Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

A day later and I have managed to pick my jaw up off the floor. Oracle....

My wife was asking why a jump of over 30% was such a big deal. When I told her about @Strawman's favourite "growth" company, CBA being a quarter of the size of Oracle she started to understand. We fondly remember walking the "bump and grind" hike in Palm Springs and overlooking Larry's private golf club that the likes of Nadal stay at for his Indian Wells tournament. She thinks Larry's increase in wealth of about $100B should maintain the golf course ok!

Can we ask Matt Comyn when CBA will pop 30%?

Basically inline of market expectations

https://hotcopper.com.au/threads/ann-2025-full-year-results-presentation.8708869/

CBA results

Preview via Motley fool: All eyes will be on Commonwealth Bank of Australia (ASX: CBA) shares today when the banking giant releases its full year results. According to a note out of UBS, its analysts are expecting the bank to report a 3.6% lift in revenue to $28.17 billion and a net profit of $10.27 billion. This is expected to underpin a full year fully franked dividend of $4.75 per share.

CBA Return (inc div) 1yr: 41.47% 3yr: 26.03% pa 5yr: 23.68% pa

https://www.livewiremarkets.com/wires/no-etfs-are-not-causing-commbank-s-hated-rally

story by switzer

Investors cannot predict all things ..hehe - enjoy - just navigate - 'do yah best'

The offshore ETF flood keeps pushing it higher

:Conclusion

Can the CBA share price keep going higher?

This is where things start to get interesting. Because while everyone agrees there’s plenty of money chasing CBA, there’s also no denying that it’s looking pretty stretched right now.

As Liu puts it:

“The best thing it will do is probably just grind higher. It might underperform a bit compared to the rest of the market, but I think the share market overall will go higher. CBA might just grind a bit higher—it is expensive—but I don’t think it’ll have a substantial fall.”

So she’s not calling the top, but also not expecting fireworks.

The valuation tells the story. Right now, CBA is trading on a price-to-earnings (P/E) ratio of 31.77. At that kind of premium, you’re basically paying for perfection. Either earnings need to grow a lot faster than anyone expects, or you need even more capital flooding in to push the price higher. And that’s where things get tougher.

Wayne doesn’t sugar-coat it:

“It does beggar belief in many ways, just looking at the valuation it trades on: relative to its earnings growth and dividend per-share growth, which have been fairly anaemic. There’s no doubt that, relative to other banks globally, CBA is expensive.”

He’s not wrong. While CBA’s business is incredibly solid with dominant market share, strong capital position and reliable dividends, none of that easily justifies 32 times earnings forever. At some point, something has to give: either earnings growth accelerates, or the multiple contracts.

For now though, the flows keep coming. And as long as the rest of the world sees CBA as Australia’s proxy blue-chip, the index-following money keeps piling in.

Hey @Bear77 quoted - 19-June-2022: CBA is Australia's second largest company (behind BHP)

$87 looks a good buy then ..hehehe.

19 - June - 2025 Now CBA in ranked 1st Largest Company.

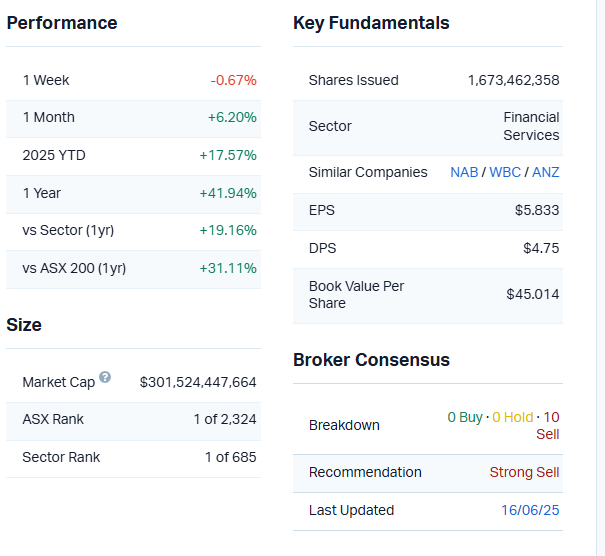

Below - some CBA stats - borrowed from Market Index.

07-June-2025: I'm going to update this straw at the end with a current situation update - but first, here's what I wrote 3 years ago.

