Pinned straw:

I sometimes stay awake at night thinking that perhaps I missed the boat here and considered an investment at 30 cents, but never pulled the trigger. But every time I look into the company, I can't but help that the Oleg and the board seem to be releasing information in ways that are designed to pump up the stock price to take "quick wins". I know this is not new news, but releasing information and classifying it as "Market Sensitive" to creative a positive sentiment with investors and potential investors is something that perhaps makes me a jaded, conservative and washed up investor which I simply can't look past ;-)

For those who invested, how did you look past this, and was your plan short term or long term? I'm genuinely curious.

Thanks, everyone for putting up your thoughts!

Appreciated !!

I'm going to hold for the moment, I stop-lossed out completely a couple of months ago to take a bit of profit, then bought back in when it was clear it wasn't falling off a cliff.

So I'm still under 12 months with my current holding...will hold on to them for the moment and see how it goes.

In my head it's a long term hold and I'm not a trader, so I've set my expectations for a bumpy ride.

There's no indication this is another Dubber or anything, so if it falls I'm sure there will be a floor short of zero, but still above my cost base....(I hope...lol)

Thanks all for your opinions ...

Bearish Points I've synthesised:

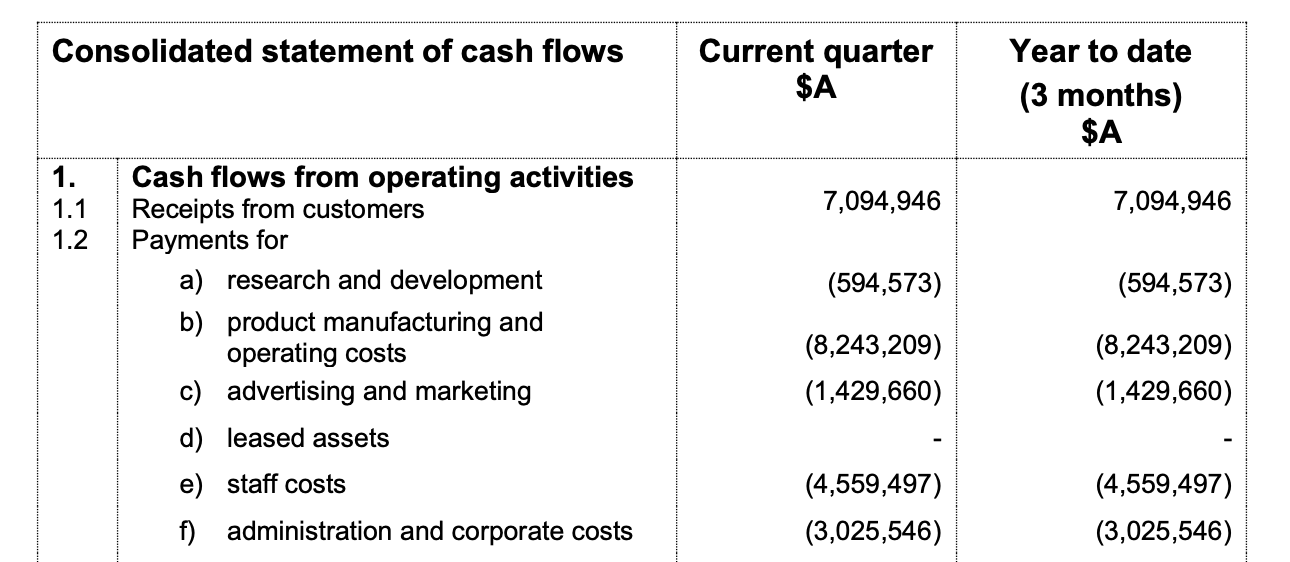

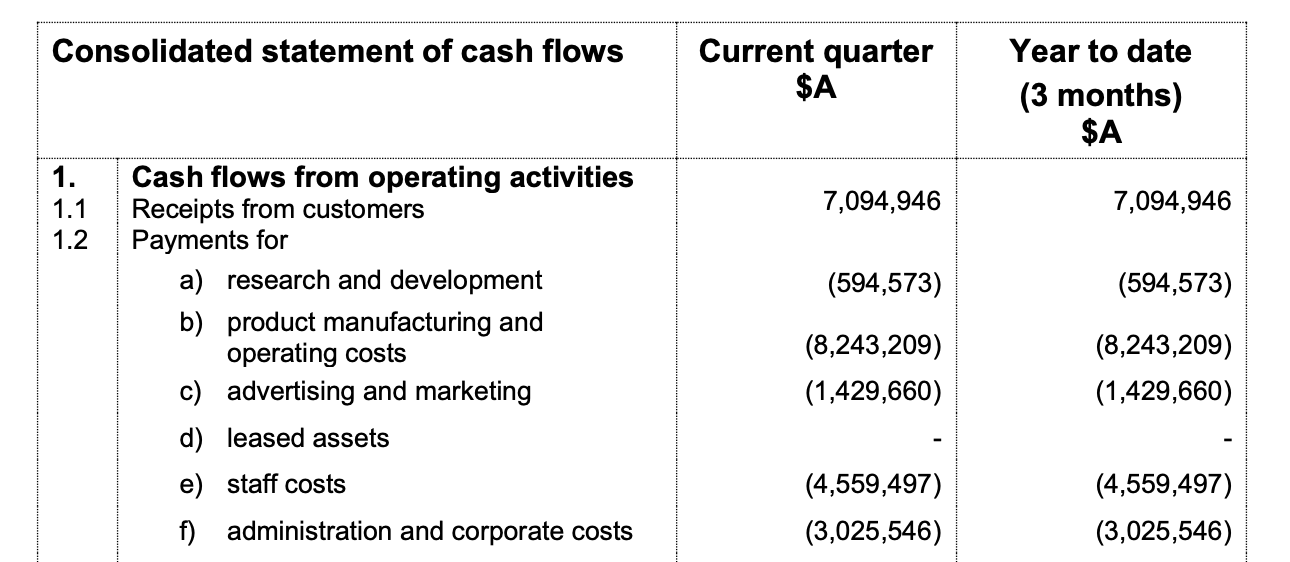

- @Hackofalltrades High degree of evolution of EWF meaning large amount of R&D spend required. These are called out as risks on Page 16 of the 2023 annual report. Based upon the 4C from Q1 are they actually spending enough on R&D to stay current / ahead of the market

- @GazD Desire to get to 50% revenue from software. Currently SaaS revenue 1Q 2024 was 561K (representing a doubling YoY) but thats relatively small percentage compared with the 16.4m overall revenue (which was a 10X growth). I.e. software growth of 2x is currently underperforming HW growth 10x (to get to 50% it needs to be growing faster). Also the express purpose of the two recent capital raises was to build "inventory" ... that's not required for software (we don't even need to burn a CD these days). So presumably more than half of that capital has been raised to stock "guns" which is 60% of their FY23 revenue.

- @topowl does the US miltiary have to purchase american made? Apparently as part of the AUKUS deal Australia is defined as part of the US domestic ... "In an unprecedented step, Australia will be included in the US Defense Production Act’s definition of domestic source. This means Australian-based businesses will be eligible to receive loans, grants and purchasing contracts direct from the US Government to support priority sectors, such as critical minerals supply chains, guided weapons, and advanced capabilities." https://www.minister.defence.gov.au/statements/2023-12-18/us-congress-progresses-aukus

