Thats fine no problem. Im only 8 months into working this method (with a success rate of probably about 80%). Dont think Im traiding all of those move though.

Its very hard to explain this here, however I have followed along with just as much skepticism as you all do to this method im explaining here. Simply put, there are 5 wave to every impulsive move up and within each of those wave there are another 5 wave and so and and so forth. There maybe consilidations or rising wedges or declining wedges or ABC patterns or what every, however there will always be the core 5 waves up.

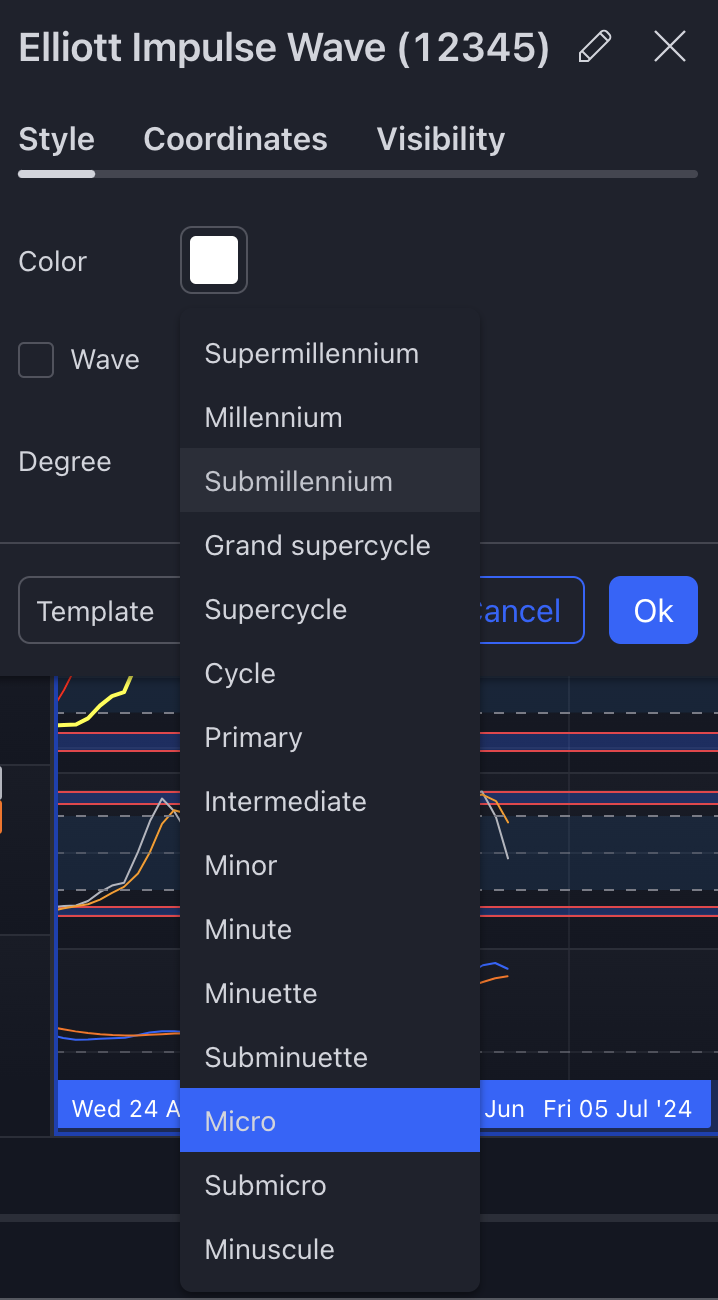

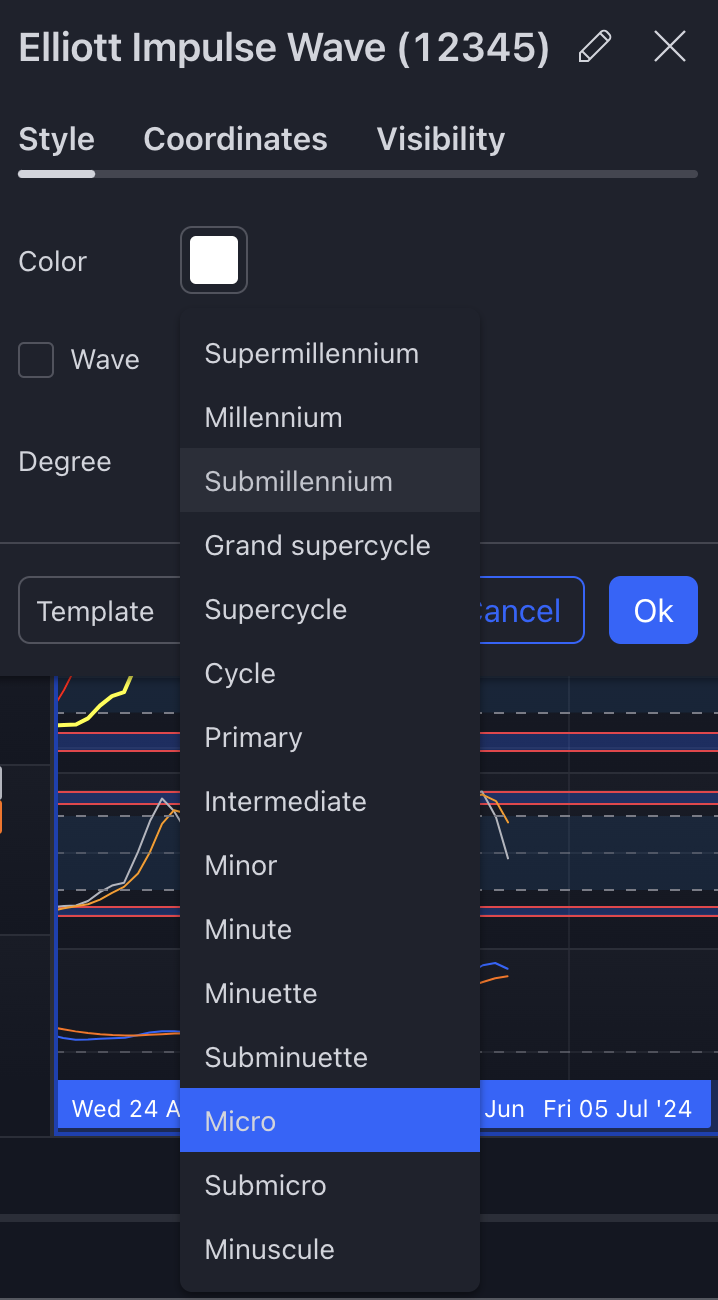

So if you think about it, the first 5 waves will become evident on the (lets say) 5m chart. If you then pulled out to say the 1d chart it would look more so like just 1 larger wave up as its not showing the detail so much and probably cant see the 5 waves it was made up of. Apply that to all the time frames. Hence when you look at my charts, I have many differnt waves plotted as in, micro waves, minor waves, Primary waves etc. Have a look at all the different levels of wave on Trading View you can chose from. Basically they would be placed on higher time frames as time went along. Remenber too that these arent idea's I came up with, this is all part of a major trading softwares features.

So when The Price action recently blasted out above the day charts I was working on, i thought to myself whats it now working on, (or what. happens then). I looked at the weekly charts and sore visually the same movemwnt there in a much bigger format. I then applied the rules to that and found it was now behaving nicely to that. Thats it.

This is not a told you so moment, however dont you think its strange the last 2 days have seen the big drop they have? why those 2 days? theres no news, so why now. I say because the pro's / algorithms are working with Elliot wave theory. So im following along.

Look I say this nicely as possible, There will be those that think its all full of crap, or there will be the hatters, thats ok. It's working well for me. Take it all with a grain of salt I say. I have to say that I see valuations on strawman all over the place that vary wildly and and i take it all with a grain of salt. As much as we try to put a forward valuation on a company, a CEO could run off with all the money or make a very poor acquisition sending a comany backward fast. We have seen it before. Nothing is fool proof. No 1 way or though or process should be used for trading, that would also be a mistake.

Trading should be made up of many NON-CORRELATED indcators/methods (chartists & Fundamentalist thoughts) to give the trader the highest probability of success. Thats it. :)