19-June-2022: CBA is Australia's second largest company (behind BHP) and is currently rated #283 here on Strawman.com (as I type this), having moved up the rankings a fair bit since their share price has reduced lately. It does say something about our primary focus here that a company like CBA rates so low in terms of people here who hold the company in their Strawman.com portfolio.

CBA is currently held here by only 4 Strawman Premium members. And I am not one of them. I have never held any of the big 4 banks in my SM portfolio.

Being the clear leader of the big 4 in terms of size and quality (and management also IMO), CBA is starting to look interesting from a price perspective:

$87.26 looks like a great price when you look at that, however when you zoom out and look at the 5-year chart...

...the pullback in 2022 hasn't been nearly so deep as the one in 2020, and I feel there is plenty of scope for that SP decline to continue further before they recover, purely based on sentiment around an impending Australian recession, and the rest of it. I think CBA is probably a decent BUY here, with a 5-year-plus view, but I think they're going lower and we'll be able to buy them even cheaper in the future, possibly the near future.

I found it interesting what FMG founder and major shareholder Andrew "Twiggy" Forrest said last week about the likelihood of a global recession this year - Andrew Forrest says no recession, but expects years of choppy markets (afr.com)

by Hans van Leeuwen, Europe correspondent

Last updated Jun 17, 2022 – 11.26am, first published at 10.36am

London: Fortescue Metals Group boss Andrew Forrest says there is “not a snowflake’s chance in hell” of a global recession this year, but warned that markets could be “choppy and uncertain” for up to three years.

Speaking to AFR Weekend during a visit to London, Australia’s richest man said Fortescue’s low cost base and its green energy plans left it well-placed to weather the storm of rising borrowing costs, soaring inflation and slower growth.

Andrew Forrest visited France this week to sign a deal for zero-emission trucks with manufacturer Liebherr.

He also shrugged off reports that China might create a centralised purchasing cartel to drive down iron ore prices, saying this was “a story which gets trotted out every three years”.

The Russia-Ukraine war has spurred sharp increases in energy and food prices. This has combined with rebounding post-pandemic labour markets and issues with supply chains and transport costs to fuel inflation.

“I don’t know of a better industry to be pivoting towards when fuel prices are going through the roof than an industry where you can make all your own fuel,” he said, referring to Fortescue’s ambitious plans to make hydrogen from renewable energy.

The prospect of rampant inflation has pushed central banks to start aggressively raising interest rates, sapping stock prices. Companies’ cost of capital may climb, deterring them from investing and expanding.

But Dr Forrest said Fortescue was relatively immune to these cyclical forces: it should still be able to raise capital, and could withstand any downturn in commodity prices.

“We smoke $3.5 billion worth of fossil fuel into the atmosphere every year. That is one hell of a pool of capital annually to invest into your own fuel production and green iron systems,” he said.

He also said there was still an abundance of capital looking for investible projects. “The largest part of that is for green projects, by a country mile. That’s not going to change.”

And even if the cost of capital rose or fell, “so does the commodity price”, giving him the revenue base he needs to push forward with his green transformation.

Fortescue plans to spend $800 million-plus to build an end-to-end supply chain for hydrogen and ammonia produced using only renewable energy, and is also investing in technology for hydrogen-powered or zero-emission ships, trucks and trains.

The biggest risk to Dr Forrest’s ambition would appear to be a drop in the price of iron ore, but he is not overly worried.

“Demand for our product has remained strong,” he said. “And if global demand for iron ore goes down, the last man standing will be the lowest cost producer. And that is Fortescue.”

‘Not a snowflake’s chance in hell’

Dr Forrest was not anticipating the kind of global recession that might sap demand for iron ore. He said there was “not a snowflake’s chance in hell” of that happening.

“From country to country, yes. But there’s pent-up demand from COVID and that’s now been exacerbated by the Russian invasion. And I think that demand is still going to be there,” he said.

“You are going to have a choppy two or three years; not recession, nothing hugely dramatic like a global recession. But markets are going to remain choppy and uncertain for two or three years.”

The other great uncertainty is geopolitical: the ever-lingering prospect of worsening relations between the US and China, with the potential for economic decoupling that might sweep up Australia even further.

Dr Forrest welcomed the Albanese government’s more temperate approach to relations with China as “a breath of fresh air”.

“I’ve really resented China being used in [Australian] politics,” he said.

