07-June-2025: I'm going to update this straw at the end with a current situation update - but first, here's what I wrote 3 years ago.

19-June-2022: CBA is Australia's second largest company (behind BHP) and is currently rated #283 here on Strawman.com (as I type this), having moved up the rankings a fair bit since their share price has reduced lately. It does say something about our primary focus here that a company like CBA rates so low in terms of people here who hold the company in their Strawman.com portfolio.

CBA is currently held here by only 4 Strawman Premium members. And I am not one of them. I have never held any of the big 4 banks in my SM portfolio.

Being the clear leader of the big 4 in terms of size and quality (and management also IMO), CBA is starting to look interesting from a price perspective:

$87.26 looks like a great price when you look at that, however when you zoom out and look at the 5-year chart...

...the pullback in 2022 hasn't been nearly so deep as the one in 2020, and I feel there is plenty of scope for that SP decline to continue further before they recover, purely based on sentiment around an impending Australian recession, and the rest of it. I think CBA is probably a decent BUY here, with a 5-year-plus view, but I think they're going lower and we'll be able to buy them even cheaper in the future, possibly the near future.

I found it interesting what FMG founder and major shareholder Andrew "Twiggy" Forrest said last week about the likelihood of a global recession this year - Andrew Forrest says no recession, but expects years of choppy markets (afr.com)

by Hans van Leeuwen, Europe correspondent

Last updated Jun 17, 2022 – 11.26am, first published at 10.36am

London: Fortescue Metals Group boss Andrew Forrest says there is “not a snowflake’s chance in hell” of a global recession this year, but warned that markets could be “choppy and uncertain” for up to three years.

Speaking to AFR Weekend during a visit to London, Australia’s richest man said Fortescue’s low cost base and its green energy plans left it well-placed to weather the storm of rising borrowing costs, soaring inflation and slower growth.

Andrew Forrest visited France this week to sign a deal for zero-emission trucks with manufacturer Liebherr.

He also shrugged off reports that China might create a centralised purchasing cartel to drive down iron ore prices, saying this was “a story which gets trotted out every three years”.

The Russia-Ukraine war has spurred sharp increases in energy and food prices. This has combined with rebounding post-pandemic labour markets and issues with supply chains and transport costs to fuel inflation.

“I don’t know of a better industry to be pivoting towards when fuel prices are going through the roof than an industry where you can make all your own fuel,” he said, referring to Fortescue’s ambitious plans to make hydrogen from renewable energy.

The prospect of rampant inflation has pushed central banks to start aggressively raising interest rates, sapping stock prices. Companies’ cost of capital may climb, deterring them from investing and expanding.

But Dr Forrest said Fortescue was relatively immune to these cyclical forces: it should still be able to raise capital, and could withstand any downturn in commodity prices.

“We smoke $3.5 billion worth of fossil fuel into the atmosphere every year. That is one hell of a pool of capital annually to invest into your own fuel production and green iron systems,” he said.

He also said there was still an abundance of capital looking for investible projects. “The largest part of that is for green projects, by a country mile. That’s not going to change.”

And even if the cost of capital rose or fell, “so does the commodity price”, giving him the revenue base he needs to push forward with his green transformation.

Fortescue plans to spend $800 million-plus to build an end-to-end supply chain for hydrogen and ammonia produced using only renewable energy, and is also investing in technology for hydrogen-powered or zero-emission ships, trucks and trains.

The biggest risk to Dr Forrest’s ambition would appear to be a drop in the price of iron ore, but he is not overly worried.

“Demand for our product has remained strong,” he said. “And if global demand for iron ore goes down, the last man standing will be the lowest cost producer. And that is Fortescue.”

‘Not a snowflake’s chance in hell’

Dr Forrest was not anticipating the kind of global recession that might sap demand for iron ore. He said there was “not a snowflake’s chance in hell” of that happening.

“From country to country, yes. But there’s pent-up demand from COVID and that’s now been exacerbated by the Russian invasion. And I think that demand is still going to be there,” he said.

“You are going to have a choppy two or three years; not recession, nothing hugely dramatic like a global recession. But markets are going to remain choppy and uncertain for two or three years.”

The other great uncertainty is geopolitical: the ever-lingering prospect of worsening relations between the US and China, with the potential for economic decoupling that might sweep up Australia even further.

Dr Forrest welcomed the Albanese government’s more temperate approach to relations with China as “a breath of fresh air”.

“I’ve really resented China being used in [Australian] politics,” he said.

He urged both Beijing and Canberra to “check their language” and make sure they were not creating an enmity by treating each other as enemies.

