I'm no fan of the banks, as I'm sure most of you know, but I always find their results material fascinating reading.

There's a lot of coverage out there, but I'll highlight some of the things i think are interesting.

The first thing to note is that CBA remains one of the most expensive banks in the world -- at a price-to-book of 3.1x, it represents more than double what you typically see for a bank.

Even JP Morgan's CEO Jamie Dimon said recently that “Buying back stock as a financial company, greatly in excess of two times tangible book [value] is a mistake. We aren’t going to do it”

P/B ratios tend to be the preferred measure for banks because of the fundamental importance of their balance sheets (well, that's always important, but it's super important for banks). Book value is less volatile than earnings and also gives a good read on lending capacity etc.

But even if you prefer a PE, 23x aint cheap either -- especially for a mature business that just reported a 6% drop in profits, and for which analysts are forecasting little to no growth in the coming years.

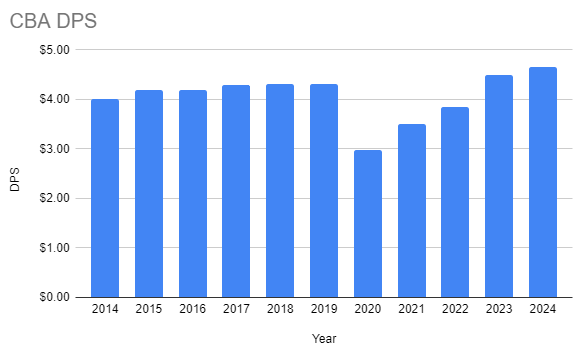

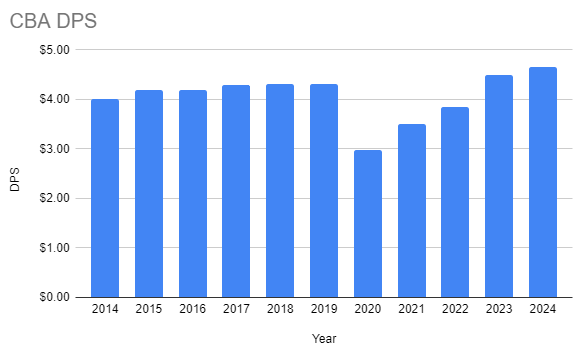

Yeah, yeah dividends blah blah blah, but is 3.5% ff (or about 5% grossed up) really that good? I mean, i can pretty much get that (virtually) risk free in CBA's own term deposits! Also, there's no growth in the dividends -- the compound annual growth rate in Divs per share over the last decade has been ~1.5%

Oh, and there's a nice reminder here that dividends can and do get cut from time to time.

I'll just remind you again that of all the loans the CBA makes, 70% are for home loans. 17% are business loans

Which makes it very hard to take Matt's assertion seriously:

Anyway, the maths is such that you only need an ~11% drop in the carrying value of their home loan book to entirely wipe out their equity. That's not likely to happen, which even a bear like me will admit, but it shows you how sensitive they are to the housing market. And you dont need much of a writedown to really take a knife to earnings.

(I will note that impaired and 90-day arrears metrics both moved in the wrong direction, with provisioning coming in 50% higher than the bank itself forecast).

Anyway, I can shake my fist at the sky all day long -- the fact is CBA has done very well in terms of share price in recent years (unlike its peers).

Still, low to no growth, highly sensitive to economic conditions and excessively valued.

Hard pass.