He urged both Beijing and Canberra to “check their language” and make sure they were not creating an enmity by treating each other as enemies.

But his support for a détente with Beijing was based on “the public interest”, he said, as geopolitical tension was not a material concern for his business.

--- ends ---

RELATED

China refuses to budge on Albanese’s trade ban ultimatum

RELATED

New trade minister keen to get the ball rolling with China

So back to CBA. There will likely be further downside from here, but at some point they will become worthy of serious consideration as part of a diversified portfolio, particularly one like mine that currently has zero banking exposure.

The sell-down of the banks (including CBA) is not entirely unjustified. They WERE quite expensive, especially CBA, and the outlook is changing, however they are NOT going broke, they are very well managed, and at some point I will likely buy some if the price keeps falling.

Also, while the banking landscape will continue to evolve, I would back CBA to keep themselves at the cutting edge of banking here in Australia, as they have done so far.

Source: AFR Banking Summit | Deloitte Australia

7th June 2025: Update:

CBA is currently STILL held here by only 4 Strawman Premium members. And I am STILL not one of them. Different 4, but still 4 holders. CBA is ranked # 137 on Strawman.com today.

And I have still never held any of the big 4 banks in my SM portfolio.

I said three years ago: Being the clear leader of the big 4 in terms of size and quality (and management also IMO), CBA was starting to look interesting from a price perspective.

But that I still wasn't buying any. Not at that level (I thought I might buy some if they dropped further).

They had just been sold down from $107 to $87/share.

Now , 3 years later, they closed yesterday (Friday 6th June 2025) at $179.90, after making a new all time high of $182/share the previous day (Thursday 5th June). So they've doubled in that three year period, which is a phenomenal effort considering there were plenty of people (including me) who thought they were expensive at $87/share.

We've discussed the reasons before - CBA are now, by far, Australia's largest company, having a market cap of over $300 Billion, which is over $100 Billion more than BHP, which is at #2. Passive ETF buying has a lot to do with it, and CBA are certainly too big to fail, certainly in terms of being the largest Australian bank with most deposits guaranteed by the Australian Government. The Australian Government won't allow any of our big 4 banks to fail. Probably not MQG either, although Macquarie are far more of a global asset manager and investment bank than a traditional bank, so you never know.

These banks are in no danger of failing anyway, IMO, but the point is that they're seen as being "Safe as Houses" - an analogy that may open up a different can of worms - about Australia's housing crisis - in terms of house prices continuing to rise making it more and more unaffordable for new entrants to enter the market, to buy their first home, and the fact that home owners having so much of their personal wealth tied up in property means that sensible reform of stuff like negative gearing is always going to be political suicide.

But it is what it is, and CBA remains the King of Australian residential property financing.

Here's what Marcus Padley penned about CBA in his Saturday "Weekly Wrap" email this morning:

Not a bad week for the ASX200. Up 1%.

If you had told me back in the dim days of April that just a few months later we would be at an all-time high, I would have checked what you had been taking. It was hard to see that, to say the least. Yet here we are. Not quite at a high, but damn close. CBA has soared to record highs, leaving everyone scratching their heads as to why. It is the most expensive bank in the galaxy, yet it still goes up. I call it the Rolex bank. It commands a premium just because. It still just tells the time, but it does it elegantly and it holds its value.

Last week I talked about why it keeps going up. That army of retail investors that will never sell, plus the passive ETF funds flowing in. All that superannuation money looking for a home. Looking for a safe home. This week there was a big overseas investor buying up the bank in a big way. Fisher Investments, which manages more than US$299bn, wanted exposure to stocks outside of the US.

Now the thing about these big US funds is they do not really care what they buy. They have a number of criteria: it must be big, it must be liquid, and it must be a name they know that can withstand a big order. These guys are based in Texas, and everything is big. The story is that they bought US$1bn worth. Now there are few stocks in Australia you could do that in — BHP maybe, RIO, CSL — but they all have issues and baggage. CBA is clean. It may be expensive, but to be honest the guys at Fisher probably don’t care. They want liquidity and scale. It’s Texas money after all. It’s big. An investment needs to be meaningful.

I see funds saying they’re allocating a 1% holding to crypto, for instance. I mean really, what’s the point? It will hardly move the dial. I guess it’s about treading carefully and easing in. Not something a Texan fund manager would do. Go big or go home. Boot scootin’ time. Can I get a Yee Haa?

