Pinned straw:

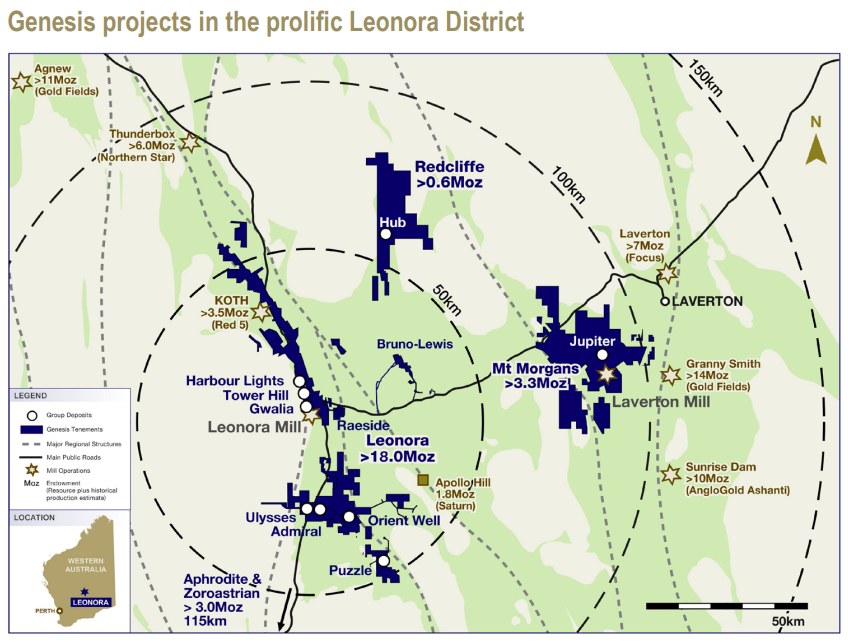

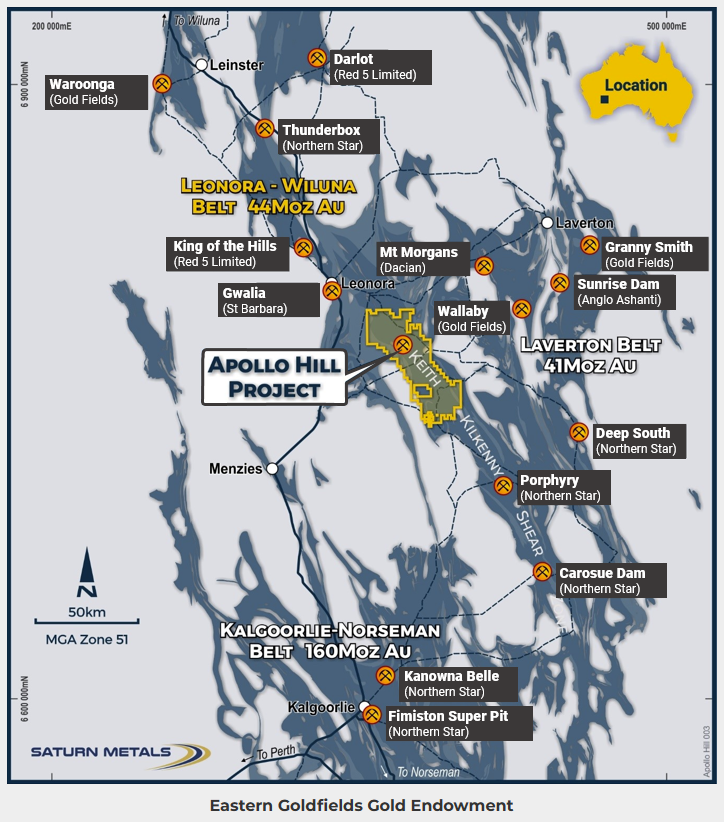

Monday 20th May 2024: I highlighted here back in December the high risk/high reward nature of Saturn Metals (STN) with their Apollo Hill Gold Project being the only major gold discovery between Leonora and Laverton that Genesis Minerals (GMD) haven't already acquired - see map below...

