Pinned straw:

@BoredSaint i couldnt work out why BBN GMs are half of LOV and NCK (both held) and around BRG (also held) which makes stuff. given its apparent dominant market position why? BBN -not held

@BoredSaint I tend to agree with your assessment.

It is too simple to label categories as "discretionary" and "non-discretionary". When $BBN was a fundies favourite pre-COVID and through the pandemic Bull market, there was a rationale by many saying the the spend was non-discretionary, with Baby Boomer Grandparents' deep pockets being recession-proof.

However, as you make clear, there is a huge range of price points within each element of the product range.

My wife and I waited until we were relatively well-off before starting our family 20 years ago. I clearly remember getting all the nursery stuff, gagets and buggies and observing how price insensitive we were. (I insisted on a McLaren stroller, as well as an all terrain convertible pram, because I lost the battle on owning a grown-up one!)

Had we started 10 years earlier, we would have got the same items, but probably paid 50%-70% less. Of course, that's the business model for category killers - maximise the addressible market in the category. But it does mean that when "discretionary spend" takes a hit because customers are paying 2x or 3x on mortgage repayments or 50% more on rent, then there is ample scope for a big part of the mid-market to trade down, while still meeting their non-discretionary needs.

For example, consider the humble stroller:

- $114 Babyzen Yoyo

- $669.99 Bubaboo Butterfly (But coz times are tough, don't pay $829.00, save $159.01)

- Also ... no McLaren (but you can get one at Big W for $700)

They are all just strollers.

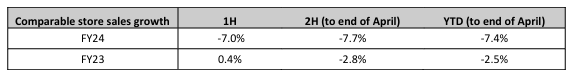

In that context, the $BBN result isn't too bad (I've not looked at any detail beyond your post).

As a retailer, its pretty low quality, with %NM historically only in the 2-4% range. Which means the negative operating leverage is deadly, particularly given its debt. But of course, provided it makes it through the trough, the upside could be spectacular. So for me, its not one to be early for in timing!

I generally like category leaders and category killers - so, I think its probably a good time to start catching up on $BBN straws, posts, and valuations.

Disc: Not held.

My retail holdings remain: $LOV, $NCK and $BRG (not strictly retail, but discretionary retail exposed).