Once they’ve filled their cowboy boots, they can tell their clients they’re investing money outside the US.

I would love to have heard that investment meeting conversation. Buy me a one billion dollars (Dr Evil Moment) of the biggest thing in Australia. What's it called? Bank of Australia. Yeah that one. Go get 'em. Can I get a Yee Haa! Damn right you can!

--- end of excerpt ---

OK, I don't know about the Yee Haa's, but MP paints an interesting picture - smart money that is perhaps not so smart - let's call it BIG money - is continuing to drive up the price. Some say that's unsustainable, a bubble, and it will burst, but the market can remain irrational longer than many of us can stay solvent, as a wise man (John Maynard Keynes) once said.

But I'm still not putting any money into CBA. I've foregone the opportunity of doubling my money in three years, with the benefit of hindsight, and CBA may double again in the next three years, but I would say the odds are that they won't, and there's also a decent chance their SP could halve in a much shorter period than that if one or two things happen, things unrelated to the bank itself but things that could very quickly drive a big investor sentiment shift, so the risk/reward equation with CBA did NOT look good to me three years ago, and it looks a damn sight worse today.

Well done to those that have held CBA through to these dizzying heights.

But they're still not for me.

Based in Victoria I see the state of the state which is not great. Cutting out departments, selling assets at fire sale prices and i dont want to get started on how we got here. The storm clouds are gathering and could impact the Nation, although not front page news, we have areas where average people are living seeing house price declines of 15 to 20 %, now that is a heavy equity hit to the people in these areas. I'm sure they are now thinking how did i get here (all made sense at 2 % interest rates) and what do I do now. A lot more people are working two jobs just to keep pace with all the bills.

Working for a big retailer we see the switch by lots of people to cheaper brands daily (sign of the Cost of living crunch) and now i think seeing these housing price drops the multi headed hydra of fear may begin creeping out and warming up for a quick sprint down the hill of reverse snowballs taking everything with it in its sight that resembles valuations of current share prices

Now conversely right now we see the banks keep hitting all time highs, whilst their main assets lenders backed by house prices (not the bricks and sticks) going the other way. I know this is not financial analysis but a lot of the world is based on emotion and illogical thinking. The good times are coming to an end in Vic and the shock will be felt nationally. I'm an optimist by nature but the current housing price numbers are not providing a good feeling on asset prices at the moment.

Would love to here other people's view of the banks and housing situation at the moment.

I can't help myself.. sorry.

Cash profit growth of 2% justifies a PE of 26x? Even with a 5% lift in payout, the dividend yield is still under 3%. Statutory profit growth of 6% looks better, but most of that came from a reduction in impairment charges -- strip that out, and statutory profit growth was just 1%. And let’s not forget, a big part of those lower impairments is thanks to higher home prices inflating collateral values -- this alone accounted for 60% of the drop!

In real terms (inflation-adjusted), profit and revenue actually went backwards.

Ok, so shares are overvalued. That’s not a new or unique take. But why on Earth would they continue a buyback at this kind of premium? They’ve got billions in franking credits just sitting there, yet instead of using them for a special dividend, they’re burning $700 million in shareholder funds to engineer earnings per share growth. Outrageous capital management.

CBA, like the other majors, is basically a giant, overleveraged bet on Australian residential property. About 70% of its loan book is in home loans, and if you include small business loans secured against property, it’s even higher. I’ve made the point before, but a 12% drop in the carrying value of CBA’s loan book would wipe out all their equity. Not saying that will happen (the average LVR is 42%) but risk happens at the edges. Seven percent of home loans have an LVR above 90%, and around $5.5 billion worth of loans are already in negative equity. A small proportion overall, sure, but if all of those defaulted, that’s an 8% hit to CBA’s equity right there.

If there was ever hope for a truly free banking and property market, free from well-intentioned but fatally flawed political interference, i'd short the hell out of this thing. But given the political reality -- this thing is "too big to fail", as is the house of cards its built on -- there's every chance the party keeps rocking for some time yet.

In fact, I note that APRA (at the urging of the treasurer) is considering excluding HELP debts from lending assessments to boost borrowing capacity for first-home buyers, while also easing financing rules for property developers. There's also talk of reducing serviceability buffers..

