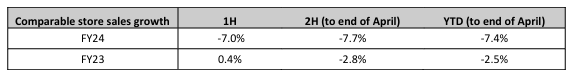

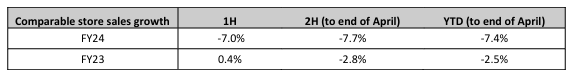

Baby Bunting released a market update last week and it was ugly to say the least.

This was likely due to rising household costs forcing new parents to minimise spending on new items for their newborns and children.

Guidance of FY24 was revised down to $2-4m (compared to $9m in FY23 and almost $20m in FY22).

This may be just based on my own anecdotal evidence as myself my wife are expecting our first child in the near future, but Baby Bunting is still our preferred go to place for all our needs for our coming newborn. Their 5% price beat policy means that even though we have shopped around for the best price, we still end up going there to purchase.

Further to this (and this may be just because we are getting to that age), we know of a lot of our friends who are also expecting. Perhaps it is due to the Chinese Zodiac being a dragon year which is amongst the most sought after zodiac signs for your child to be. This may not flow through in the numbers until the 2H.

I think BBN represents an interesting business to look into given its share price decline given its market dominance in the baby category and perhaps the next results could be the bottom of their cycle.

Wonder if anyone has any thoughts?

Disc: Not held but watching...