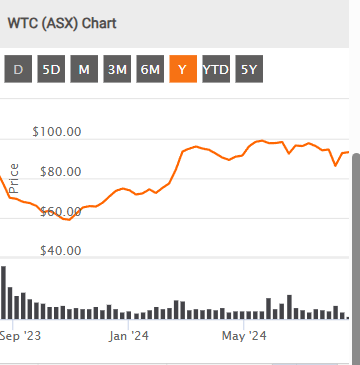

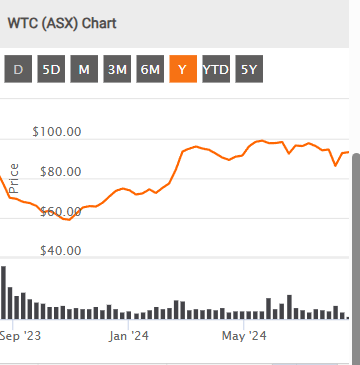

This Result looks ok at a glance:

21 August 2024 WiseTech delivers strong financial performance and outlook 33% CargoWise revenue growth, 28% total revenue growth 48% EBITDA margin, ahead of expectations WiseTech Global Limited (WiseTech or the Company) today announced its financial results for the twelve months ended 30 June 2024 (FY24). FY24 highlights

• Total revenue of $1,041.7 million, up 28% (up 15% organically1 ) on FY23

• CargoWise revenue of $880.3 million, up 33% (up 19% organically) on FY23, driven by full and part year effect of FY23/FY24 M&A and customer growth including new Large Global Freight Forwarder (LGFF) rollouts

• EBITDA of $495.6 million, up 28% on FY23; 48% EBITDA margin ahead of expectations and 4QFY24 EBITDA margin run rate at 50%

• Underlying NPAT2 of $283.5 million, up 15% on FY23; with statutory NPAT of $262.8 million, up 24%

• Strong free cash flow of $333.0 million, up 14% on FY23 • Final dividend of 9.2cps, up 10% on FY23; representing payout ratio of 20% of Underlying NPAT

• CargoWise customer penetration momentum continues with LGFF wins – Sinotrans (Top 25), APL Logistics, Yamato Transport, TIBA Tech and Grupo TLA Logistics. Nippon Express (Top 25) was secured post year-end

• Three breakthrough product releases announced for FY25 - CargoWise Next, Container Transport Optimization and ComplianceWise, with planned releases commencing 1H25

WISETECH GLOBAL LIMITED (ASX:WTC) - Ann: WiseTech delivers strong financial performance and outlook, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

Final ordinary dividend (cps) 9.2cps up 10%