Pinned straw:

My last post touched on the incredible growth of EVs over the better part of the decade, but didn't address concerns around the industry being propped up by incentives and the like.

The obvious argument in response relates to Telsa -- one of two current market leaders. They recently made over 15b in profits. Sounds pretty sustainable to me!

I think the principal argument though is the fact the EV industry is still in its infancy -- manufacturers will grow more efficient as they scale, finding efficiencies and ways to manufacture more affordably. The below for instance is a great read:

Plunging battery prices will deliver cost parity for EVs by 2025

Electric vehicle (EV) battery prices are forecast to fall by 40 per cent by 2025, according to global financial giant Goldman Sachs, and will help deliver overall cost parity for electric vehicles by that date.

The most expensive EV component is the battery pack. I would almost bet my house on that fact that we will see significant improvements to batteries over the medium to long term, relevant to both cost and performance.

If the author of the AFR article doesn't expect innovations and improvements -- that will ultimately make the manufacture of EVs more affordable -- they are kidding themselves.

Unfortunately, it seems “click-bait titles” are part and parcel of all media now-days.

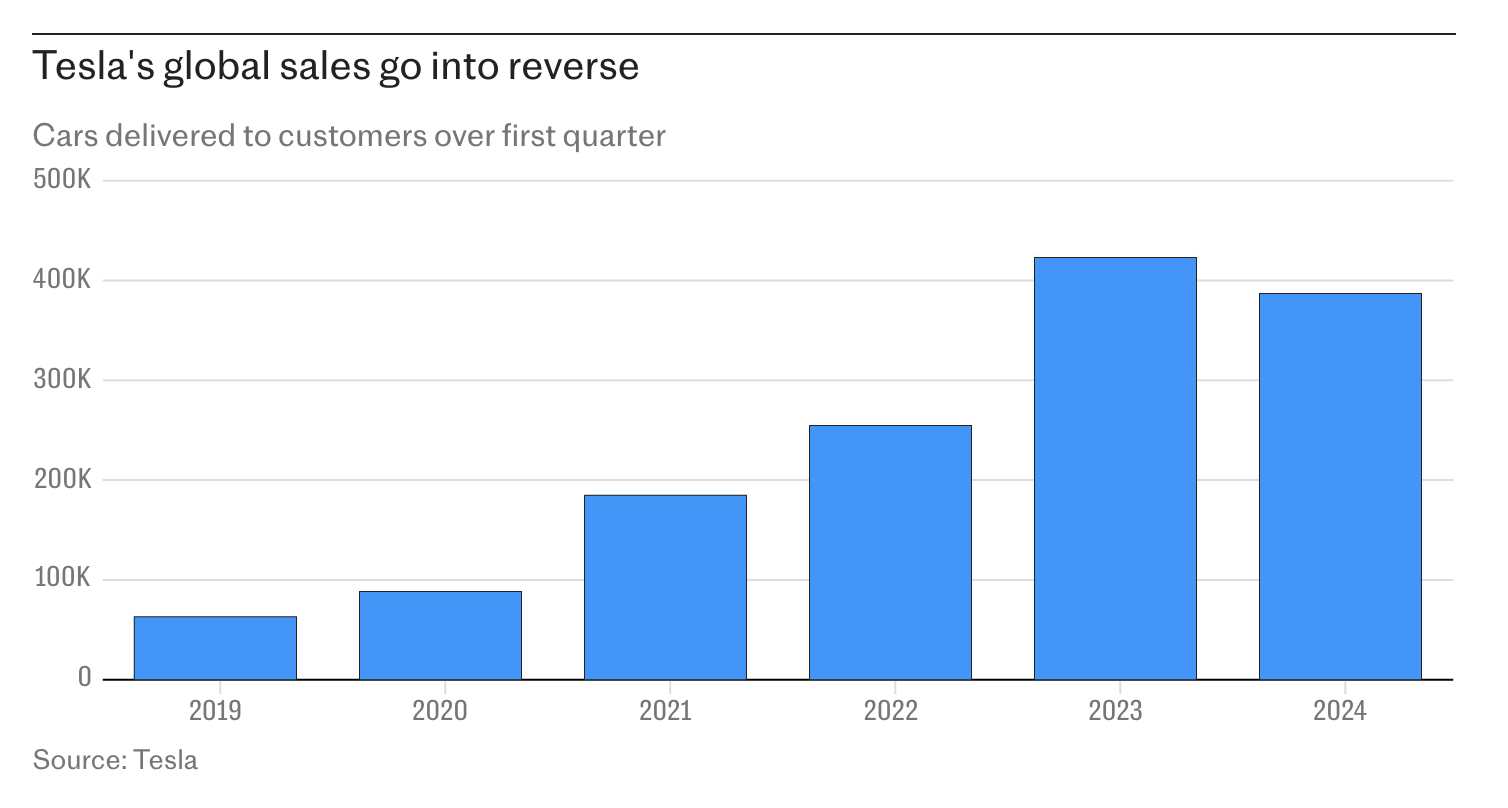

I also love all the doom and gloom re: EV failing to note car sales of ICE vehicles are also down.

Who would have thought after a couple of years of higher interest rates (note higher not high as the media love pushing) eventually spending habits would have to adjust.

I guess you don’t get as many clicks on your articles with a heading of “EV sales down in 2024 after a record 2023 when interest rates normalised.

@Ipsum as you say, its just a cycle.

Both on the upswing and the downswing, there are those who create narratives that project linear trends. The lithium supply pressure build was years in the making, and hasn't played out yet, because there are enough low cost suppliers still bringing new production on-stream. The demand side slowdown, also appears temporary - albeit, perhaps the consensus forecasts were too bullish and didn't consider factors like infrastructure drag, brakes on consumer spending power, the strength of hybrids as a preferred customer proposition, government policy etc.

Of the cycles, I'm still eyeing copper as my preferred pick and trying to be patient. Its role in the global tranistion is pretty fundamental but, unlike lithium, the supply challenge is much greater, with a long run trend of falling grades and rising cost relentlessly nudging up the right-hand end of the cost curve.