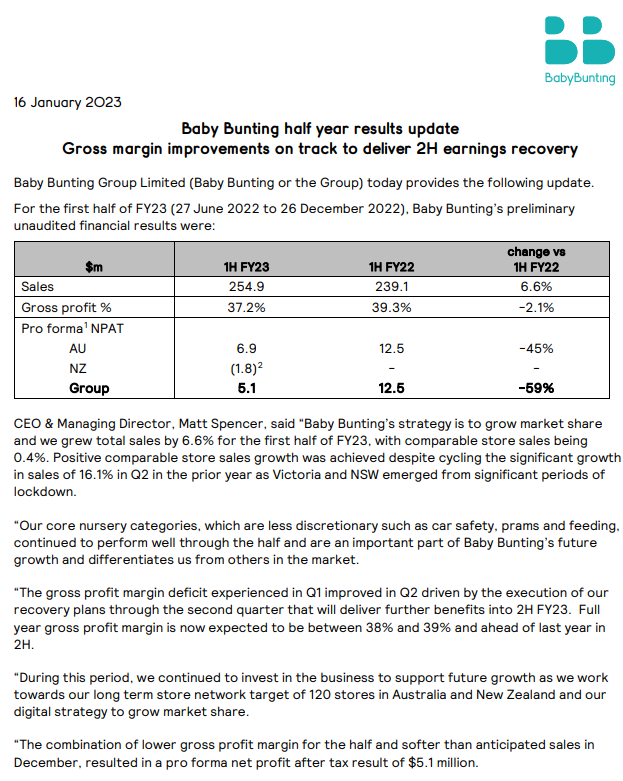

Baby Bunting gave an interesting update this morning that may (or may not) give insight into the retail sector generally. On face value the actuals are underwhelming and, in some cases, deteriorated in Q2 versus Q1. Total revenue was up 7% year on year, but mainly on the back of their aggressive store rollout program. Comparative store sales were virtually flat and significantly negative in Q2 YoY. Margins were down YoY also and all of this means net profit will be the lowest half year result in three years. As a result the market is giving them some tap.

But some green shoots may be appearing if their forecast can be believed. Margins actually improved in Q2 versus Q1 and are forecast to continue to do so at an accelerating rate. Store rollout is helping boost the topline and backworking opex from the figures they do provide suggests that while costs may be growing, they are far from out of control. All of which has them forecasting record FY23 NPAT of $21.5-24m. They will be leaning heavily on 2H given they've 'only' delivered $5m of NPAT in 1H.

In a market of quality retailers I'd maintain that Baby Bunting remains among the leaders, albeit that it's a relative comparison and none are immune from cyclicality. If they do deliver on the FY forecast the downturn of the last 12 months will barely register in their financials. They are currently trading below pre-COVID levels. I've held them previously but sold out back in Jan 2021. I wouldn't be adverse to owning them again but would need to do more work on that forecast, plus keep hearing noises about competition coming after them specifically.