Mining analytical equipment manufacturer $XRF released its FY24 results today.

ASX Release

Their Highlights

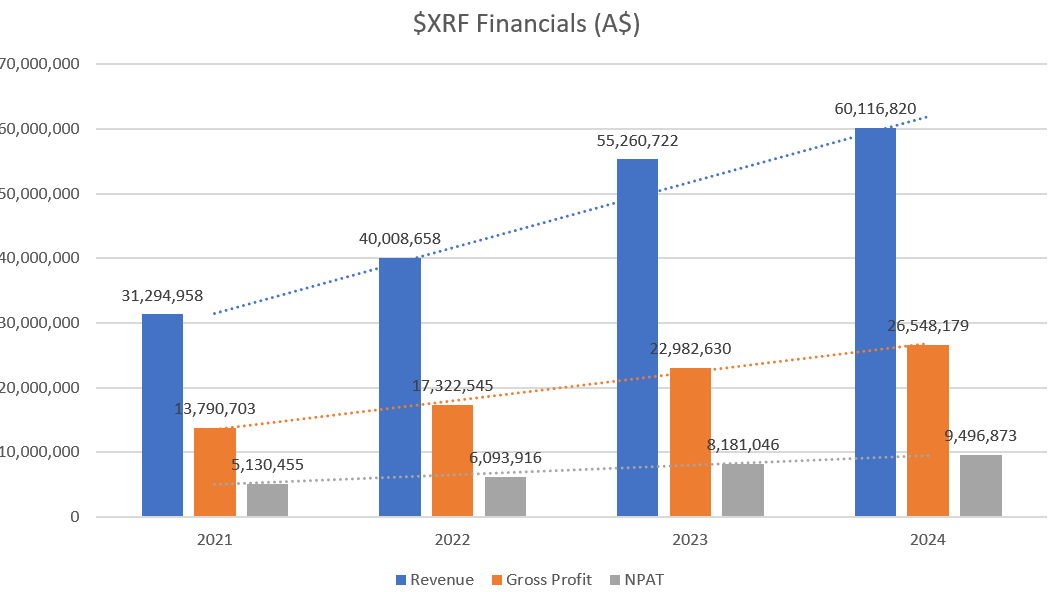

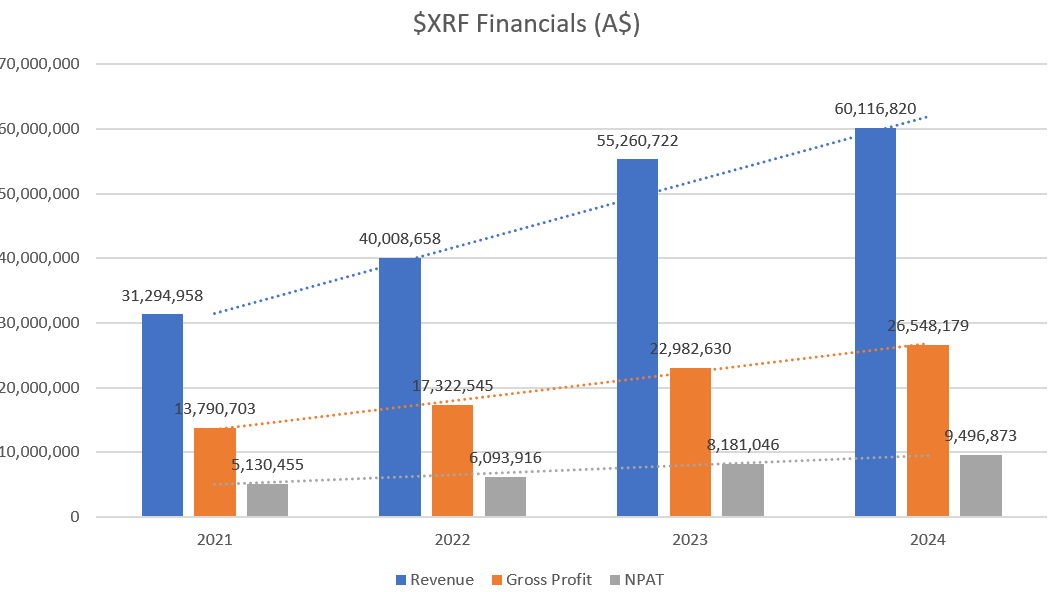

- Revenue up 9% to $60.1m from $55.3m

- Net Profit After Tax up 16% to $8.9m from $7.7m

- June Q4 Profit Before Tax of $3.3m and Sales Revenue of $16.2m

- June Q4 Profit Before Tax and Non-Controlling Interests (Orbis) of $3.9m

- Final fully franked dividend of 3.9 cents per share

My Analysis

$XRF provides quarterly revenue and PBT updates, so there was little room for any overall surprises.

In July 2024, the acquisition of the outstanding 50% in Orbis became effective. Without the previous NCI, PBT for Q4 was $3.3m. Including the NCI, PBT rises to $3.9m. Future periods will now enjoy the full contribution of Orbis.

The main driver of the result was %GM expansion from 41.6% to 44.2%, leading to gross margin increasing by 15.5% on revenue up 8.8%.

Performance was primarily driven by capital Capital Sales, up 16% with an NPBT margin of 21% up from 18% in FY24. With the initial sales of xrTGA (thermogravimetric analysis) equipment, capital sales are expected to continue to grow strongly into FY25. Management noted "Sales growing in numerous markets worldwide". Capital sales are also expect to benefit in FY25 as the company launches new products that have been in development.

Consumables revenue was up 11%, albeit with PBT margin compressing slightly to 30% from 31% in FY24. Falling Lithium prices were called out as impacting both selling prices and production costs, and will lower working capital requirements into FY25.

Precious metals was the only underperformer, with revenue down 1% on PCP. The problematic German Office was called out as reducing profit from FY23 by $0.8m "due to economic conditions. This is expected to improve in FY25.

The final fully franked dividend of 3.9 cps represents a +18% increase on last year, and a grossed up yield of 3.8%,... not so impressive in this high interest rate environment, but this is primarily a capital growth play.

Free cash flow was $5.7, down from $7.1m in the PCP due to investment in manfuacturing facilities, however, cash on the balance sheet increased to $12.0m from $10.4m.

My Key Takeaways

The results represent good - if unremarkable - progress.

NPAT growth of 16% was strong albeit bringing the 3-year CAGR down to 23%.

Strong capital sales helped cover a weak performance in precious metals.

$XRF continues to be a steady performer.

Disc: Held in RL and SM