Friday 22nd November 2024: Money of Mine: Turning a Deposit into a Mine (Entech Interview)

"We sat down with a couple of legends, Jill Irvin & Shane McLeay of Entech [Mining], the gurus on what’s needed to turn a deposit into a mine"

Entech Mining is a private company - here's their website: https://entechmining.com.au/about. Shane (Macca) and Jill are on the first (top) line of their senior management on that webpage.

They explain the difference between the various studies, scoping, pre-feasibility and feasibility studies, and what goes into them, and a lot more.

Apparently they either share the same office building as the MoM crew or else they are situated next door, but there was a reference from Matty early on about Jill and Shane making the 100 metre trip to come and see them.

"They taught us about all the tricks in a mining company’s key studies, what makes a good study or bad one, the key numbers to look out for, where clients put the pressure on them, what’s underappreciated about their work & a whole heap more."

CHAPTERS

- 0:00:00 Introduction

- 0:02:24 Scoping vs PFS vs DFS

- 0:07:33 Resource confidence for studies

- 0:11:10 Exploration targets

- 0:13:00 Clues for a bad project

- 0:15:00 Managing capex vs optimal design

- 0:16:55 Chalice putting up 2 scenarios

- 0:18:34 Right amount of money to spend on studies

- 0:20:24 Internal studies

- 0:22:38 Competitiveness between consultants

- 0:26:18 Reviewing other studies

- 0:31:34 Refusing to do a study

- 0:34:16 Liability

- 0:37:15 Evolution of study requirements

- 0:38:43 Discount rates

- 0:40:00 Rules of thumb for grade

- 0:42:18 High grade that doesn't work

- 0:43:46 Importance of orebody continuity

- 0:46:48 Capex for 3rd world countries

- 0:48:39 Owner mining vs contracting

- 0:51:54 Geotechnical impact

- 0:54:51 Contingency

- 0:55:54 Contract tendering

- 0:59:22 Metal equivelants

- 1:01:58 Best study and most challenging study

- 1:05:22 Electrification

- 1:07:48 Conveyor systems

- 1:12:40 Electrifying open pits

-------------------------------

DISCLAIMER

All information in this podcast is for education and entertainment purposes only and is of general nature only.

The hosts of Money of Mine (MoM) are not financial professionals. MoM and our Contributors are not aware of your personal financial circumstances. Before making any investment decision, you should consult a licensed financial, legal or tax professional.

MoM doesn’t operate under an Australian financial services licence and relies on the exemption available under the Corporations Act 2001 (Cth) in respect of any information or advice given. MoM strive to ensure the accuracy of the information contained in this podcast but we don’t make any representation or warranty that it’s accurate or up to date. Any views expressed by the hosts of MoM are their opinion only and may contain forward looking statements that may not eventuate.

MoM will not accept any liability whatsoever for any direct or indirect loss arising from any use of information in this podcast.

-------------------------------

So I did learn some stuff from this, and I was most interested in the short section where they were asked about competition within their sector and tendering, because the two main competitors they have here in Australia, particularly in Gold and other precious metals, plus copper, are GR Engineering Services (GNG.asx) and Lycopodium (LYL.asx) - I hold both of them - and it was certainly interesting to hear Macca say that more than half the work does NOT go out to tender - they either get the work and nobody else gets a look-in, or the work goes to someone else and Entech doesn't get a look-in - and that is mostly based on existing relationships between miners and study consultants - so prior work done.

0:22:38 Competitiveness between consultants

This does back up what I've observed and read regarding GNG & LYL both getting a lot of repeat work from their respective client bases.

18-Nov-2024: Investment insights: "Electrified growth in mining services", Oscar Oberg, Wilson Asset Management (lead portfolio manager of WAM, WAX, WAA and WMI) [Published November 6, 2024]

Electrified growth in mining services

Oscar Oberg discusses four observations from a recent trip to Perth and shares his top stock picks poised to benefit.

The mining services sector was the first sector I ever worked on as an equities analyst when I started out in the market 14 years ago and it is fair to say that over that period, I have seen a fair share of highs and many lows. Right now, the environment for these companies is the most positive the WAM Capital (ASX: WAM) team and I have seen. Usually when we have seen periods like this, we ask ourselves the question, “is this too good to be true?”, but in this case we see other factors unrelated to commodity prices that can continue elevated spending from the miners, that in turn can benefit mining services companies.

The team and I travel to Perth three to four times a year to meet with the management teams of a range of mining and mining services companies, both listed and unlisted. Last week, Senior Investment Analyst Shaun Weick and I visited 10 companies across two days and came back to Sydney feeling the most positive around the sector than we have been for some time.