But his support for a détente with Beijing was based on “the public interest”, he said, as geopolitical tension was not a material concern for his business.

--- ends ---

RELATED

RELATED

So back to CBA. There will likely be further downside from here, but at some point they will become worthy of serious consideration as part of a diversified portfolio, particularly one like mine that currently has zero banking exposure.

The sell-down of the banks (including CBA) is not entirely unjustified. They WERE quite expensive, especially CBA, and the outlook is changing, however they are NOT going broke, they are very well managed, and at some point I will likely buy some if the price keeps falling.

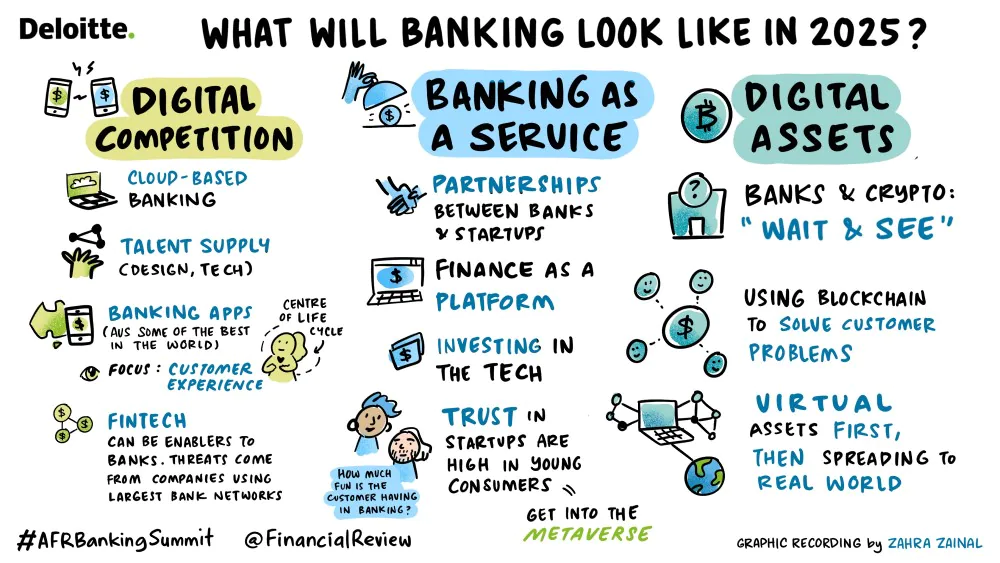

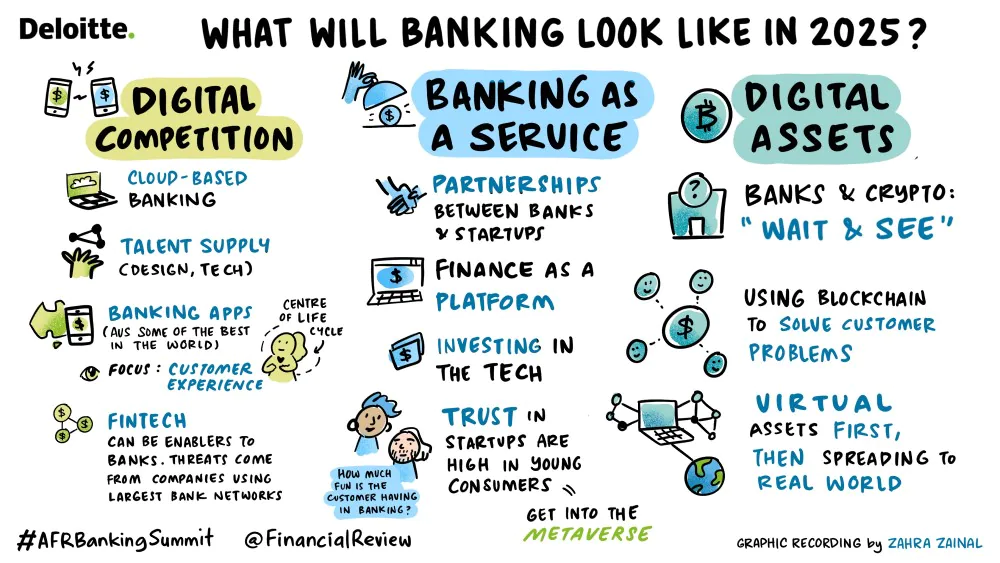

Also, while the banking landscape will continue to evolve, I would back CBA to keep themselves at the cutting edge of banking here in Australia, as they have done so far.