Red 5's (RED's) King of the Hills (KOTH) gold mine and mill to the north west of Leonora is the only other major gold project within that 50km radius of Leonora and RED are merging with Silver Lake Resources (SLR) so I'm really hoping Raleigh Finlayson (@ Genesis) doesn't try to outbid SLR for RED now that RED are so expensive - and I'm saying that as a Genesis [GMD] shareholder with no direct interests in STN, RED or SLR at this point. I did try to pick up a small position in STN here on SM a few weeks back when they looked particularly cheap - but they got away from me - and look at them today:

Chart Data sourced from Commsec.

That's a fairly steady rise since February - and it's not all to do with the gold price:

Source: https://goldprice.org/

That's US$ gold price movements on the left and A$ gold price movements on the right. As you can see, there was a gold price drop in the second half of April which is NOT reflected in STN's chart. Pleasingly, the US$ gold price has already made up all of that lost ground from April - and then some, making fresh all time highs yet again, so we're seeing some really positive movement across the Aussie Gold Sector today:

Most of the larger gold producers are up by between 3% and 6% today so far, with the physical gold bullion ETFs/ETPs (Exchange Traded Funds/Products) up by less than 2% (+1.8% to +1.9%) so that indicates positive sentiment is back.

The worst performing Aussie gold sector stock today on that list is M2M (Mt Malcolm Mines) who are probably going to go broke if they don't get acquired (for peanuts) first. Their market cap is now under $3 million and they have just announced an SPP priced @ 2 cps when their SP was trading on-market at 2 cps. The SPP is supposed to raise just $1m, which would be more than one third of their market cap, but it won't raise $1m because they've been trading BELOW the offer price on every day since they announced it - mostly at 1.8 cps, today down to 1.7 cps. Their MO is to announce positive drill results and then immediately do a placement to take advantage of the minor pop in the SP, but the pops are getting smaller and smaller as people get wiser. They are always struggling to keep the lights on, so the chances of further positive drill results are pretty slim considering they don't have the money to pay for the drilling. M2M's projects are also within that same area - even closer to Leonora than Apollo Hill (STN's project) is, but they haven't proven up a decent deposit yet, just some individual good hits, so they are at a WAY earlier stage in their project development than Saturn is with Apollo Hill. The reason M2M's projects do not show up on that map at the top of this post is that they haven't got a decent gold deposit worth including yet, and they don't have the money to drill the ground that they have got to prove that the gold there is substantial. They have reported some great hits, but they could just be one-offs. They are chronically underfunded and they don't have enough interest from anybody to enable them to raise enough money to do some serious drilling there. The only way I can see them progressing those tenements/projects is really only if they get acquired by a larger company with better management and deeper pockets.