Labour constraints are easing

During COVID, a number of companies were impacted by higher labour costs due to a scarcity of labour and the resulting lower productivity as staff turnover increased. Most of the mining companies are based in Western Australia, namely the iron ore areas of the Pilbara, and the pandemic presented inefficiencies and barriers in travelling between states across Australia. The easing of these restrictions had an immediate positive impact on the sector, strengthening the outlook.

More importantly, the price of nickel has collapsed over the last 12 months, and in more recent times we have witnessed a fall in lithium pricing which has seen a number of projects being halted, improving the availability of labor. With mining services companies having a large exposure to iron ore, gold and copper, we think improved levels of productivity and a reduction in staff turnover can benefit mining services margins.

Sustaining capital expenditure will continue

The three iron ore majors BHP Group (ASX: BHP), Rio Tinto (ASX: RIO) and Fortescue (ASX: FMG) have a vast production profile that they need to sustain every year as reserves deplete. Mines are also getting deeper and more remote which impacts the cost of production. This means that mining services companies exposed to the production profile of the three iron ore majors are set to benefit from continued capital expenditure irrespective of near-term volatility around commodity prices.

Critical infrastructure is also ageing and needs to be replaced. We see the potential for a looming replacement cycle for car dumpers, rail networks, port infrastructure, stackers and reclaimers, which will be positive for the incumbent mining services companies.

Power infrastructure

The landscape of Australia’s power infrastructure is undergoing a seismic shift, driven by renewable energy expansion and decarbonization. Historically, Australia’s power grid was anchored by coal-fired power stations positioned along coastal regions near populated areas. From those coal power stations, there is a network of power lines, substations and power stations that continue to extend through every state, right through to the most remote areas. With a large number of renewable projects being developed in remote areas, an extensive network of power lines and infrastructure is now required to feed back into populated regions. For these reasons we see unprecedented infrastructure spending into power to modernise the electricity grid.

At the same time we are seeing companies across the mining sector push towards long-term net zero emission targets. This shift places additional pressure on the existing power infrastructure, necessitating rapid updates from its current and very old technology, to accommodate renewable energy.

Defence

Similar to other governments globally, Australia is ramping up its defence expenditure. Recently the Federal and Western Australian government announced the creation of a new precinct at Henderson in WA which will be focused on shipbuilding and the maintenance of nuclear powered submarines. Mining Services company, Civmec (ASX: CVL) suggests this spending could be tens of billions of dollars.

The way to play mining services

Looking at our investment portfolio, we are positive on the outlook for NRW Holdings (ASX: NWH), which is one of the largest civil earthworks and contract mining companies in Australia. NRW Holdings have a strong management team and a robust balance sheet which we think will be used or accretive acquisitions. We hold the company in the WAM Capital and WAM Active (ASX: WAA) investment portfolios and we believe the stronger than expected outlook can drive earnings upgrades over the course of the year.

One of our largest holdings in the portfolio, ServiceStream (ASX: SSM) has a dominant exposure in telecommunications and utilities maintenance across Australia. In the 2024 financial year the company had elevated tendering costs in relation to bidding for defence maintenance work, with a number of contracts being awarded in early 2025. Defence is usually a very tough sector to enter, so in the event ServiceStream was to be successful winning a contract in this space, we would take this as a major positive for the company and a catalyst for the market to re-rate the share price higher.

The second company we like is GenusPlus Group (ASX: GNP). GenusPlus is one of the leading engineering companies for power in the country, largely transmission lines or power lines, and is exposed to the electrification theme. The business is founder led with CEO, David Riches owning 49% of the shares on issue. The business is running a number of projects, both in the resources sector and the infrastructure sector and we believe GenusPlus can deliver above its 20% earnings growth forecast for the 2025 financial year.

Another company is Austin Engineering (ASX: ANG), a manufacturer of buckets and truck trays for the mining sector. Austin Engineering have a strong exposure to the iron ore majors, and despite reporting a slightly weaker than expected result, we believe the company are gaining momentum for a strong FY2026, largely due to plans to double the capacity of the North America and South American manufacturing facilities.

--- ends ---

Disclosure: I (Bear77) hold NRW Holdings (NWH), but I do not hold SSM, ANG, GNP or CVL. I also don't hold BHP, RIO or FMG who were also mentioned in Oscar's article above. I also don't hold any WAM, WAA, WAX or WMI, the four LICs that Oscar manages @ Wilson Asset Management/WAM Funds (being half of their 8 LICs) - I sold all of my WLE (WAM Leaders) this morning at the open, as they went ex-div today, and I wanted to redeploy that capital elsewhere, and I used most of that $127 K to buy more EGL, RMS and GMD. Gold stocks have moved higher in the past couple of hours, including RMS & GMD, so it seems that it was a good time to buy the dip early today, as the gold stock sell-off may actually be over, at least for today... I also topped up my WGB (WAM Global) which goes ex-div on Wednesday.