Firstlinks: Looking beyond banks for dividend income

James Gruber, 20 November 2024

The Big Four banks have had a stellar run over the past 12 months. For instance, Commonwealth Bank (ASX: CBA) is up 56% during the period, and 43% year-to-date. It’s a head spinning move for the ASX’s largest stock with a market capitalization of $260 billion.

Source: Morningstar

Is CBA a $115 billion better business (the equivalent of Westpac's current market capitalisation) than a year ago? Not if you go by earnings, which were down 2% in the last financial year. The prospects for future earnings aren’t impressive either, with most analysts looking for mid-single digit growth over the next three years. And these analysts assume provisions for bad debts remain near all-time lows – a big assumption.

What explains the rampant run-up in bank share prices? ‘Fundamentals’ as we like to call them in the finance industry don’t explain the moves. More likely, it’s liquidity. Mining stocks have been in the doldrums and large fund managers and super funds have essentially been forced to buy the banks to get returns. Passive ETFs have amplified the price rises.

Gone are the good old days

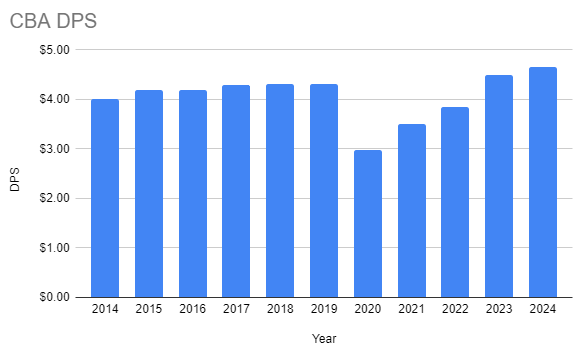

Once upon a time, the banks offered high starting yields (due to lower prices), with steady, growing dividend streams, but that’s now a distant memory. For instance, CBA grew dividends by a compound annual growth rate (CAGR) of 9.2% in the decade to 2003, by 8.9% in the decade to 2013, but by just 1.74% in the decade to 2023. Similarly, Westpac increased dividends by 9% CAGR in the ten years to 2003, by 9.5% in the following ten years, yet dividends declined by 3.1% per annum in the decade to 2023.

The slowing dividend growth is the result of slowing earnings growth, due to a host of reasons. Increased competition for deposits and loans, greater capital requirements, slowing credit and economic growth, and other factors have played a part.

Future earnings growth also looks tepid at best, and consequently so does dividend growth. Even with franking credits, the picture doesn’t appear anywhere near as positive as it did over much of the past 40 years.

Yet, the current share prices don’t reflect this. CBA is sporting a price-to-earnings ratio (PER) of 27.7x, making it the most expensive bank in the developed world, and by a distance. The PERs of the other banks are cheaper, though far from cheap: Westpac (ASX: WBC) at 17.4x, NAB (ASX: NAB) at 17.5x, and ANZ (ASX: ANZ) at 15x.

These high prices have left dividend yields at the lower end of history, with CBA’s yield at 3%, Westpac’s 4.5% NAB’s 4.3%, and ANZ’s at 5.1%.

Looking beyond banks

Banks have been the go-to source of dividend income for investors for years, yet they don’t offer the same prospects for high, growing income that they once did. What should investors do?

The yields on banks aren’t disastrous, so I’m not suggesting that it’s time to cut and run from them. However, it does seem an opportune time to look beyond the banks for better dividend prospects.

Here are some ideas:

Steady compounders. These are potential bank alternatives, offering steady, growing income. I like medical insurers such as Medibank Private (ASX: MPL) and NIB (ASX: NHF), with dividend yields of 4.4% and 5% respectively. Yes, there are risks around hospital cost negotiations, yet these seem to be at least partially priced in. While pricing is set by government, growing demand for private healthcare should ensure increasing earnings and dividends for many years.

Origin Energy (ASX: ORG) is another one in this category. It’s the country’s electricity and gas supplier and its attractive prospects have made it the subject of takeover bids. With a 5.1% yield and reasonable valuations, it deserves a place in income portfolios.

