Confirmation and a sigh of relief. I guess the falling share price was betting the worst case scenario which had suddenly reversed in the last couple of days.

Not enough to plug the funding gap though. Startup Capex of 42m plus 20m contingent payment on FID and then 30m for production restart but after 18 months.

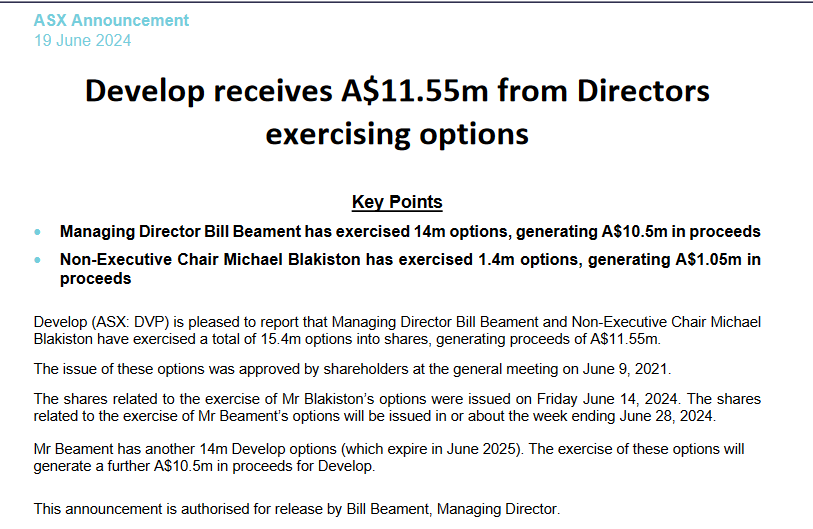

Probably cash on hand from last quarter is 36-14+11.5=33.5m

Not out of the woods.

Never knew holding VXR/DVP requires so much patience.

Still holding DVP due to Bill Beament's record so there is lots of confirmation bias here which is not healthy.

May expect another fall but I think it will be safe to top up on any dip now these options are done.

Any NST shareholders out there that held since 1c please share your thoughts!