06-Sep-2024: "IPD Group (IPG): Record Orders Fuel the Recovery in Organic Growth", Taylor Collison, Update [BUY, 12m TP=$5.80, published by TC on 02-Sep-2024]

I don't hold this one, but there's a free broker report (courtesy of the ASX free Friday broker reports email) on them by TC, FWIW. They are into engineering, but I haven't had a close look at exactly what they do, so they might be manufacturers more than contractors, but I'm probably going to have a look at them over the next week and see if there's anything of value there. They reported on the 30th August, and the market liked it enough to send their SP up +9.23% on the day, and they're now trading at just over $5, so there's still some upside between here and TC's 12-month target price (TP) for IPG of $5.80, IF TC are right.

Most brokers tend to be bullish on the companies they cover, because the companies are either already clients or are potential clients of that broker, so take it all with a grain or three of salt, but there are sometimes some interesting details in these reports, like an overview of what the company does for instance, and their various divisions, and how those divisions have traditionally contributed to group earnings, that sort of thing. It's the "forward looking statements" that you have to watch out for.

TC's update starts off bullish, as you would expect: Revenue growth of 28% and adj. EBIT growth of 47% included recent acquisitions. Like-for-like (LFL) revenue and EBIT growth was 2 and 3 percent respectively. Disappointing, and down on IPD’s recent record, but no big deal. The devil is in the detail. Core IPD and Ex Engineering grew by double-digits, whilst CMI (5-month benefit) had LFL EBIT declines. Issues at CMI look mostly temporary. IPD carries a record order book, has new products launching and project wins, plus FY25 gets a full period of earnings from CMI. Growth ahead.

--- end of excerpt ---

I'll still have a look, but unlikely to spend too much time on this one. Here's their results announcement - idp-group-FY24-Results-Announcement.PDF [30-Aug-2024]

Everything appears to be trending up at a good clip except for a smallish decline in gross margin - but no biggy when their NPAT was up +44.7% on Revenue that was up +28%. One of the most important metrics, EPS, was up a very healthy +30.1% from 18.6 cps to 24.2 cps. Not sure what sort of base this is coming off - have to have a look at that during the week, but not horrible, so far.

20-Aug-2024: This forum thread is about the ASX companies that provide mining services as well as those that provide engineering and construction services; some do both.

Mono's (MND) reported today, a company I held for many years but do not currently hold because I thought that they looked a bit expensive considering a few of their metrics have been declining (heading the wrong way) over recent years.

Monadelphous-Reports-2024-Full-Year-Results.PDF

Monadelphous 2024 Full Year Results Presentation.PDF

Considering their lack of major E&C projects and Albemarle's Kemerton Lithium Hydroxide plant expansion being put on hold and MND being stood down from that job, their results were reasonable:

- Revenue $2.03 billion (including Monadelphous’ share of joint venture revenue), up 11% on FY23

- Record full year revenue for Maintenance and Industrial Services (MIS) – $1.32 billion (much of it recurring revenue, which they are trying to increase clearly)

- Engineering Construction (E&C) revenue $712.7 million, up 31.5%

- Secured more than $3.0 billion in new contracts and extensions - includes contracts awarded from 1 July 2023 to today, less a $200 million reduction in construction work-in-hand resulting from termination of contracts for convenience by Albemarle announced after year end, following Albemarle’s recent review of its asset and cost structure.

- EBITDA margin 6.28%, up from 5.96% pcp

- Net profit after tax up by 16.2% to $62.2 million, EPS 64.1c

- Full year dividend of 33cps (pcp 25 cps), making total FY24 dividends of 58cps (adding the 25 cps interim and the 33 cps final div's together), dividend payout ratio 91% (up +18.4% on the 49cps of dividends paid in the previous year).

- Cash flow from operations $187.7 million; cashflow conversion rate 169%

- Significant pipeline of opportunities in resources and energy sectors

The big surprise may have been the increased dividend and the increased dividend payout ratio (91%).

The market liked it - MND are currently up +10% (+$1.18) to $13 today, with an hour to go, bringing them back to where they were trading at in early July, but still around 7% below the $14 level we saw around a year ago.

I thought they looked fully valued at around $14, and I would have got interested if they dropped back to $10 or below, but they only got down to around $11.40 in the sell-down early this month.

