@thetjs The starting point is my valuation, for which I have an expected value, and a range (min-max), where the range covers what I think is about "80%" of where the "true" value lies. I know it's all subjective, but I try to quantify the risk and reward in this way. Although my valuations are flawed and subjective, doing this means that I take my decisions based on analysis and not emotion.

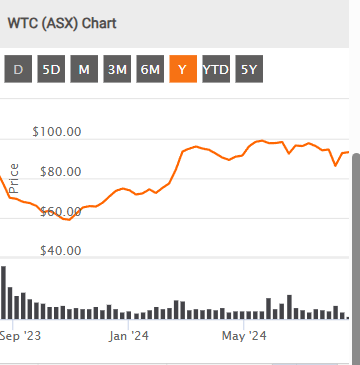

For a business for which I have a very high conviction like $WTC, if the SP falls back towards the middle of my range, I'll build up to a 5% position. And if the SP gets down towards the bottom of my range, then I'll increase up to a maximum of a 10% position. This has happened twice in the last 15 months, although one time (late Aug-23) I didn't get more than a 6.7% position before the SP turned sharply back up again.

This is also why I don't try to pick "tops" and "bottoms" but phase my buys and sells in over time.

Generally, c. 10% on a cost-basis is the largest portion of my portfolio I will put into any one business. Any business can fail, and this is the level of exposure I am comfortable with. I emphasis on a "cost-basis" because I don't sell down to "take profits" anymore. I used to until about 3 years ago. Now, I only sell on valuation.

The logic here is that - in the absence of new, company-specific information - the lower the SP falls, the increased confidence I have that my investment will yield a higher return over time.

In theory, it doesn't matter how much cash I have, as I will always sell lower conviction holdings for the opportunity to buy a business for which I have a higher conviction at a fair price. I say "always", but if everything in my portfolio was beaten up at the same time and far below my valuations, clearly in practice I wouldn't sell. This is one reason why I always try to hold 5-10% cash in RL, so that I can always act on these opportunities. This is important, because just when my most coveted business offers a good deal, macro-factors might equally mean that most or all of the rest of my portfolio is beaten up!

Interestingly, there are relatively few companies that I feel confident enough to do this with. Most of the time, my valuation ranges are too wide to be actionable in this way. (In the last 8 years, I have only done this with $WTC, $ALU, $XRO, $TNE, $PNV and $BRG - all companies I have followed a long time and researched in depth.)

I hope this is clear.