Dividend growers. This group of companies comprises great businesses with relatively low dividend yields but with opportunities to grow those dividends at a brisk clip. Brambles (ASX: BXB) is one, offering a yield of 2.6%, albeit only partly franked. Resmed (ASX: RMD) is another, with a paltry yield of 0.8%, but with a great track record of increasing dividends (more than 7% CAGR over the past ten years). And a personal favourite is Washington H. Soul Pattison (ASX: SOL). It has raised dividends in each of the past 24 years, by 10% per annum. It’s a phenomenal track record that’s unlikely to be repeated. However, the future still appears bright for the conglomerate. Soul Patts offers a 2.7% current dividend yield.

Comeback stories, returning cash. Here are stocks where there is real value and the potential for business turnarounds and for cash to be returned to shareholders. Ramsay Health Care (ASX: RHC) offers a possible opportunity. Better returns should come from an increased focus on its Australian assets. Also, negotiations with insurance funds over costs could prove a catalyst for the stock.

Perpetual (ASX: PPT) is another one. Everyone hates the company given its history. Yet, it’s inexpensive and if a proposed demerger goes ahead, that should result in about a billion dollars finding its way back to shareholders.

What didn’t make the list

There are notable absentees from the stock ideas above. First, there are no miners. I just don’t think miners deserve a large spot in portfolio given their volatile earnings and dividends. Second, the supermarkets are excluded too. Despite recent issues, the shares still seem on the expensive side and dividends aren’t compelling. Government pressure is effectively capping pricing, and they’re still dealing with cost issues.

What about dividend ETFs?

Given ETFs are all the rage, the inevitable question is whether there are ETFs that can provide investors with decent dividend income. My issue with a lot of the dividend ETFs is that they’re loaded with banks and materials companies. For example, the largest dividend ETF, Vanguard’s Australian Shares High Yield ETF (ASX: VHY) has 66% exposure to financials and materials, in line with its benchmark. It’s fine if that’s what you’re looking for. However, if you want to diversify away from banks and miners for yield, then please carefully read the fine print of dividend ETFs.

Are international shares an option?

International shares are an option for those seeking income. However, these shares don’t have the franking credits that are on offer in Australia. For this reason, I’ve always looking for yield in Australia and growth outside of it. It’s a strategy that may not suit everyone and depends on your circumstances.

James Gruber is editor of Firstlinks and Morningstar.

--- ends ---

Source: https://www.firstlinks.com.au/looking-beyond-banks-dividend-income

Disclosure: I do not hold CBA or any bank.

According to Commsec CBA is currently very expensive at 3.58 x book value - possibly the most expensive bank of scale in the world.

The decision to sell if you've held CBA for years is more complex because of things like CGT considerations, and the dividend yield based on your buy price being OK, rather than the current dividend yield now based on where they are trading today - which is low. However, in terms of CBA being a "Buy" up here... Yeah, Nah! Not even close.

When overseas money and then passive funds flow back out of our large banks, there will be significant downside - because there's so far to fall back to book value and also down to an above-market dividend yield.

And with the likely market volatility alongside possible economic risks we're likely to experience in 2025 - including the risk of the A$ falling further against the US$ - our big banks are not going to be as "safe as houses" in my opinion.

To be upfront, I’m a holder of CBA in real life (4.4%). I’ll try not to let that influence my valuation of the business. @Strawman has already covered the FY24 result and has pointed out how expensive CBA looks on both PB (price to book) and PE ratios. @juneauquan pointed out that the PB usually sits between 2-2.5 (currently 3.16) and the last time CBA's PB ratio went above 3 was in March 2015. Share price at this time rallied to $96.

While we’ve been focusing on PE, PB and NIM to determine a valuation for CBA, something more important has been changing without too much attention. I hate to be a stuck record, but yes it’s Return on Equity (ROE). Simply put that’s the annual return we get as investors for our share of equity in that business. In 2016 we earned 15.7% on our equity in CBA, and in FY24 we earned 13.1%. Yet we are paying an all time high for our share of equity (PB 3.16).

So the ROE has declined, but if our share of equity has increased then that could make up for it. The BV has increased in 8 years, but sadly the book value for CBA now ($43.70) is less than it was in 2021 ($44.40)!

I think using historical PE or PB to value businesses with increasing or declining ROE is too simplistic.

Let’s look at it another way to see if the valuation can be justified. Let’s give McNiven’sFormula a whirl! (See here for a brief explanation of the formula).

ROE for 2024 was 13.1%. What’s more important is what ROE will be going forward. Based on analyst consensus ROE could be 13.7% in 3 years time (Simply Wall Street data). For the purpose of valuation let’s be generous and assume forward ROE is 13.7%.