MND are mostly E&C contractors.

Macmahon Holdings (MAH) are mining contractors, the type that do the actual mining for mine owners - and they also reported today and rose by around +8%. They are currently up +7.7% @ 31.25 cps, but they got up to 32.5 cps this morning, being +12% above their 29 cps close yesterday.

NRW Holdings (NWH) are both - they do mining services as well as engineering and construction, and they reported last week, on Thursday 15th August, and their share price rose +9.7% on the day to close at $3.50 (where they are right now as I type this).

Other ones to watch:

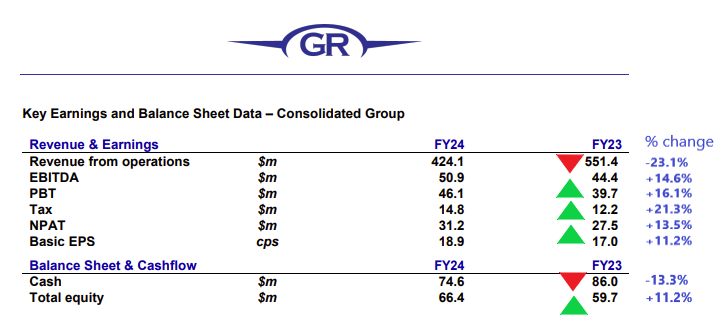

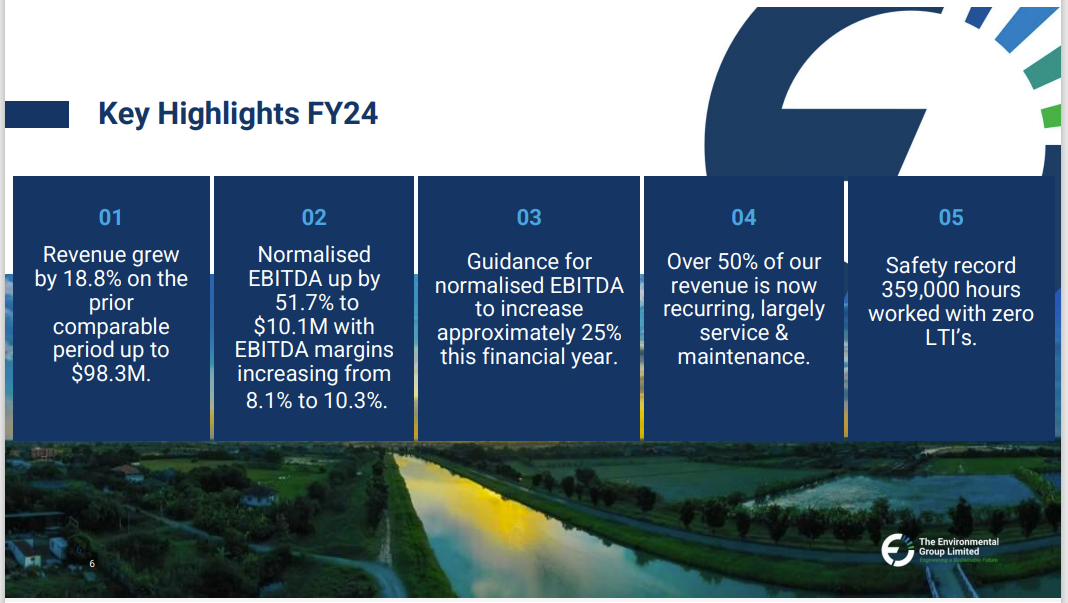

- The Environmental Group (EGL), reporting this Thursday, 22nd August; and

- Duratec (DUR), reporting on Wednesday 28th August.

Another company that reported today, XRF Scientific (XRF), once again exceeded market expectations, and they're currently up +5.7%, however they traded as high as $1.51 earlier which was +7% above yesterday's $1.41 close. XRF are not contractors, but they are still a "picks and shovels play" on mining, as they provide the testing gear (and consumables) for the testing labs and the larger miners who do their own on-site sample testing.

Of the companies I've just mentioned, I only currently how NRW (NWH) in real life (real money portfolios), however I have also held XRF, DUR, EGL, MAH and MND in real money portfolios in the past - XRF, DUR and EGL were all in the portfolio I sold up in June. I currently hold those three in my Strawman.com virtual portfolio here.

It seems to me that these contractors (so all but XRF who tend to look fully valued or close to it much of the time but whose share price keeps rising anyway because their business keeps getting bigger and better) are finally getting some love, albeit probably because the market had low expectations and they appear to be beating those expectations when they report.