Pinned straw:

@jcmleng Good to read your update and that the problems of the past appear to be behind them. I held from 2019 to 2021 - long enough to make a c. 20% loss before I realised some important lessons:

1) This is a risky business because the imbalance of power with buyers;

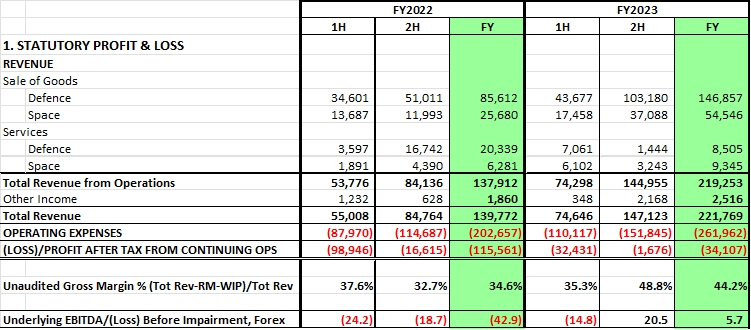

2) It essentially takes on project and supply chain risk when it signs up to contracts that - because of 1) - it probably can't fully price in. For example, several of its systems have to be integrated into the client's operations and meet performance tests before payments are made. So its not just making and shipping widgets.

3) I could never get the transparency and understanding of the economics of the business, in large part because of the long cash conversion cycle (money tied up for a long time) and different contracts and products probably with quite different economics not visible to investors;

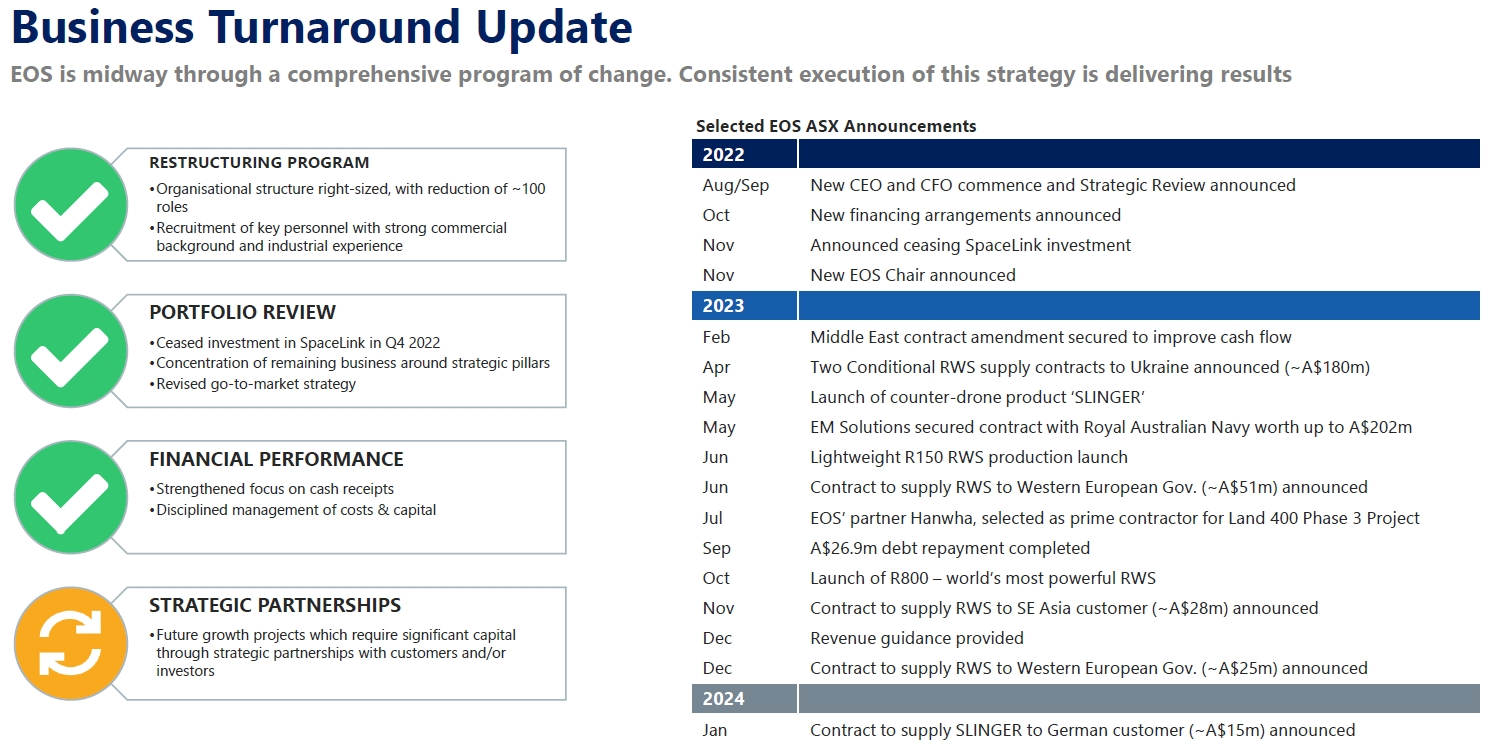

4) Management turnover is a concern. I'm glad they changed out the lot that were in charge when I held - they were overpaid and I don't think they were straight with shareholders over the risks they were managing (although, the closed borders and inability to move people to do acceptance testing during COVID was a big issue outside their control). Also, there was little skin in the game. To be clear, I am talking about the previous lot - I don't know much about the current crowd. But with a new bunch in charge, there is zero basis of confidence for me to invest. It is clearly not a great business that will succeeed no matter who is in charge.

I am still concerned that this business is not shareholder-friendly. Total compensation of the CEO is $1.6m, for a company with a market cap of $275m, where SOI have gone from 113m to 193m in 5 years, that doesn't make a profit, and has very unpredictable cashflows. Of course, it is really hard to attract top talent in the defence industry, and you will have to pay up if you want a CEO with experience in the international majors. This is the dilemma the Board will have faced.

If I am reading the annual report correctly, the CEO and CFO/COO own a total of zero (0) share between them. In fact, according to Simply Wall St, the Executive Team own 0.035% of SOI.

There's no doubt they have some great, relevant tech. and strong market tailwinds. They may even do very well from here.

However, I prefer businesses where I have some way of looking at how they've gone in the past and then being able to have a go and assess what they can look like in 3 to 5 years time, following the current strategy. When I held $EOS, I quickly reaslised this wasn't a business I'd ever be able to do that.

Its not an investment I could ever hold in the foreseeable future with any conviction. It just wouldn't make my top 30. And I'd never sleep easy, always waiting for the next surprise.

Everything I've written does not negate that this might well prove to be a fantastic investment from here, if the recent progress continues. It just doesn't fit my style and my comments above probably say more about me than about the company.

Disc. Not held