That means we are paying $138 for $43.70 in equity which is returning 13.7% per year.

Our valuation using McNiven’s Formula depends on our required return. Paying $138 per share for CBA you might expect a return of 6.7% (including franking credits). That’s a mere 1.7% premium to a term deposit for a hell of lot more risk! Perhaps buying an ETF like VAS would give you a better return with a lower level of risk? Mind you, you would be still getting a big chunk of CBA in VAS!

So what annual return would you be happy with to hold Australia’s so called “best bank”? Is an 8% annual return good enough to take the additional risk in owning CBA? Perhaps it is? After all it’s as solid as a bank gets!

For a required 8% annual return the valuation comes back to $110. I still think that’s a high valuation for CBA. Generally I would be looking for a solid growth business with ROE in excess of 20% to accept an annual return of 8%.

We sold another parcel of CBA on Friday (IRL). I’d like to sell the lot. The quandary we have, which probably explains why there are so few sellers of CBA even at such exorbitant prices, is the capital gains tax. Our cost price is $28 and the capital gain is $110 per share. We can’t sell our entire holdings without triggering a huge tax bill. @Solvetheriddle also talked about this. It makes sense to sell a few parcels each year and offset the gains with some loss making shares. That’s if these share prices continue. I can’t see how they can.

Held IRL 4.4%

I'm no fan of the banks, as I'm sure most of you know, but I always find their results material fascinating reading.

There's a lot of coverage out there, but I'll highlight some of the things i think are interesting.

The first thing to note is that CBA remains one of the most expensive banks in the world -- at a price-to-book of 3.1x, it represents more than double what you typically see for a bank.

Even JP Morgan's CEO Jamie Dimon said recently that “Buying back stock as a financial company, greatly in excess of two times tangible book [value] is a mistake. We aren’t going to do it”

P/B ratios tend to be the preferred measure for banks because of the fundamental importance of their balance sheets (well, that's always important, but it's super important for banks). Book value is less volatile than earnings and also gives a good read on lending capacity etc.

But even if you prefer a PE, 23x aint cheap either -- especially for a mature business that just reported a 6% drop in profits, and for which analysts are forecasting little to no growth in the coming years.

Yeah, yeah dividends blah blah blah, but is 3.5% ff (or about 5% grossed up) really that good? I mean, i can pretty much get that (virtually) risk free in CBA's own term deposits! Also, there's no growth in the dividends -- the compound annual growth rate in Divs per share over the last decade has been ~1.5%

Oh, and there's a nice reminder here that dividends can and do get cut from time to time.

I'll just remind you again that of all the loans the CBA makes, 70% are for home loans. 17% are business loans

Which makes it very hard to take Matt's assertion seriously:

Anyway, the maths is such that you only need an ~11% drop in the carrying value of their home loan book to entirely wipe out their equity. That's not likely to happen, which even a bear like me will admit, but it shows you how sensitive they are to the housing market. And you dont need much of a writedown to really take a knife to earnings.

(I will note that impaired and 90-day arrears metrics both moved in the wrong direction, with provisioning coming in 50% higher than the bank itself forecast).

Anyway, I can shake my fist at the sky all day long -- the fact is CBA has done very well in terms of share price in recent years (unlike its peers).

Still, low to no growth, highly sensitive to economic conditions and excessively valued.

Hard pass.

I can’t believe the momentum behind the Big 4 banks this year? CBA is up 40% in 12 months, reaching $134.25 today! Until today I’ve held onto every CBA share and said I wouldn’t sell because of the capital gains. The temptation is just too much at these levels. I’ve sold some CBA and NAB today and will offset some of the gains with losses on a few poor performers.

Reasons for reducing:

- PE 22.6x , the highest in 5 years

- Forward ROE 13.7%, OK, the best of the big 4, but not exceptional

- Dividend 3.5% fully franked, OK but not as good as a term deposit

- PB, 3 x book value, very high for a bank

- PEG 8.7, not compelling

- Analyst TP Consensus $93, can’t see the share price holding

- Annual return based on McNiven’s valuation is 7% per year (incl growth & dividends). There are solid growth stocks with higher ROI.

Held IRL (4.5%)

Index has a lot of miners so RoE I imagine swings with commodity price - but still tells a story.

