Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Quite the move with Baby Bunting shares today after their results were released. up 28%!!

I'm not intimately familiar with the business, but this seems to be all about an improvement in same store sales combined with a material lift in gross margins. In a low margin business like BBN, that can have a big impact on profitability. A 340bp improvement in gross margins saw the EBITDA margin rise from 3.2% last year to 5.4% this year, which pushed EBITDA up 77% even though revenue was only 4.7% higher.

Still, in a challenging retail environment, that margin tailwind can just as easily turn into a headwind. BBN has managed steady and consistent revenue growth since listing, apart from a small dip in FY24, but net profit has been far more volatile and is now only back to where it was in FY17.

Retail is a tough game.

Baby Bunting released a market update last week and it was ugly to say the least.

This was likely due to rising household costs forcing new parents to minimise spending on new items for their newborns and children.

Guidance of FY24 was revised down to $2-4m (compared to $9m in FY23 and almost $20m in FY22).

This may be just based on my own anecdotal evidence as myself my wife are expecting our first child in the near future, but Baby Bunting is still our preferred go to place for all our needs for our coming newborn. Their 5% price beat policy means that even though we have shopped around for the best price, we still end up going there to purchase.

Further to this (and this may be just because we are getting to that age), we know of a lot of our friends who are also expecting. Perhaps it is due to the Chinese Zodiac being a dragon year which is amongst the most sought after zodiac signs for your child to be. This may not flow through in the numbers until the 2H.

I think BBN represents an interesting business to look into given its share price decline given its market dominance in the baby category and perhaps the next results could be the bottom of their cycle.

Wonder if anyone has any thoughts?

Disc: Not held but watching...

$BBN announced their HY results this morning, providing the next peak into retail-land.

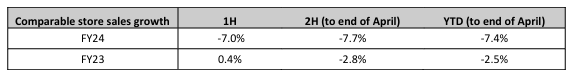

Interestingly the rate of decline improved in Q2 (-5.3% LFL pcp) over Q1 (-8.8% LFL pcp).

Interesting to see how this reads across others.

Disc: Not held in RL or SM

More downgrades in retail-land. This time its category-killer $BBN.

FY23 Trading Update Market down 22% (trading this morning around -20% to -25%)

LFL sales expecting to be down -4% to -5% for the FY.

The guidance for comparable "pro forma" NPAT is $13.5m - $15.0m down from $21,5m - $24.0m

I think this is one of the first examples in the sector that starts to demonstrate the heavy negative operating leverage of retailers with a high CODB and low operating margins.

Still, given the heavy discounting of $BBN over the last year, seeing consensus TP fall from $6.39 to $2.81 (before the next updates), I really do wonder if a further 20% markdown to $1.39 isn't over-doing it?

I don't really follow this stock (as I always felt it was over-hyped), but I am interested as part of my overall monitoring of retail.

Eventually, the sector will present some fantastic buying opportunities. I'm not implying that's now, but the time will come.

Competitive pressures are my biggest concern to the margin guidance. Just think back to the debacle that occurred a few years back when competitors were going out of business. Price matching becomes a real issue in these scenarios.

Feels like costs have blown up a bit with this update, I sometimes wonder how good their internal systems are given these negative surprises seem to come out of nowhere.

Based on a long term view, there is probably good entry point not far from here. Quality name with long runway of store rollout ahead. A good one to buy on the rare dips and sell on the highs.

The one thing I have never liked though is the low ownership from management and repeated selling.

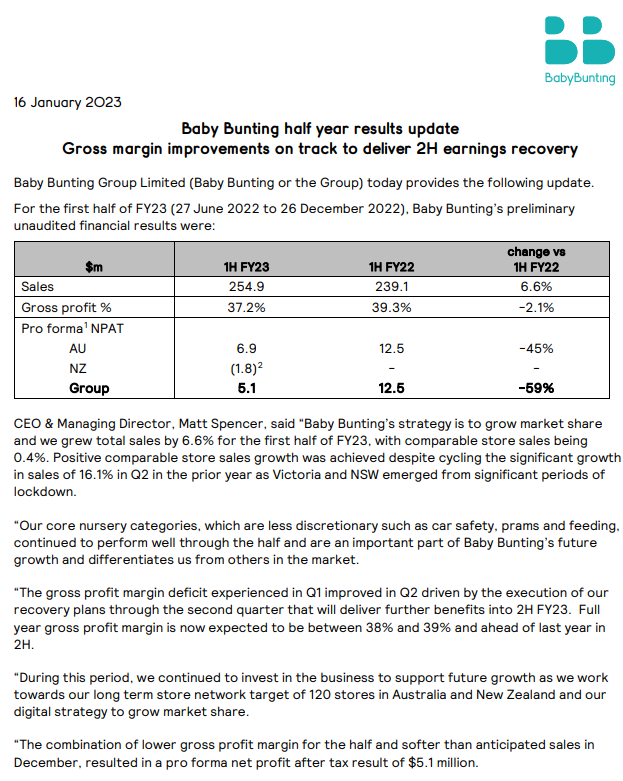

Baby Bunting gave an interesting update this morning that may (or may not) give insight into the retail sector generally. On face value the actuals are underwhelming and, in some cases, deteriorated in Q2 versus Q1. Total revenue was up 7% year on year, but mainly on the back of their aggressive store rollout program. Comparative store sales were virtually flat and significantly negative in Q2 YoY. Margins were down YoY also and all of this means net profit will be the lowest half year result in three years. As a result the market is giving them some tap.

But some green shoots may be appearing if their forecast can be believed. Margins actually improved in Q2 versus Q1 and are forecast to continue to do so at an accelerating rate. Store rollout is helping boost the topline and backworking opex from the figures they do provide suggests that while costs may be growing, they are far from out of control. All of which has them forecasting record FY23 NPAT of $21.5-24m. They will be leaning heavily on 2H given they've 'only' delivered $5m of NPAT in 1H.

In a market of quality retailers I'd maintain that Baby Bunting remains among the leaders, albeit that it's a relative comparison and none are immune from cyclicality. If they do deliver on the FY forecast the downturn of the last 12 months will barely register in their financials. They are currently trading below pre-COVID levels. I've held them previously but sold out back in Jan 2021. I wouldn't be adverse to owning them again but would need to do more work on that forecast, plus keep hearing noises about competition coming after them specifically.

Tough day for Baby Bunting after giving a trading update at their AGM this morning. There was a pretty savage response to what looks like largely temporary cost pressures, not yet passed on to consumers. I don't own this (I have previously) but it looks really interesting at these levels. I'm not going to be in any hurry to jump in given I suspect the next 6-12 months could see sales come under pressure for many retailers, just as cost pressures plateau. However, I think there will come a point to buy these selectively, but it will probably come before you're really comfortable buying into the turnaround.

It will be interesting to see how other high quality retailers report, who haven't yet indicated major inflation or demand impacts. I'm thinking the likes of JB HiFi, Shaver Shop, Beacon Lighting and Nick Scali. To different extents the market is already anticipating a level of pain to come but hearing the news from the company directly is likely to ramp up pessimism significantly.

statutory net profit after tax of $19.5 million up 14.6%. On a pro forma basis NPAT was $29.6 million, up 13.6% on the prior corresponding period and pro forma EBITDA was $50.5 million, up 16.1%.