail channel. (I purchased my last Breville product this way.)

This is a long-term hold in my RL portfolio. Never exciting, but over the years you notice!

Anyway, I thought I'd post as the presentation gives a great overview of the business at a more strategic level than the periodic results reports.

Value

Current SP is a little below the long term average P/E, and bang on the mid-point of my current valuation of $26.00, representing fair value.

SP of $25.96 compares with analyst TP consensus $25.45 (range $20 - $31.30, n=15), which is about 12 months into an upgrade cycle from a low point TP of $22.

Disc: Held in RL