Source: AFR Banking Summit | Deloitte Australia

7th June 2025: Update:

CBA is currently STILL held here by only 4 Strawman Premium members. And I am STILL not one of them. Different 4, but still 4 holders. CBA is ranked # 137 on Strawman.com today.

And I have still never held any of the big 4 banks in my SM portfolio.

I said three years ago: Being the clear leader of the big 4 in terms of size and quality (and management also IMO), CBA was starting to look interesting from a price perspective.

But that I still wasn't buying any. Not at that level (I thought I might buy some if they dropped further).

They had just been sold down from $107 to $87/share.

Now , 3 years later, they closed yesterday (Friday 6th June 2025) at $179.90, after making a new all time high of $182/share the previous day (Thursday 5th June). So they've doubled in that three year period, which is a phenomenal effort considering there were plenty of people (including me) who thought they were expensive at $87/share.

We've discussed the reasons before - CBA are now, by far, Australia's largest company, having a market cap of over $300 Billion, which is over $100 Billion more than BHP, which is at #2. Passive ETF buying has a lot to do with it, and CBA are certainly too big to fail, certainly in terms of being the largest Australian bank with most deposits guaranteed by the Australian Government. The Australian Government won't allow any of our big 4 banks to fail. Probably not MQG either, although Macquarie are far more of a global asset manager and investment bank than a traditional bank, so you never know.

These banks are in no danger of failing anyway, IMO, but the point is that they're seen as being "Safe as Houses" - an analogy that may open up a different can of worms - about Australia's housing crisis - in terms of house prices continuing to rise making it more and more unaffordable for new entrants to enter the market, to buy their first home, and the fact that home owners having so much of their personal wealth tied up in property means that sensible reform of stuff like negative gearing is always going to be political suicide.

But it is what it is, and CBA remains the King of Australian residential property financing.

Here's what Marcus Padley penned about CBA in his Saturday "Weekly Wrap" email this morning:

Not a bad week for the ASX200. Up 1%.

If you had told me back in the dim days of April that just a few months later we would be at an all-time high, I would have checked what you had been taking. It was hard to see that, to say the least. Yet here we are. Not quite at a high, but damn close. CBA has soared to record highs, leaving everyone scratching their heads as to why. It is the most expensive bank in the galaxy, yet it still goes up. I call it the Rolex bank. It commands a premium just because. It still just tells the time, but it does it elegantly and it holds its value.

Last week I talked about why it keeps going up. That army of retail investors that will never sell, plus the passive ETF funds flowing in. All that superannuation money looking for a home. Looking for a safe home. This week there was a big overseas investor buying up the bank in a big way. Fisher Investments, which manages more than US$299bn, wanted exposure to stocks outside of the US.

Now the thing about these big US funds is they do not really care what they buy. They have a number of criteria: it must be big, it must be liquid, and it must be a name they know that can withstand a big order. These guys are based in Texas, and everything is big. The story is that they bought US$1bn worth. Now there are few stocks in Australia you could do that in — BHP maybe, RIO, CSL — but they all have issues and baggage. CBA is clean. It may be expensive, but to be honest the guys at Fisher probably don’t care. They want liquidity and scale. It’s Texas money after all. It’s big. An investment needs to be meaningful.

I see funds saying they’re allocating a 1% holding to crypto, for instance. I mean really, what’s the point? It will hardly move the dial. I guess it’s about treading carefully and easing in. Not something a Texan fund manager would do. Go big or go home. Boot scootin’ time. Can I get a Yee Haa?

Once they’ve filled their cowboy boots, they can tell their clients they’re investing money outside the US.

I would love to have heard that investment meeting conversation. Buy me a one billion dollars (Dr Evil Moment) of the biggest thing in Australia. What's it called? Bank of Australia. Yeah that one. Go get 'em. Can I get a Yee Haa! Damn right you can!

--- end of excerpt ---

OK, I don't know about the Yee Haa's, but MP paints an interesting picture - smart money that is perhaps not so smart - let's call it BIG money - is continuing to drive up the price. Some say that's unsustainable, a bubble, and it will burst, but the market can remain irrational longer than many of us can stay solvent, as a wise man (John Maynard Keynes) once said.

But I'm still not putting any money into CBA. I've foregone the opportunity of doubling my money in three years, with the benefit of hindsight, and CBA may double again in the next three years, but I would say the odds are that they won't, and there's also a decent chance their SP could halve in a much shorter period than that if one or two things happen, things unrelated to the bank itself but things that could very quickly drive a big investor sentiment shift, so the risk/reward equation with CBA did NOT look good to me three years ago, and it looks a damn sight worse today.

Well done to those that have held CBA through to these dizzying heights.

But they're still not for me.