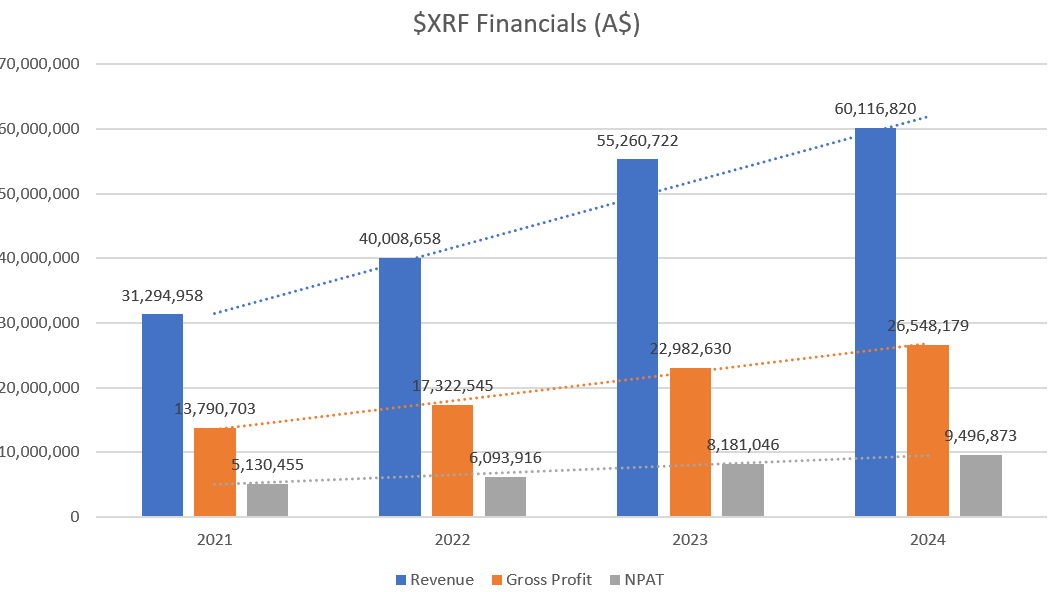

Mining analytic equipment supplier $XRF posted their 1H FY25 results today.

ASX Announcement

Their Highlights

- Revenue of $28.7m

- Profit Before Tax up 13% to $7.0m from $6.1m

- Net Profit After Tax up 12% to $5.0m from $4.5m

- Operating Cash Inflow up 105% to $4.4m from $2.2m

- Record quarterly Profit Before Tax of $3.8m in December Q2

References to profit above are net of profit attributable to non-controlling interests.

Key Points from the Report

Although precious metals and capital equipment had relatively subdued sales, the stand out for the result was the strong consumables performance, where although sales revenue was flat to the PCP, PBT increased by 26%, which carried the result for the group.

Overall PBT advanced 9.4% on a reported basis, or 13% adjusting for the accounting impact of the non-controlling interest due to the acquisition of the outstanding 50% of Orbis.

Orbis contributed $697k to PBT vs. $369k in 1H24. And the German office returned to profitability and is expected to remain there.

Overall, while it was an unexciting result for the half year, I note that this is perhaps unsurprising, as globally FY24 was a less-than-stellar year for global mining (critical minerals and gold notwithstanding!)

Today’s result shows the resilience of $XRF’s installed, durable equipment base and the ability of this to drive robust consumable sales throughout the cycle, without changing the underlying cost base.

Overall, the balance sheet is in very good shape, with borrowings having been further reduced, resulting in declining financing costs.

It was a weaker period for overall cashflow, with the purchase of the remaining Orbis shares costing almost $2m and the annual dividend payment of $4.1m coming out in the half. The cash position should strengthen in the current half, even with a payment of $1.16m expected for Labfit, assuming completion this month, as planned.

At the time of writing, the market has taken the result in its stride with a modest uptick in SP on moderate volumes (which are low for this business at the best of times.)

Results in Context

In the chart below I’ve updated the quarterly revenue and PBT results. Revenue growth continues just below the trend, with profit growth just on trend.

My Key Takeaways

$XRF continues to have all the indications of a quiet, steady compounder.

It remains a long-term hold for me and has quietly grown to become a 5% position in my RL portfolio.

Looking like another wincourtesy of the Strawman Community … several of the usual suspects!

Disc: Held in RL and SM