More Bullish Points

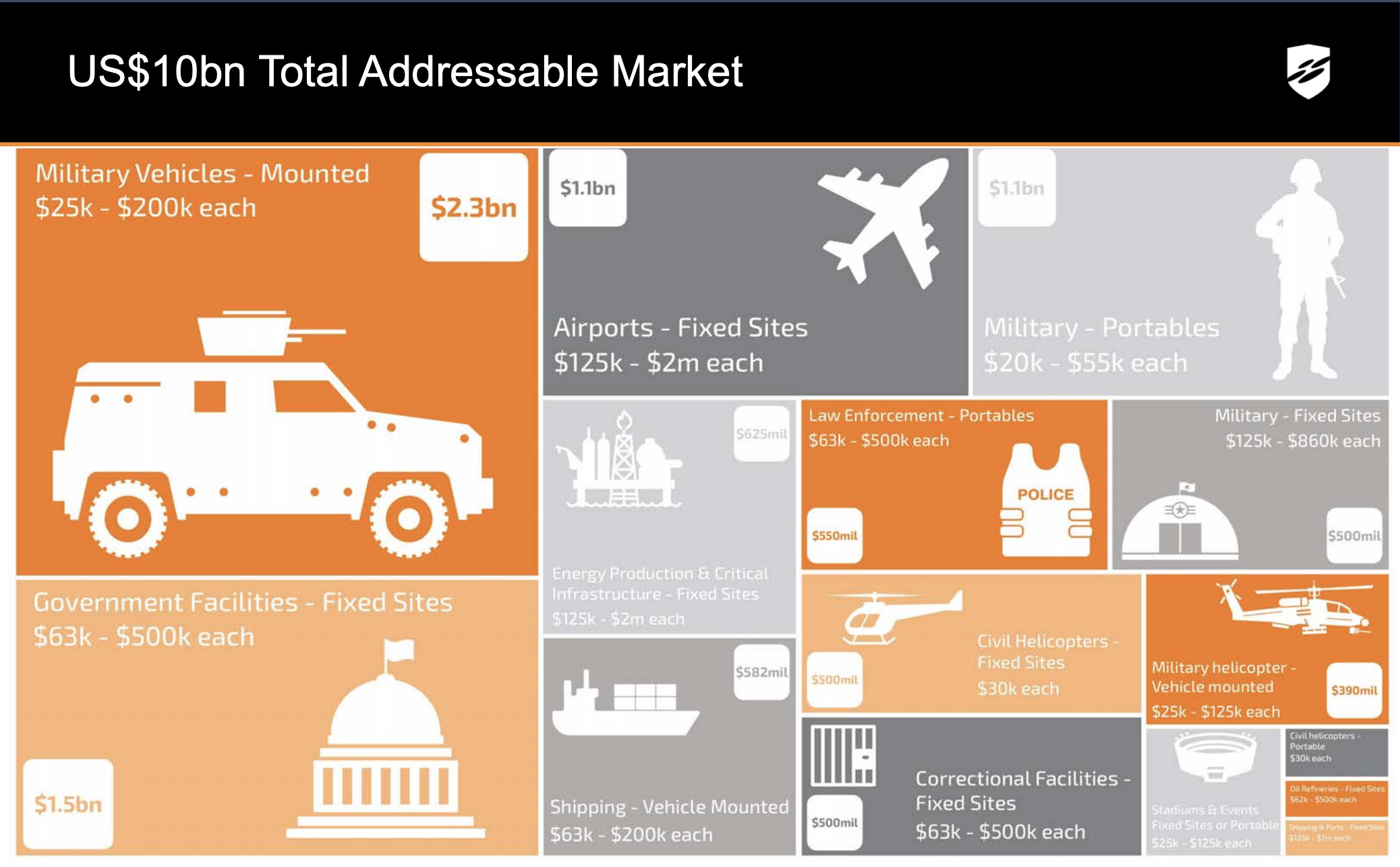

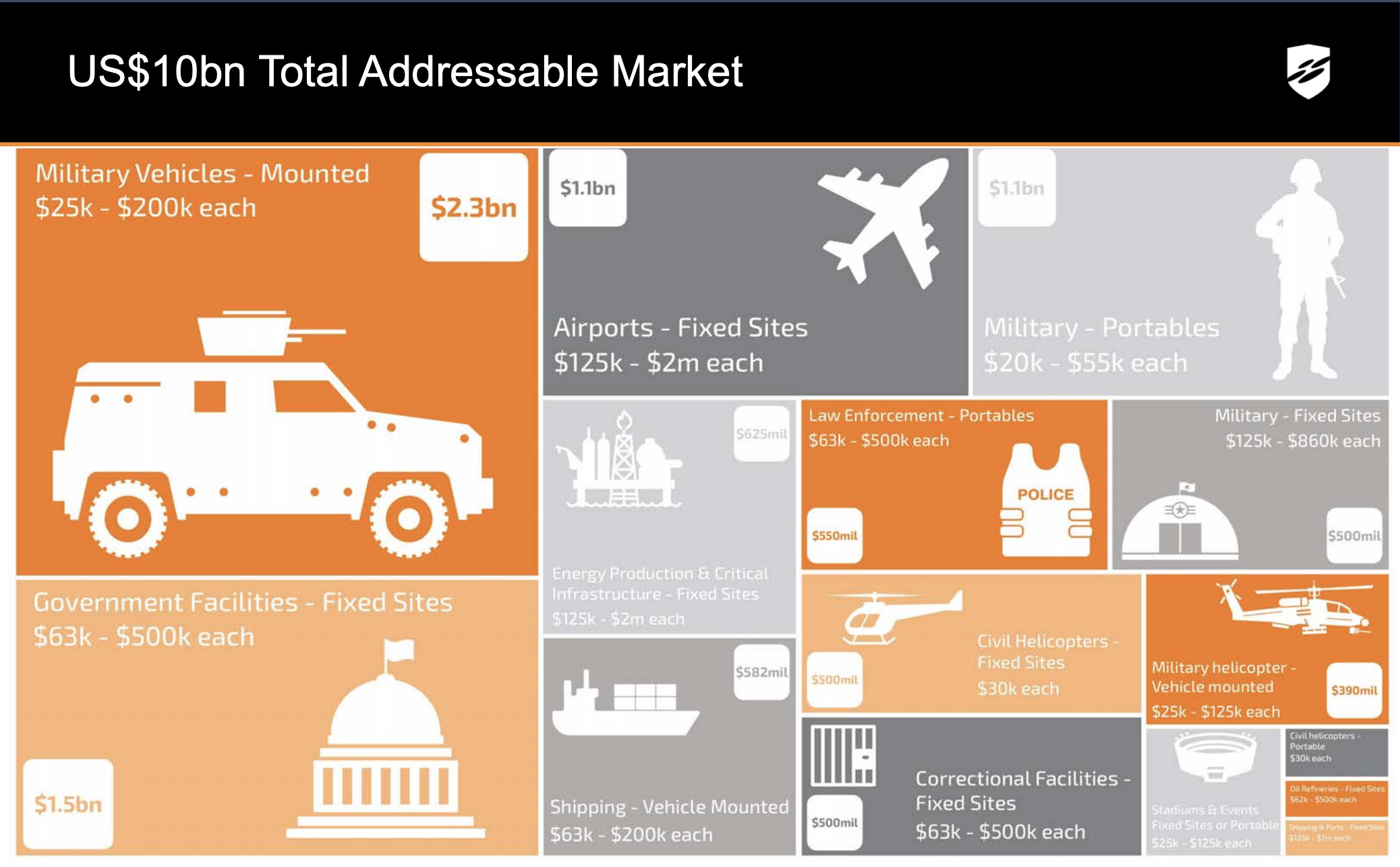

- @NewbieHK Still effective against commercial drones (even though military ones will probably evolve more quickly to make the guns less effective). Although much of the focus seems to be military related to date, DRO does point out quite a large TAM for civilian uses as well (eg. shipping, critical infrastructure, correctional facilities, stadiums, airports etc.) where the drones are more commercial nuisance rather than MilSpec with grenades strapped to them. I assume that things like this fixed infrastructure will be more likely to have their revenue in the detect space with maybe less requirement for defeat (i.e. guns). Maybe military is the tip of the spear for early revenue (on page 9 of the latest investor presentation they note >75% of revenue from defence) and civilian is the long tail of growth. They also note that fixed site revenue is only 5% in 2023 but likely to rise.

Digging into this, maybe I should hit Oleg up for a VP of Commercial Sales role since I'm not a former Navy Seal or military veteran and am too skinny to look cool in fatigues, also the organisation doesn't really seem to be very focussed on the civilian market at the moment.

DISC: Held IRL and SM (but nervous as the position has got pretty big)

I'm not sure exactly how this applies to Droneshield, but I can say that the military podcasts I listen to continually say that the electronic warfare is constantly evolving. A drone will use a frequency, so they will jam it, so they will put the drone on a different frequency, so they'll jam that, so they'll develop an ability for it to switch between multiple frequencies, etc. This is ongoing.

I'm not sure exactly what this means for the company, but I suspect it means a lot of continual development and a very quick obsolescence of products.