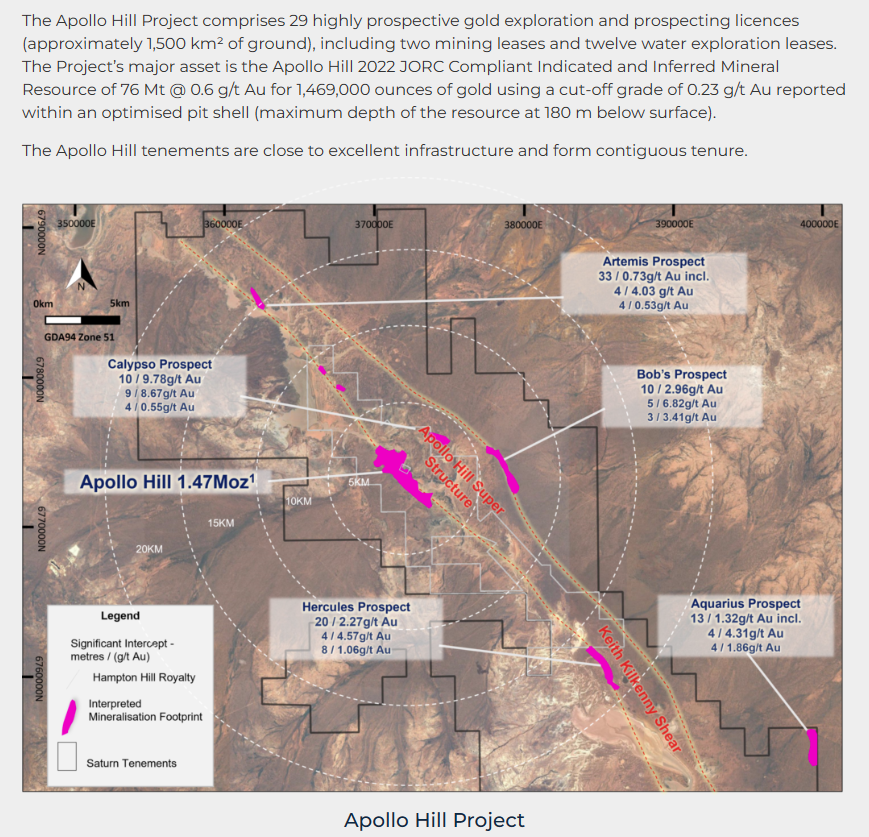

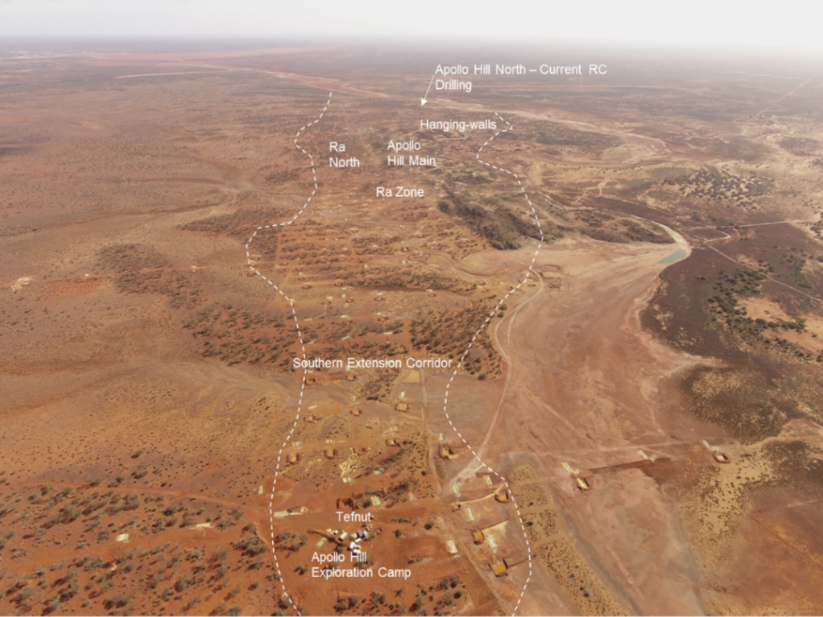

Apollo Hill has 1.8 million ounces of gold there, which is a decent deposit for sure, and while it is mostly relatively low grade, there's a lot of gold and it's all close to surface (so open pit mining) and relatively cheap to extract the gold. You can read about their progress here: Saturn-Metals-March-Quarterly-Activities-and-Cashflow-Report.PDF

They also released an Investor-Presentation.PDF on May 7th. They have GR Engineering (GNG; I hold GNG shares both here and IRL) helping them with the testwork and the design of the plant, so they are certainly moving forwards with Apollo Hill, and (unlike M2M) STN have the money to fund that progress, and the ability to raise more capital as required. That is now being reflected in their rising share price. They weren't even the sector's best performer so far today - that would be Ausgold (AUC) whose SP is up by over +30% today so far.

But +14% today by STN is not to be sneezed at. Especially when they've been making similar moves for about 2 months now.

Too early stage for me - not taking a punt on STN. I was prepared to add them to my SM portfolio a few weeks back as a trade (and what a trade it would have been!) but not with real money.

On today's Aussie gold sector watchlist, my top performer in my real money portfolios is in 5th position, BGL (Bellevue Gold) with a nice +7% to +8% move (they're currently +7.98% @ $2.03 - or up +15 cps). NST & GMD are both between +2.7% and +3%, or thereabouts. Good to see the rally is back on.