08-Feb-2025: From Marcus Padley's Saturday weekly wrap email this morning:

Excerpt:

SPI Futures down 64.

Wall St wobbles a touch overnight (Dow down 444, NASDAQ down 1.37%, S&P 500 down 0.95%) on more Trump mutterings about 'reciprocal' tariffs to come, and on higher than expected average earnings numbers which caused bond yields to rise 4.8bp and 7.1bp (10Y and 2Y). Consumer confidence numbers hit a 7-month low, and within that survey, inflation expectations rose, but you wonder if that read was taken before or after the tariff delays. Amazon down 4.1% on results. Alphabet down another 3.2%. Tesla down 3.4%. We are through the US Big Tech results season. It hasn't exactly lit up the market, but it hasn't punctured it either.

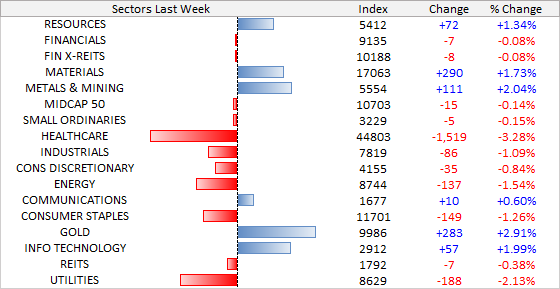

Resources faded a bit after a better week – BHP and RIO down 0.7% and 0.4% on Friday in the US.

The ASX 200 is within 0.65% of its all-time high. All banks inspired. The NASDAQ is 3.4% from its high, the S&P 500 1.5%. We are floating around at the highs and about to go into the post-results season doldrums in the US.

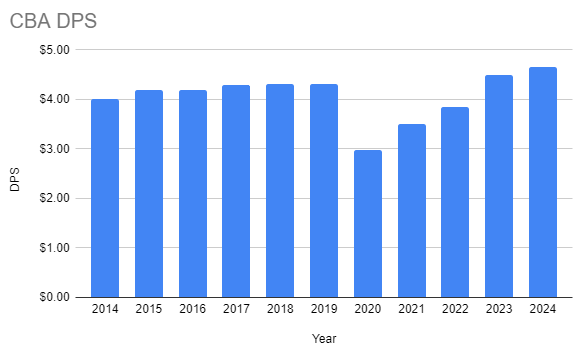

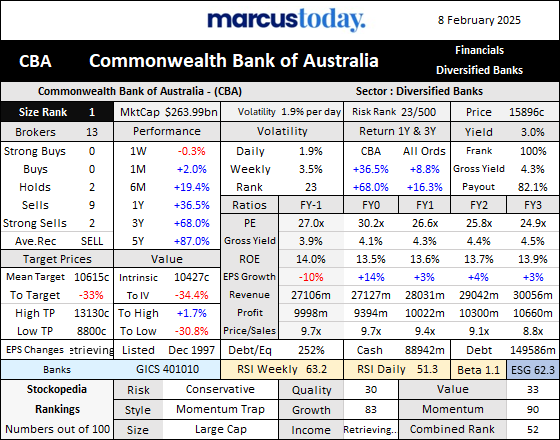

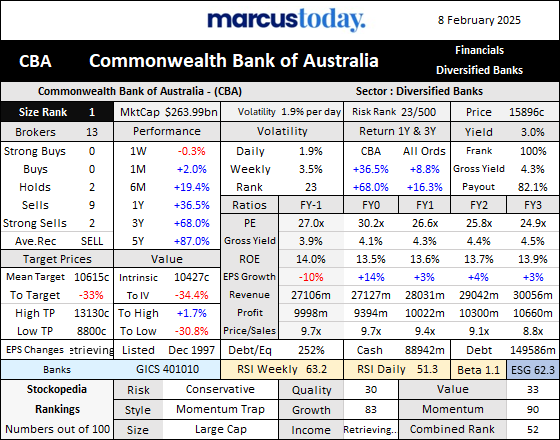

Results season here is about to take off. Whether the CBA results can hold the share price is the main debate this week. How a low growth stock like this could ever hit a 30x PE I don't know (I do - people are paying up for safety). In the old days the banks were a buy if the PE ever got below 10x and a sell if they ever got over 15x. Now 30x. Pressure is on.

---

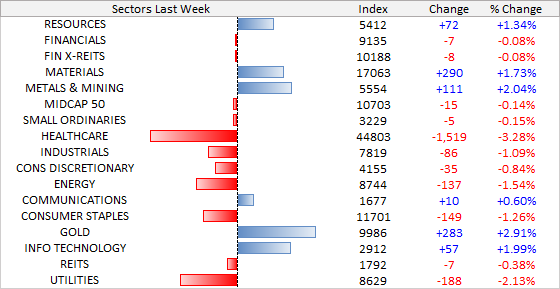

Aussie Sector movements this past week - Banks underperformed:

--- end of excerpts ---

CBA are slated to report their H1 results (to December 31st 2024) on Wednesday (12 February 2025) - and they have already (last week) informed the market of some changes to their reporting - CBA-Items-impacting-CBA's-financial-reporting-(03-Feb-2025).PDF

I haven't looked into that in any detail because I don't hold CBA or any banks directly.

Even though many punters would invest in CBA ahead of BHP because of the risk with cyclical miners and the exposure to commodity prices that BHP clearly has, I imagine that if demand for our bulk commodities (iron ore, coal) and other metals and minerals declines significantly, Australia, as a commodities-based economy, would look far less attractive as an investment destination for overseas investors, and if our ASX falls on the back of commodity price declines, that will also make CBA look less attractive, because it's the largest constituent of the ASX, and a receding tide will take everything down with it, not just the miners.

I'm talking here about a deep correction to the ASX, not day to day or week to week volatility. And we know that such events do happen, and we're probably overdue for such an event to be honest. So, as I said before, the only thing propping up CBA is positive sentiment, and that can change very quickly. There are many reasons why people might be buying CBA at these very elevated levels, and also reasons why people are loathe to sell and lock in massive capital gains in many cases which they would then have to pay considerable tax on, however I don't fall into either of those categories myself, coz I'm not holding, and I'm not seeing CBA as a top investment idea with clearly more upside than downside risk.

I actually think there is far more downside risk, which is one reason I'm steering clear of them, and there are others, such as my own track record of making more money in other sectors (not financials, and especially not banks). But horses for courses, each to their own, different strokes for different folks and de gustibus non disputandum.

Disc: Nah.