Firstly this bit of information applies to any big 4 bank, not just CBA

In the past, the Big 4 used to have foreign exchange services but recently have decided to close down this service.

This means no more deposit of foreign cheques to the big banks. No ifs or buts. Justification is that not many people use foreign cheques and currency and costs too much to service.

In response it appears the smaller mutual banks (formerly credit unions) have come in to fill this hole, allowing new customers to deposit foreign cheques if it is done 3 months before the cheque expires.

Sounds crazy that people are still using foreign cheques, but most of the large instos such as Morgan Stanley still insists on writing cheques in USD for non-US customers.

Unfortunately I'm one of those customers and in desperation had to open an account recently with a mutual bank to cash a USD cheque.

Was a great experience though, looks like the funds were available within 2 months. And I didn't think it was so easy as I thought I had to be "vouched" by a member or join a trade union.

Big 4, look out! The old credit union turned mutual banks are coming to grab your lunch!

Good overview of the majors - Bank reporting season scorecard (firstlinks.com.au)

The below graph is a bit scary being so low - good but gets worse/normalises? Been a really good few years for the banks in terms of bad debts and now reaping higher NIMs at the moment. Do bad debts come back to bite with higher rates?

I recently observed that CBA has launched a 'invoice creating platform' through netbank. Similar to paypal, they can help you track customer payments and send reminders once you've issued your invoice through their platform.

I would not be surprised if they start developing rudimentary accounting systems on their business accounts for microbusiness eg expense categorisation, upload/storage of invoices (or perhaps electronic invoice straight from merchant). They already use optical readers to auto-populate payment information off a bill.

Summarising a previous forum post which I thought would be more relevant here for CBA, here are the opportunities for regaining merchant businesses and assisting micro businesses:

- Basic invoicing functionality

- Categorisation/management of expenses - maybe SaaS paid cloud storage for invoice document management (they already receive electronic invoices on your behalf from large utilities/comms providers

- Ability to offer BNPL to business (not just individuals)

- Ability to accept payments in all it's forms - foreign currencies, Crypto, perhaps Wechat Pay/Alipay in the future

- Integration of deals such as business insurance and loan applications

- Future: Maybe even management of electronic contracts through blockchain tech (eg House/Financing settlements/transfers)

Look out Xero, MYOB, Reckon ! The cheapest plan of the lot for these services is $25/mth last time I checked (without the timesheets and complex functions). Micro businesses will certainly take advantage of CBAs free invoice offering rather than using Paypal.

Observation: CBA offered removal of their monthly account keeping fee in favour of a 'pay per use over the counter transaction fee', leaving business customers who do most things online less disgruntled.

Observation: Through their startups thinktank, CBA has recently launched a retail deals app to capture a slice of the retail market. I'm not sure this will work but it's definitely a very interesting data capture opportunity for CBA!

As announced earlier this week, CBA is asking for a small community of users to trial their crypto platform. Then they will launch trading through their CBA app.

“In looking at ways that we can support our customers, we have made the strategic decision to form an exclusive partnership in Australia with Gemini, a global leader with strong security and a track-record of serving large institutions. CBA will leverage Gemini’s crypto exchange and custody service and integrate it into the CommBank app through APIs,” - Matt Comyn CEO CBA.

"As part of its approach CBA has also partnered with Chainalysis, a global leader in blockchain data and analytics to help compliance teams monitor and mitigate the threat of crime through crypto asset exchanges."

About Gemini

Gemini is a platform that allows customers to buy, sell, store, and earn cryptocurrencies like bitcoin, ether, and DeFi tokens. Gemini's simple, reliable, and secure products are built to empower the individual. Gemini was founded in 2014 by twin brothers Cameron and Tyler Winklevoss. For more information, visit https://www.gemini.com.

About Chainalysis

Chainalysis is the blockchain data platform. They provide data, software, services, and research to government agencies, exchanges, financial institutions, and insurance and cybersecurity companies in over 60 countries. Chainalysis data powers investigation, compliance, and market intelligence software to allow consumer access to cryptocurrency safely. Backed by Accel, Addition, Benchmark, Coatue, Paradigm, Ribbit, and other leading firms in venture capital, Chainalysis aims to build trust in blockchains to promote more financial freedom with less risk. For more information, visit www.chainalysis.com.